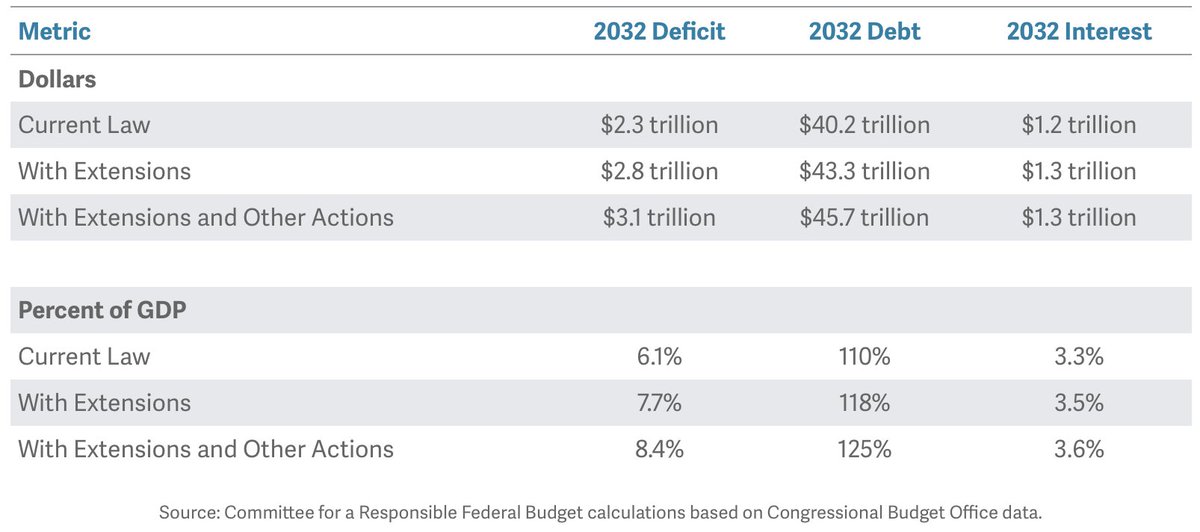

🚨NEW🚨 Under alternative, fiscally-irresponsible scenarios based on @USCBO's baseline – including likely policy extensions and more deficit-financed actions – #deficits could surpass $𝟯 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 and #debt could reach 𝟭𝟮𝟱% of GDP by 2032.

➡️crfb.org/blogs/debt-cou….

➡️crfb.org/blogs/debt-cou….

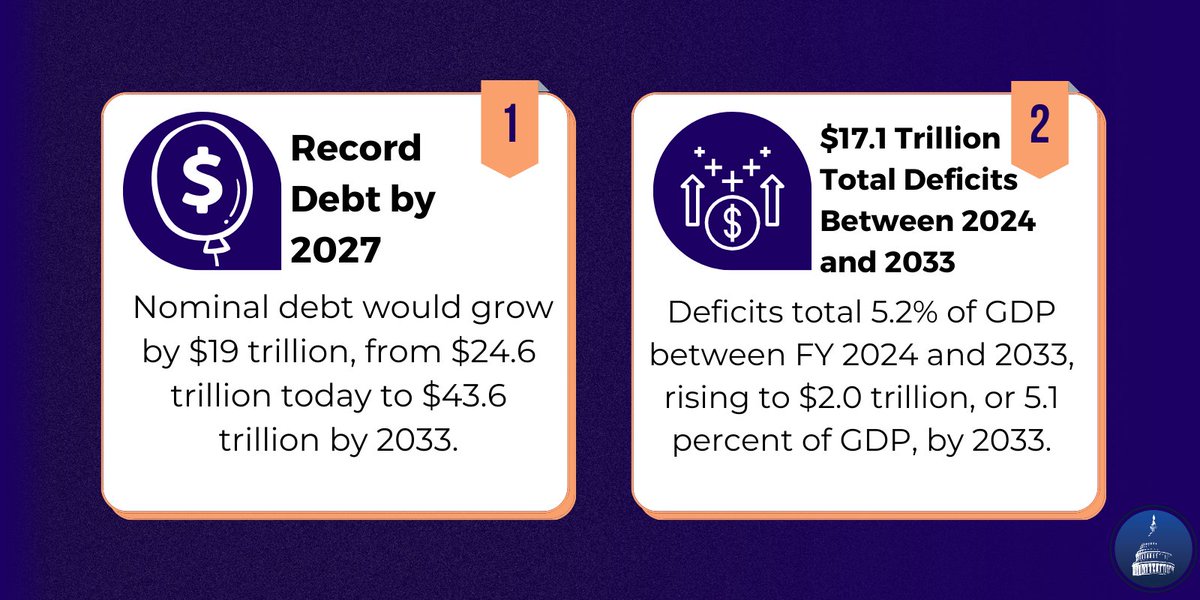

➡️Last week, @USCBO projected that debt will reach a record 110% of GDP and deficits will reach $2.3 trillion by 2032.⤵️

But the baseline is based on current law, and ignores future legislation, administrative actions and temporary policy extensions.

But the baseline is based on current law, and ignores future legislation, administrative actions and temporary policy extensions.

https://twitter.com/BudgetHawks/status/1529536568926543872?s=20&t=-FqXEBvmO2AfiBPHuK_IcA

➡️We've mapped debt, deficits & interest payments based on two alternative, more realistic scenarios:

➤With extensions of temporary policies & with spending growing faster than inflation;

➤With the above extensions, plus other debt-financed legislative & administrative actions.

➤With extensions of temporary policies & with spending growing faster than inflation;

➤With the above extensions, plus other debt-financed legislative & administrative actions.

🚨Under both scenarios, debt and deficits would soar beyond those projected by @USCBO in its baseline –

➤With extensions: $3.1 trillion added to deficits, and 118% debt-GDP.

➤With extensions and other actions: $5.5 trillion added to deficits, and 125% debt-GDP.

➤With extensions: $3.1 trillion added to deficits, and 118% debt-GDP.

➤With extensions and other actions: $5.5 trillion added to deficits, and 125% debt-GDP.

📈These scenarios would also push interest payments to record levels. Interest spending will rise significantly from 1.6% of GDP in 2022 to a record 3.3% in 2032 under current law.

➤With extensions: 3.5%

➤With extensions and additional actions: 3.6%

➤With extensions: 3.5%

➤With extensions and additional actions: 3.6%

➡️Ultimately, debt could rise much higher – up to 125% of GDP under our estimates – if policymakers extend several costly temporary policies + take on several other deficit-increasing policies.

Given our bleak fiscal situation, we can't afford more irresponsible actions.

Given our bleak fiscal situation, we can't afford more irresponsible actions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh