Lateral Economic Indices

#economics #inflation #recession

@AlessioUrban @PauloMacro @riteshmjn @SamanthaLaDuc @bon_laetitia @markminervini @ankitapathak_ @avasthiniranjan @564pankaj @JustPunforfun @_prashantnair @dugalira @chigrl

#economics #inflation #recession

@AlessioUrban @PauloMacro @riteshmjn @SamanthaLaDuc @bon_laetitia @markminervini @ankitapathak_ @avasthiniranjan @564pankaj @JustPunforfun @_prashantnair @dugalira @chigrl

Hemline Index (George Taylor, 1925).

Skirt hemlines are higher when the economy is performing better, and longer during downturns.!!!

(Fuming Feminist Economists)

Skirt hemlines are higher when the economy is performing better, and longer during downturns.!!!

(Fuming Feminist Economists)

Lipstick Index (Leonard Lauder)

He found that in the backdrop of an uncertainity, people wanted to go shopping but desisted buying expensive items.

So most bought lipsticks.

Post 9/11 his company’s lipstick sales doubled.

With the use of mask lipstick Index lost its value.

He found that in the backdrop of an uncertainity, people wanted to go shopping but desisted buying expensive items.

So most bought lipsticks.

Post 9/11 his company’s lipstick sales doubled.

With the use of mask lipstick Index lost its value.

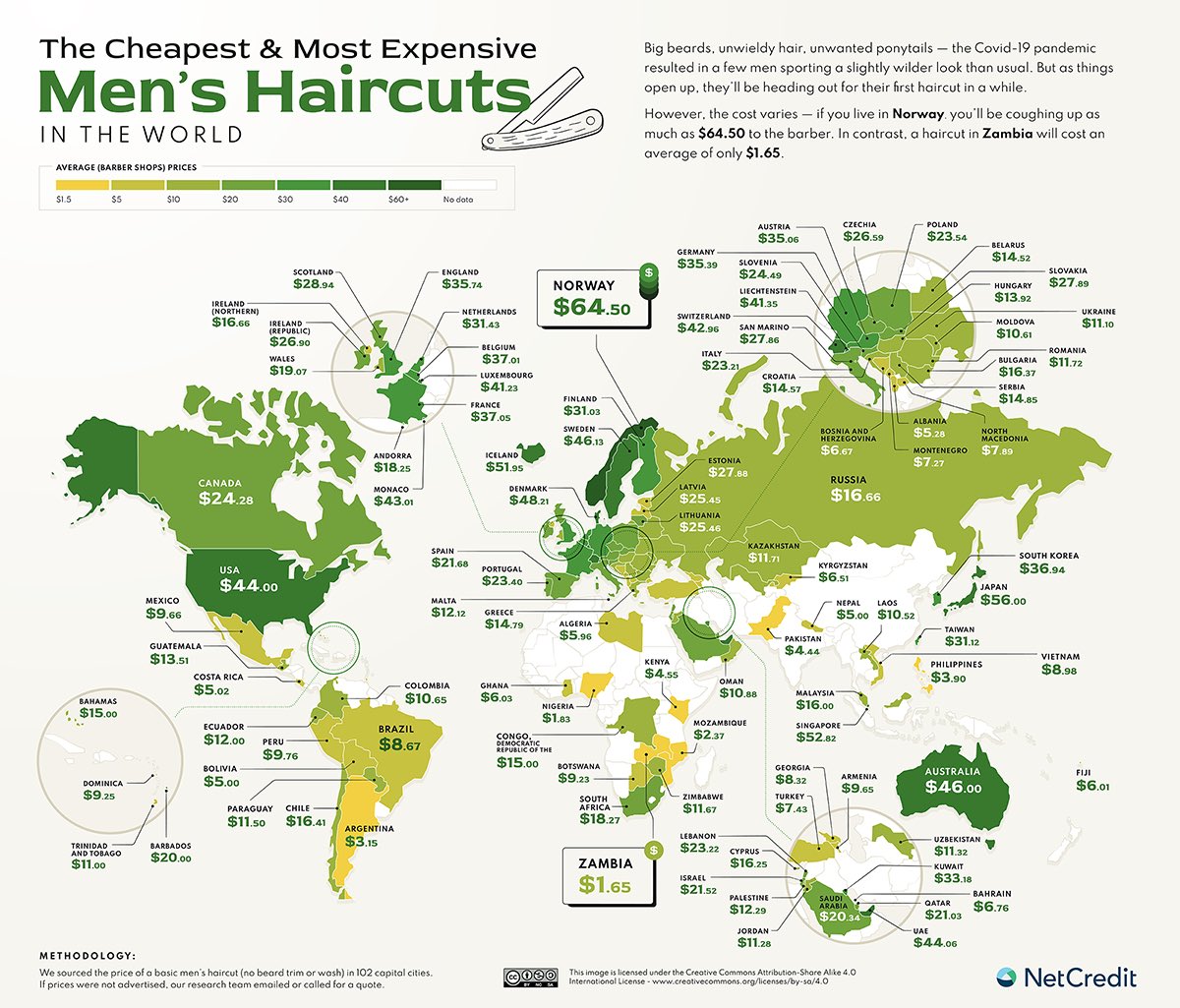

Haircut Index (Paul Mitchell)

Customers visit salons for haircuts every 6weeks during good economic times, but every 8 weeks when consumer confidence drops.

This has certainly gone tops turvy now as salons and barber shops remain closed and many opt for a cut at home.

Customers visit salons for haircuts every 6weeks during good economic times, but every 8 weeks when consumer confidence drops.

This has certainly gone tops turvy now as salons and barber shops remain closed and many opt for a cut at home.

Dry-Cleaning Index (Alan Greenspan, Former US Fed Chairman)

When consumer confidence is low, dry cleaning sales figures drop – and resume again when the economy improves.

When consumer confidence is low, dry cleaning sales figures drop – and resume again when the economy improves.

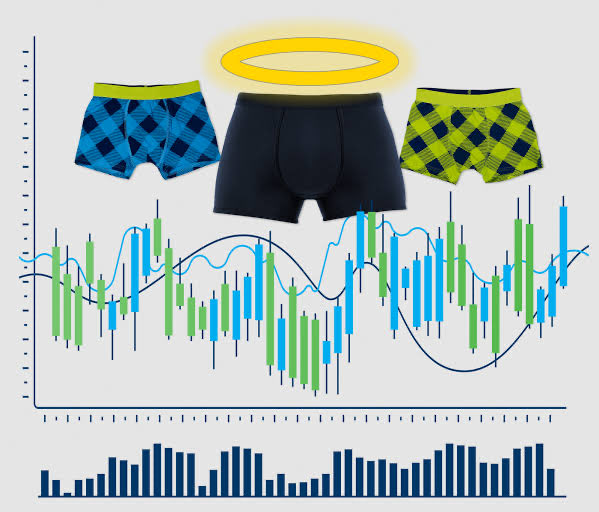

Men’s Underwear Index (Greenspan)

A decline in men’s underwear sales indicates a poor overall state of the economy, while an upswing in sales predicts an improving economy.

A decline in men’s underwear sales indicates a poor overall state of the economy, while an upswing in sales predicts an improving economy.

Led Zeppelin:

The Stairway to Heaven" curve moves upwards – gently sloped, slowly rising – with small periods of flat growth where in economy tires itself out while having to climb so many steps, and so it pauses, stops to breathe, and then rises again.

The Stairway to Heaven" curve moves upwards – gently sloped, slowly rising – with small periods of flat growth where in economy tires itself out while having to climb so many steps, and so it pauses, stops to breathe, and then rises again.

Do RT First Tweet / Like / Forward

End

End

Dating Sites on the other hand showed an increase during recession. No wants to face losing money and being lonely at the same time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh