#Terra's meltdown led many native protocols to look outward to the #Cosmos & realise the benefits of joining an ecosystem of fully interoperable & scalable app-chains

One such project is @mars_protocol and in today’s thread I’m running it through the usual quality checklist 🧵

One such project is @mars_protocol and in today’s thread I’m running it through the usual quality checklist 🧵

@mars_protocol If you're unfamiliar with my investment framework, you may want to have a look at this thread first

https://twitter.com/Thyborg_/status/1530866549153681408

@mars_protocol The first criteria is the total addressable market (TAM) which represents the revenue opportunity available to the protocol

Mars is a lending & borrowing (also called credit or money-market) protocol

On Ethereum, the top 10 actors in the category capture a TVL close to $15 bn

Mars is a lending & borrowing (also called credit or money-market) protocol

On Ethereum, the top 10 actors in the category capture a TVL close to $15 bn

@mars_protocol Ethereum itself currently has a TVL of $60 bn, meaning money-markets represents about 25% of that

Cosmos has a TVL close to $8 bn and the biggest IBC-connected lending protocol is @hard_protocol on the @kava_platform with $110 M - per @DefiLlama analytics - or around 1.5%

Cosmos has a TVL close to $8 bn and the biggest IBC-connected lending protocol is @hard_protocol on the @kava_platform with $110 M - per @DefiLlama analytics - or around 1.5%

@mars_protocol @hard_protocol @kava_platform @DefiLlama While competing protocols like @Umee_CrossChain are also gearing up for launch, a new Cosmos money-market should experience significant TVL growth within a relatively short amount of time

Especially considering the bright Cosmos outlook this year

Especially considering the bright Cosmos outlook this year

https://twitter.com/ThyBorg_/status/1527242686243098624

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain Looking at Mars's solution to capture market shares, we see a non-custodial, open-source, transparent, algorithmic & community-governed credit protocol.

That in itself is very similar to existing & upcoming solutions on Cosmos or elsewhere:

That in itself is very similar to existing & upcoming solutions on Cosmos or elsewhere:

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain The Contract-to-Borrower (C2B) model is used by most DeFi lending and borrowing platforms: users provide collateral to the protocol in order to borrow funds, and the borrowed funds can be used elsewhere for anything they want

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain Mars stands out because of the Contract-to-Contract borrowing (C2C) model: instead of requiring separate collateral deposits to enable borrowing, Mars is enabling other protocols to allow their contracts to be used as collateral in exchange for a credit line

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain In essence, users can borrow funds without depositing collateral, provided the funds are being used by a pre-approved smart contract

An obvious first use case is an integration with #Osmosis, where existing LP tokens on @osmosiszone would serve as collateral

An obvious first use case is an integration with #Osmosis, where existing LP tokens on @osmosiszone would serve as collateral

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone This is more capital-efficient than over-collateralised lending & enables a large number of leveraged yield farming strategies

The mechanics are out-of the scope of this thread, but you may a look at these screenshots from @danku_r Mars video to get a sense of the possibilities

The mechanics are out-of the scope of this thread, but you may a look at these screenshots from @danku_r Mars video to get a sense of the possibilities

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone @danku_r Within Cosmos, Mars is planning to adopt a fragmented architecture by porting and deploying its contracts to multiple chains: it will initially exist on Osmosis but then deploy to other chains that will integrate with a future Mars hub app chain

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone @danku_r The specifics of @larry0x's suggested design will also require a separate thread but you can read his Mars forum post below

As it stands, this is the most ambitious use of the IBC protocol that I'm personally aware of

forum.marsprotocol.io/t/an-overview-…

As it stands, this is the most ambitious use of the IBC protocol that I'm personally aware of

forum.marsprotocol.io/t/an-overview-…

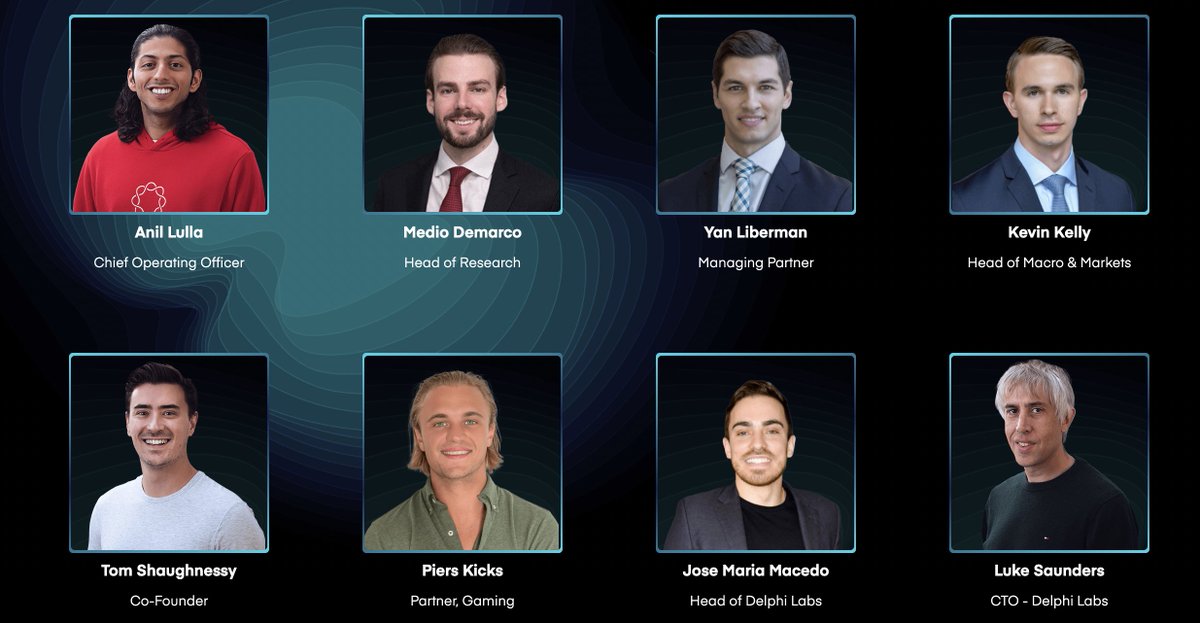

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone @danku_r @larry0x Mars is a product of @Delphi_Digital, specifically the "Delphi Lab" division, which is focused on incubating dApps

The website mentions a team of 20+ experts, including economists, quants, devs, lawyers & UX experts

Terra's DEX @astroport_fi is another product of Delphi Lab

The website mentions a team of 20+ experts, including economists, quants, devs, lawyers & UX experts

Terra's DEX @astroport_fi is another product of Delphi Lab

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone @danku_r @larry0x @Delphi_Digital @astroport_fi My understanding is that most of Delphi devs are anonymous

The management team, however, is well-known in the Terra community and I expect they'll start interacting with more Cosmos people going forward

The management team, however, is well-known in the Terra community and I expect they'll start interacting with more Cosmos people going forward

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone @danku_r @larry0x @Delphi_Digital @astroport_fi In fact @larry0x & @ZeMariaMacedo were already interviewed by @chjango on the Osmosis channel

In a preemptive update, I've added José & Larry to my list of popular Cosmos Twitter accounts below

datastudio.google.com/s/o8T0OBXkfTs

In a preemptive update, I've added José & Larry to my list of popular Cosmos Twitter accounts below

datastudio.google.com/s/o8T0OBXkfTs

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone @danku_r @larry0x @Delphi_Digital @astroport_fi @ZeMariaMacedo @chjango Mars is an "unincorporated joint venture" funded by a LUNA & UST grant from Terraform Labs

Apparently, there was no capital-raising aside from the TFL grant, meaning Mars has no VC investors

Apparently, there was no capital-raising aside from the TFL grant, meaning Mars has no VC investors

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone @danku_r @larry0x @Delphi_Digital @astroport_fi @ZeMariaMacedo @chjango That's an interesting legal set up which I'm planning to look into in a subsequent thread, likely along $MARS tokenomics & distribution

For now, Mars officially becomes the fourth protocol listed on my Cosmos report below datastudio.google.com/s/pjPq_LgWRXA

For now, Mars officially becomes the fourth protocol listed on my Cosmos report below datastudio.google.com/s/pjPq_LgWRXA

@mars_protocol @hard_protocol @kava_platform @DefiLlama @Umee_CrossChain @osmosiszone @danku_r @larry0x @Delphi_Digital @astroport_fi @ZeMariaMacedo @chjango Since I'm covering the whole Cosmos ecosystem through educative & digestible threads on governance proposals, airdrops, tokens, teams & projects, you might consider retweeting the thread below & giving me a follow @Thyborg_ ✌️

https://twitter.com/Thyborg_/status/1536302383675736064

• • •

Missing some Tweet in this thread? You can try to

force a refresh