1/.@Bancor V3 launched 6 days ago and TVL mooned to $260M USD 👀

⁉Why did it grow so fast?

V3 solves a few problems that #defi farmers hate👇

1. Staking two tokens in LP pools, therefore...

2. Incurring Impermanent loss

2. Compounding rewards yourself.

$BNT solutions are🧵

⁉Why did it grow so fast?

V3 solves a few problems that #defi farmers hate👇

1. Staking two tokens in LP pools, therefore...

2. Incurring Impermanent loss

2. Compounding rewards yourself.

$BNT solutions are🧵

2/On Uniswap you need to provide liquidity with 2 tokens, so if you farm stables you will need to provide liquidity in DAI/USDC etc.

Yet, Bancor V2 allows single asset deposits and claimed to give 100% impermanent loss protection.

@Gemini wrote a good explanation how it works.

Yet, Bancor V2 allows single asset deposits and claimed to give 100% impermanent loss protection.

@Gemini wrote a good explanation how it works.

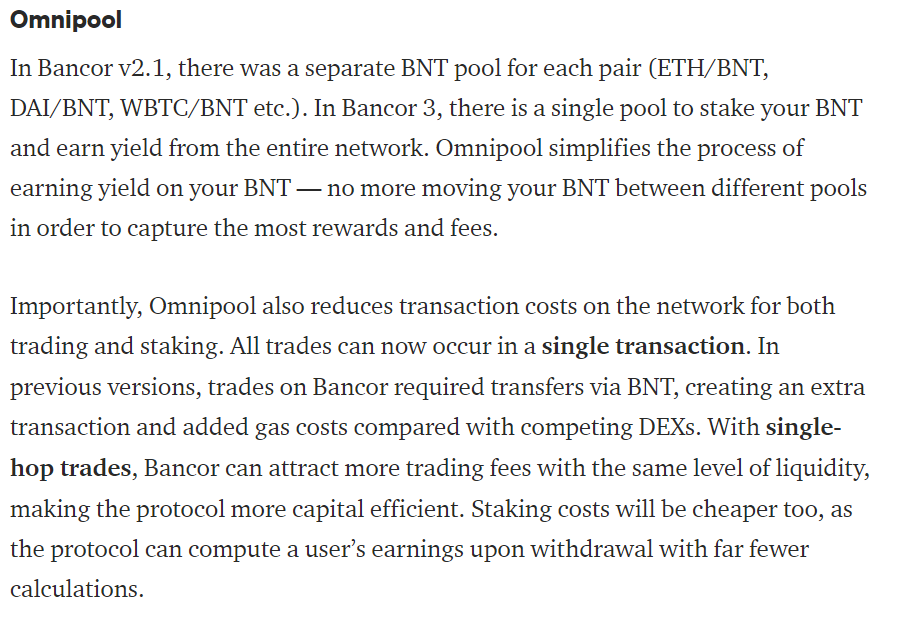

3/V3 changed the mechanics slightly by creating an Omnipool of $BNT.

With the Omnipool, no need to choose in which pool to stake your BNT.

It also reduces transaction and gas fees.

With the Omnipool, no need to choose in which pool to stake your BNT.

It also reduces transaction and gas fees.

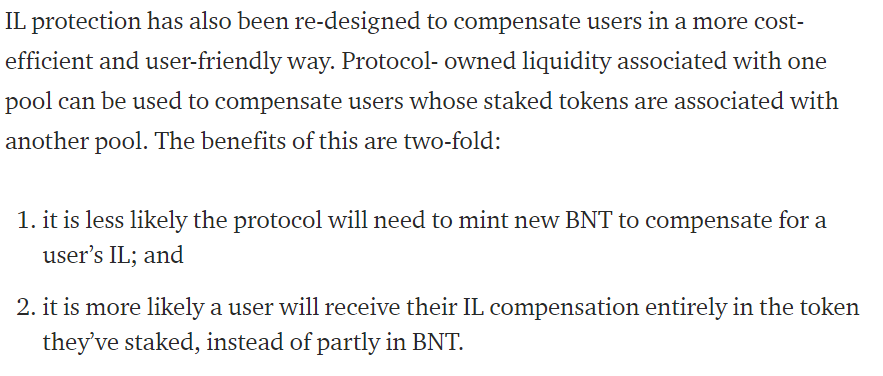

4/ V2 also had IL protection, but you had to stake tokens for at least 100 days.

V3 boasts with Instant IL protection.

The protocol uses fees earned from its co-investments of BNT in Omnipool to compensate for the network-wide cost of IL.

V3 boasts with Instant IL protection.

The protocol uses fees earned from its co-investments of BNT in Omnipool to compensate for the network-wide cost of IL.

5/ It seems like there is still a possibility that part of the IL protection could come from minting NEW $BNT tokens that are distributed instead of the originally staked token.

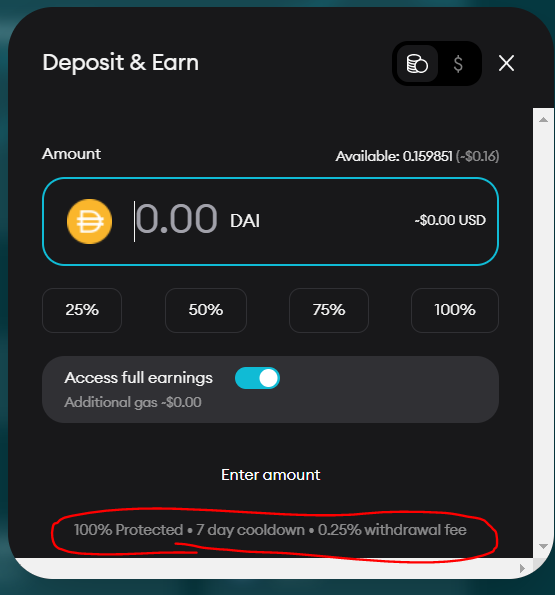

Keep in mind that there is a 0.25% withdrawal fee and 7 day cool down.

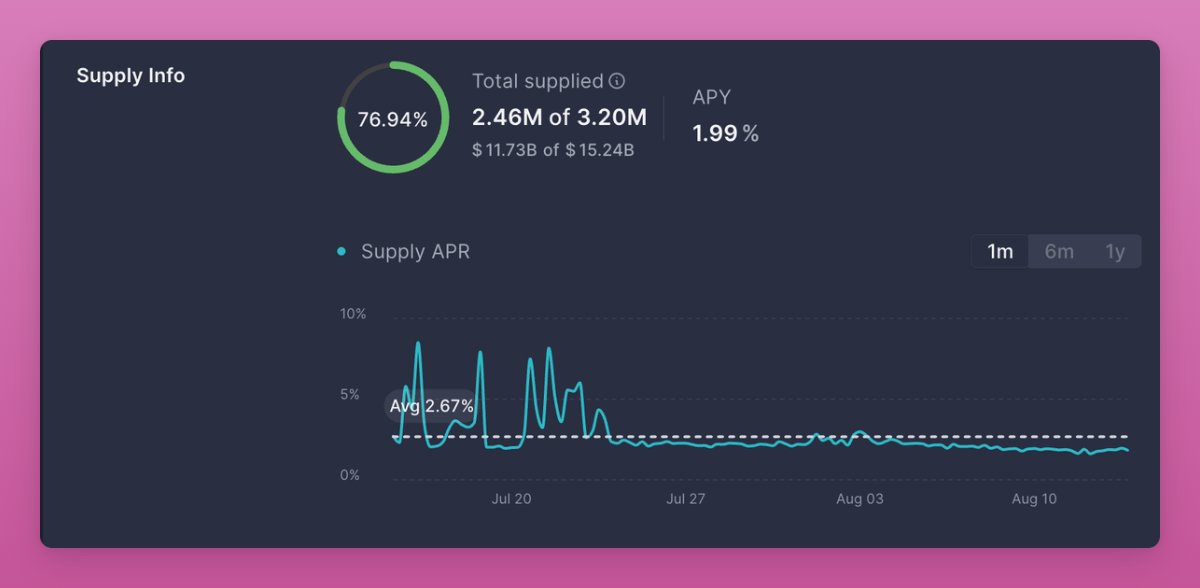

Yet yield for $DAI is high.

Keep in mind that there is a 0.25% withdrawal fee and 7 day cool down.

Yet yield for $DAI is high.

6/ Yield aggregators prospered thanks to their autocompound feature.

Yet, yield aggregators take their own cut in deposit/withdrawal fees, 'harvesting' fees etc.

Bancor V3 addition of Compounding Rewards maximizes yield and reduces gas costs.

Good job @Bancor 💯

Yet, yield aggregators take their own cut in deposit/withdrawal fees, 'harvesting' fees etc.

Bancor V3 addition of Compounding Rewards maximizes yield and reduces gas costs.

Good job @Bancor 💯

7/ There are more features, such as Dual-Sided Rewards, Multichain and L2 support etc, but those three changes are what every #DeFi yield farmer is looking for.

blog.bancor.network/introducing-ba…

blog.bancor.network/introducing-ba…

• • •

Missing some Tweet in this thread? You can try to

force a refresh