$UST's collapse is the biggest threat to crypto right now. It has massive ramifications across the entire industry.

Is this the end of $UST and $LUNA? Or simply a blip on the radar?

🧵: A thread on the $UST de peg and what it means for crypto. 👇

Is this the end of $UST and $LUNA? Or simply a blip on the radar?

🧵: A thread on the $UST de peg and what it means for crypto. 👇

2/ $UST has officially lost its $1 peg.

It's been a day of drama, with $UST hitting a low of $0.61 before bouncing back to the $0.90 region.

The entire crypto industry is glued to the charts, as it sends shockwaves through the entire industry.

It's been a day of drama, with $UST hitting a low of $0.61 before bouncing back to the $0.90 region.

The entire crypto industry is glued to the charts, as it sends shockwaves through the entire industry.

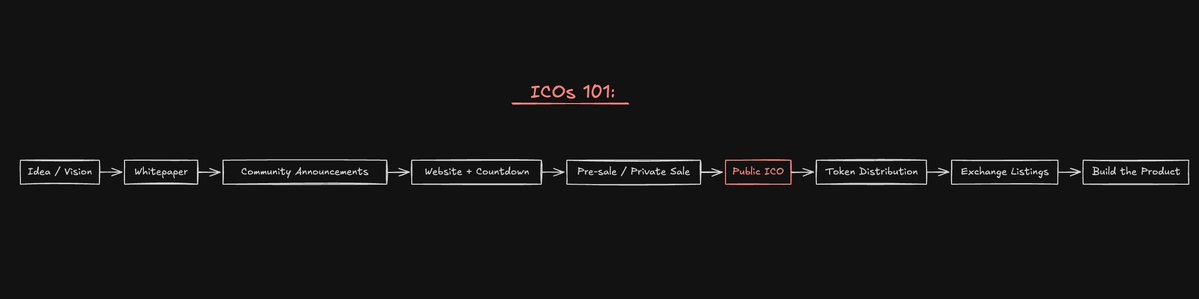

3/ To understand why a de peg is possible, let's explore the different types of stablecoins.

$UST is a decentralised algorithmic stablecoin.

• Algorithmic: Backed by an algorithm, not assets.

• Fiat-backed: Backed by tangible assets (like $BUSD)

$UST is a decentralised algorithmic stablecoin.

• Algorithmic: Backed by an algorithm, not assets.

• Fiat-backed: Backed by tangible assets (like $BUSD)

4/ Algorithmic stablecoins like $UST are valuable because they are:

• Scalable, ideal for facilitating DeFi

• Decentralised

• Improved capital efficiency

Unfortunately this also creates risks, which can result in de pegging.

• Scalable, ideal for facilitating DeFi

• Decentralised

• Improved capital efficiency

Unfortunately this also creates risks, which can result in de pegging.

5/ $UST stabilises its peg by allowing:

• You to redeem 1 $UST for $1 worth of $LUNA, or

• 1 LUNA for its equivalent value in $UST.

To incentivise the arbs, $UST must possess true utility.

• You to redeem 1 $UST for $1 worth of $LUNA, or

• 1 LUNA for its equivalent value in $UST.

To incentivise the arbs, $UST must possess true utility.

6/ What's its main utility? Anchor protocol.

The 19.5% yield on Anchor incentivised large amounts of liquidity, and is currently responsible for 51.8% of $UST's circulating supply.

The 19.5% yield on Anchor incentivised large amounts of liquidity, and is currently responsible for 51.8% of $UST's circulating supply.

https://twitter.com/jonwu_/status/1523793500508094465?s=20&t=l7yozlmQ0xT-Y9MxNnHY0Q

7/ However, Anchor's dominance over $UST is also an issue, as it has lost 57.8% of its total TVL this week.

$UST leaves Anchor > Swapped for other assets > Sell pressure on $UST.

$UST leaves Anchor > Swapped for other assets > Sell pressure on $UST.

8/ Unfortunately this is a major issue for $LUNA.

• When $UST is minted, the equivalent dollar value of $LUNA is burnt (great for $LUNA as it reduces the total supply).

But this also works the opposite way:

• When $UST supply reduces, $LUNA is minted.

• When $UST is minted, the equivalent dollar value of $LUNA is burnt (great for $LUNA as it reduces the total supply).

But this also works the opposite way:

• When $UST supply reduces, $LUNA is minted.

9/ If more $LUNA are minted, this increases the total supply - resulting in more tokens entering the market.

We can see that the total supply change is +25.3m in the last 24h.

Just one day has wiped out over a month worth of supply burn.

We can see that the total supply change is +25.3m in the last 24h.

Just one day has wiped out over a month worth of supply burn.

10/ As you can imagine, this is bad for the $LUNA price as more tokens are now circulating.

As a result, $LUNA has dropped 64% in just 4 days.

As a result, $LUNA has dropped 64% in just 4 days.

11/ But, even a 24m increase in supply isn't enough to warrant a 64% correction. However:

Emotions rule crypto. FUD and panic are usually stronger forces than any tangible baseline metric (at least in the short term).

Remember that crypto is a highly inefficient market.

Emotions rule crypto. FUD and panic are usually stronger forces than any tangible baseline metric (at least in the short term).

Remember that crypto is a highly inefficient market.

12/ And this is exactly what happened to $UST.

1. Coordinated attack with the sole purpose of destroying the peg ($285m dumped on Curve by one party).

2. FUD starts spreading on Twitter

3. People panic out of $UST (shorters get aggressive)

4. Liquidation cascade

1. Coordinated attack with the sole purpose of destroying the peg ($285m dumped on Curve by one party).

2. FUD starts spreading on Twitter

3. People panic out of $UST (shorters get aggressive)

4. Liquidation cascade

13/ Don't be fooled. There are big players that made obscene amounts of money from this sell event (likely at your expense).

There are also whales that are making millions riding the arb on the way up (peg is already at 0.90 from 0.61)

This is a true war of the bulls vs bears.

There are also whales that are making millions riding the arb on the way up (peg is already at 0.90 from 0.61)

This is a true war of the bulls vs bears.

14/ But, Terra foundation had a plan for this. Over the last few months, they have been buying #bitcoin to use as a monetary reserve.

They bought almost $2b of $BTC. Why? To protect the peg during times of extreme stress (like we're seeing right now).

They bought almost $2b of $BTC. Why? To protect the peg during times of extreme stress (like we're seeing right now).

15/ As you can imagine, this isn't good for #Bitcoin as LFG could sell $BTC in order to get $UST back to peg.

https://twitter.com/jasonpizzino/status/1523791890620960768?s=20&t=c__krVLk-_2w1Dtw7HMSrg

16/ The market clearly hasn't responded well to this.

Even though $2b is small in the scheme of #Bitcoin's $600m market cap, it's still enough to induce panic.

Remember, a major catalyst for $BTC's last run was @stablekwon buying, so it makes sense that it works in reverse.

Even though $2b is small in the scheme of #Bitcoin's $600m market cap, it's still enough to induce panic.

Remember, a major catalyst for $BTC's last run was @stablekwon buying, so it makes sense that it works in reverse.

17/ As we know, alts are an extension of #Bitcoin. The combination of macro uncertainty + LFG has resulted in significant headwinds.

Many DeFi protocols have exposure to $UST. Failing to restore peg could have huge ramifications across the entire market.

Many DeFi protocols have exposure to $UST. Failing to restore peg could have huge ramifications across the entire market.

https://twitter.com/LFG_org/status/1523512201088143360?s=20&t=l7yozlmQ0xT-Y9MxNnHY0Q

18/ But there's hope.

@stablekwon says he has a plan. I have faith that they will fight to defend the $UST peg at all costs.

@stablekwon says he has a plan. I have faith that they will fight to defend the $UST peg at all costs.

https://twitter.com/stablekwon/status/1524049689510694916?s=20&t=-3mCXqX4CIkEeR6ou3We0Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh