1/ Short Strangles

As the name suggests, you need to sell options in this strategy

It involves 2 legs:

Short OTM CE

Short OTM PE

As the name suggests, you need to sell options in this strategy

It involves 2 legs:

Short OTM CE

Short OTM PE

2/ Stance

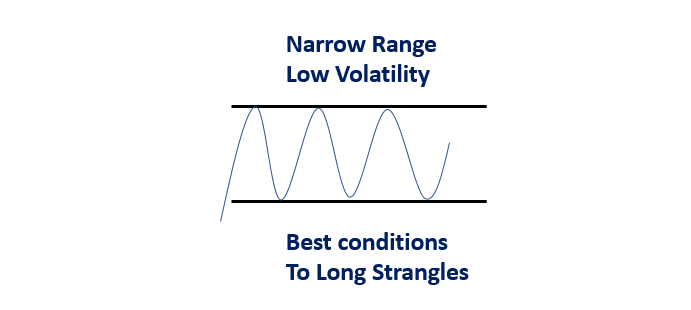

You expect the market to trade within a narrow range. A narrow range means low volatility and hence lowering option premium due to theta decay

You expect the market to trade within a narrow range. A narrow range means low volatility and hence lowering option premium due to theta decay

3/ Net Credit Strategy

Shorting options means that you will receive premium

Ex Nifty spot 16200

To create Short Strangle

Short 16300CE @92

Short 16100PE @132

Total premium received = 92 + 132 = 224

Shorting options means that you will receive premium

Ex Nifty spot 16200

To create Short Strangle

Short 16300CE @92

Short 16100PE @132

Total premium received = 92 + 132 = 224

@132 4/ Maximum Profit

The max profit is the premium received at entering the strategy, possible when the market expires within or at the selected strikes

In the Ex, expiry at or between 16100 or 16300, means options go worthless due to theta decay and you receive 224 points per lot

The max profit is the premium received at entering the strategy, possible when the market expires within or at the selected strikes

In the Ex, expiry at or between 16100 or 16300, means options go worthless due to theta decay and you receive 224 points per lot

@132 5/ Maximum Loss

The risk is open ended.If the market expires outside the selected strikes,there will be a loss

The extent of the loss depends upon the magnitude of the rally away from your strikes

In that case, volatility and option premium would increase which means more loss

The risk is open ended.If the market expires outside the selected strikes,there will be a loss

The extent of the loss depends upon the magnitude of the rally away from your strikes

In that case, volatility and option premium would increase which means more loss

@132 6/ Advantages over Short Straddles

Short Strangles: are

More sensitivity towards theta decay due to OTM options

Have wider breakeven points, good for option selling

Narrow price move and less volatility means more decay, compared to straddles, for same time-wise correction

Short Strangles: are

More sensitivity towards theta decay due to OTM options

Have wider breakeven points, good for option selling

Narrow price move and less volatility means more decay, compared to straddles, for same time-wise correction

@132 7/ Limitations over Short Straddles

While creating a Short Strangle you receive a lesser premium compared to Short Straddles.

This is due to OTM options used in strangles, which have a lesser premium compared to ATM option used in short straddles

While creating a Short Strangle you receive a lesser premium compared to Short Straddles.

This is due to OTM options used in strangles, which have a lesser premium compared to ATM option used in short straddles

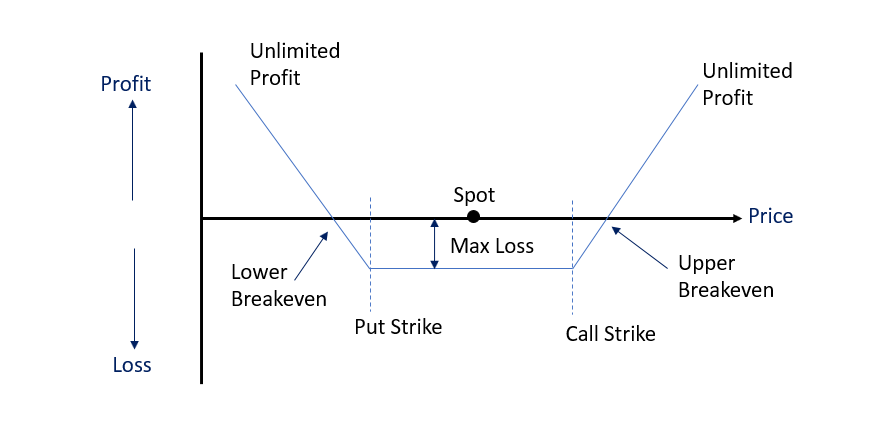

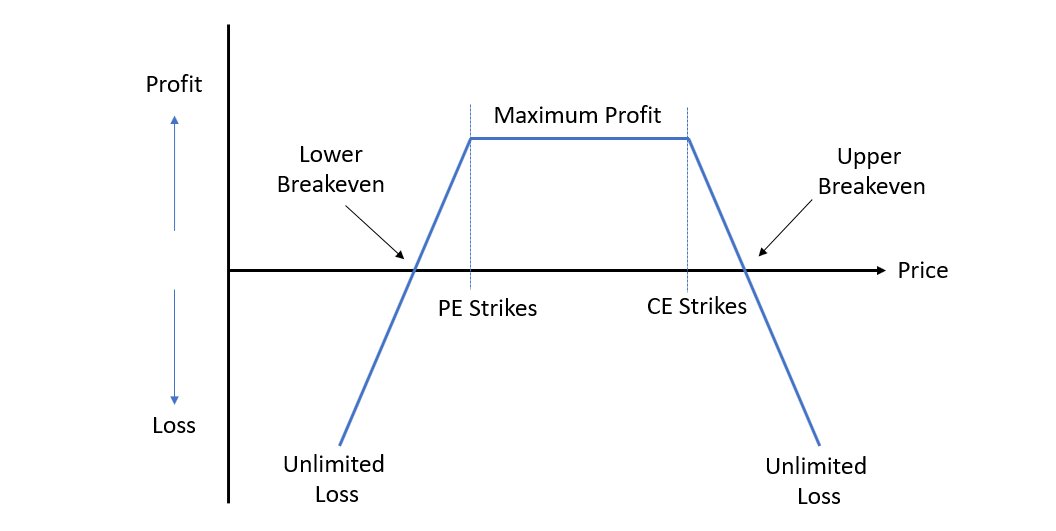

@132 8/ Payoff Diagram

Short Strangle Stance – Sideways

Involves selling OTM CE and OTM PE

Max Profit – Limited to the premium received (on expiry within strikes)

Risk – Unlimited (on expiry outside breakevens)

Breakevens – Wider

Short Strangle Stance – Sideways

Involves selling OTM CE and OTM PE

Max Profit – Limited to the premium received (on expiry within strikes)

Risk – Unlimited (on expiry outside breakevens)

Breakevens – Wider

@132 Stay tuned @finkarmaIN for more write-ups in the coming days

Don’t forget to like and retweet

Thanks for reading

Don’t forget to like and retweet

Thanks for reading

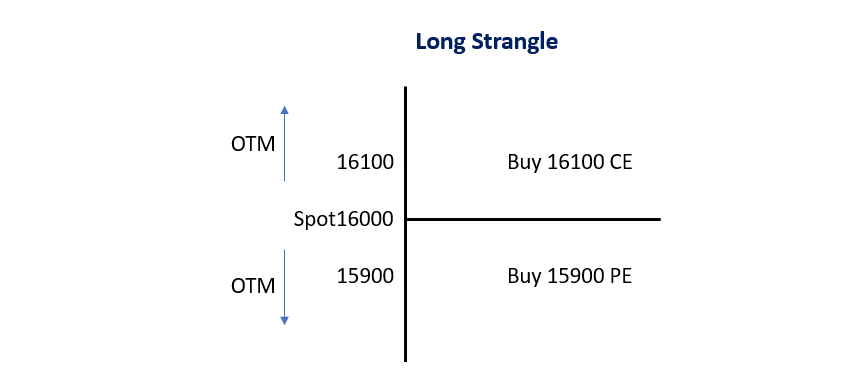

@132 If you loved this, check out our thread on Long strangle :

https://twitter.com/finkarmaIN/status/1527280615367712768?s=20&t=zDOJdy-eAsQIY1OTuZJRrw

• • •

Missing some Tweet in this thread? You can try to

force a refresh