How to get URL link on X (Twitter) App

2. I don't think it's a major driver when it comes to inflation. Monetary Policy plays a more important role.

2. I don't think it's a major driver when it comes to inflation. Monetary Policy plays a more important role.

Not all is red.. Specks of green seen.

Not all is red.. Specks of green seen.

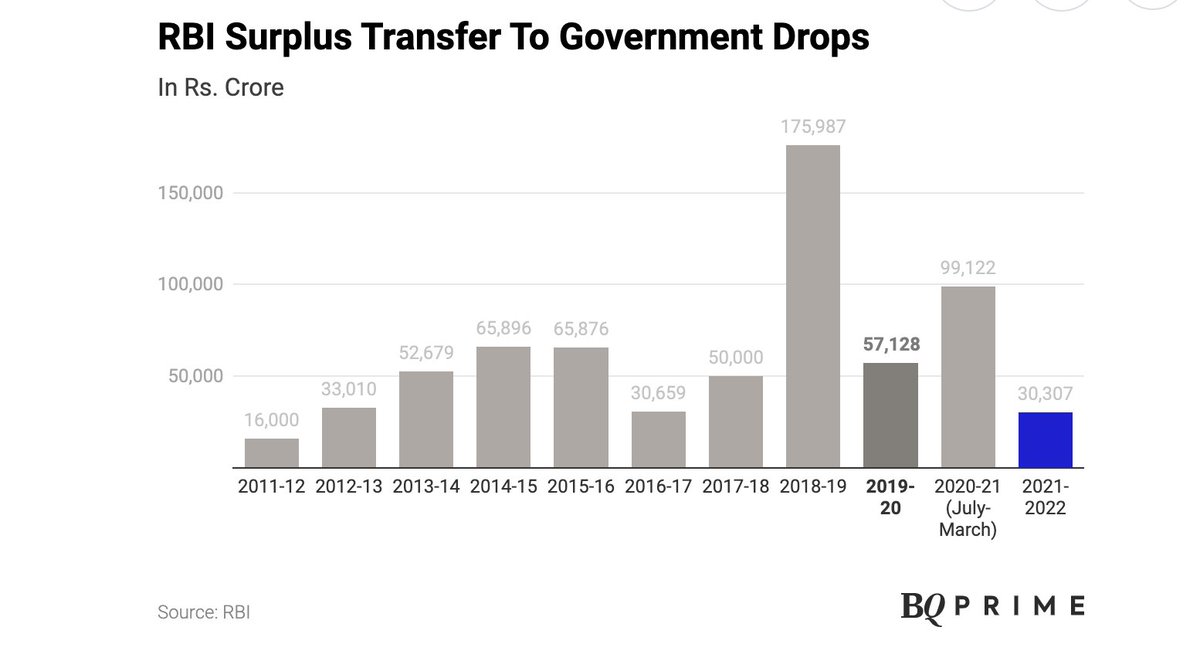

https://twitter.com/dugalira/status/1527599862300127233Lowest since 2011 - 2012

Apocalypse Now.

Apocalypse Now.

Update: No Gross Change here inOI at 34000

Update: No Gross Change here inOI at 34000

Yes the clots have to be removed. What about the Ticargelor and Aspirin he is on??

Yes the clots have to be removed. What about the Ticargelor and Aspirin he is on??

Psst. There is nothing official about this.

Psst. There is nothing official about this.

https://twitter.com/HayekAndKeynes/status/1520003618820210693

https://twitter.com/jasongoepfert/status/1520040516955643905?s=21&t=bFvKSw2M-qzcwUfjN6ToxQ

https://twitter.com/agrawalmohit12/status/1519895417936351233Amazon reported its first quarterly loss since 2015 on Thursday.

With inflation currently around 7%(USA) and 6,95%(India), businesses and consumers are feeling the pinch.

With inflation currently around 7%(USA) and 6,95%(India), businesses and consumers are feeling the pinch.

https://twitter.com/optionurol/status/1517266038701797376?s=21&t=2Rqf5ibA5hFEXe3nEL9S7g

Could not be saved and broke the trend line. Heading to next level of 33291...

Could not be saved and broke the trend line. Heading to next level of 33291...

EOD Put Positions

EOD Put Positions