1/ I received a lot of requests to look into #Freeway.

It promises 43% yield/year. 🤔

After Anchor crashed, many of you are eager to lose your money again. I have to oblige & warn you again!

"Is it safe? Should I send them all my money?"

Time to find out.

An exposé thread 👇

It promises 43% yield/year. 🤔

After Anchor crashed, many of you are eager to lose your money again. I have to oblige & warn you again!

"Is it safe? Should I send them all my money?"

Time to find out.

An exposé thread 👇

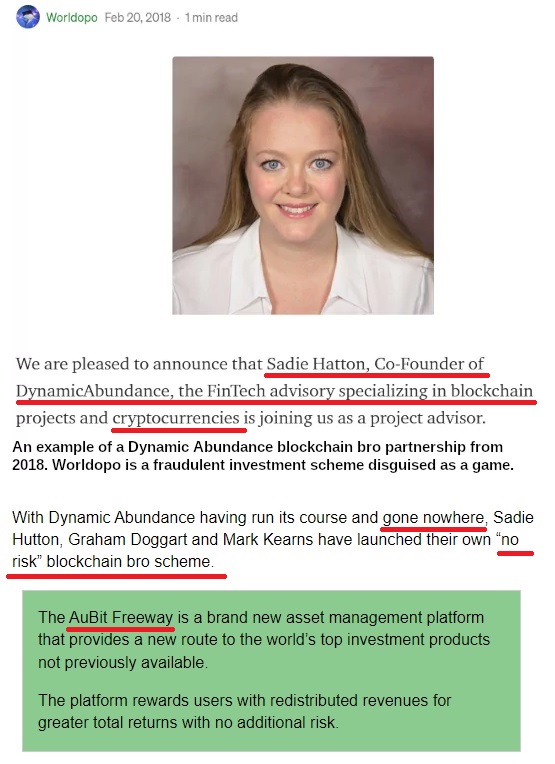

2/ What is Freeway?

A rebrand of AuBit, founded in 2017.

They started the old fashion way in TradFi & then realized crypto is the new ball game.

Enter Sadie, a new fresh face with experience in crypto (the "CEO").

Spot anything suspicious? 👇

A rebrand of AuBit, founded in 2017.

They started the old fashion way in TradFi & then realized crypto is the new ball game.

Enter Sadie, a new fresh face with experience in crypto (the "CEO").

Spot anything suspicious? 👇

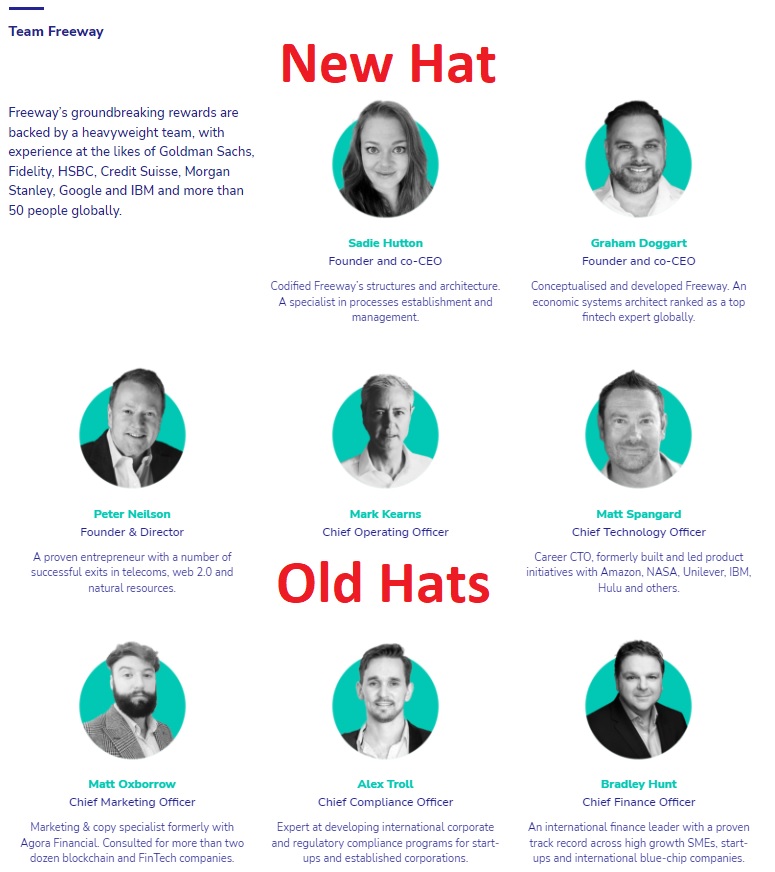

3/ Their whole team is made of old hats with a lot of TradFi experience turned into "crypto experts".

Sadie is just the new face of the rebranded AuBit now called Freeway. She's after your cash & she's excellent at marketing.

So what is going on here, really? 👇

Sadie is just the new face of the rebranded AuBit now called Freeway. She's after your cash & she's excellent at marketing.

So what is going on here, really? 👇

4/ If you check Twitter & other social media you will see A TON of promotions about Freeway.

All these "influencers" are making a profit via commissions. You refer more people and you get more yield/year.

Starts to sound like multilevel marketing, right Sadie? 👇

All these "influencers" are making a profit via commissions. You refer more people and you get more yield/year.

Starts to sound like multilevel marketing, right Sadie? 👇

5/ Check this dude out, he made a 20-tweet promo thread about Freeway.

In the process, he inserted his referral code four times, but calls his research "objective".

If you sub to Freeway socials you can boost your yield by up to 10%! 🤣

So where is the cash coming from?! 👇

In the process, he inserted his referral code four times, but calls his research "objective".

If you sub to Freeway socials you can boost your yield by up to 10%! 🤣

So where is the cash coming from?! 👇

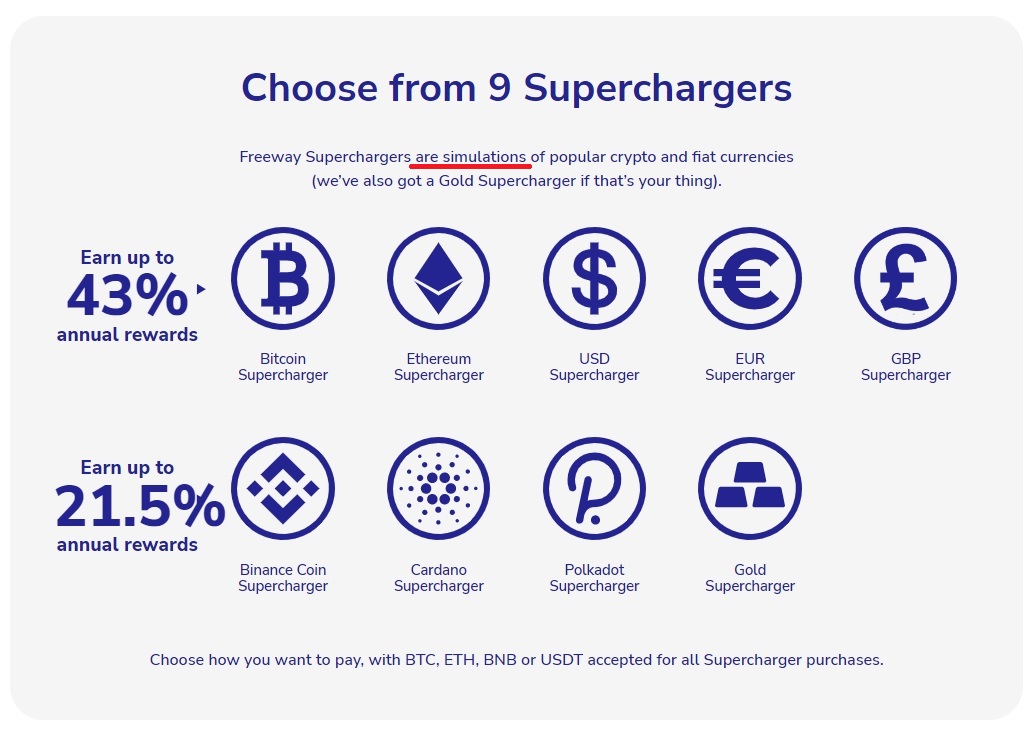

6/ Introducing SUPERCHARGERS or "simulations"!

You give Freeway your #Bitcoin/cash & in exchange, you receive worthless tokens that simulate prices! Seriously, check their site! 😲

Your rewards are in the same worthless tokens.

Do I need to remind you of Luna & UST?

Next 👇

You give Freeway your #Bitcoin/cash & in exchange, you receive worthless tokens that simulate prices! Seriously, check their site! 😲

Your rewards are in the same worthless tokens.

Do I need to remind you of Luna & UST?

Next 👇

7/ In effect, they take your deposits & use them as collateral to max their leverage & do whatever (trade/invest).

Freeway is regulated, so they can't really play with your money, but they can use your money as... collateral!

Yay, free money machine again!

But there is more 👇

Freeway is regulated, so they can't really play with your money, but they can use your money as... collateral!

Yay, free money machine again!

But there is more 👇

8/ Remember Luna unbonding time of 21 days? That rekt many during the May crash to 0.

They COULD NOT sell or liquidate their tokens.

Freeway calls it "notice period". 🤣

Plus you get more rewards if you go for 30 days lock! lol

Juicy stuff ahead 👇

They COULD NOT sell or liquidate their tokens.

Freeway calls it "notice period". 🤣

Plus you get more rewards if you go for 30 days lock! lol

Juicy stuff ahead 👇

9/ If you stake Freeway tokens or #FWT you get even more yield!

Wait, FWT token? Of course, I mean they need to maximize their game.

Launched in 2021, it pumped & dumped at least 6 times.

Those old TradFi team members sure know their game.

What or WHO pays the yield? 👇

Wait, FWT token? Of course, I mean they need to maximize their game.

Launched in 2021, it pumped & dumped at least 6 times.

Those old TradFi team members sure know their game.

What or WHO pays the yield? 👇

10/ If you don't know, the source is likely YOU! 😅

There is no proof of funds/trading success/cash flow.

If they run out of liquidity, surprise!

Your SUPERCHARGER tokens are worthless + they can stop paying you overnight (tweet #6).

"But is it safe? Sorry, I am a degen." 👇

There is no proof of funds/trading success/cash flow.

If they run out of liquidity, surprise!

Your SUPERCHARGER tokens are worthless + they can stop paying you overnight (tweet #6).

"But is it safe? Sorry, I am a degen." 👇

11/ That dude in tweet #5 says they have $150 mil in Assets Under Management (AUM) & can pay the yield until $250 mil AUM.

AUM = your money

This sounds a lot like Anchor's yield reserve discussions... you know how that ended.

Next 👇

AUM = your money

This sounds a lot like Anchor's yield reserve discussions... you know how that ended.

Next 👇

https://twitter.com/DU09BTC/status/1504862672721952771?s=20&t=o_woUBWJHVMeByzJee-4uA

12/ They are likely using Freeway as a front cover to raise a lot of cash by promising unrealistic returns.

Then they use said cash for their own "legacy business" as collateral.

They also farm their users for marketing (via referrals) & via the #FWT token.

My assessment 👇

Then they use said cash for their own "legacy business" as collateral.

They also farm their users for marketing (via referrals) & via the #FWT token.

My assessment 👇

13/ Crypto is a new source of money for them & they mint worthless tokens in exchange.

These are totally UNREGULATED. Check their terms (pics)

1️⃣ Tokens = worth 0

2️⃣ Staked tokens = you don't own them

3️⃣ You can't sue them

4️⃣ You waive all rights

Can this thing crash to 0? 👇

These are totally UNREGULATED. Check their terms (pics)

1️⃣ Tokens = worth 0

2️⃣ Staked tokens = you don't own them

3️⃣ You can't sue them

4️⃣ You waive all rights

Can this thing crash to 0? 👇

14/ If they leverage too much or they become bankrupt, yes.

Look at #Terra/ #Luna / #UST. $50 bil, GONE!

Remember, your money/deposit is probably collateral to someone else. You will NOT have priority.

You will be left holding the bag.

Next 👇

Look at #Terra/ #Luna / #UST. $50 bil, GONE!

Remember, your money/deposit is probably collateral to someone else. You will NOT have priority.

You will be left holding the bag.

Next 👇

https://twitter.com/DU09BTC/status/1523693970395901953

15/ Will it crash to 0? Hard to say.

If you check their team, they look quite "professional" with experience in Cayman Islands & Seychelles (EU black listed tax havens). 😂

This is an old wolf with new clothes, name & face.

Do you still want to invest in this now? 👇

If you check their team, they look quite "professional" with experience in Cayman Islands & Seychelles (EU black listed tax havens). 😂

This is an old wolf with new clothes, name & face.

Do you still want to invest in this now? 👇

16/ Always do your due diligence!

Check my Terra / Luna threads linked below as you will spot some parallels.

+ STOP falling for "influencers" telling you how great this yield is... it's a TRAP. Google multilevel marketing.

Also 👇

evernote.com/shard/s349/cli…

Check my Terra / Luna threads linked below as you will spot some parallels.

+ STOP falling for "influencers" telling you how great this yield is... it's a TRAP. Google multilevel marketing.

Also 👇

evernote.com/shard/s349/cli…

17/ Read my #USDD thread and stablecoin guide to stay safe in this market.

+ AVOID inflationary tokens like #FWT. That is a NO GO in a bear market.

Lastly 👇

+ AVOID inflationary tokens like #FWT. That is a NO GO in a bear market.

Lastly 👇

https://twitter.com/DU09BTC/status/1530582931244294145?s=20&t=IO-wSPfjFJt_BNNPNkjfAQ

18/ If you liked this thread, #retweet the first post to get more of this content in the future! 😍

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Please retweet my opening post. Thank you!

https://twitter.com/DU09BTC/status/1533887404351922176?s=20&t=qhpoEkxer5_o7-vMxLigew

• • •

Missing some Tweet in this thread? You can try to

force a refresh