How a #DeFi derivatives exchange is catching up to the big boys.

A thread 🧵 on @dYdX and the metrics to back up their push for dominance.

🪡

A thread 🧵 on @dYdX and the metrics to back up their push for dominance.

🪡

DYDX has slowly become one of the best places to trade perpetual futures.

Only needing an EVM wallet, it is one of the first #DeFi DEX's to offer reliable trading options. You can use leverage, or simply set all types of limit orders on the exchange.

But let's look at the data.

Only needing an EVM wallet, it is one of the first #DeFi DEX's to offer reliable trading options. You can use leverage, or simply set all types of limit orders on the exchange.

But let's look at the data.

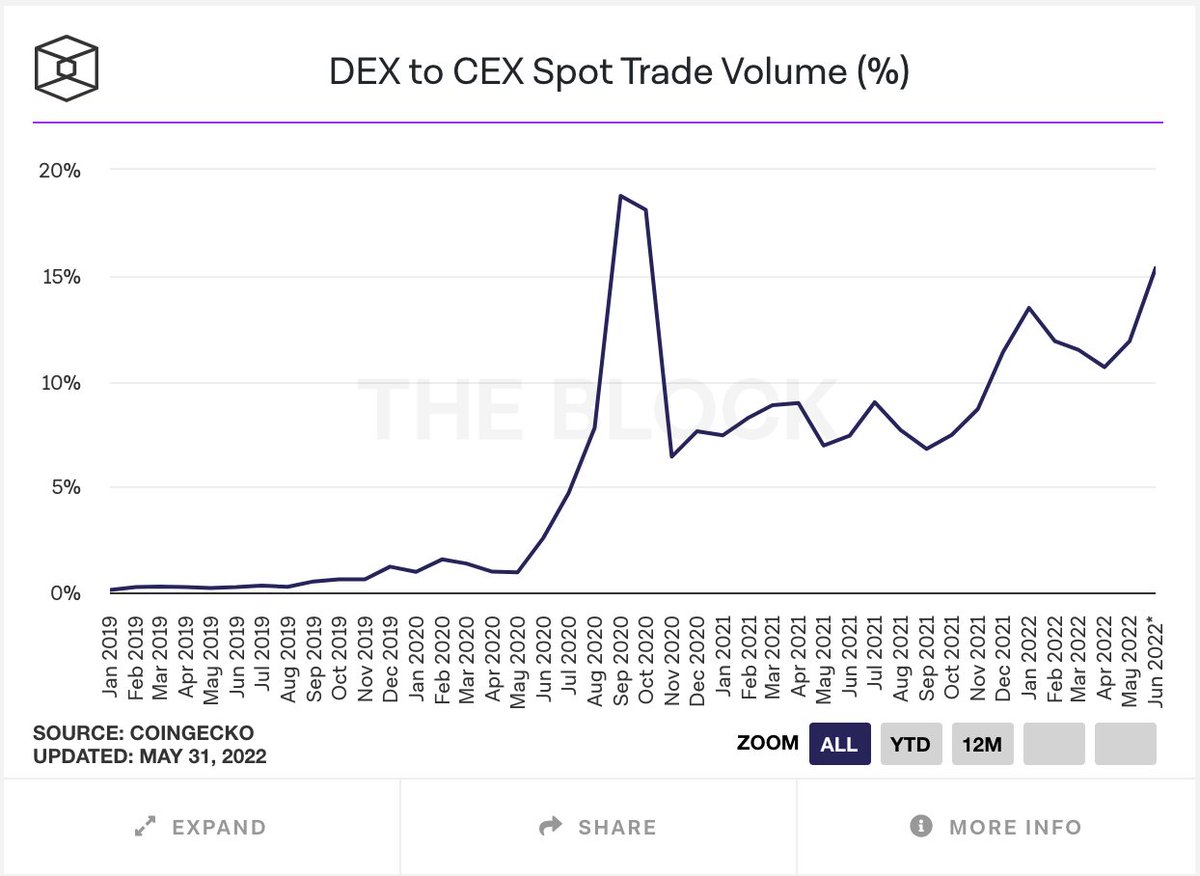

@TheBlock__ has a nice chart showing how DEX spot trading volume has been constantly gaining on CEX spot trading.

This is in spite of the current market environment.

This is in spite of the current market environment.

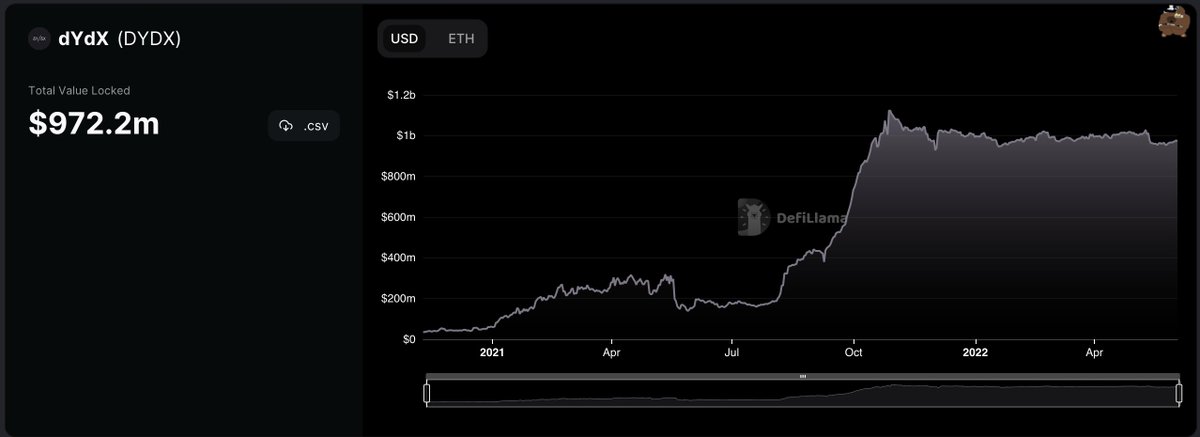

If we look into the TVL on @dYdX we can see that it has remained really consistant since Nov 2021, something most #DeFi dApps cannot say.

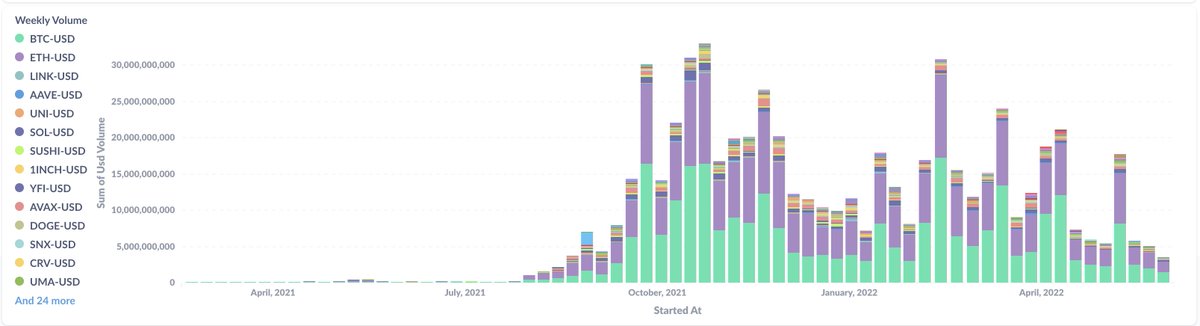

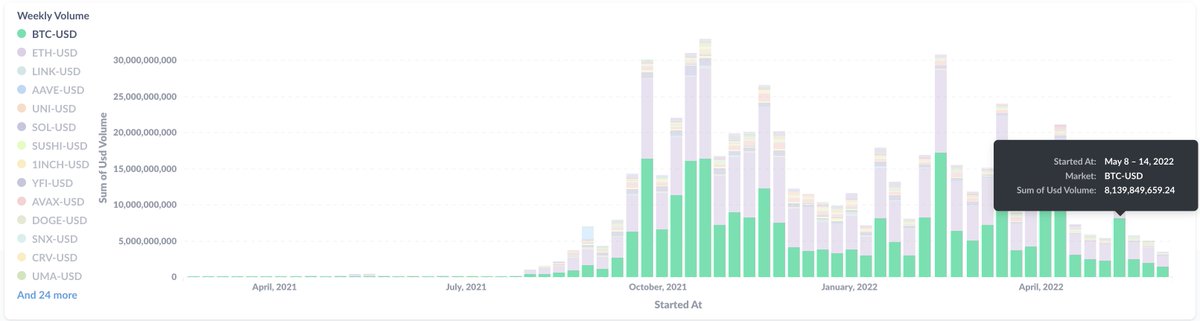

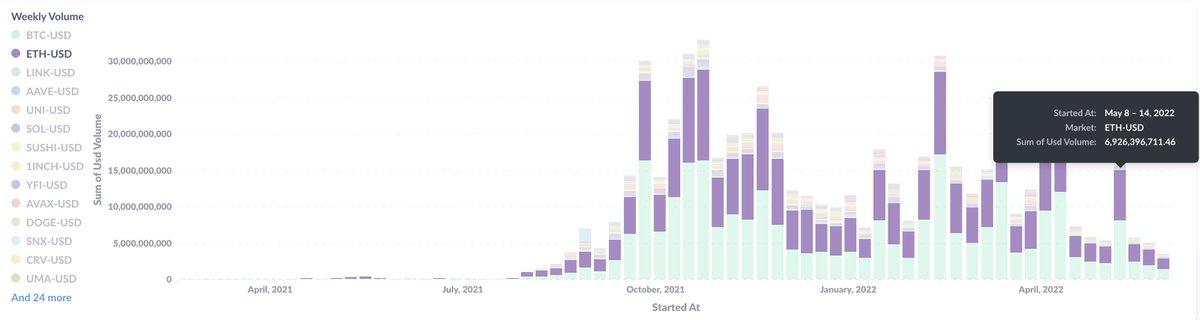

Next we look at their weekly Volume, and though this has also passed its highs from Oct 2021, We have still had nice volume throughout 2022.

Breaking down the volume more we can observe that #BTC & #ETH continue to be the most traded pairs on the platform.

Next I want to show Open Interest, and even though it had it's high in Nov 2021, the pullback in OI is directly correlated to price and overall interest from users.

Traders are less willing to take on risk in the current environment. Even then, OI has remained high.

Traders are less willing to take on risk in the current environment. Even then, OI has remained high.

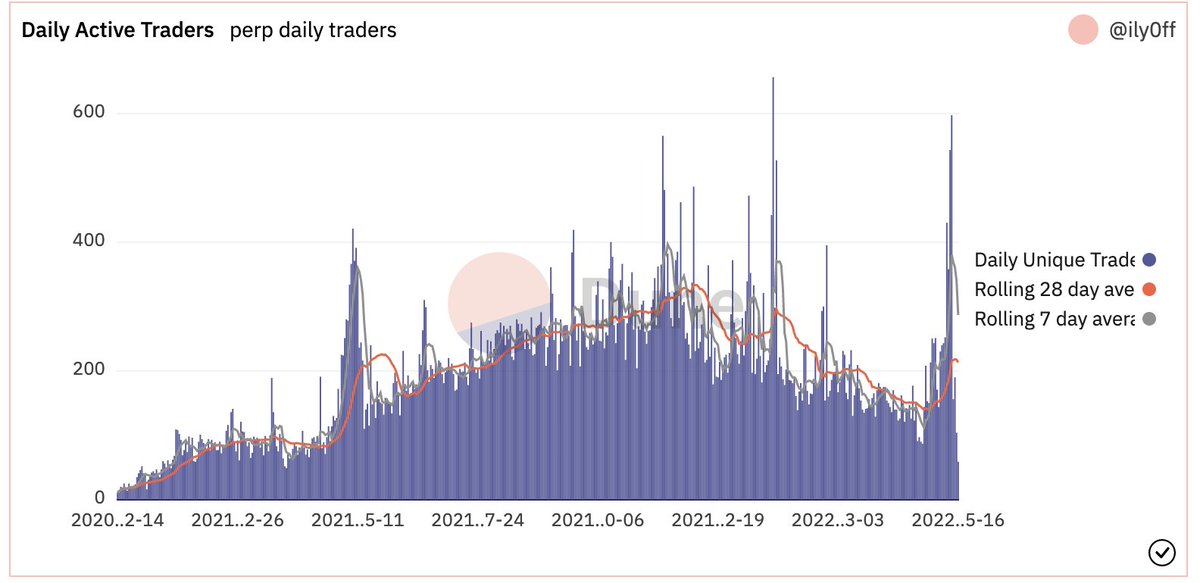

Finally looking at daily active traders, we can see that it also matches the OI as there have been less traders on average since the Nov top.

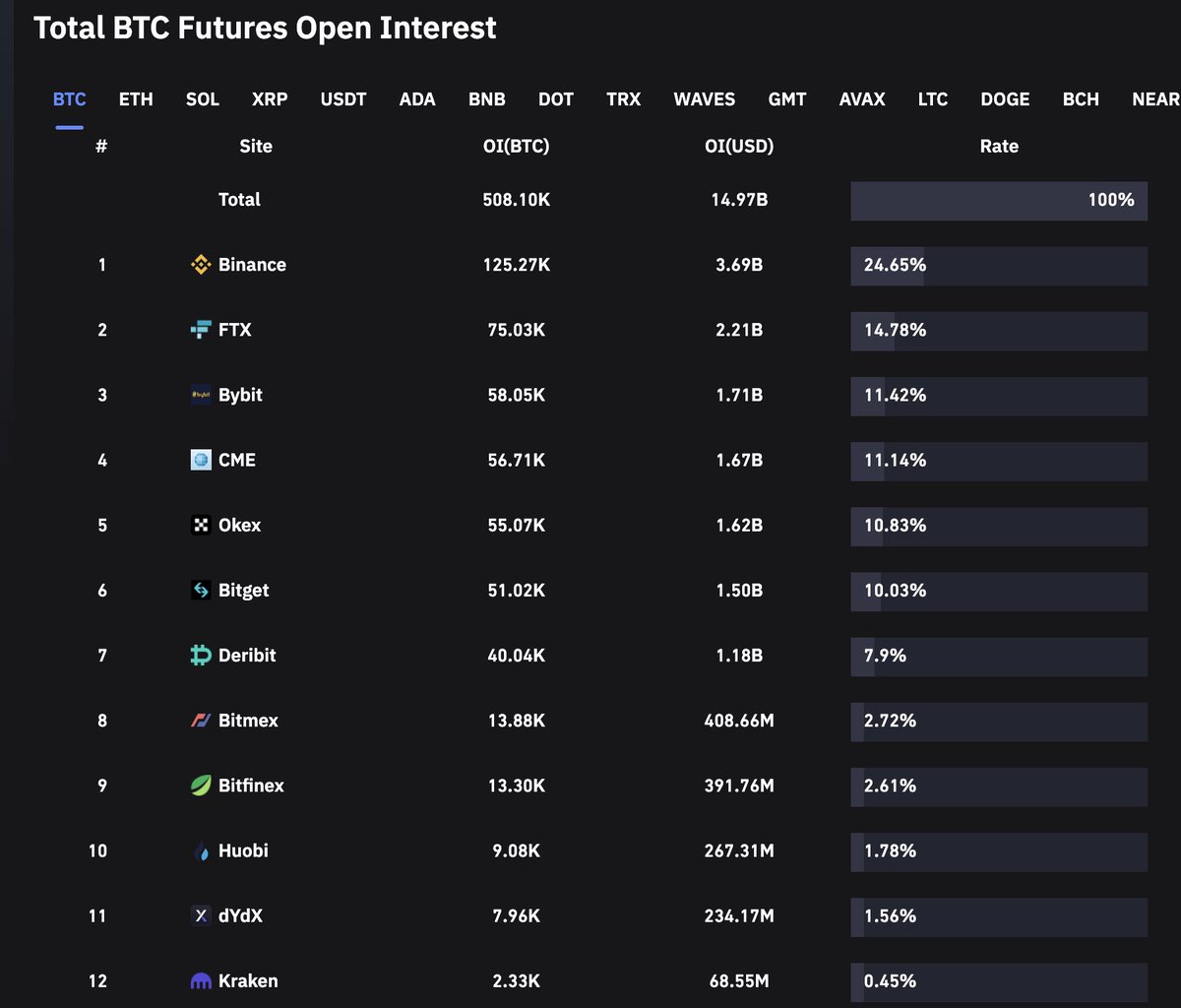

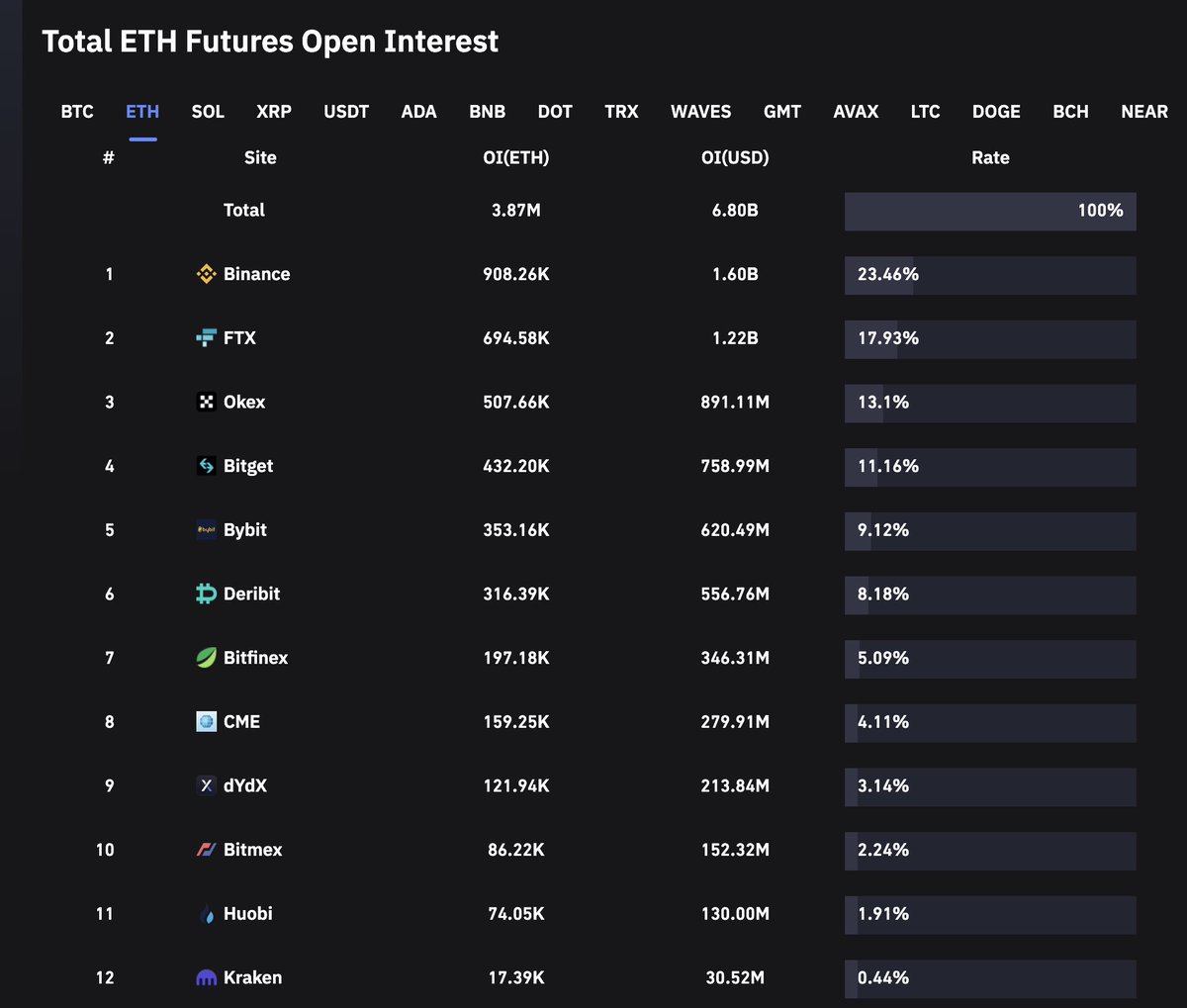

Something that is very interesting is how #dydx compares in OI against other CEXs.

Currently in # 11 place for #BTC OI, it is ahead of some big CEXs like Kraken.

It sits in # 9th place for #ETH OI. Ahead of Bitmex and not far from the CME.

Currently in # 11 place for #BTC OI, it is ahead of some big CEXs like Kraken.

It sits in # 9th place for #ETH OI. Ahead of Bitmex and not far from the CME.

This shows that @dydx is gaining ground for traders that are trading using any type of futures derivatives.

It will be interesting to see if they can continue to gain against CEXs over the next few years.

It will be interesting to see if they can continue to gain against CEXs over the next few years.

@dYdX offers gas-less trading & on ramping from #ETH , it also rewards it's traders, with their $DYDX tokens.

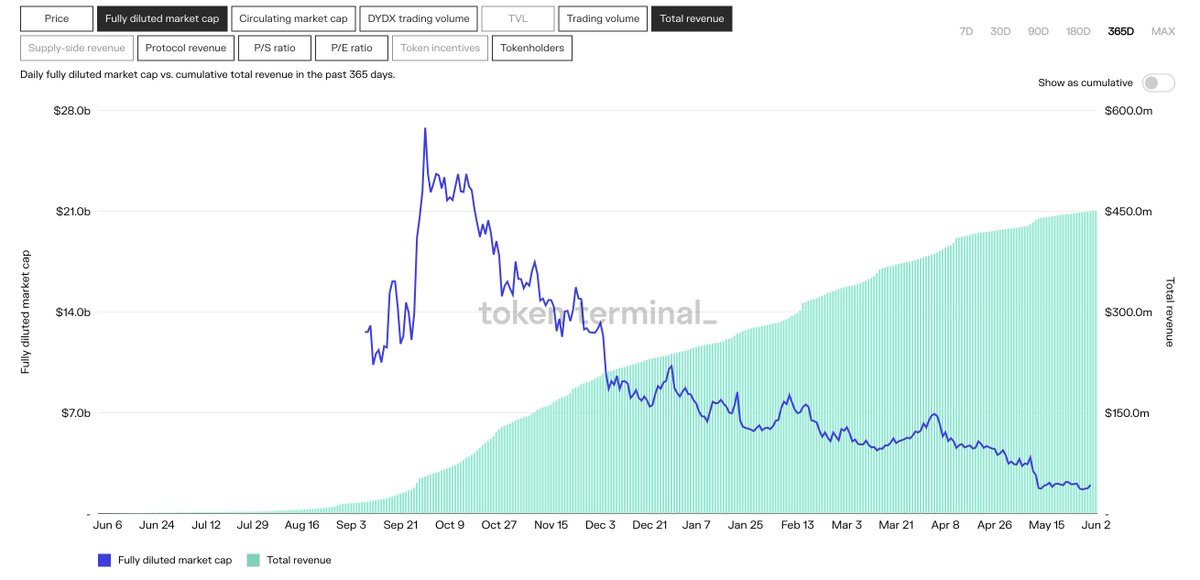

Though their native toke has not done too well, it would not take much for them to begin directing their revenue toward their stakers for it to be come very attractive

Though their native toke has not done too well, it would not take much for them to begin directing their revenue toward their stakers for it to be come very attractive

When you look at their Total revenue (cumulative) vs the P/S ratio you can get an idea on just how much #dydx holders could stand to gain if these rewards were to be turned on.

For now, the token is not as attractive as the platform that has been created, though it would not take much to make it a token worth holding as the platforms stats speak for themselves.

#dydx is clearly by traders, for traders. Any trader appreciates their good UX, kudos

#dydx is clearly by traders, for traders. Any trader appreciates their good UX, kudos

#dydx is a platform I have tried and works seamlessly for trading. Moving forward I will be probably moving some of my trading onto it, and will be monitoring the token as it could become quite the gem with some changes being implemented.

If you enjoyed this thread please like and RT as it helps other find the info.

• • •

Missing some Tweet in this thread? You can try to

force a refresh