In Part I of the stablecoin long read thread I outlined the conditions that led to the $UST disaster. BUT (!) decentralized stablecoins are a beautiful concept that definitely has a future.

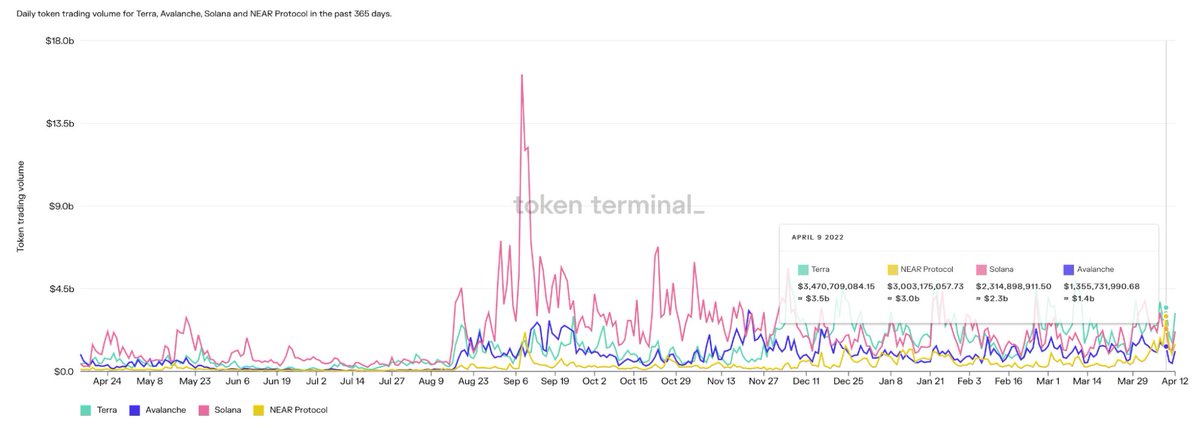

1/ So, the topic for Part II is $USN – @NEARProtocol's native stablecoin.

1/ So, the topic for Part II is $USN – @NEARProtocol's native stablecoin.

2/ If you missed the first part, then it is better to start researching the topic with it.

There I described the main prerequisites that led to the collapse of the #UST and options for how this could have been avoided.

There I described the main prerequisites that led to the collapse of the #UST and options for how this could have been avoided.

https://twitter.com/_alexpavlov/status/1526532828418256898

3/ #USN by @DcntrlBank is a fully collateralized decentralized stablecoin backed by $NEAR and $USDT with more assets to be added soon. The peg is maintained by on-chain arbitrage and rebalancing of the treasury to ensure stability in any market conditions.

4/ Unlike $UST and $LUNA, the #NEAR supply does not change based on USN transactions, except that it results in an increase in $NEAR staking, which actually generates income for $USN holders.

5/ As described in Part I, one of the biggest challenges $UST faced was @anchor_protocol's net loss due to the high APY for stakers funded by the Terra team. $USN stakers will receive ORGANIC income from NEAR staking rewards.

6/ How to evaluate the USN security?

The easiest way is to calculate the NEAR M.Cap/USN supply ratio. As long as it is above about 4, it is safe, and when it drops to 2, the USN peg becomes fragile. Now, this value is 42, so the margin of safety is huge.

The easiest way is to calculate the NEAR M.Cap/USN supply ratio. As long as it is above about 4, it is safe, and when it drops to 2, the USN peg becomes fragile. Now, this value is 42, so the margin of safety is huge.

7/ Wen $USN staking?

There is no specific date, but it should be presented soon. Two options are now available: #NEAR's @finance_ref with 5.91% APY and @auroraisnear's @trisolarislabs with 8.33% APY.

@burrowcash, @BastionProtocol, and other NEAR dApps coming soon.

There is no specific date, but it should be presented soon. Two options are now available: #NEAR's @finance_ref with 5.91% APY and @auroraisnear's @trisolarislabs with 8.33% APY.

@burrowcash, @BastionProtocol, and other NEAR dApps coming soon.

8/ Another decentralized stablecoin was recently launched, $USDD, @trondao's native stablecoin. #USDD now offers 12% of APY and its M.Cap is worth $463 million. And according to @justinsuntron, the Tron Foundation has $10 billion in reserves backing this asset.

9/ To sum it up, decentralized stablecoins like $USN or $USDD could be the next big thing in #DeFi because the crypto world needs a safer way to store capital in less volatile assets than $BTC, less centralized than $USDT, and more capital efficient than $DAI.

10/ The $UST experiment resulted in dramatic consequences but showed that the concept is viable. If $USN and $USDD avoid UST’s mistakes, such as too high yield for farming, excess of mercenary capital in supply, and weak stablecoin-centered ecosystems, they are likely to succeed.

11/ Also, in the case of stablecoins, #DAO plays a big role. As the central bank of each country, the DAO must closely monitor the current situation and adjust the strategy, i.e. lower staking or farming rates to reduce demand and vice versa to stimulate the economy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh