💸Stablecoins farming strategies💸

In a time of unpredictable market volatility, it's very important to protect your assets. While holding stablecoins is a good risk-free way.

In this thread we will show you how you can make money with stablecoins on #Avalanche

🧵👇

In a time of unpredictable market volatility, it's very important to protect your assets. While holding stablecoins is a good risk-free way.

In this thread we will show you how you can make money with stablecoins on #Avalanche

🧵👇

1/ One-side Farm

1.1/ Platypus Finance

When it comes to farming/staking stablecoins, we must of course mention #1 AMM stableswap @Platypusdefi

. If you are holding stablecoins, you should check this out:

- Go to Pool, Select Alt Pool

- Deposit Deposit into pool and earn APR

1.1/ Platypus Finance

When it comes to farming/staking stablecoins, we must of course mention #1 AMM stableswap @Platypusdefi

. If you are holding stablecoins, you should check this out:

- Go to Pool, Select Alt Pool

- Deposit Deposit into pool and earn APR

@Platypusdefi Bonus tip:

- Stake some $PTP on Platypus to Boost Yield

- When you stake $PTP you also receive $vePTP -> Boost more Yield

- Stake some $PTP on Platypus to Boost Yield

- When you stake $PTP you also receive $vePTP -> Boost more Yield

@Platypusdefi 1.2/ Vector Finance

You are thinking about how you should balance Stablecoins and $PTP to maximize profits. So let @vector_fi

do this for you, just simply:

- Select Platypus Pool on Vector

- Deposit Stablecoins into Platypus pool

- Earn boosted yield

You are thinking about how you should balance Stablecoins and $PTP to maximize profits. So let @vector_fi

do this for you, just simply:

- Select Platypus Pool on Vector

- Deposit Stablecoins into Platypus pool

- Earn boosted yield

@Platypusdefi @vector_fi 2/ LP Farm

- Provide LP Stablecoins pairs via @traderjoe_xyz and @pangolindex

- Farm LP directly on @traderjoe_xyz and @pangolindex or farm LP on these protocols:

@snowballdefi

@penguin_defi

@Defrost_Finance

@KyberNetwork

- Provide LP Stablecoins pairs via @traderjoe_xyz and @pangolindex

- Farm LP directly on @traderjoe_xyz and @pangolindex or farm LP on these protocols:

@snowballdefi

@penguin_defi

@Defrost_Finance

@KyberNetwork

@Platypusdefi @vector_fi @traderjoe_xyz @pangolindex @snowballdefi @penguin_defi @Defrost_Finance @KyberNetwork 3/ One-side Farm and/or LP farm

Via @yieldyak_ and @echidna_finance you can both deposit $UST or $UST pairs to earn reward

- Earn Stablecoins or LP tokens in return on Yield Yak

- Earn Stablecoins , LP tokens or $ECD on Echidna Finance

Via @yieldyak_ and @echidna_finance you can both deposit $UST or $UST pairs to earn reward

- Earn Stablecoins or LP tokens in return on Yield Yak

- Earn Stablecoins , LP tokens or $ECD on Echidna Finance

@Platypusdefi @vector_fi @traderjoe_xyz @pangolindex @snowballdefi @penguin_defi @Defrost_Finance @KyberNetwork @yieldyak_ @echidna_finance 4/ Lend/Borrow

4.1/ BenQi

You can use Stablecoins as collateral and borrow assets from @BenqiFinance

- Earn Supply APR and Distribution APR (in $QI and $AVAX) when you deposit assets

- Pay Borrow APR

- Be ware of liquidation

4.1/ BenQi

You can use Stablecoins as collateral and borrow assets from @BenqiFinance

- Earn Supply APR and Distribution APR (in $QI and $AVAX) when you deposit assets

- Pay Borrow APR

- Be ware of liquidation

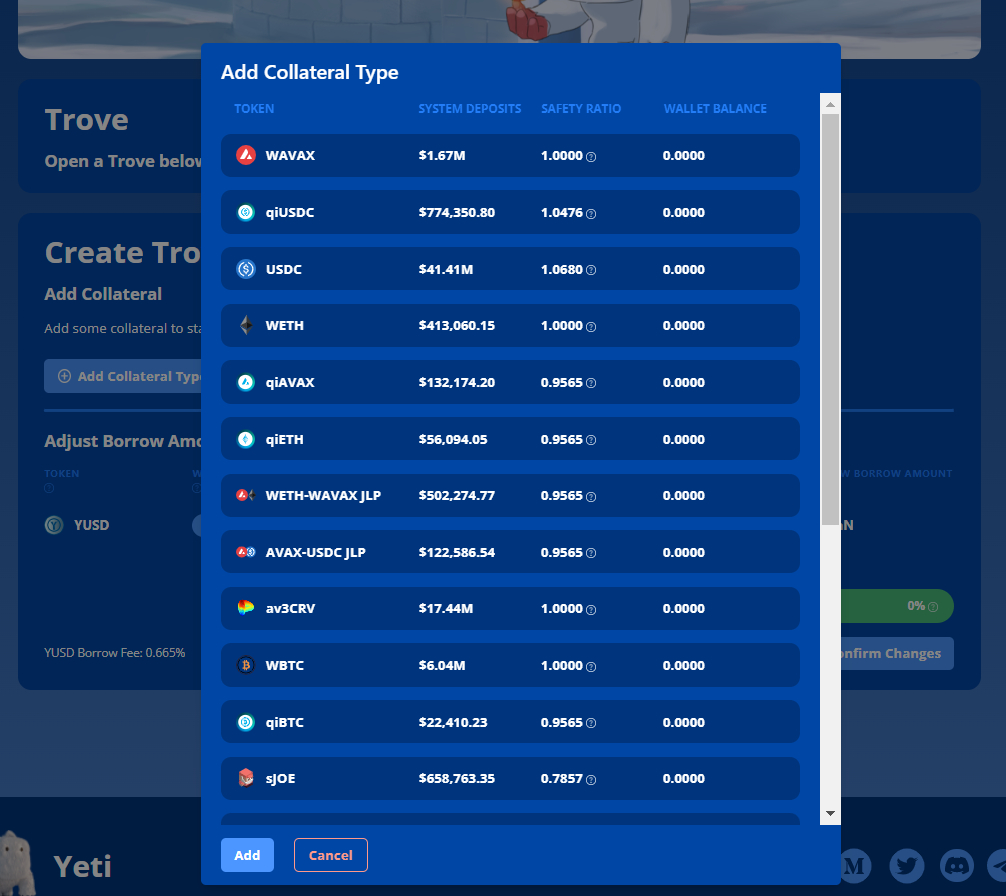

@Platypusdefi @vector_fi @traderjoe_xyz @pangolindex @snowballdefi @penguin_defi @Defrost_Finance @KyberNetwork @yieldyak_ @echidna_finance @BenqiFinance 4.2/ Yeti Finance

Via @YetiFinance you can:

- Add Stablecoins as collateral

- Leverage farming

- Farming and staking rewards are auto-compounded

- Borrowers receive YUSD (can be swapped or re-deposited into Yeti Finance)

Via @YetiFinance you can:

- Add Stablecoins as collateral

- Leverage farming

- Farming and staking rewards are auto-compounded

- Borrowers receive YUSD (can be swapped or re-deposited into Yeti Finance)

@Platypusdefi @vector_fi @traderjoe_xyz @pangolindex @snowballdefi @penguin_defi @Defrost_Finance @KyberNetwork @yieldyak_ @echidna_finance @BenqiFinance @YetiFinance Bonus tip:

1️⃣Use Yeti Calculator to visually see all the factors involved when opening or managing a Trove. Start with Yeti Calculator before putting money in this protocol and opening any positions.

1️⃣Use Yeti Calculator to visually see all the factors involved when opening or managing a Trove. Start with Yeti Calculator before putting money in this protocol and opening any positions.

@Platypusdefi @vector_fi @traderjoe_xyz @pangolindex @snowballdefi @penguin_defi @Defrost_Finance @KyberNetwork @yieldyak_ @echidna_finance @BenqiFinance @YetiFinance 2️⃣Check overall stats to see: Overall Trove Stats, Debt, Summary, Total Weighted Collateral Value, Total YUSD Debt, and Individual Collateral Ratio.

3️⃣Adjust the Overall Trove Stats and Debt to see changes in your Total Weighted Collateral Value and Individual Collateral Ratio.

3️⃣Adjust the Overall Trove Stats and Debt to see changes in your Total Weighted Collateral Value and Individual Collateral Ratio.

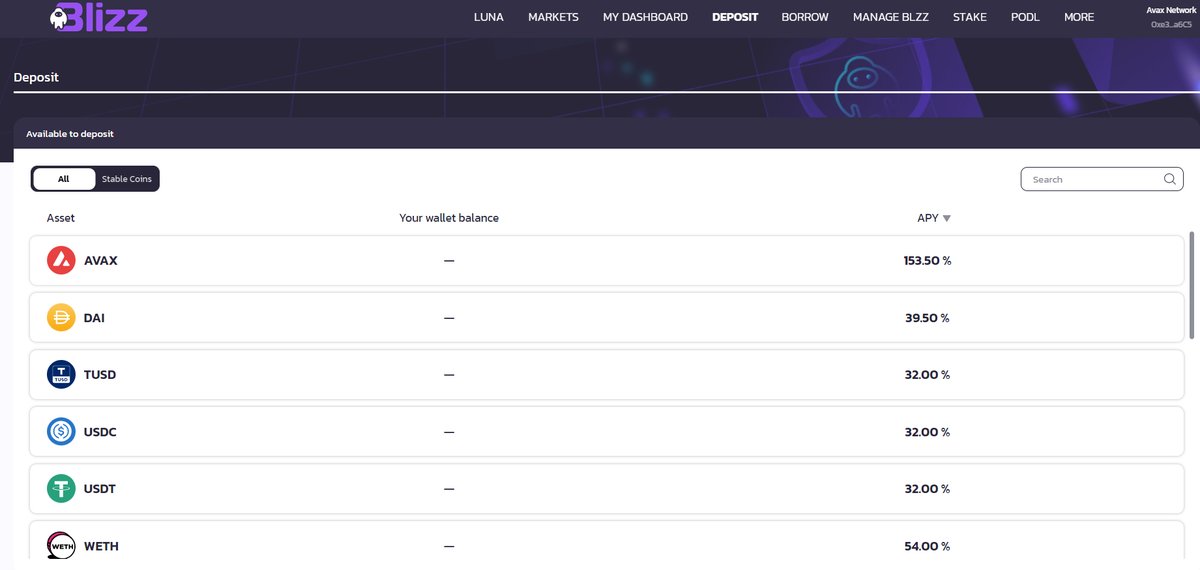

@Platypusdefi @vector_fi @traderjoe_xyz @pangolindex @snowballdefi @penguin_defi @Defrost_Finance @KyberNetwork @yieldyak_ @echidna_finance @BenqiFinance @YetiFinance 4.3/ @BlizzFinance is a protocol that accept a as collateral and allow you to borrow up to 20 different assets on Avalanche. Bring many more usecase for Stablecoins

Be sure to check them out: blizz.finance

Be sure to check them out: blizz.finance

@Platypusdefi @vector_fi @traderjoe_xyz @pangolindex @snowballdefi @penguin_defi @Defrost_Finance @KyberNetwork @yieldyak_ @echidna_finance @BenqiFinance @YetiFinance @BlizzFinance Disclaimer

The information above is the sole opinion of the researcher.

Please do your own research before making any decision.

The information above is the sole opinion of the researcher.

Please do your own research before making any decision.

• • •

Missing some Tweet in this thread? You can try to

force a refresh