Three major considerations for successful crypto trading:

- assessment of the protocol

- assessment of the token

- timing of the purchase

A thorough explanation on my investment framework, applied to Cosmos tokens 🧵

- assessment of the protocol

- assessment of the token

- timing of the purchase

A thorough explanation on my investment framework, applied to Cosmos tokens 🧵

The purpose of this thread is to explain the methodology I use to rank Cosmos protocols & tokens in the following document

datastudio.google.com/s/r3dNrJ6GmmI

datastudio.google.com/s/r3dNrJ6GmmI

Let's get the timing out-of-the-way first: in the context of investing, it means the decision of when to purchase or sell a particular asset

That decision must factor in the macro-economic situation, the roadmap, the upcoming milestones etc.

That decision must factor in the macro-economic situation, the roadmap, the upcoming milestones etc.

Recent Cosmos examples of good timing include:

- buying $ROWAN prior to #Sifchain PMPT

- buying $STARS prior to the marketplace launch

- buying $EVMOS prior to the #Osmosis listing

- buying $ROWAN prior to #Sifchain PMPT

- buying $STARS prior to the marketplace launch

- buying $EVMOS prior to the #Osmosis listing

While timing is absolutely critical in a short to medium term strategy, its importance fades in the longer term

Timing the market is hard & isn't part of the reports, but I do share regular "Cosmos alpha" threads w/ potential trading signals

Timing the market is hard & isn't part of the reports, but I do share regular "Cosmos alpha" threads w/ potential trading signals

https://twitter.com/ThyBorg_/status/1528329843124776960

The reports include, however, both a protocol assessment and a token assessment

It is of major importance to understand the difference between these two assessments so let's break it down in details:

It is of major importance to understand the difference between these two assessments so let's break it down in details:

The protocol assessment includes four elements:

1- the total addressable market (TAM) representing the revenue opportunity available to the protocol

2- the vision & strategy to solve the problem of the target market, the current traction & the differentiation from competitors

1- the total addressable market (TAM) representing the revenue opportunity available to the protocol

2- the vision & strategy to solve the problem of the target market, the current traction & the differentiation from competitors

3- the expertise & capabilities of the team to execute on their vision and market & sell the protocol efficiently

4- the reputation & strength of the financial backers of the protocol as well as their ability to help the team execute

4- the reputation & strength of the financial backers of the protocol as well as their ability to help the team execute

A good protocol doesn't mean a good token, and #Terra's fall is a great example of this dichotomy:

- Trillion USD stable coin market & active L1

- Great "decentralised" money value prop

- Amazing execution from Do Kwon & TFL

- Solid backers w/ Delphi, Hashed & Jump

- Trillion USD stable coin market & active L1

- Great "decentralised" money value prop

- Amazing execution from Do Kwon & TFL

- Solid backers w/ Delphi, Hashed & Jump

The $LUNA token, however, was tied to the ability of $UST to maintain its peg and got quickly minted into oblivion as soon as the system started failing

The token assessment uses the protocol assessment because the TAM, solution, team & investors definitely have an effect on the token's performance

Yet it is important to recognise that a good protocol doesn't automatically spell profit for investors

Yet it is important to recognise that a good protocol doesn't automatically spell profit for investors

Consider this example:

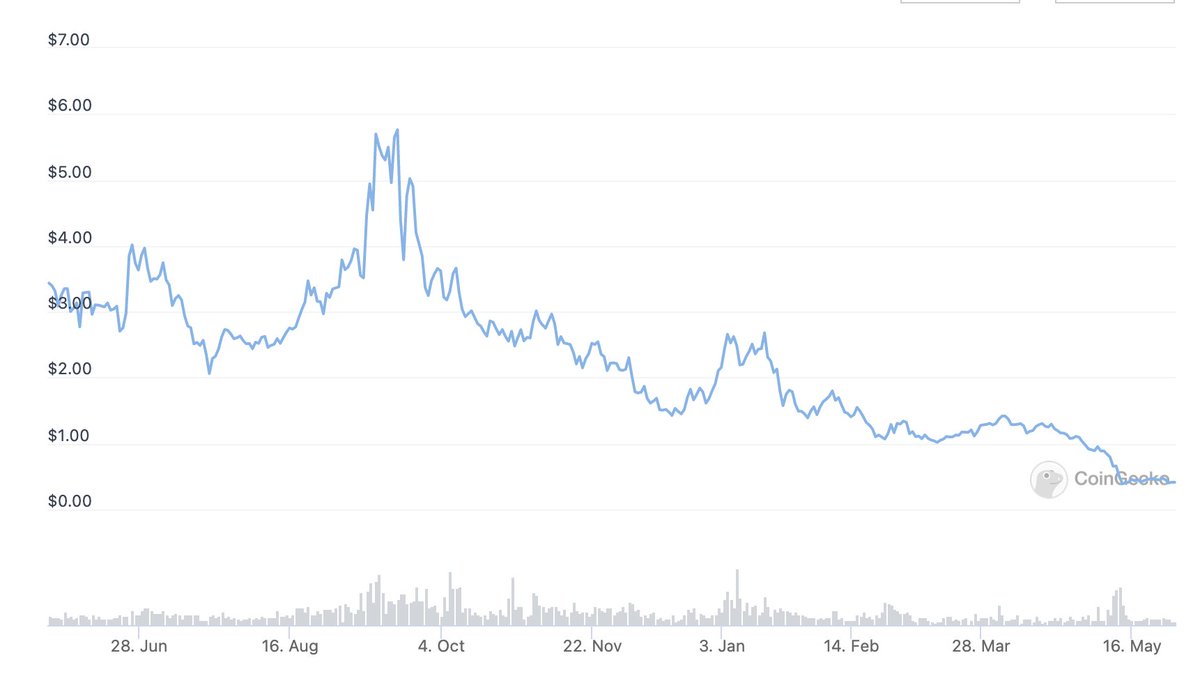

@akashnet_ is one the most interesting project in all of crypto

But $AKT has been in a downtrend since Sept-2021, including as $BTC was making all-time highs in Nov & Dec

@akashnet_ is one the most interesting project in all of crypto

But $AKT has been in a downtrend since Sept-2021, including as $BTC was making all-time highs in Nov & Dec

@akashnet_ So the token assessment takes into account four other elements:

1- Value-accrual is the ability of the token to capture the economic value of the protocol.

E.g @SecretNetwork usage brings value to $SCRT because it is required for gas fees

1- Value-accrual is the ability of the token to capture the economic value of the protocol.

E.g @SecretNetwork usage brings value to $SCRT because it is required for gas fees

@akashnet_ @SecretNetwork 2- Utility is the quantity & strength of the token's use cases

E.g $OSMO is used to secure @osmosiszone blockchain, to provide liquidity on the #Osmosis DEX and soon to pay for transaction fees

E.g $OSMO is used to secure @osmosiszone blockchain, to provide liquidity on the #Osmosis DEX and soon to pay for transaction fees

@akashnet_ @SecretNetwork @osmosiszone 3- A fair distribution is important to protect new holders from being used as exit liquidity from early investors

E.g low initial float and short unlock schedules for VCs made most of Solana token charts look as depressing as $ATLAS

E.g low initial float and short unlock schedules for VCs made most of Solana token charts look as depressing as $ATLAS

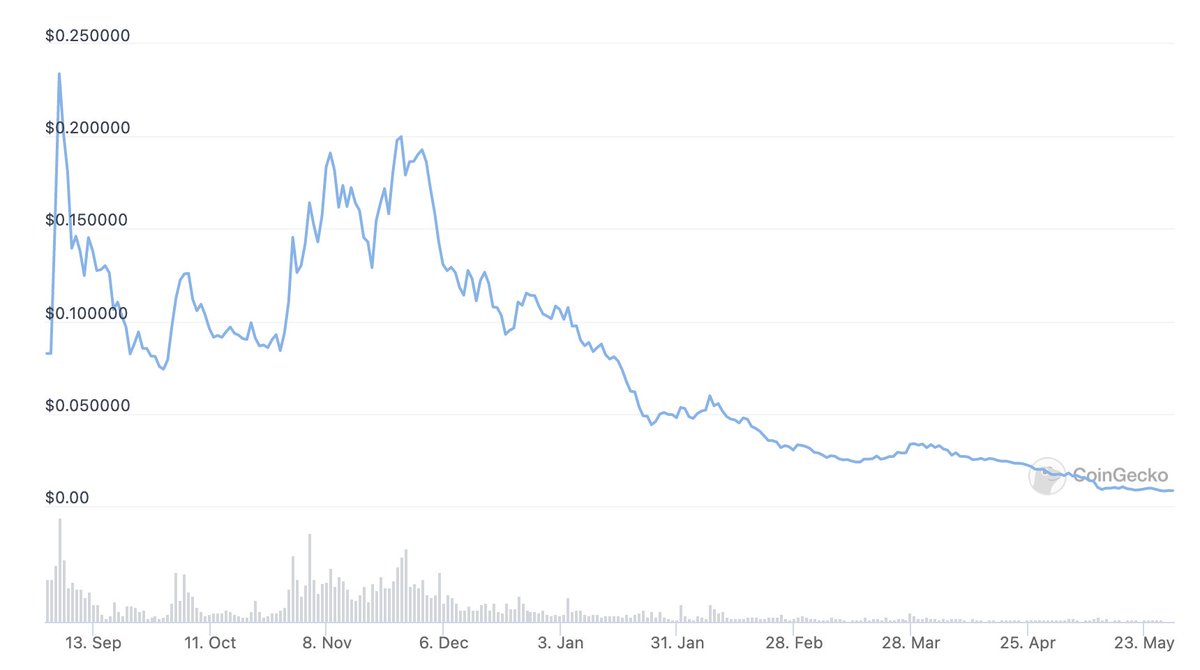

@akashnet_ @SecretNetwork @osmosiszone 4- A reasonable inflation schedule protects long-term holders from dilution of their stake in the protocol & typically lead to better price performance

E.g @Fortisoeconomia on #Juno is an example of an extreme inflation schedule leading the $BFOT token to loose all of its value

E.g @Fortisoeconomia on #Juno is an example of an extreme inflation schedule leading the $BFOT token to loose all of its value

@akashnet_ @SecretNetwork @osmosiszone @Fortisoeconomia The token list already includes king $ATOM based on the thread below. Other blue-chips will be added in the coming weeks

https://twitter.com/ThyBorg_/status/1528692222517837824

@akashnet_ @SecretNetwork @osmosiszone @Fortisoeconomia The protocol list already includes the @inter_protocol from the @agoric team (although the protocol's token is a stable)

https://twitter.com/ThyBorg_/status/1526517897111040000

@akashnet_ @SecretNetwork @osmosiszone @Fortisoeconomia @inter_protocol @agoric And since I'll be relentlessly covering the rest of the Cosmos ecosystem through educative & digestible threads on governance proposals, airdrops, tokens, teams & projects, you may consider retweeting this & giving me a follow @Thyborg_ ✌️

• • •

Missing some Tweet in this thread? You can try to

force a refresh