I write about equity, personal finance, money hacks and my hobbies. On the journey to Financial Freedom. *All opinions are my own, Likes & RTs ≠ Endorsements*

How to get URL link on X (Twitter) App

ICICI Lombard has a health insurance known as Health Shield 360 specially for bancassurance channel.

ICICI Lombard has a health insurance known as Health Shield 360 specially for bancassurance channel.

Enter Nifty200 Momentum30 index! The Nifty200 Momentum 30 Index aims to track the performance of 30 high momentum stocks across large and mid-cap stocks.

Enter Nifty200 Momentum30 index! The Nifty200 Momentum 30 Index aims to track the performance of 30 high momentum stocks across large and mid-cap stocks.

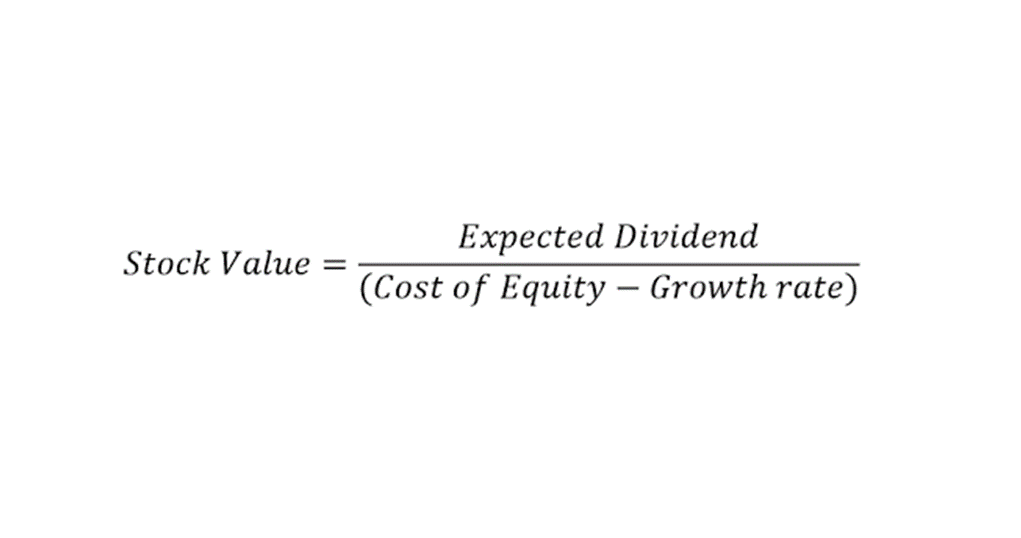

The Dividend Discount Model (DDM) calculates the fair value of a stock based upon the sum of all future dividends discounted to their present value

The Dividend Discount Model (DDM) calculates the fair value of a stock based upon the sum of all future dividends discounted to their present value

1. Stage Analysis

1. Stage Analysis

The company is Glenmark Life Sciences.

The company is Glenmark Life Sciences.

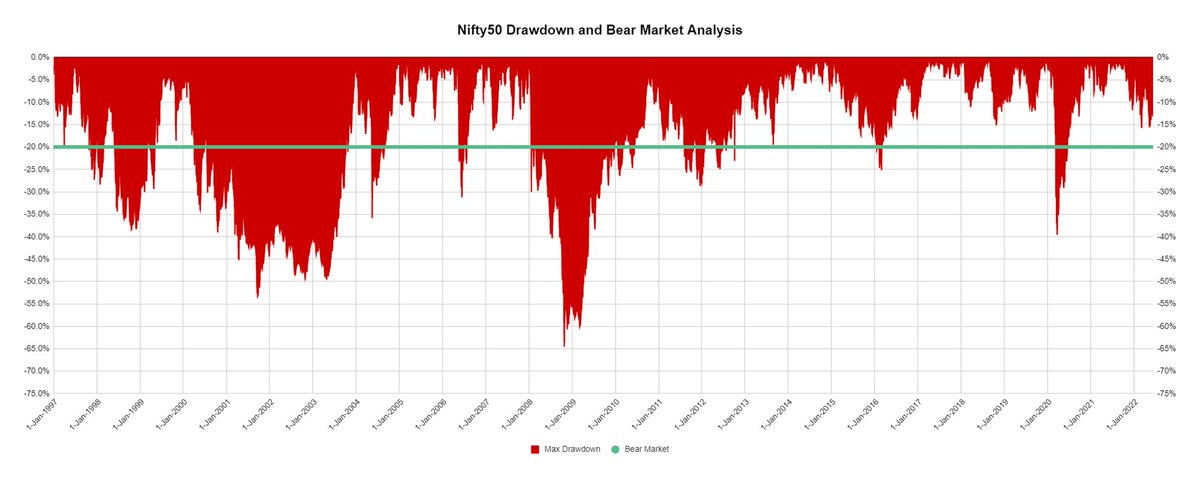

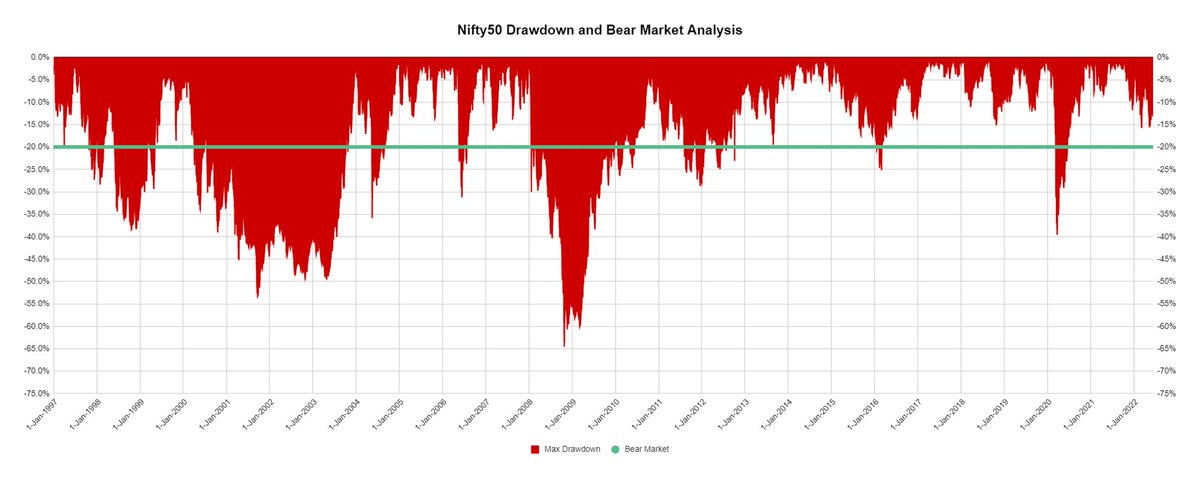

But first, do you know the definition of a bear market?

But first, do you know the definition of a bear market?

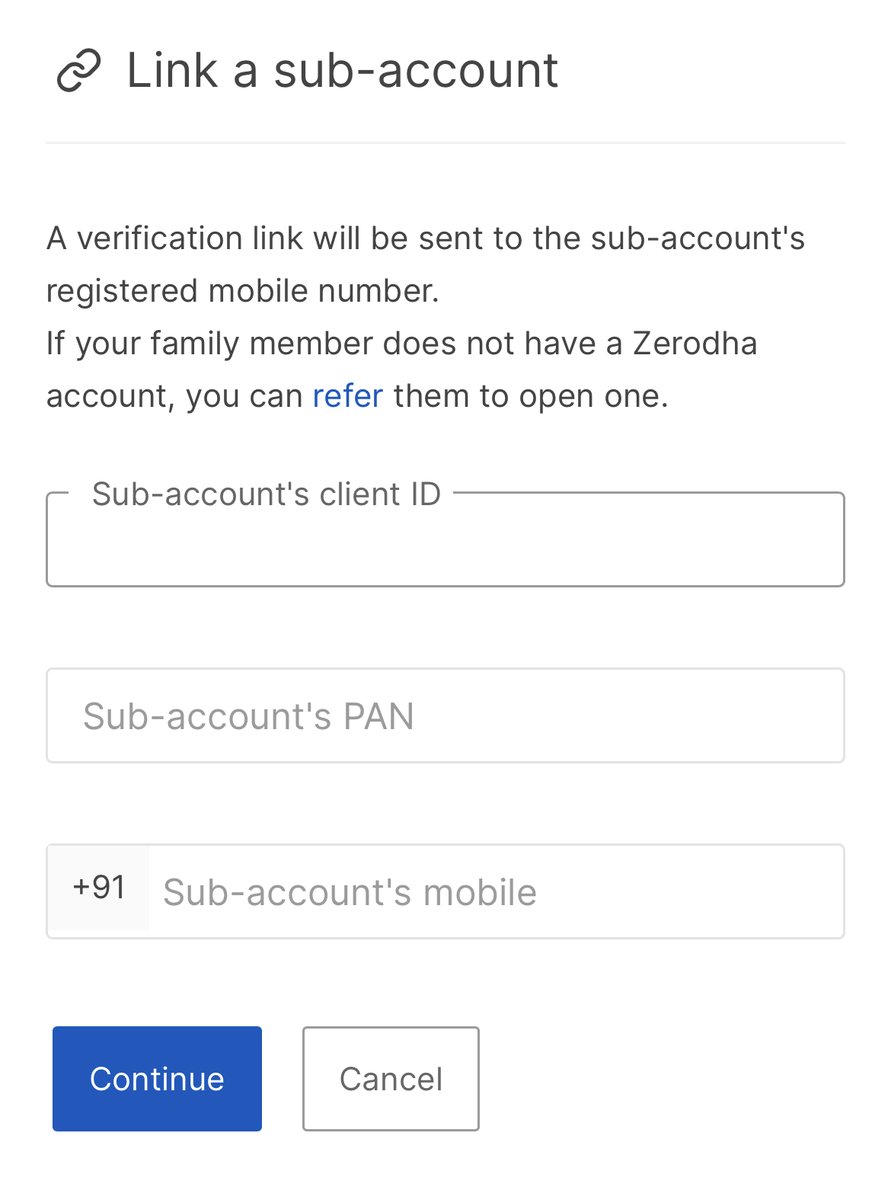

Family account linking can be done directly from the Kite mobile app itself.

Family account linking can be done directly from the Kite mobile app itself.

Lesson 1 – Never average down with deteriorating fundamentals

Lesson 1 – Never average down with deteriorating fundamentals