👍🏾

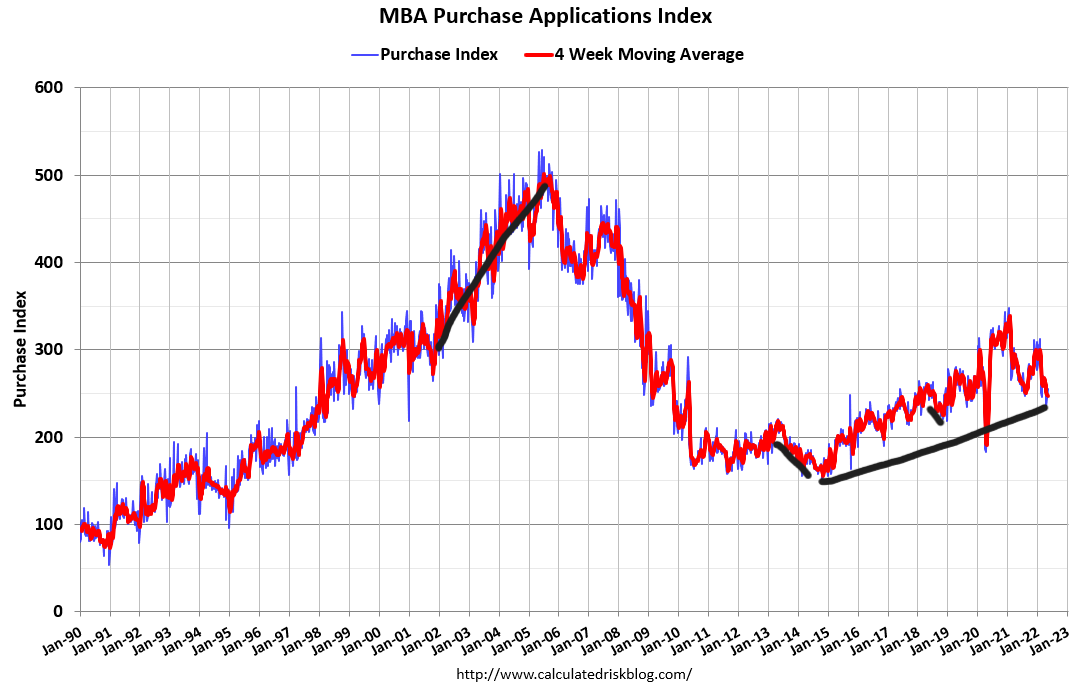

Exploding higher post-1996 would mean the seller will not be a natural buyer of a home. They will sell and rent or sell to be homeless if they're owners currently with a significant payment 😉

Exploding higher post-1996 would mean the seller will not be a natural buyer of a home. They will sell and rent or sell to be homeless if they're owners currently with a significant payment 😉

https://twitter.com/realMeetKevin/status/1524188159193452545

Tik Tok

Twitter

Clubhouse

Youtube

Reddit

To me, great promotional people, but if you don't forecast sales, it's useless.

Clubhouse

Youtube

To me, great promotional people, but if you don't forecast sales, it's useless.

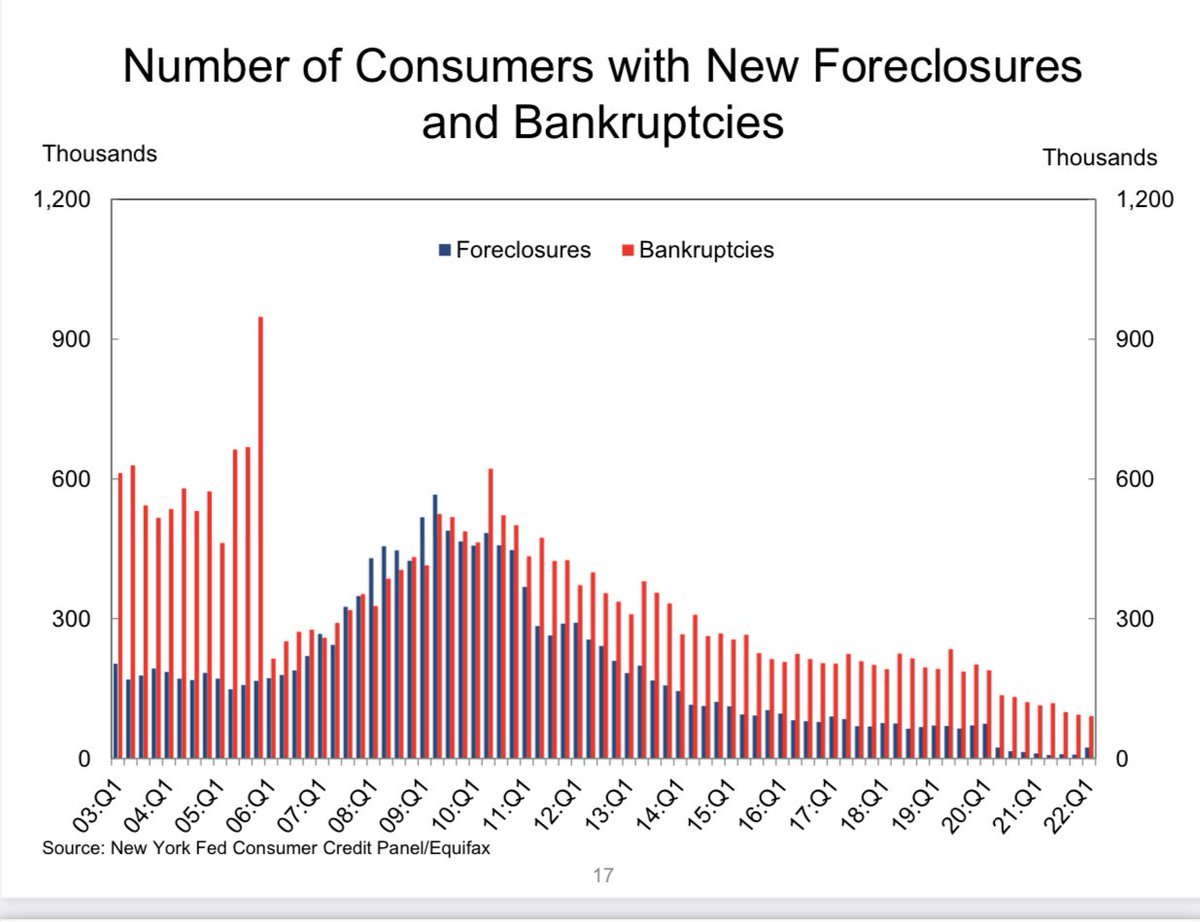

The funny part I always love is people talk about a crash, and a lot of them say 10% declines after 7 failed crash calls, which means they're off by a lot from their original call

Then there are the 🦇 $#IT 2012 price declines people, who are so adorable with using 2012 charts as a reference. You know who they're on Twitter! 😎😉

The rule of thumb: Ask them about their housing forecast in the past. Even better economic forecast!

So far today, all I have gotten for many years.

" I don't forecast"

No $#*! smart! 🥳.

So far today, all I have gotten for many years.

" I don't forecast"

No $#*! smart! 🥳.

Knowing this would be the case, I made one last desperate plea to all my housing crash friends from 2012-to 2019.... before 2020 started. Don't go there, and this is why 😉As a teacher I failed you because you didn't listen

loganmohtashami.com/2019/07/07/hou…

loganmohtashami.com/2019/07/07/hou…

and for that, I apologize that I couldn't convince that you were FOS!

• • •

Missing some Tweet in this thread? You can try to

force a refresh