I analyzed 25+ years of #Nifty data to better understand bear markets 🐻

Why?

Given the recent market sell-off and bearish stance of market participants, history and data is your best guide to prepare if we're headed for a bear market.

Thread with findings below 🧵👇

1/n

Why?

Given the recent market sell-off and bearish stance of market participants, history and data is your best guide to prepare if we're headed for a bear market.

Thread with findings below 🧵👇

1/n

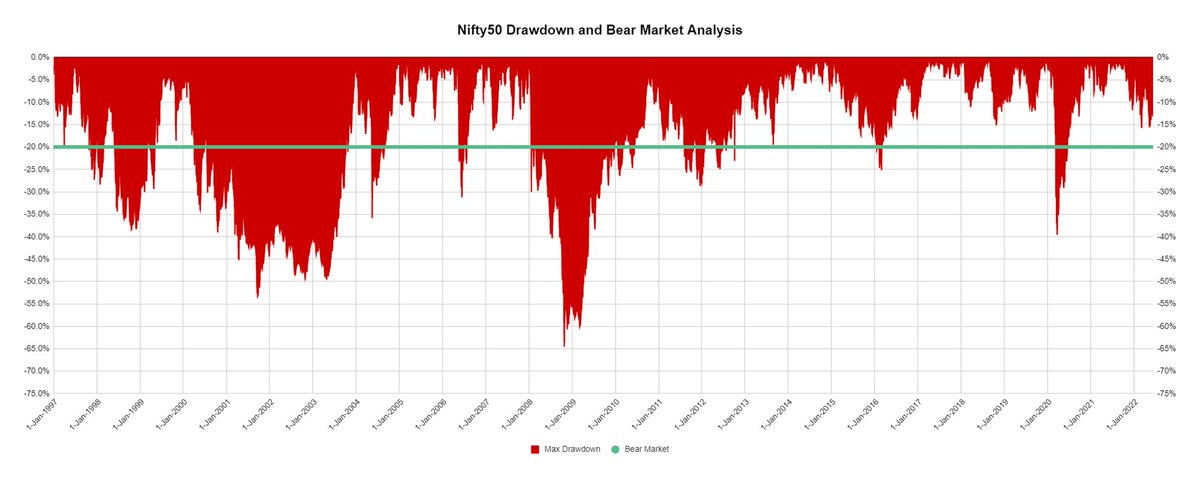

But first, do you know the definition of a bear market?

When any index falls 20% or more from it's all time high, it is termed to be in a #bearmarket 🐻

How do you calculate length of a bear market? The time duration in days from previous all-time high to market bottom.

2/n

When any index falls 20% or more from it's all time high, it is termed to be in a #bearmarket 🐻

How do you calculate length of a bear market? The time duration in days from previous all-time high to market bottom.

2/n

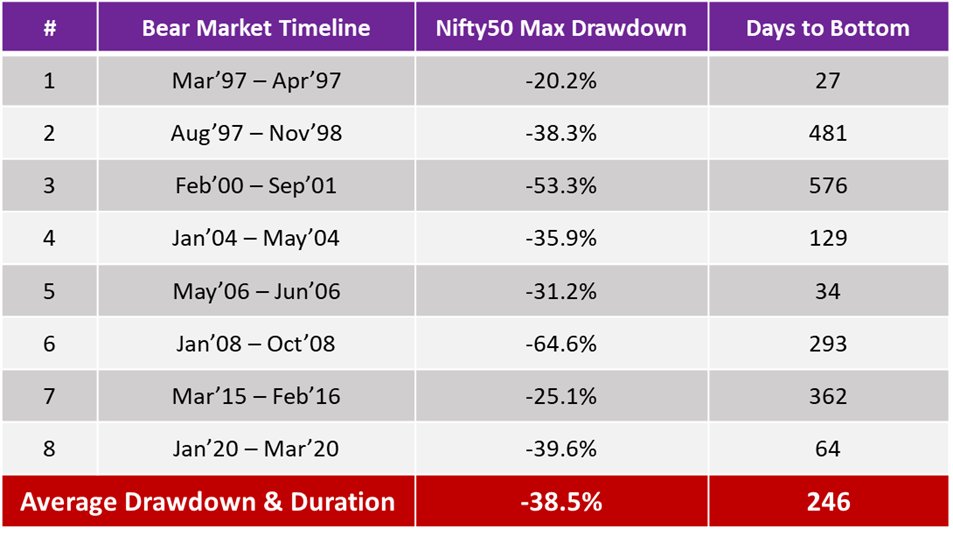

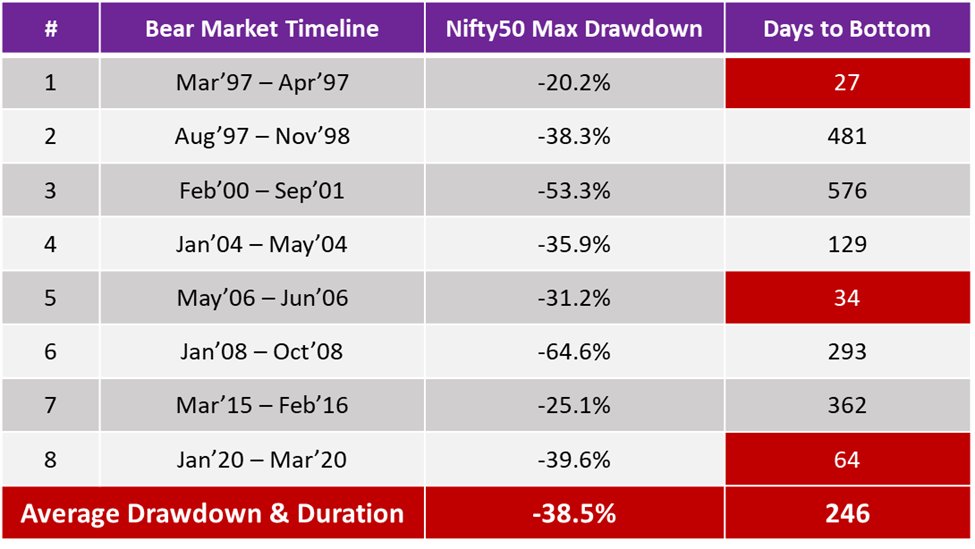

🇮🇳 Nifty last 25 years (1997-2022*)

Number of Bear Markets = 8

Average drawdown % = -38.5%

Average bear market duration = 246 days (8 m)

Key takeaway - Bear markets occur every ~3 years and take on average 8 months to bottom

3/n

Number of Bear Markets = 8

Average drawdown % = -38.5%

Average bear market duration = 246 days (8 m)

Key takeaway - Bear markets occur every ~3 years and take on average 8 months to bottom

3/n

1997 and 2006 saw the fastest bear markets with Nifty correcting 20-30% in just ~1 month.

Unbelievably, 1997 had 2 bear markets! Just imagine suffering 20% drawdowns twice in a few months!

Mar 2020 Covid crash was the 3rd fastest and 3rd worst bear market.

4/n

Unbelievably, 1997 had 2 bear markets! Just imagine suffering 20% drawdowns twice in a few months!

Mar 2020 Covid crash was the 3rd fastest and 3rd worst bear market.

4/n

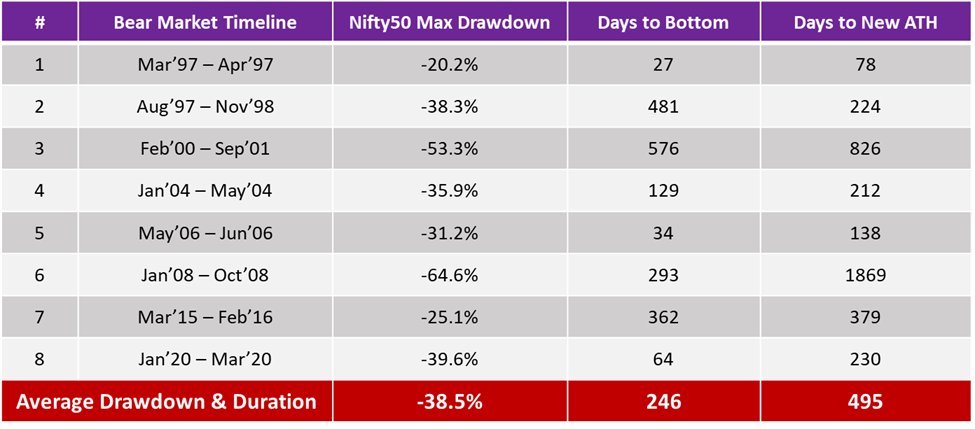

Okay, how should we define Bear Market Recovery?

The no of days from market bottom to a new all-time high.

Sadly, bear markets take time to recover.

Almost double the time to recover to a new ATH compared to the time to form a bottom.

Avg recovery duration – 495 days

5/n

The no of days from market bottom to a new all-time high.

Sadly, bear markets take time to recover.

Almost double the time to recover to a new ATH compared to the time to form a bottom.

Avg recovery duration – 495 days

5/n

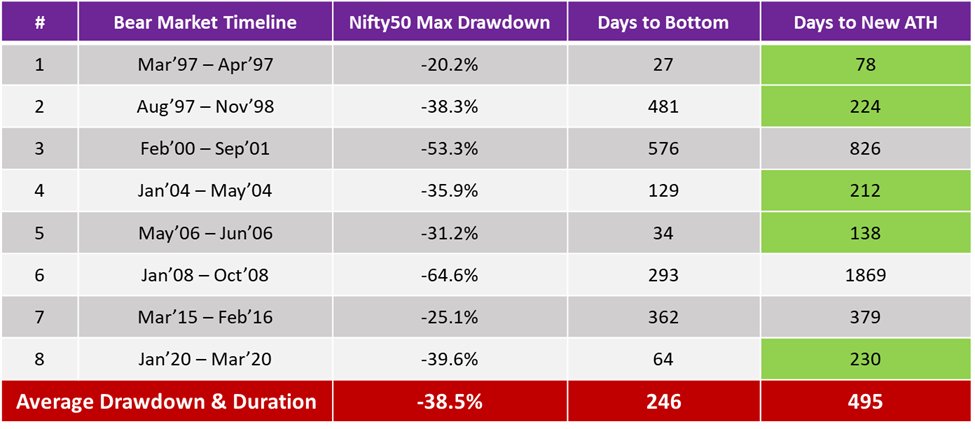

Every cloud has a silver lining.

495 days or 16 months is the avg bear market recovery duration but they have been as short as 78 days (1997) or 138 days (2006).

5 out of 8 bear markets recovered within 8 months

Takeaway – Most bear markets recover within a year

6/n

495 days or 16 months is the avg bear market recovery duration but they have been as short as 78 days (1997) or 138 days (2006).

5 out of 8 bear markets recovered within 8 months

Takeaway – Most bear markets recover within a year

6/n

Bull Markets 🐂 have Bear Phases 🐻

We have all heard about 2003-07 bull market.

Nifty went ~7x in 5 years

April 2003 - 920

Jan 2008 - 6357

But even one of India's biggest bull markets had 2 bear markets in 2004 and 2006.

Bull markets never go up in a straight line.

7/n

We have all heard about 2003-07 bull market.

Nifty went ~7x in 5 years

April 2003 - 920

Jan 2008 - 6357

But even one of India's biggest bull markets had 2 bear markets in 2004 and 2006.

Bull markets never go up in a straight line.

7/n

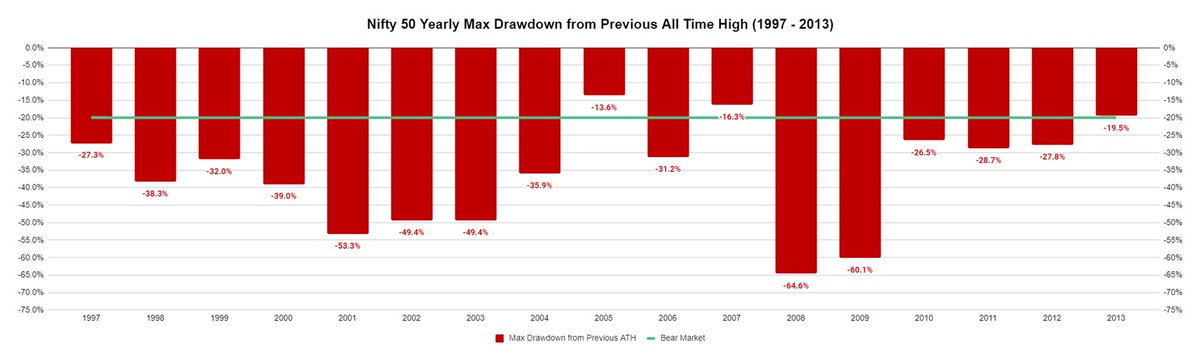

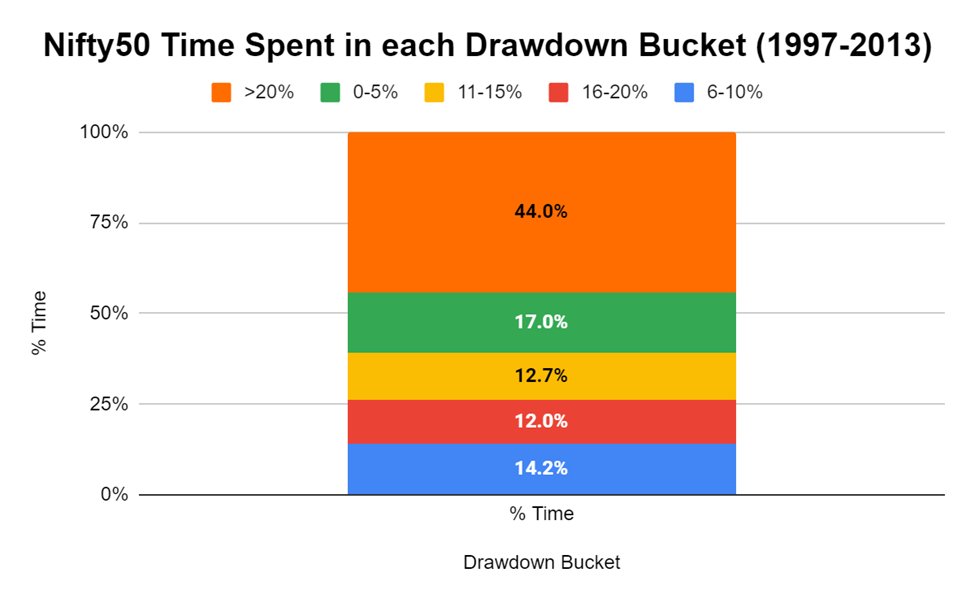

Key Question - So do you need to wait ~3 years for a bear market to buy equities?

The answer to this question has gradually changed in the past 25 years.

Between 1997-2013, the market was in bear market territory every single year barring just 2 years.

8/n

The answer to this question has gradually changed in the past 25 years.

Between 1997-2013, the market was in bear market territory every single year barring just 2 years.

8/n

You will hardly believe the next insight given how strong India's markets have been in the recent past.

But in a span of 17 years between 1997-2013, our markets spent close to ~50% time in bear market (20%+ decline) territory.

9/n

But in a span of 17 years between 1997-2013, our markets spent close to ~50% time in bear market (20%+ decline) territory.

9/n

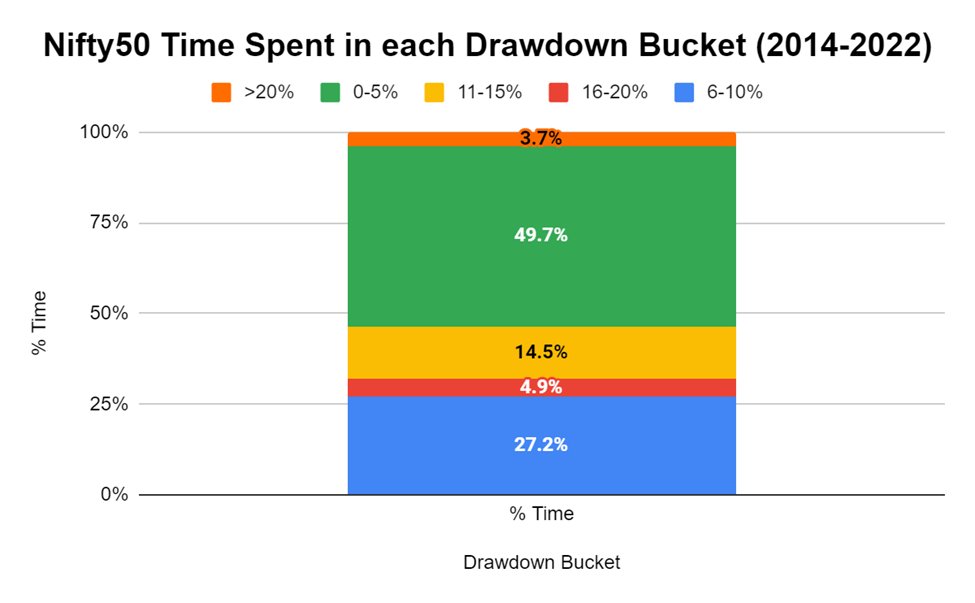

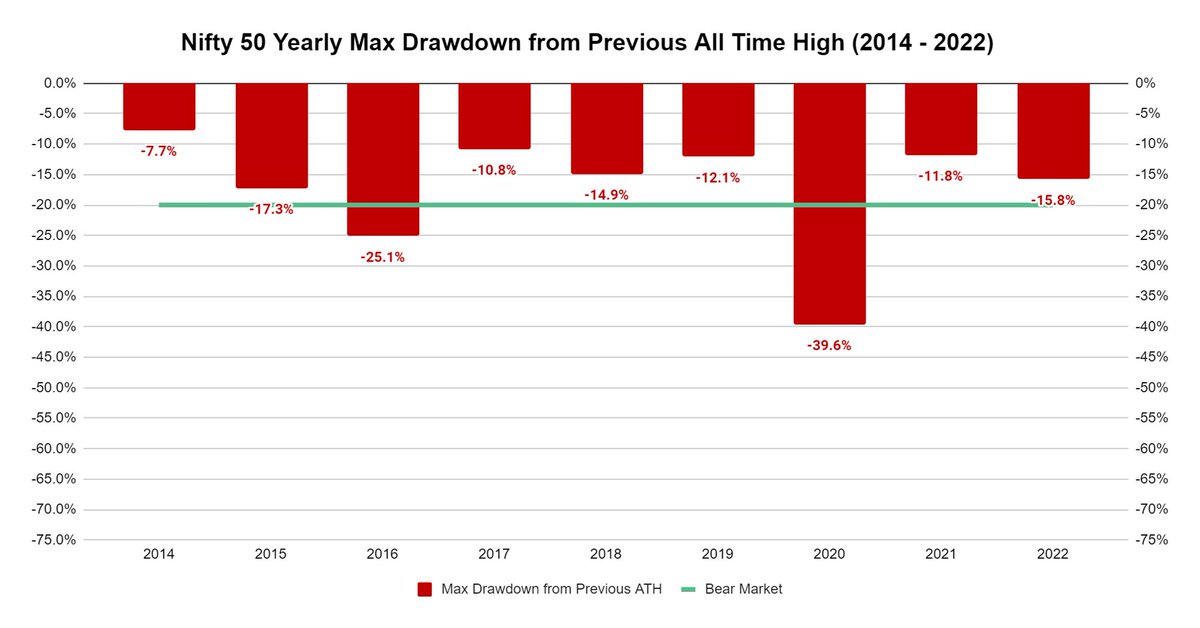

However, since 2013 🇮🇳 markets have been extremely resilient with just 2 bear markets in 9 years.

Complete opposite to above chart, Nifty has spent 50% time in last 9 years near ATHs.

And spent just 4% time in bear market territory

10/n

Complete opposite to above chart, Nifty has spent 50% time in last 9 years near ATHs.

And spent just 4% time in bear market territory

10/n

In the last 8.5 years, markets have corrected ~15% every other year and I cannot predict if the 25-30% frequent drawdowns between 1997-2013 will become the norm anytime soon.

So, 15%+ declines from ATH can be used as a good metric to increase equity allocation in my view.

11/n

So, 15%+ declines from ATH can be used as a good metric to increase equity allocation in my view.

11/n

This thread took me 15+ hours of research and writing, so please retweet if you find it useful.

I will create a separate thread for bear markets in small caps if this thread gets enough traction.

Summary and Learnings of last 25 years of Bear Markets in 🇮🇳👇

12/n

I will create a separate thread for bear markets in small caps if this thread gets enough traction.

Summary and Learnings of last 25 years of Bear Markets in 🇮🇳👇

12/n

Bear Market Summary

1. 🐻 occurs every ~3 years and avg 8 months to bottom

2. 🇮🇳 has only seen 2 bear markets in last 9 years

3. 🐻 recoveries take double the time (16 months)

4. Bull 🐂 markets can have multiple 🐻 phases

5. Increase equity allocation on 15%+ declines

END

1. 🐻 occurs every ~3 years and avg 8 months to bottom

2. 🇮🇳 has only seen 2 bear markets in last 9 years

3. 🐻 recoveries take double the time (16 months)

4. Bull 🐂 markets can have multiple 🐻 phases

5. Increase equity allocation on 15%+ declines

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh