Zerodha has released a cool new feature to link your family member accounts and see them all in one place.

This is very useful if you have one person operating all family accounts.

Short thread on how to do this 🧵👇

#Zerodha @zerodhaonline

PS: Retweet to share with others

This is very useful if you have one person operating all family accounts.

Short thread on how to do this 🧵👇

#Zerodha @zerodhaonline

PS: Retweet to share with others

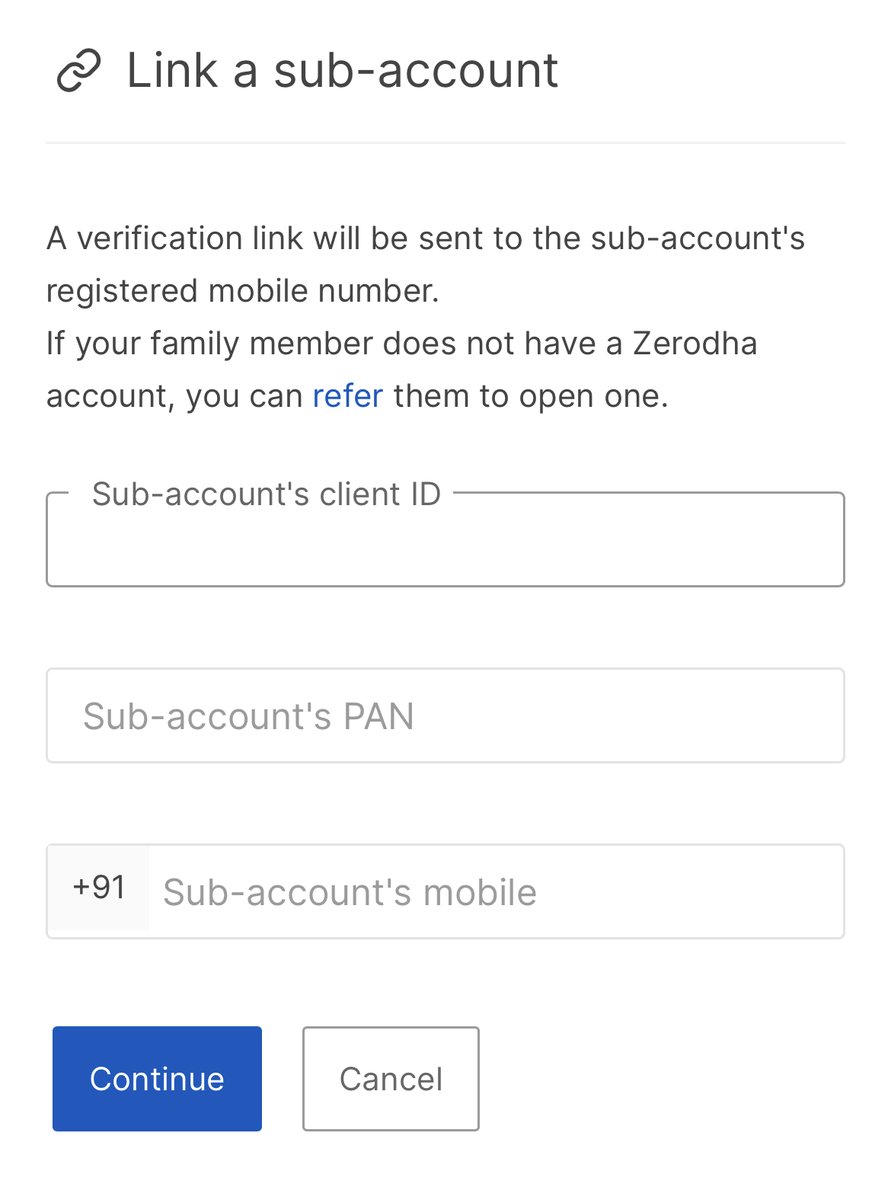

Family account linking can be done directly from the Kite mobile app itself.

Just go to your Client ID tab and there is a link for "Family" under Console.

Once you click that, you get an option to link an account. Then, you need to enter a few details of your family account.

Just go to your Client ID tab and there is a link for "Family" under Console.

Once you click that, you get an option to link an account. Then, you need to enter a few details of your family account.

Your family member will receive a SMS with a link to accept the account linking.

They need to click the link, login to Kite and accept the family account linking request.

Repeat the above steps for as many accounts you need to link.

They need to click the link, login to Kite and accept the family account linking request.

Repeat the above steps for as many accounts you need to link.

The best aspect of this new feature is how smoothly Zerodha combines all the different family portfolios.

Ex: If I have bought Reliance across family accounts, it shows the quantity, avg buy price, profit/loss across all accounts along with breakdown

Good job @zerodhaonline 👏

Ex: If I have bought Reliance across family accounts, it shows the quantity, avg buy price, profit/loss across all accounts along with breakdown

Good job @zerodhaonline 👏

• • •

Missing some Tweet in this thread? You can try to

force a refresh