👇🏾The man who said Millenials don't buy homes is part of the anti central bank trolling crew that has been terrible for 11 years. He will never, ever forecast sales

https://twitter.com/Econimica/status/1524447329259909121

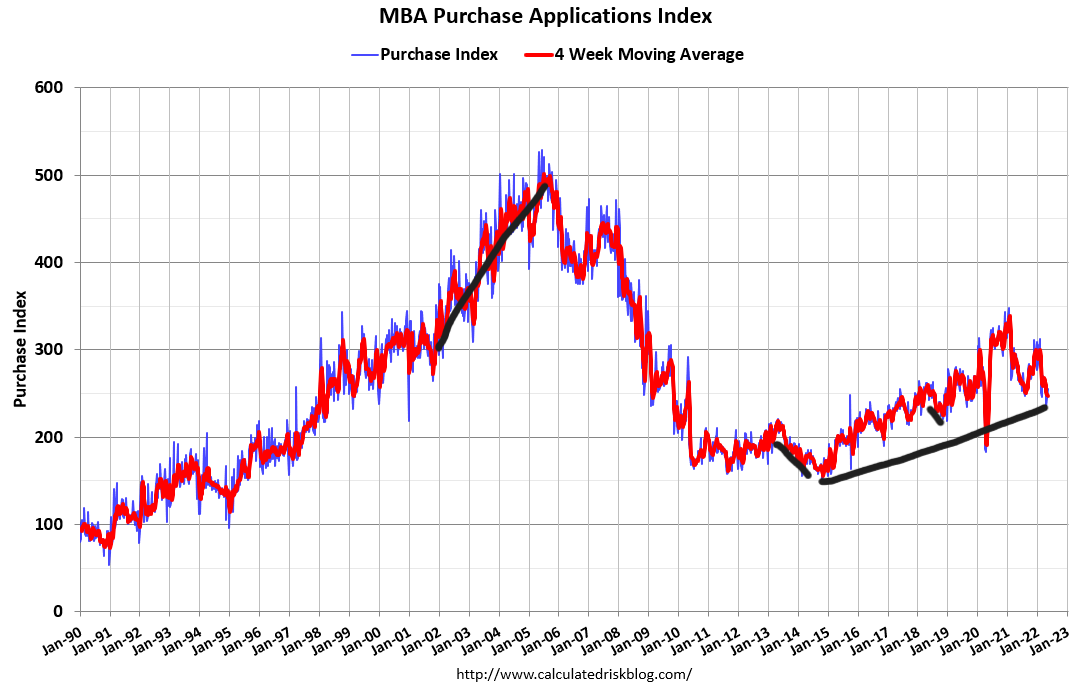

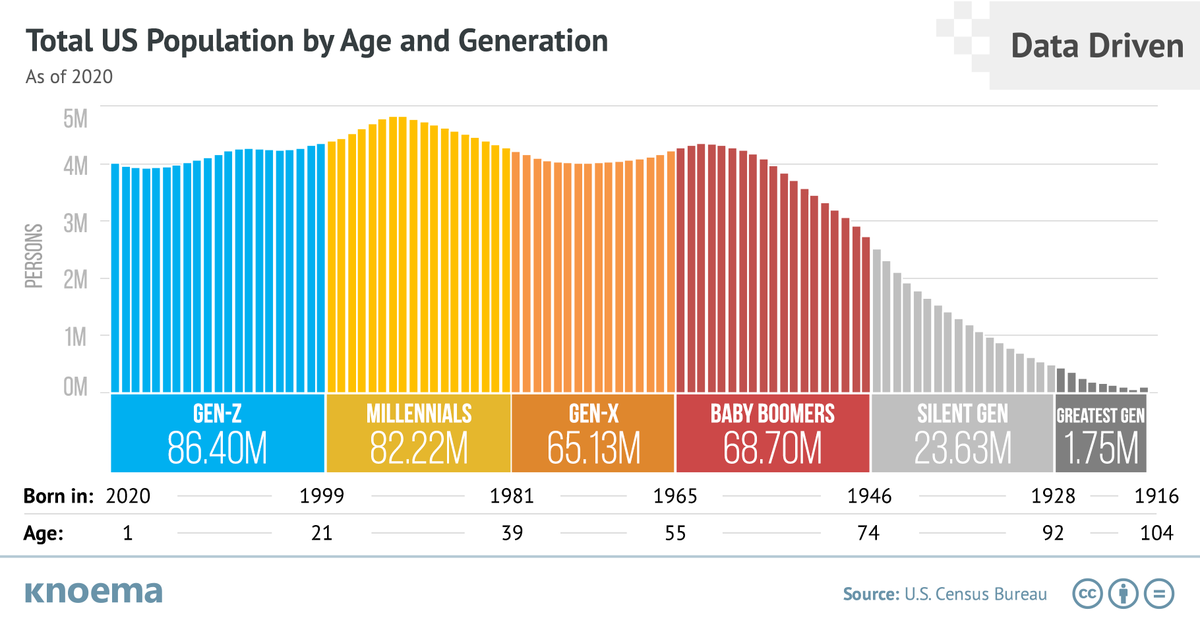

Economics is demographics and productivity; the rest is stamp collecting! However, demographics and mortgage rates are prime for housing. 2020-2024 will be different for many years because of #Demographics.

People buy homes, not an MBS. 😉

People buy homes, not an MBS. 😉

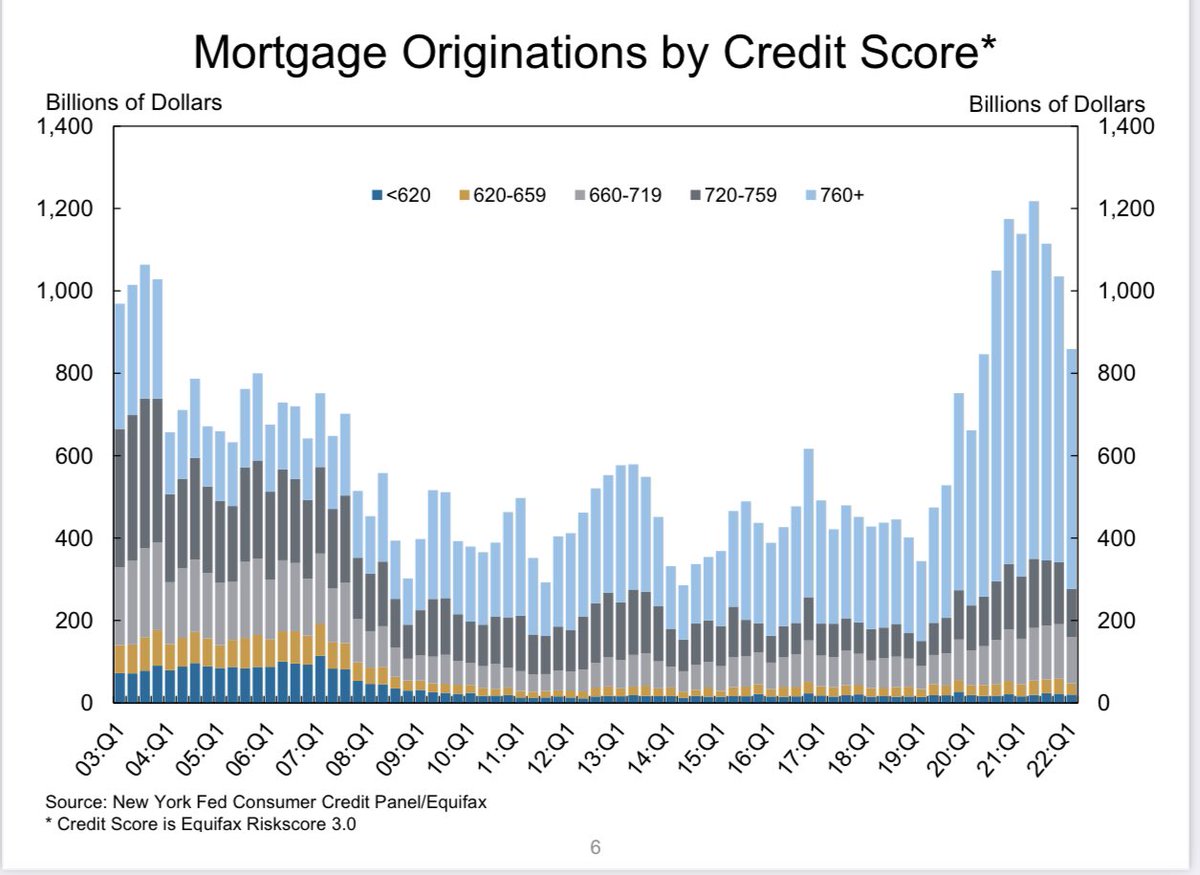

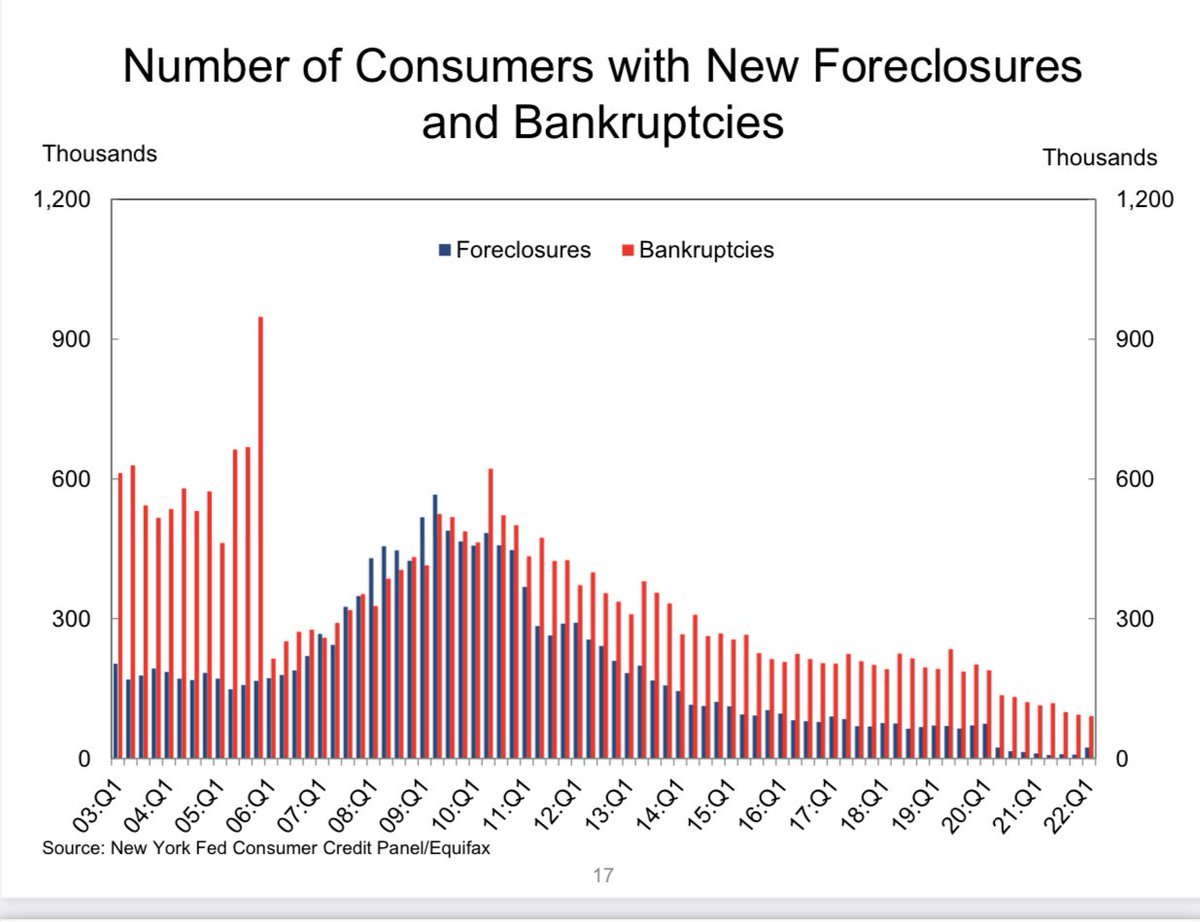

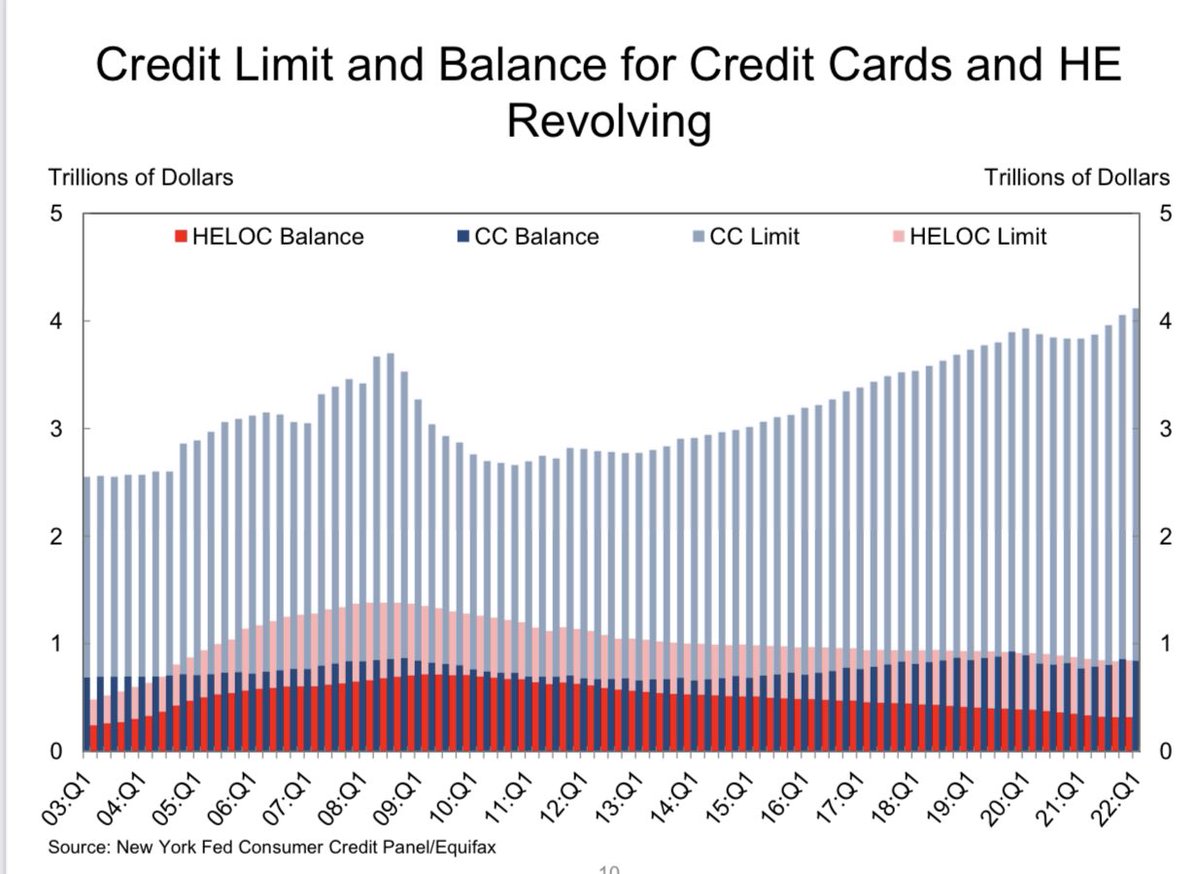

Even with this last desperate plea in 2019, don't go there with the housing bubble crash, you were wrong from 2012-to 2019 for a reason. It didn't matter, same people, same lines, Ya Ya Ya loganmohtashami.com/2019/07/07/hou…

They thought Covid19 was their savior, 🤨😉loganmohtashami.com/2020/08/26/dem…

Now, price growth is way too much! The market is savagely unhealthy. However, they get no claim to this housing market after the last 11 years. 💪🏾

You have lost your privilege to talk about housing: Housing Bubble Boys 2.0 & Forbearance Crash Bros. #RIP

You have lost your privilege to talk about housing: Housing Bubble Boys 2.0 & Forbearance Crash Bros. #RIP

• • •

Missing some Tweet in this thread? You can try to

force a refresh