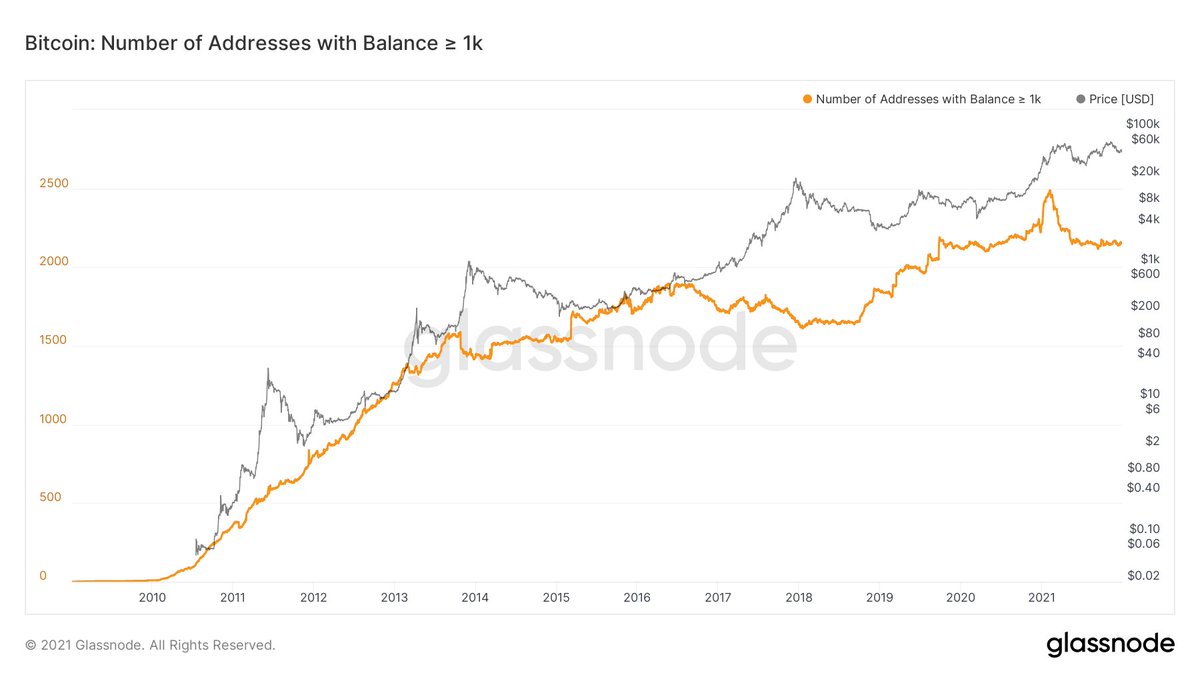

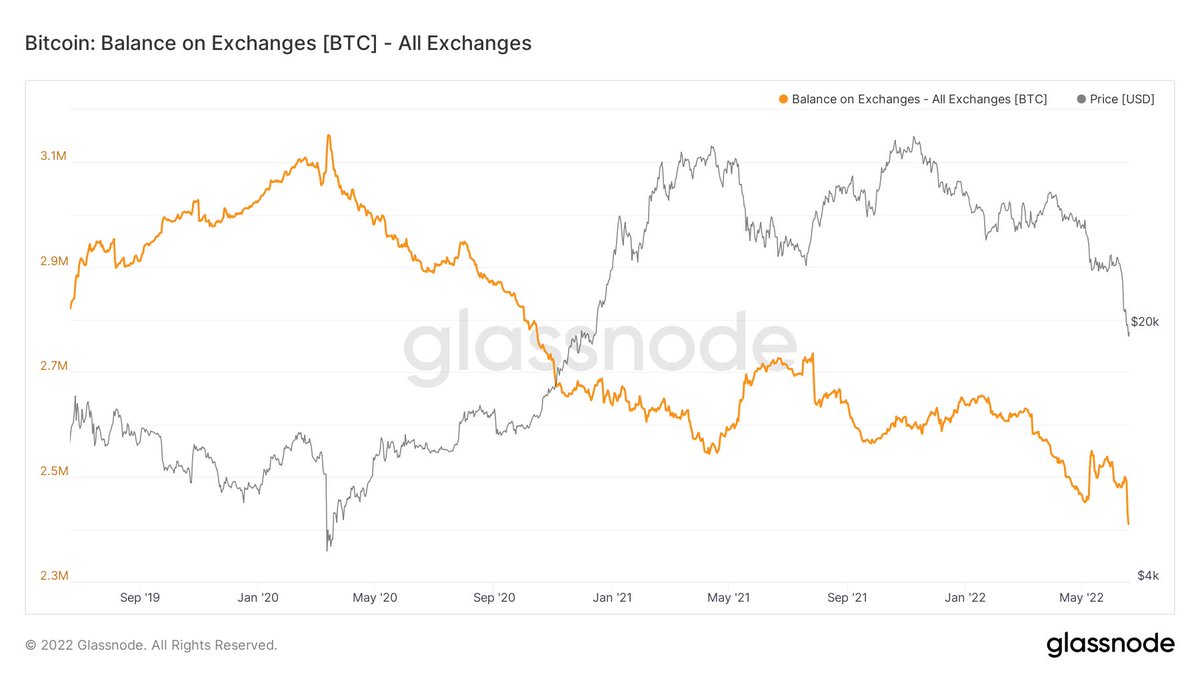

I think we can officially kill the "#BTC leaving exchanges is bullish" narrative once and for all.

Balance down. Price up.

Balance up. Price down.

Balance down. Price down.

Exchange balance has no proven (or mildly observed) effect on the market at this juncture. Just a number.

Balance down. Price up.

Balance up. Price down.

Balance down. Price down.

Exchange balance has no proven (or mildly observed) effect on the market at this juncture. Just a number.

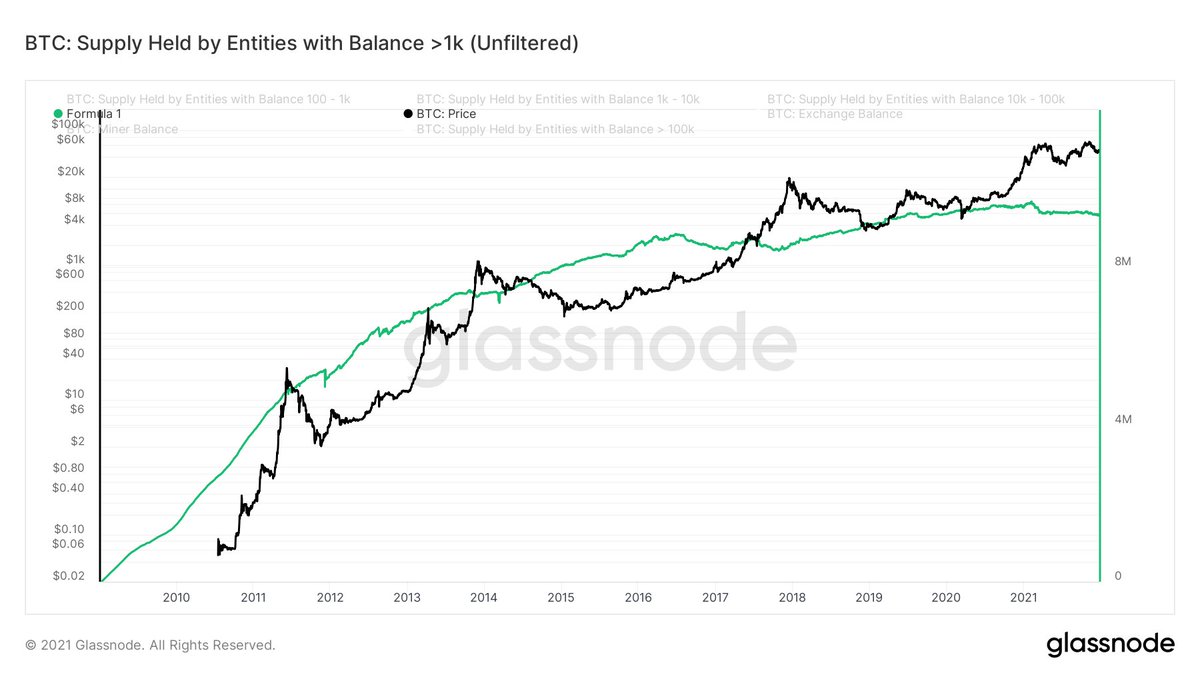

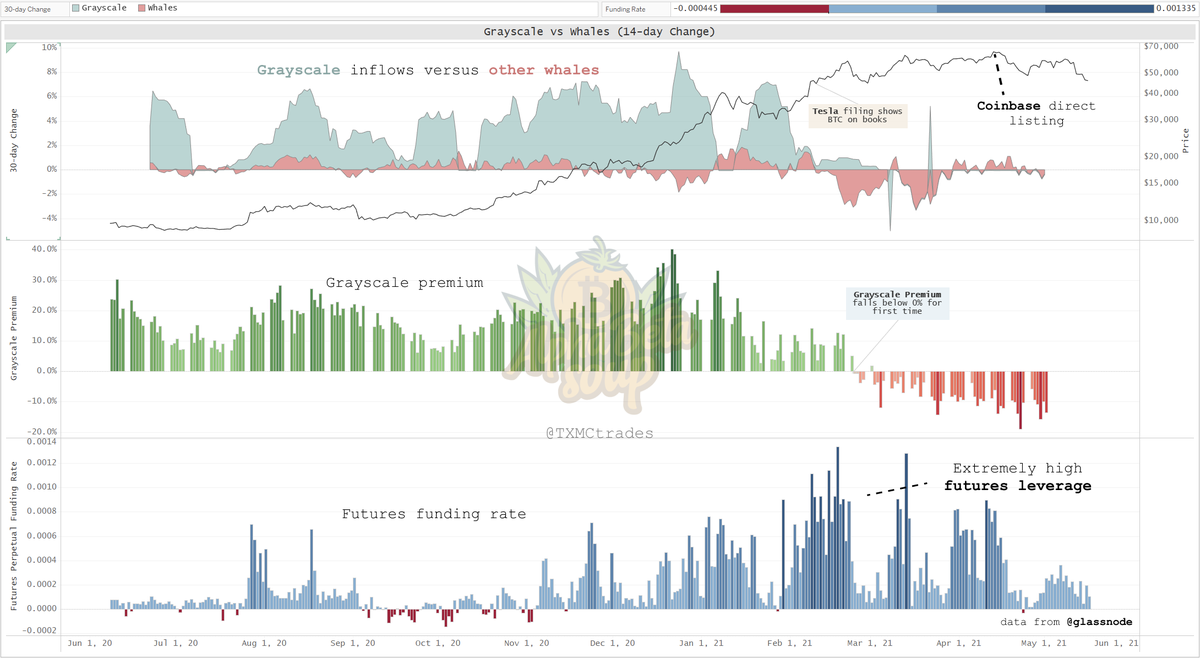

It makes sense why there was a belief, for a time. The pico top of balances was March 2020.

I believe the real story is the continual attrition of dominance by core exchanges to custodial competition.

Meanwhile the relationship with price is thinner than cheesecloth.

I believe the real story is the continual attrition of dominance by core exchanges to custodial competition.

Meanwhile the relationship with price is thinner than cheesecloth.

There may still exist a risk that a huge inflow could portend selling. After all, exchanges are where most markets are. But it's not required for 📉

In the absence of this, we observe the steady dispersion of custody to businesses & homes unknown as the #Bitcoin market matures.

In the absence of this, we observe the steady dispersion of custody to businesses & homes unknown as the #Bitcoin market matures.

I seem to have triggered some w/ this. Not my intent. Just giving my view.

Long term, it's good for BTC to get off exchanges. I have said this publicly.

But this metric is not tethered to price action, and "scarcity" in its true form is a long way off, friends.

Long term, it's good for BTC to get off exchanges. I have said this publicly.

But this metric is not tethered to price action, and "scarcity" in its true form is a long way off, friends.

When coins leave a known entity like Coinbase, they wander into a grey box of on-chain uncertainty, & we've scant insight as to the makeup of that ownership or its intent.

Of the hundreds, thousands of firms using #BTC globally on-chain, there are at most a few dozen identified.

Of the hundreds, thousands of firms using #BTC globally on-chain, there are at most a few dozen identified.

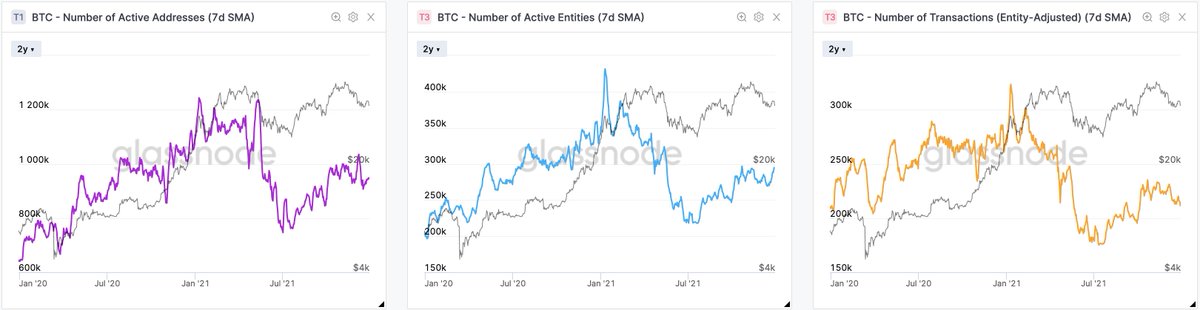

There are groups working tirelessly to identify known entities on-chain & track their activity. It's a never ending job of immense complexity, and there is still much unknown.

The expansion of #BTC's market, w/ new firms appearing all the time, means it's a race that has no end.

The expansion of #BTC's market, w/ new firms appearing all the time, means it's a race that has no end.

We don't know with certainty that when a coin leaves a known exchange, that it's going to an individual holder and not another custodian serving a cohort of users.

We don't know if it's a new exchange, an OTC desk, a trading house, an investment firm, or Joe Schmoe Bitcoiner.

We don't know if it's a new exchange, an OTC desk, a trading house, an investment firm, or Joe Schmoe Bitcoiner.

As a result, we can't celebrate the tale of sovereignty using only exchange balance as our evidence.

It can be useful to look at, to understand the scale of exchange custody, to watch for inflows that hint at exit motivation.

Outside of those uses, my view is less constructive.

It can be useful to look at, to understand the scale of exchange custody, to watch for inflows that hint at exit motivation.

Outside of those uses, my view is less constructive.

• • •

Missing some Tweet in this thread? You can try to

force a refresh