IRON CONDOR (IC)

If Short Strangle’s margin and unlimited loss potential is too much for you then the Iron Condor option strategy could be a perfect fit for you. It's not as complex as it sounds

A thread 🧵

#options #trading

If Short Strangle’s margin and unlimited loss potential is too much for you then the Iron Condor option strategy could be a perfect fit for you. It's not as complex as it sounds

A thread 🧵

#options #trading

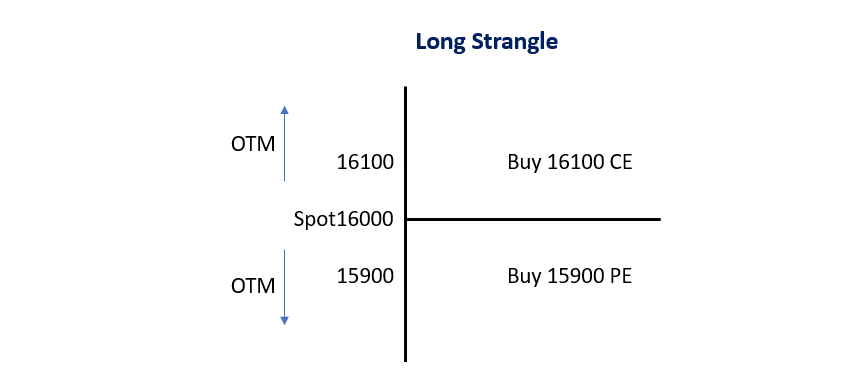

1/ Big Brother of Short Strangle (SS)

I am sure you read our previous thread on SS where you sell slightly OTM options in a sideways market.

To create an IC

Create an SS first

Buy the next OTM CE

Buy the next OTM PE

Let’s clear with an example

I am sure you read our previous thread on SS where you sell slightly OTM options in a sideways market.

To create an IC

Create an SS first

Buy the next OTM CE

Buy the next OTM PE

Let’s clear with an example

Ex.

If Nifty is trading at 16300 and you expect it to trade in a narrow range of 200 points till expiry then

Sell 16400CE

Sell 16200PE

This is SS, right?

Now Buy 16500CE

Buy 16100 PE

That is IC

If Nifty is trading at 16300 and you expect it to trade in a narrow range of 200 points till expiry then

Sell 16400CE

Sell 16200PE

This is SS, right?

Now Buy 16500CE

Buy 16100 PE

That is IC

In the above Ex

Sell 16400CE @117

Sell 16200PE @157

Premium received = 274

Buy 16500CE @ 80

Buy 16100PE @ 117

Premium paid = 197

Net premium received = Received – Paid = 274 – 197 = 77

This net credit is the max profit potential in an IC

Sell 16400CE @117

Sell 16200PE @157

Premium received = 274

Buy 16500CE @ 80

Buy 16100PE @ 117

Premium paid = 197

Net premium received = Received – Paid = 274 – 197 = 77

This net credit is the max profit potential in an IC

@117 @157 3/ Safety Comes at a Cost

Max profit potential in case of IC (77) is much less than SS (274), but consider this as cost for capping the risk

We know that there is unlimited risk in SS, in case market makes sharp move. This risk is capped with two long options in case of IC

Max profit potential in case of IC (77) is much less than SS (274), but consider this as cost for capping the risk

We know that there is unlimited risk in SS, in case market makes sharp move. This risk is capped with two long options in case of IC

@117 @157 4/ Max Loss Potential

Our sold strike = 16400

Our bought (protective) strike = 16500

Spread = 16500 – 16400 = 100

Max Loss = Spread – Net premium received

Spread = 100 – 77 = 23

Thereby our maximum loss reduces (from unlimited in SS) to 23 points

Our sold strike = 16400

Our bought (protective) strike = 16500

Spread = 16500 – 16400 = 100

Max Loss = Spread – Net premium received

Spread = 100 – 77 = 23

Thereby our maximum loss reduces (from unlimited in SS) to 23 points

@117 @157 5/ IC Risk-Reward Ratio

From the above Ex

Max profit = 77

Max Loss = 23

Risk/Reward potential = 1:3 which is good

In most cases RR will be favorable, that is more than the risk involved

From the above Ex

Max profit = 77

Max Loss = 23

Risk/Reward potential = 1:3 which is good

In most cases RR will be favorable, that is more than the risk involved

@117 @157 6/ IC Margin Requirements

I have put the above figures in Zerodha margin calculator and came up with following results:

a/ For the following Short Strangle

I have put the above figures in Zerodha margin calculator and came up with following results:

a/ For the following Short Strangle

@117 @157 Margin Required = Rs1,19,237

This seems high for a strategy that is open-ended so it has to be covered as follows

This seems high for a strategy that is open-ended so it has to be covered as follows

@117 @157 b/ For Iron Condor

We added 100 points spread to the SS (long 16500CE & 16100PE)

Now Margin required = Rs37,693

We need significantly less margin in this 4legged IC than a 2-legged SS. This is because our short options have been funding our long options

We added 100 points spread to the SS (long 16500CE & 16100PE)

Now Margin required = Rs37,693

We need significantly less margin in this 4legged IC than a 2-legged SS. This is because our short options have been funding our long options

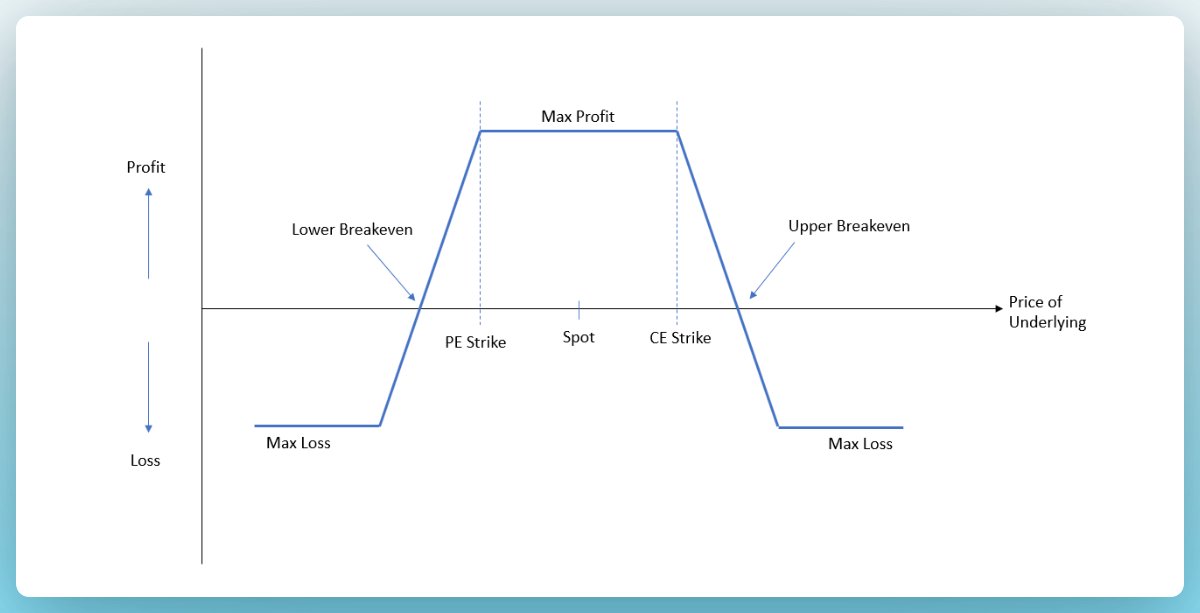

@117 @157 7/ Breakeven Points (BE)

There are two breakeven points in IC

Upper BE = Short CE strike + Net premium received

Lower BE = Short PE Strike – Net Premium received

In the above Example

Upper BE = 16400 + 77 = 16477

Lower BE = 16200 – 77 = 16133

There are two breakeven points in IC

Upper BE = Short CE strike + Net premium received

Lower BE = Short PE Strike – Net Premium received

In the above Example

Upper BE = 16400 + 77 = 16477

Lower BE = 16200 – 77 = 16133

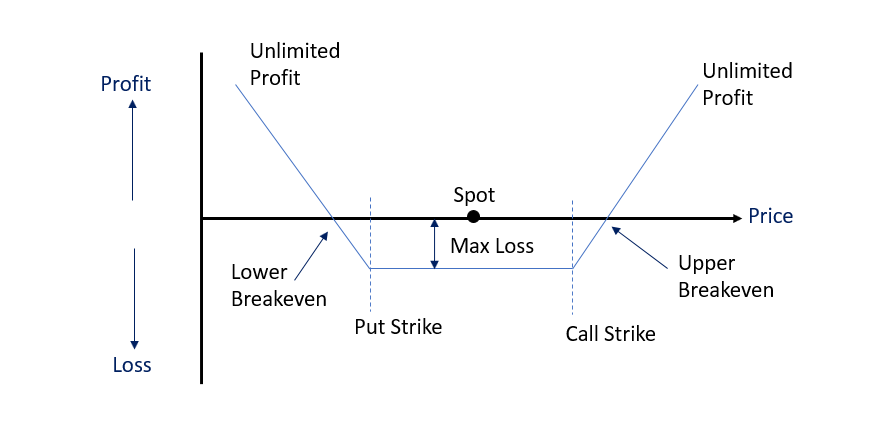

@117 @157 8/ Payoff Diagram

From the diagram you can see that you will have max profit if market expires within the short CE and PE strikes

The profit reduces as market expires between the short strikes and BE points

Outside the BE points, there is limited loss

From the diagram you can see that you will have max profit if market expires within the short CE and PE strikes

The profit reduces as market expires between the short strikes and BE points

Outside the BE points, there is limited loss

@117 @157 9/ Five-point Summary

IC is an improvisation over SS

It makes money when market expires in the expected range

Has Narrower BE points

Has lesser margin requirements than SS

Got limited risk at the cost of less profit potential than SS

IC is an improvisation over SS

It makes money when market expires in the expected range

Has Narrower BE points

Has lesser margin requirements than SS

Got limited risk at the cost of less profit potential than SS

@117 @157 Stay tuned @finkarmaIN for more such writeups in coming days

Don’t forget to like and retweet

Thanks for reading

Don’t forget to like and retweet

Thanks for reading

• • •

Missing some Tweet in this thread? You can try to

force a refresh