Coming back after a few days off Twitter, thought I'd try and explain in a (hopefully) easy + visual way why, despite things being really tough right now, there's space for hope - even if it doesn't feel like it

🧵👇

#SriLankaEconomicCrisis #EconomicCrisisLK #SriLanka #aragalaya

🧵👇

#SriLankaEconomicCrisis #EconomicCrisisLK #SriLanka #aragalaya

Disclaimer - personal opinion of course, and this framework is a complete oversimplification, but hopefully this can serve as a useful introduction into why there's space for hope

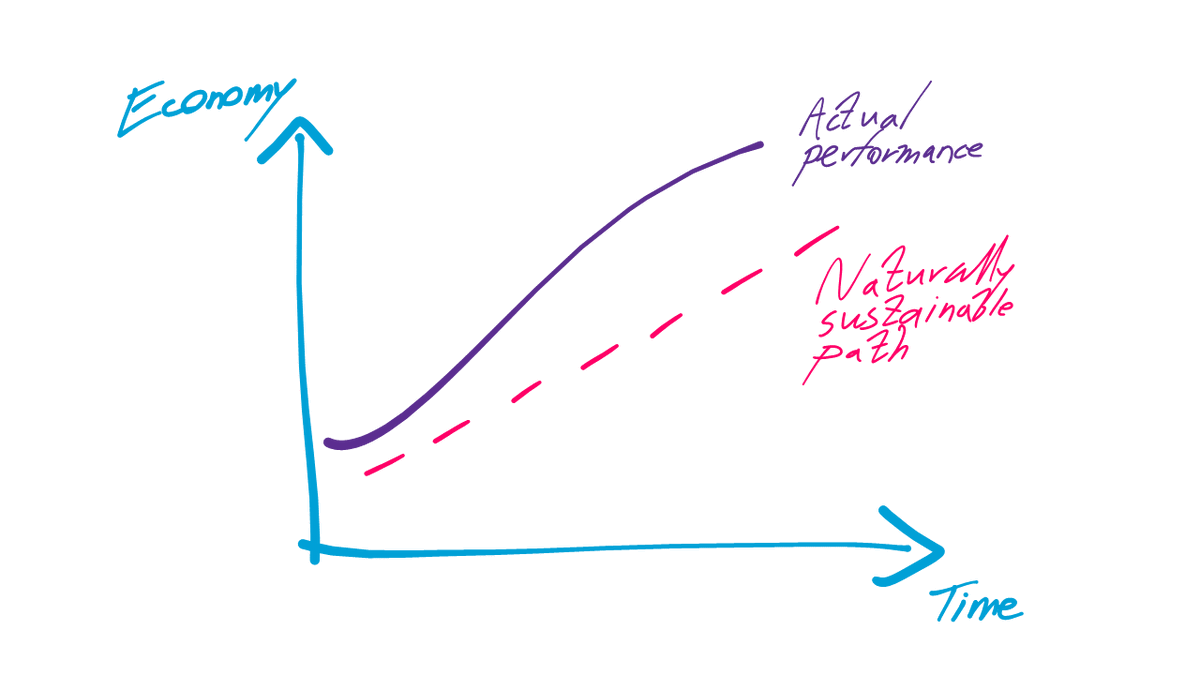

Explaining this visually in a series of simplified graphs.

It maps the performance of the economy over time.

Here, economy is an overall measure of money, QoL, growth, etc. Up is good, down is bad.

It maps the performance of the economy over time.

Here, economy is an overall measure of money, QoL, growth, etc. Up is good, down is bad.

So for any country, I'm going to explain 2 lines.

One is the actual performance of the economy - simple enough, what actually happens.

Second is slightly more complicated - but its essentially what is sustainably possible with current resources - or the current potential.

One is the actual performance of the economy - simple enough, what actually happens.

Second is slightly more complicated - but its essentially what is sustainably possible with current resources - or the current potential.

To be clear, when I say sustainable/current resources, I'm NOT talking about the environment, but of economic resources.

Think of it as what we can do with money we currently have (pink) vs what we actually do with money we borrow/print as well (purple).

Think of it as what we can do with money we currently have (pink) vs what we actually do with money we borrow/print as well (purple).

Now in many instances in the real world, what actually happens is above "natural potential" because we can borrow money we don't currently have, and use it to improve our economy.

If that doesn't improve our potential, while actual performance goes up, potential is slower.

If that doesn't improve our potential, while actual performance goes up, potential is slower.

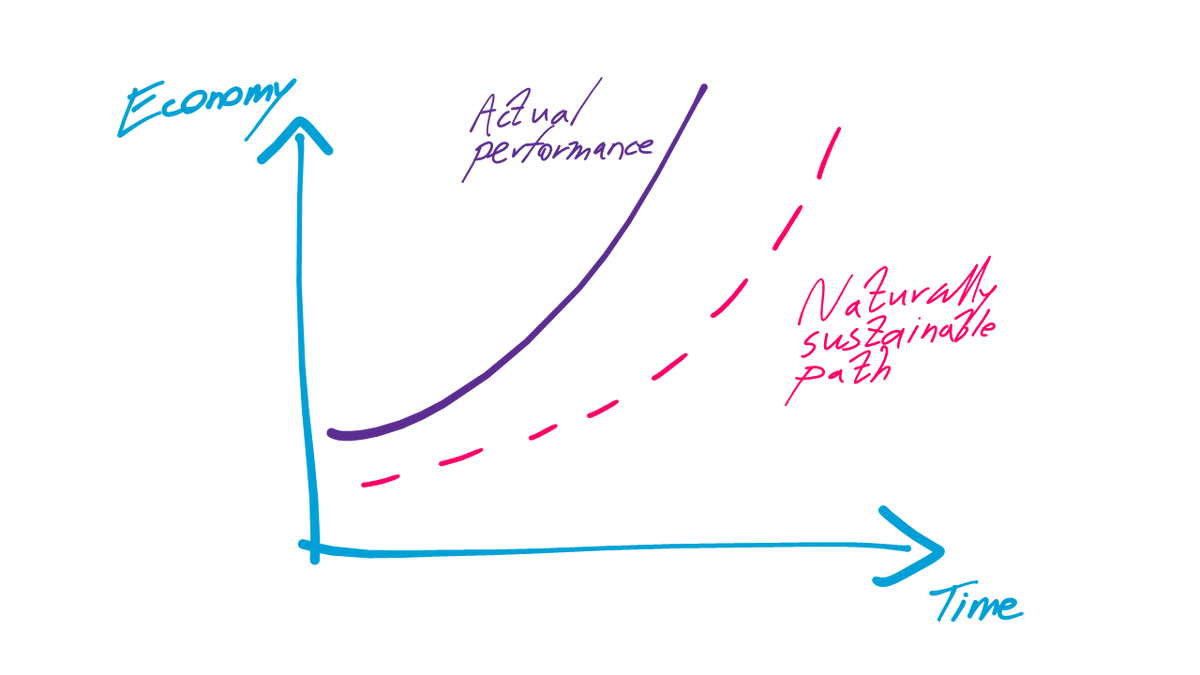

Now if this economic growth ALSO grows our underlying ability, then it's great. Eg - education driven growth

Even if your "actual" growth is not sustainable in short term, you're growing your potential up as well - so there's no "crash" down to the norm.

Even if your "actual" growth is not sustainable in short term, you're growing your potential up as well - so there's no "crash" down to the norm.

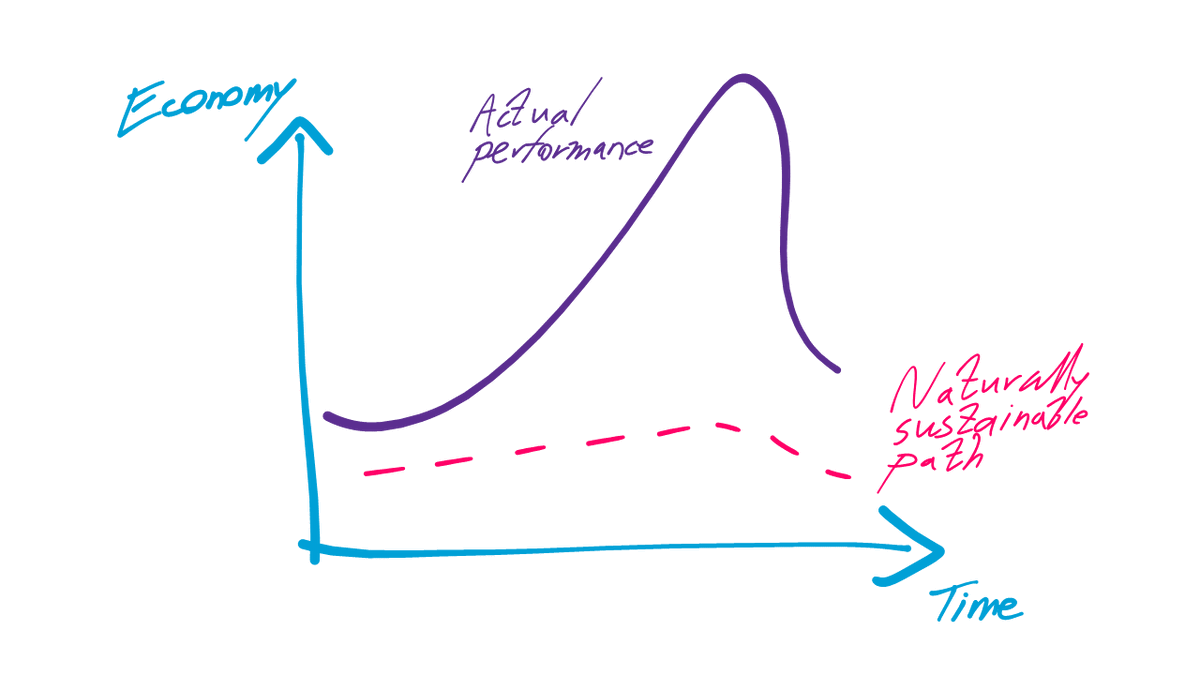

Bringing this to Sri Lanka - I've explained before how our economy has a strong consumption as opposed to long-term investment bias.

That means our economy sees "actual growth" in short term - while potential growth is slow.

That means our economy sees "actual growth" in short term - while potential growth is slow.

Now the thing is, this "actual growth" is not sustainable by definition. It's kept up by borrowing from the future, and once that starts falling, so too does your actual performance.

(printing money is also borrowing from future - future inflation is what you "pay back")

(printing money is also borrowing from future - future inflation is what you "pay back")

But thing is, it's worse than that. When your economy is forced to come back down to the norm, if the crash is hard enough, it can reduce your potential as well!

Eg - shortages, powercuts, unemployment, inflation

Eg - shortages, powercuts, unemployment, inflation

Lets zoom in on this falling part. Now if we let it continue falling, it will keep crashing - causing massive harm UNTIL at some chaotic future, our current economy is equal to our sustainable potential.

This is bad. Think of it as becoming so poor there's no more to fall.

This is bad. Think of it as becoming so poor there's no more to fall.

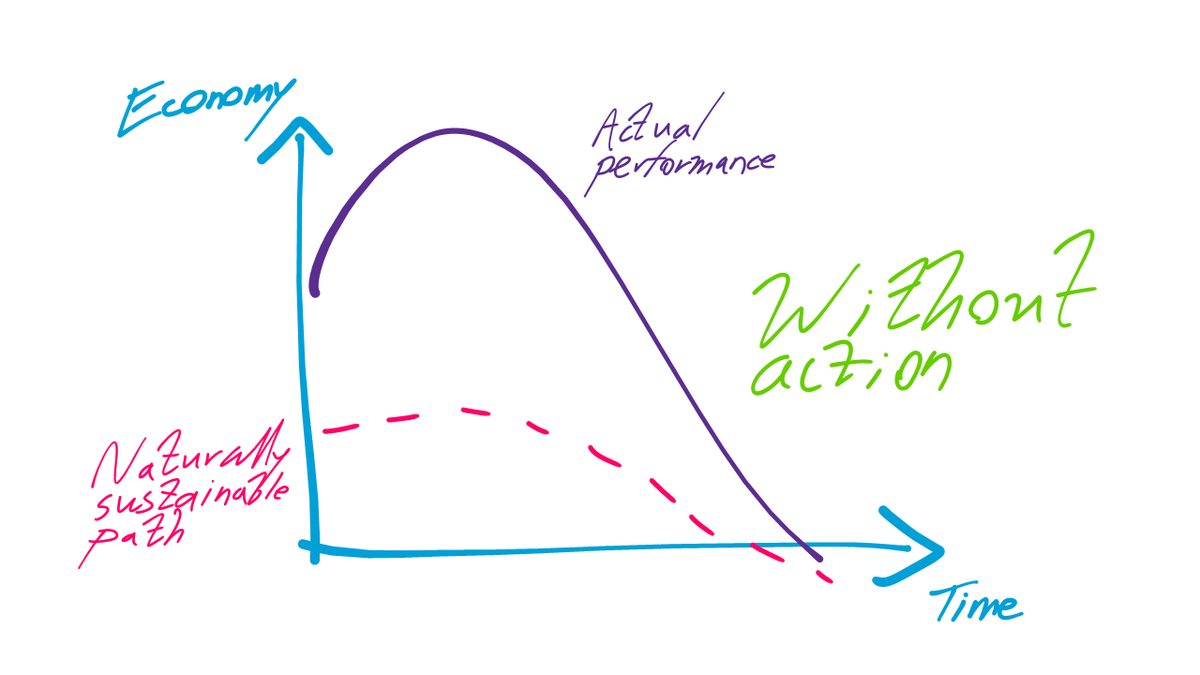

Now if you take action, the outlook is better. You're still going to go down for a while because of the crash that has been set in motion due to not being able to continue with unsustainable measures - but the pace of the fall is slower because of actions you take.

When you're in this negative situation, it's easy to say "the action we took made the situation get worse".

It definitely can look like that. After the action, things did get worse.

It definitely can look like that. After the action, things did get worse.

But the crucial point is that it's better, often far better, than the alternative - that massive terrible crash to zero.

You're going down because your earlier growth was due to unsustainable factors - so keeping that up is not possible anymore.

You're going down because your earlier growth was due to unsustainable factors - so keeping that up is not possible anymore.

But remember, action also means that your potential also gets onto a better trajectory. This is what allows you to reduce the speed of your crash, and in fact, start a recovery well before you reach rock bottom.

This is one point that gives me a little hope - avoiding the worst.

This is one point that gives me a little hope - avoiding the worst.

Now, if we had acted much earlier - possibly before the peak, we could've had a much better outcome. At that point, action would have made things worse in the short term - but avoided the worst crash.

This has been SL's economic story in past cycles in my view.

This has been SL's economic story in past cycles in my view.

This time around, we were very late. Things just got so so so bad even before we acted - that even after acting, we're going to be in a lot of pain.

I think right now, we're at that point - things are getting bad fast and it's at such a low level compared to what we're used to (and things look like they could get even worse), that it's difficult to come to terms with that fact that we're in a better alternative scenario.

A terrible scenario happens if we reverse our actions. We're so far down, that restarting unsustainble action might not even give us temporary relief, and might just immediately drag us down to that crash scenario again.

I really hope we don't do that.

I really hope we don't do that.

But as long as we continue this action, there's hope.

That's important - that this pain is not in vain.

Yes, I personally think our leaders are to blame and they should take more of the burden themselves. Yes, I personally think they need to be prosecuted for bringing us here.

That's important - that this pain is not in vain.

Yes, I personally think our leaders are to blame and they should take more of the burden themselves. Yes, I personally think they need to be prosecuted for bringing us here.

But our pain is not in vain. Things will start to improve at some point, and in my view, this will be sooner rather than later.

I know there's so much pain and sorrow everywhere. We need to do all we can to reduce this. But even if we fail at that, this is NOT the end.

I know there's so much pain and sorrow everywhere. We need to do all we can to reduce this. But even if we fail at that, this is NOT the end.

This is the future we can hope for. To come to a path of sustainably improving our lives through improving the underlying potential of the economy

Yes, it'll take time for things to get back to where we were. But since we have no space to backtrack, hopefully, we can stick to it

Yes, it'll take time for things to get back to where we were. But since we have no space to backtrack, hopefully, we can stick to it

The future will still have ups and downs, we can never escape reality after all.

But I'm confident that in the long term, things will improve and improve to levels we could never have expected.

That's what we can and will build towards.

But I'm confident that in the long term, things will improve and improve to levels we could never have expected.

That's what we can and will build towards.

Adding a clarification on the recovery of the "economy" - referring to overall indicator that also denotes shortages and the like. Things like GDP might be weaker for longer. Impacts on companies, unemployment, these things don't immediately reverse. (1/2)

But the worst of the worst does, including shortages, availability of basic food medicine etc - this improves faster than later. That's where hope for the majority lies in.

• • •

Missing some Tweet in this thread? You can try to

force a refresh