yesterday I threw out an off the cuff question to @bitfinexed

How much of the redeemed #tether was used to recover and maintain its peg?

The obvious answer is whatever they had to.

I've spent a big chunk of today crunching data to see what answers I could come up with.

How much of the redeemed #tether was used to recover and maintain its peg?

The obvious answer is whatever they had to.

I've spent a big chunk of today crunching data to see what answers I could come up with.

Last night I scratched out my hypothesis - to maintain its peg...#tether would need to tap its own cash...can only do that via redemptions and the 'tell' will be burning the tokens like they never existed.

Basis for this thinking is pretty simple. That's what they do when they need cash and lots of it. Remember back in 2018 #novogratz was swooning over the orderly redemption of $700m by #tether.

But no one could work out where or who the cash went to...then NYAG discovered that #bitfinex had cracked open the #tether piggybank....#jointhedots

After getting pinged by NYAG Bitfinex/tether had to pivot and paper over the funds as a loan.....but this didn't change their habits...here's the repayment of $100m by #bitfinex..

essentially - burn on the way out and issue new tokens on the way back in.....

essentially - burn on the way out and issue new tokens on the way back in.....

So with that background in mind - let the #FUD begin.

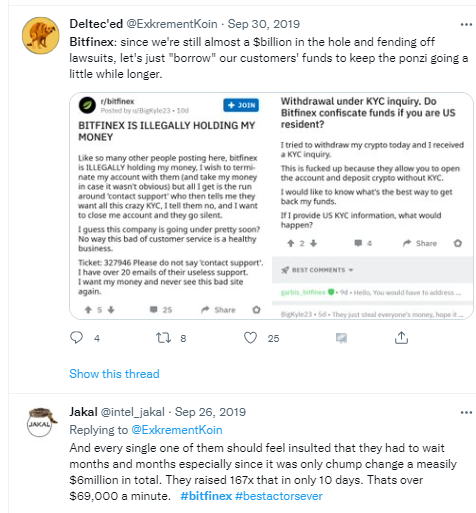

Really? How amazing.....because they have always been so quick to process redemptions to outsiders...lets take a trip down memory lane....#bitfinex customers hung out to dry for months after the wiz lost nearly a billion to #cryptocapital....but yeah now #bestactorsever

Meanwhile the other rats have gone with the predictable down for #scheduledmaintenance h/t @ben_mckenzie and @MikeBurgersburg

What are the chances that Donkey and team are prioritising customers wanting to get out of #tether and literally emptying the coffers....meanwhile there are amazing white knights digging in and buying billions of tethers to stop Armageddon.

Lets just call bullshit right here....there's absolutely only one reason anyone would process billions of redemptions....and that is so they can buy billions of tether on the market. Anyone else is a rat trying to escape the sinking ship.

What really shits me is this bullshit....about the ninja efficiency of traders arbing #tether every time their is even a sliver of profit to be made....because of course half a percent is the best arbitrage opportunity in the market

Lets just have a look at how ridiculous this rationale is. The best opportunity in the entire market in the last 48hours is propping up #tether. No other bargains out there.

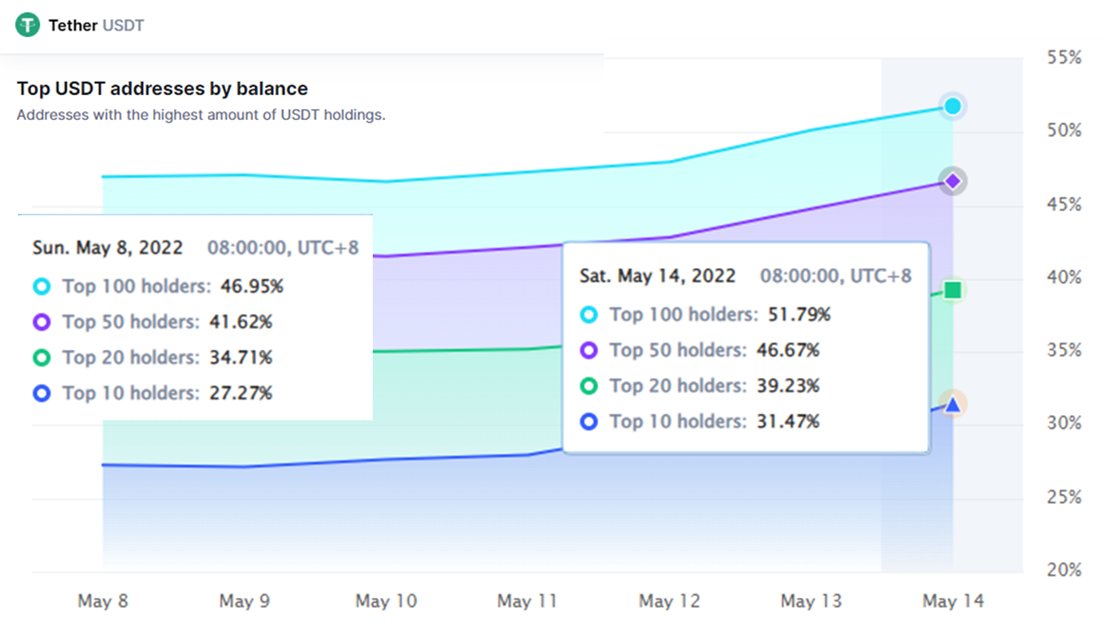

So who's buying up all the #tether? Well its certainly not the broader market - Here's a chart of tether top 100 holders over the last week (nothing says decentralisation quite like 0.002195% of holders owning > 50%).

So it was the top 100 chart where I started to drill down. As all the action has happened in the last few days I've only built out the data for 1 May to 14 May 2022 using coinmarketcap data. The issued USDT has been estimated by mktcap/closing price

I've used the % from the chart to estimate the tokens held by each segment of the top 100 (1-10, 11-20 etc).

Stripping away some of the noise - and just comparing 1 May to 14 May 2022. The top 10 now hold 31.5% of issued tokens an increase of 3.7B tokens in 13 days. Yet the total tokens on issue have reduced by 4.4B

while the top 100 now for the first time hold more 50% of tokens on issue....holders 11-100 now have 1.5B less tokens.

Best indicator as to the percentage of the redemptions that have been used on their own account to re-peg #tether is the actual tokens burned.

• • •

Missing some Tweet in this thread? You can try to

force a refresh