Short Straddle

Brings net credit for the risk-taker professionals

A detailed thread

#options #trading

Brings net credit for the risk-taker professionals

A detailed thread

#options #trading

1/ Our previous thread was dedicated to the long straddle options strategy which had the potential for unlimited gains with limited risk.

In this thread, we will focus on the contrasting short straddle strategy

In this thread, we will focus on the contrasting short straddle strategy

2/ Short Straddle

In long straddles, we buy ATM CE and PE options but in short straddles, we sell ATM CE and PE options of the same strike, same underlying for the same expiration period

In long straddles, we buy ATM CE and PE options but in short straddles, we sell ATM CE and PE options of the same strike, same underlying for the same expiration period

Therefore, the two legs of this strategy comprise

Short ATM CE

Short ATM PE

Short ATM CE

Short ATM PE

Because we are selling the two options, we receive the premium. Therefore, it is a Net Credit strategy

Example:

Say, Nifty spot is at 15782

To create a short straddle

Short 1lot 15800 CE @ Rs167

Short 1lot 15800 PE @ Rs183

Say, Nifty spot is at 15782

To create a short straddle

Short 1lot 15800 CE @ Rs167

Short 1lot 15800 PE @ Rs183

Total premium received = 167 + 183 = 350 or 350 x 50 (Nifty lot size) = 17,500

So, Net credit when this position is opened with one lot each = Rs17,500

So, Net credit when this position is opened with one lot each = Rs17,500

3/ When do Short Straddles make money?

In simple words, this strategy works in a range-bound market. The market/underlying has to trade within the breakeven points (discussed in the following sections) to make money

In simple words, this strategy works in a range-bound market. The market/underlying has to trade within the breakeven points (discussed in the following sections) to make money

This is because we have sold options. If the market stays in a range till expiration, theta decay will work in our favor and will eat the entire premium.

This way the whole premium which was credited while opening position, will be our profit

This way the whole premium which was credited while opening position, will be our profit

4/ When do Short Straddles not make money?

We know that long straddles make money when the market moves decisively in one direction. Contrastingly, this is the scenario where short straddles won’t work.

We know that long straddles make money when the market moves decisively in one direction. Contrastingly, this is the scenario where short straddles won’t work.

Let us say that you have a short straddle and the market makes a sharp rally, you will lose money.

Also, if the market makes a sharp fall, you will lose money

Also, if the market makes a sharp fall, you will lose money

A decisive move in a direction means an increase in volatility and hence high option premiums. As we have sold options, we would never be profitable with the increasing option premium

5/ When do we use Short Straddles?

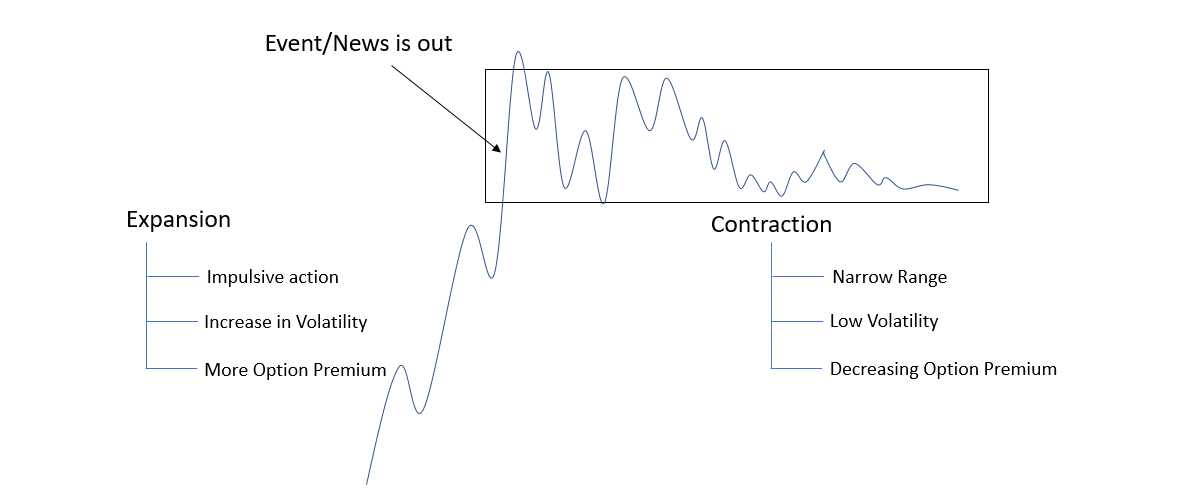

As we discussed in our previous thread on long straddles the market moves up or down through phases of contraction and expansion. Short straddles will work the best in a contraction phase of the market.

As we discussed in our previous thread on long straddles the market moves up or down through phases of contraction and expansion. Short straddles will work the best in a contraction phase of the market.

This phase results in some popular patterns like rectangles, flags and pennants, etc.

Market contraction means, a narrow range and lesser volatility.

Market contraction means, a narrow range and lesser volatility.

The decreasing implied volatility leads to decreasing option premium and when this scenario stays till expiry, the options will expire worthlessly.

Therefore, the best-case scenario will be that the market expires at or near our ATM strike

Therefore, the best-case scenario will be that the market expires at or near our ATM strike

But when do we expect low volatility? The answer is, after high volatility.

High volatility occurs around an event or news. High Volatility inflates option premiums and traders would like to collect that premium through short straddle

High volatility occurs around an event or news. High Volatility inflates option premiums and traders would like to collect that premium through short straddle

When the news is out, volatility drops like hell and so do the option premiums.

Thus, traders can make money through a short straddle by theta decay or volatility drop

Thus, traders can make money through a short straddle by theta decay or volatility drop

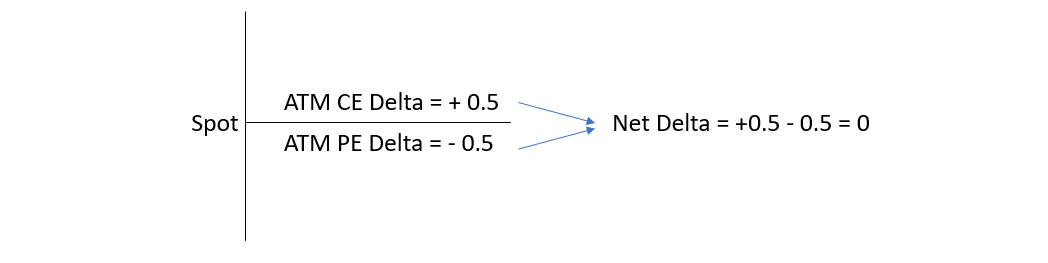

6/ Short Straddles are Delta Neutral

In our thread on delta, we discussed that the delta of a call option is considered +ve and for a put option is -ve. Delta for ATM call/put is almost 0.5 and this value increases as we go ITM and decreases as we go OTM

In our thread on delta, we discussed that the delta of a call option is considered +ve and for a put option is -ve. Delta for ATM call/put is almost 0.5 and this value increases as we go ITM and decreases as we go OTM

The value of 0.5 here means that the option would move half a point with a 1-point movement in the underlying

Since we are creating a short straddle with ATM call and put, the delta would be as follows:

ATM call delta = +0.5

ATM put delta = - 0.5

Short straddle Net Delta = -0.5 + 0.5 = 0

ATM call delta = +0.5

ATM put delta = - 0.5

Short straddle Net Delta = -0.5 + 0.5 = 0

The position will not stay delta neutral as the underlying moves away from our ATM strike. It will turn positive or negative depending on the market direction.

Traders like to hedge +ve or -ve delta by selling or buying shares of the underlying

Traders like to hedge +ve or -ve delta by selling or buying shares of the underlying

7/ Advantages and Limitations

A major advantage of Short straddle is that it is a net credit strategy

Another advantage is that it makes you money when the market is in a narrow range, which is a very common scenario, after an event or news, in all types of markets

A major advantage of Short straddle is that it is a net credit strategy

Another advantage is that it makes you money when the market is in a narrow range, which is a very common scenario, after an event or news, in all types of markets

Also, traders know the maximum profit that he is going to receive in this position.

This way he can adjust his position size to keep the risk involved within his affordable limits

This way he can adjust his position size to keep the risk involved within his affordable limits

You will lose money if the market breaks out of the breakeven range. Thus, you need to avoid this strategy in a trending environment.

However, it would be best to utilize volatility spikes, in a range-bound market, due to events, etc.

However, it would be best to utilize volatility spikes, in a range-bound market, due to events, etc.

Another limitation is that the risk involved is unlimited. So, you will need to adjust or hedge this position accordingly.

Therefore, this strategy is not for newbie option traders but for experienced option traders

Therefore, this strategy is not for newbie option traders but for experienced option traders

As this position involves option selling you need to have lots of margin in your account, so you need to have good capital for short straddles

9/ Examples

Let us say Nifty spot is at 15782

To create a short straddle

Short 1lot 15800 CE @ Rs167

Short 1lot 15800 PE @ Rs183

Total premium received = 167 + 183 = 350

Let us say Nifty spot is at 15782

To create a short straddle

Short 1lot 15800 CE @ Rs167

Short 1lot 15800 PE @ Rs183

Total premium received = 167 + 183 = 350

Case1/

Nifty expires at our ATM strike 15800

15800CE = 0

15800PE = 0

Profit = total premium received = 350 (Max Gain)

Nifty expires at our ATM strike 15800

15800CE = 0

15800PE = 0

Profit = total premium received = 350 (Max Gain)

Case2/

Nifty expires up at 16000

15800CE = 200

Loss = 200 – 167 = 33

Nifty expires up at 16000

15800CE = 200

Loss = 200 – 167 = 33

15800PE = 0

Gain = premium received in PE = 183

Profit = 183 – 33 = 150

Gain = premium received in PE = 183

Profit = 183 – 33 = 150

Case3/

Nifty expires up at 16150

This is our upper breakeven point = Strike + total premium received

= 15800 + 350 = 16150

Nifty expires up at 16150

This is our upper breakeven point = Strike + total premium received

= 15800 + 350 = 16150

15800CE = 350

Loss = 350 – 167 = 183

Loss = 350 – 167 = 183

15800PE = 0

Gain = 183

Profit/Loss = 183 – 183 = 0

Gain = 183

Profit/Loss = 183 – 183 = 0

Case4/

Nifty expires up at 16300

15800CE= 500

Loss = 500 – 167 = 333

Nifty expires up at 16300

15800CE= 500

Loss = 500 – 167 = 333

15800PE = 0

Gain = 183

Net loss = 333 – 183 = 150

Gain = 183

Net loss = 333 – 183 = 150

Case5/

Nifty expires down at 15600

15800CE = 0

Gain = 167

Nifty expires down at 15600

15800CE = 0

Gain = 167

15800PE = 200

Loss = 200 – 183 = 17

Net Profit = 167 – 17 = 150

Loss = 200 – 183 = 17

Net Profit = 167 – 17 = 150

Case6/

Nifty expires at 15450

This is our lower breakeven point = Strike – total premium received

= 15800 – 350 = 15450

Nifty expires at 15450

This is our lower breakeven point = Strike – total premium received

= 15800 – 350 = 15450

15800CE = 0

Gain = 167

Gain = 167

15800PE = 350

Loss = 350 – 183 = 167

Net Profit/Loss = 167 – 167 = 0

Loss = 350 – 183 = 167

Net Profit/Loss = 167 – 167 = 0

Case7/

Nifty expires down at 15300

15800CE= 0

Gain = 167

Nifty expires down at 15300

15800CE= 0

Gain = 167

You can observe that there is maximum profit at breakeven. The profit decreases as Nifty expires away from the ATM strike. There is a loss beyond the breakeven on either side

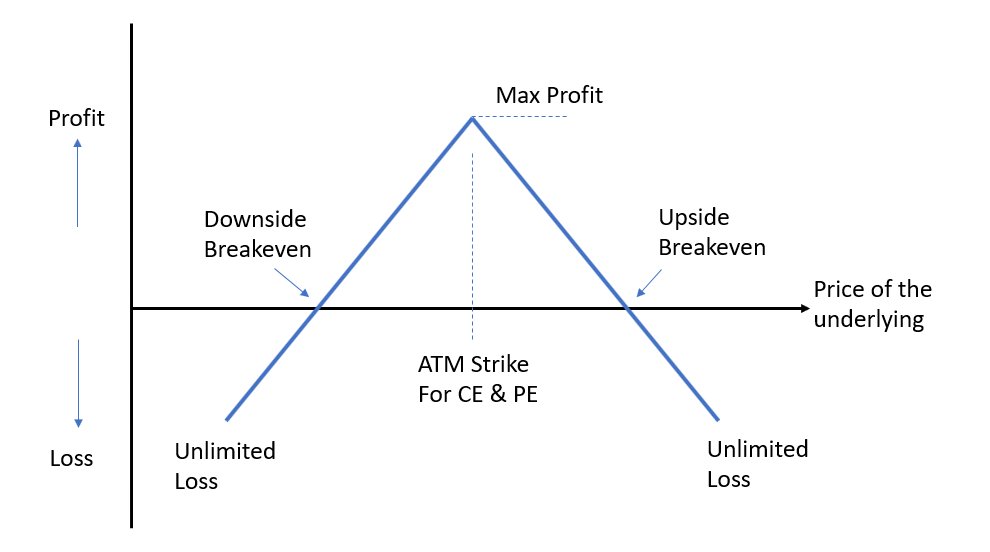

10/ Pay-off Diagram

The diagram presents limited profit and unlimited loss as it goes beyond the breakeven points.

Higher premiums mean a wider breakeven range and hence higher chances of profitable trade.

The diagram presents limited profit and unlimited loss as it goes beyond the breakeven points.

Higher premiums mean a wider breakeven range and hence higher chances of profitable trade.

You need to keep in mind that such high premiums are available when there are a greater number of days to expiry

So that’s it for today

Stay tuned @finkarmaIN for more such writeups in the coming days

Don’t forget to like and retweet

Thanks for reading

Stay tuned @finkarmaIN for more such writeups in the coming days

Don’t forget to like and retweet

Thanks for reading

• • •

Missing some Tweet in this thread? You can try to

force a refresh