#THREAD

A new report from the LSE’s 'International Inequalities Institute' examines the who, what, & where of UK ‘non-doms’, revealing a complex story of the current British economic elite beyond the attention-grabbing headlines about Russian oligarchs.

eprints.lse.ac.uk/114607/

A new report from the LSE’s 'International Inequalities Institute' examines the who, what, & where of UK ‘non-doms’, revealing a complex story of the current British economic elite beyond the attention-grabbing headlines about Russian oligarchs.

eprints.lse.ac.uk/114607/

#Sociology often faces criticism - especially from the right-wing press & right-wing politicians.

I'm sure it's not a coincidence that sociology is one of the few academic disciplines to have taken Global inequality very seriously, for a very long time.

es.britsoc.co.uk/a-new-sociolog…

I'm sure it's not a coincidence that sociology is one of the few academic disciplines to have taken Global inequality very seriously, for a very long time.

es.britsoc.co.uk/a-new-sociolog…

'The UK’s ‘non-doms’: Who are they, what do they do, & where do they live?', by Arun Advani, David Burgherr, Mike Savage & Andy Summers', examines & analyses the historical legacies, as well as the contemporary configuration, of global inequality.

Global inequality is analysed through interdisciplinary research by economists, historians, & sociologists "to examine the nature of inequalities, how they emerged, & their ongoing implications in the present." - Gurminder Bhambra, British Sociological Association President.

‘Non-doms’ are people who live in the UK but claim on their tax return that their permanent home (domicile) is elsewhere, enabling them to avoid paying tax on overseas income & only pay it on that portion of their income which is earned in Britain or is brought in from overseas.

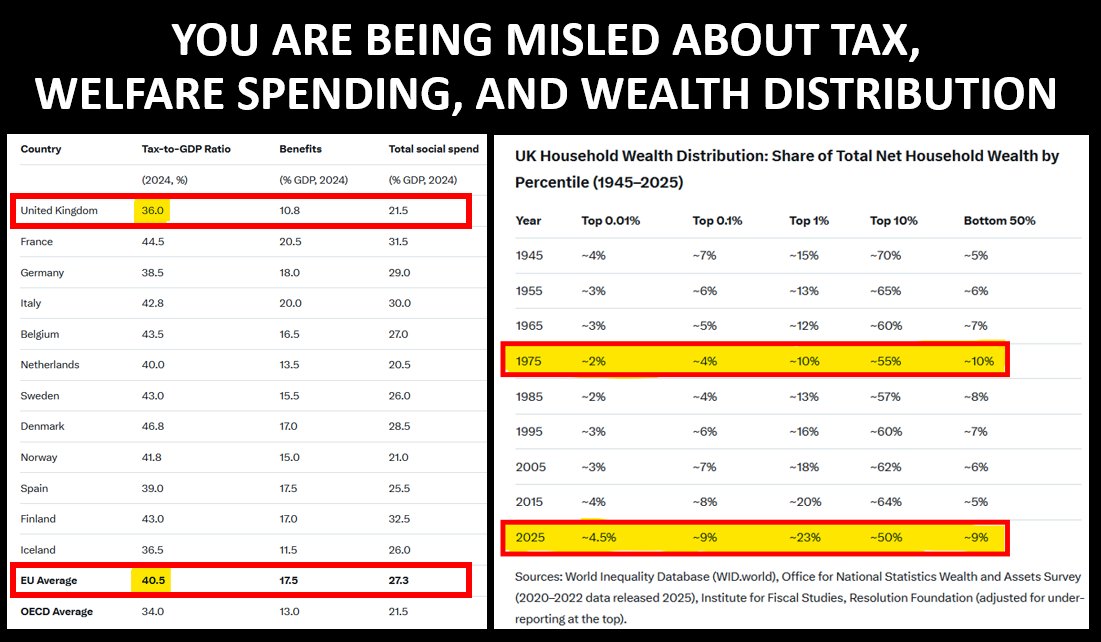

0.3% of British taxpayers earning under £100,000 in 2018 had claimed non-dom status, while 27% of taxpayers earning £1-2 million had.

Two in five top earners in the oil industry & more than one in 10 residents of London's wealthiest neighbourhoods have claimed “non-dom” status.

Two in five top earners in the oil industry & more than one in 10 residents of London's wealthiest neighbourhoods have claimed “non-dom” status.

This practice emerged with the introduction of Income Tax in the late eighteenth century, despite some attempts to abolish the category. It is unique to Britain & emerged in the context of empire to enable the wealthy to ringfence their colonial gains away from national scrutiny.

The Napoleonic Wars, during which the new Income Tax was introduced, occurred during the height of colonial extraction of wealth from India & the peak of the transatlantic trade in humans. The East India Company, Royal African Company & others had MPs on their payrolls.

Then - as now - political connections were leveraged to organised sustained resistance to increased direct taxation &, as Patrick O’Brien argues, the legislation that subsequently emerged ‘provided taxpayers with numerous possibilities for evasion’.

This included exempting foreign income & assets – income & assets derived from empire & colonial ventures – from taxation in Britain.

With the end of formal empire, it might have been assumed that the structures that facilitated these avoidances would have been dismantled.

With the end of formal empire, it might have been assumed that the structures that facilitated these avoidances would have been dismantled.

Instead, they increased in number & became available to a wider global elite willing to reside in Britain.

The analysis in the report points to the transformation of this elite after empire, while also highlighting empire’s centrality to its ongoing connections.

The analysis in the report points to the transformation of this elite after empire, while also highlighting empire’s centrality to its ongoing connections.

The number of individuals who have ever claimed ‘non-dom’ status over the last 20 years make up about 1% of the UK’s population. 93% of them were born abroad, with an additional 4% having spent considerable time abroad.

As Advani, Burgherr, Savage and Summers show, most ‘non-doms’ live in London with some outposts in Oxford and Cambridge.

In effect, while not being integrated into the tax system, they are integrated into the highest political and cultural circles.

In effect, while not being integrated into the tax system, they are integrated into the highest political and cultural circles.

Their political interests are catered for – one might say, represented without taxation – & they are a determining part of a British culture of inequality that venerates wealth & allows poverty to grow.

"There is compelling support for the public perception that non-doms are disproportionately highly affluent individuals who can be viewed as a part of a global elite."

This research makes a vital contribution to a new sociology of inequality, & has the potential to transform the research & policy landscape. In a period charcterised by the worst #CostOfLivingCrisis for 60 years, tax breaks for the very wealthy certainly deserve further scrutiny.

• • •

Missing some Tweet in this thread? You can try to

force a refresh