Relentlessly curious -- I read a lot -- Big mouth -- Unintentional Bitcoinoclast -- @alphabetasoup_

6 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/txmctrades/status/1723026208386871614

Uniformly, re-steepening of the curve out of inversion happens before or during recession, not after.

Uniformly, re-steepening of the curve out of inversion happens before or during recession, not after.

https://twitter.com/txmctrades/status/1535437877403852801

This isn't just a matter of gig workers hidden from unemployed, or marginally attached failing to apply for jobs or respond to surveys. Those things occur but they don't change this story.

This isn't just a matter of gig workers hidden from unemployed, or marginally attached failing to apply for jobs or respond to surveys. Those things occur but they don't change this story.

https://twitter.com/TXMCtrades/status/1612110532072316929A cyclical downturn is a roller coaster and the pathway is non-linear- a phrase I stress often.

https://twitter.com/txmctrades/status/1617873966085066752

https://twitter.com/TXMCtrades/status/1590180579625951233

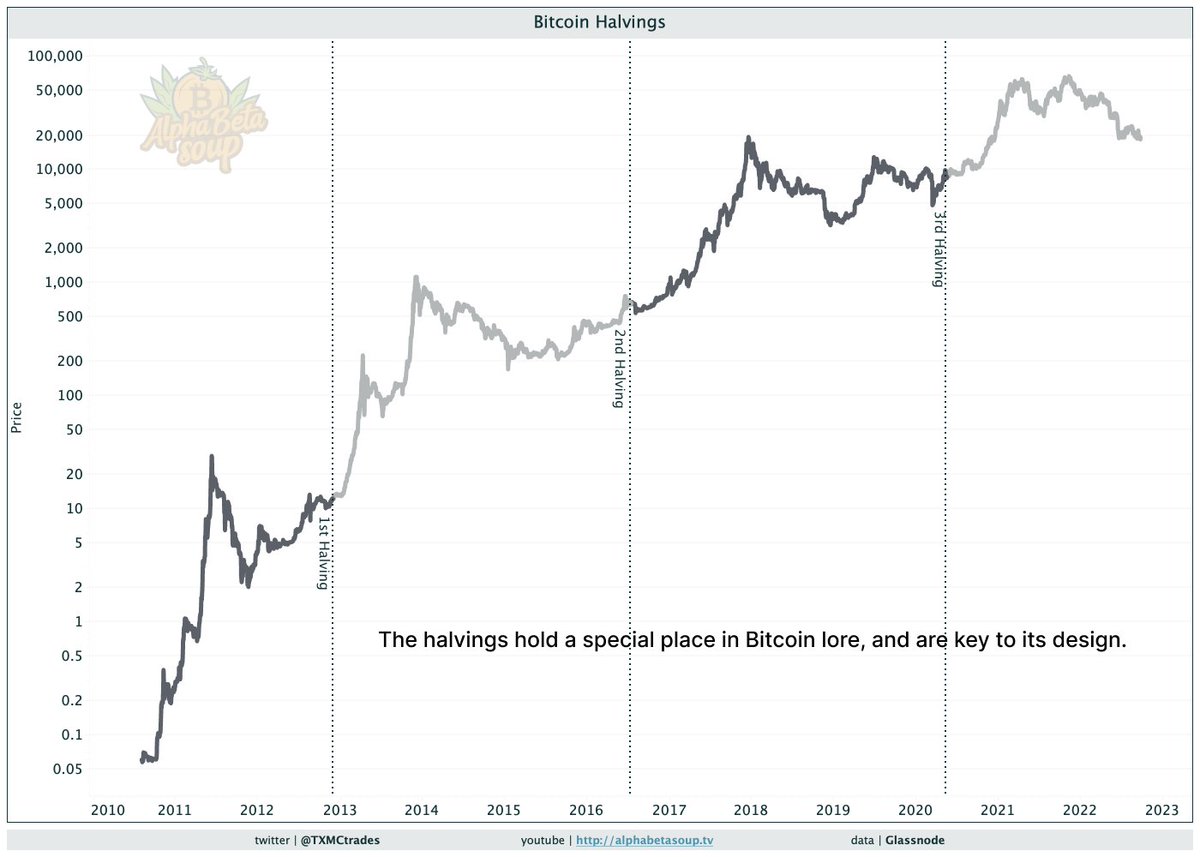

https://twitter.com/TXMCtrades/status/1574387149495050242The halving is a magical event where the issuance rate of new #BTC is halved every 210,000 blocks.

https://twitter.com/TXMCtrades/status/1541961015247753217I hold this view because it seems to me that #BTC desires to be a denominator for some amount of commerce.

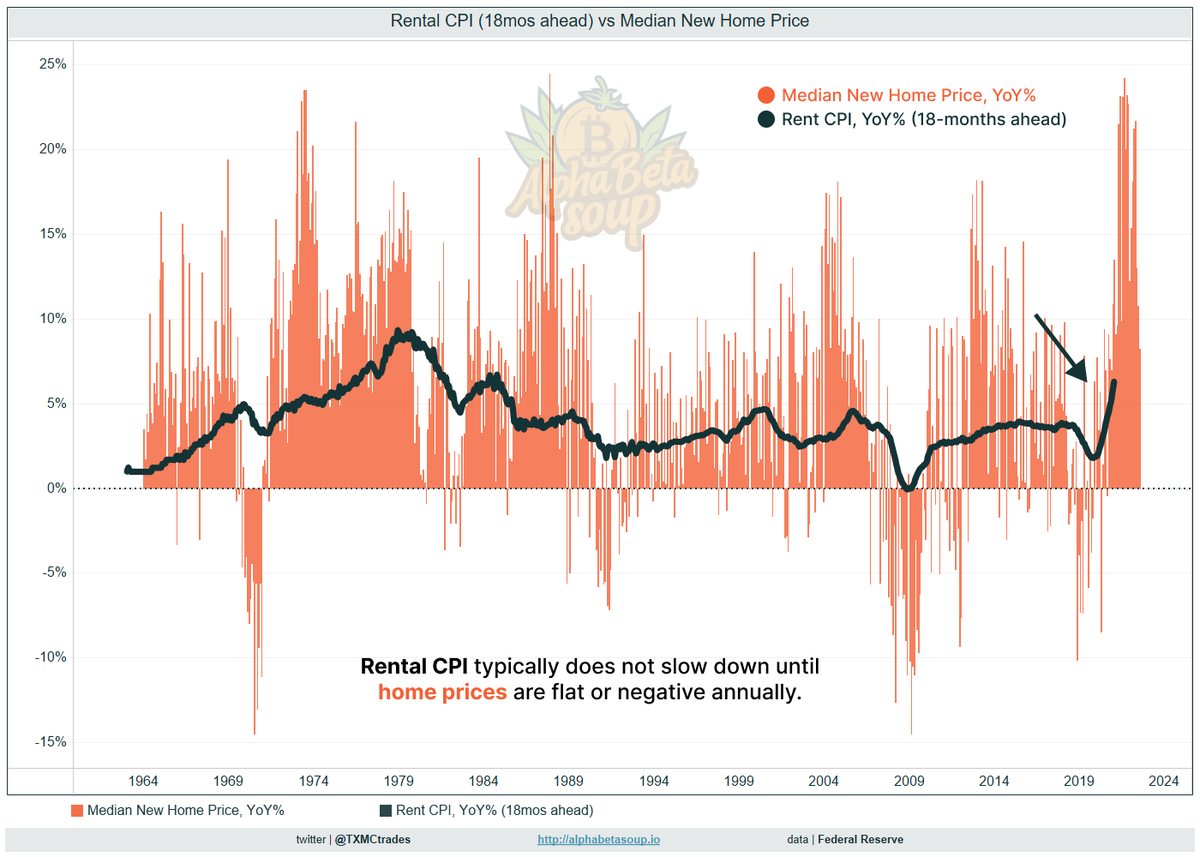

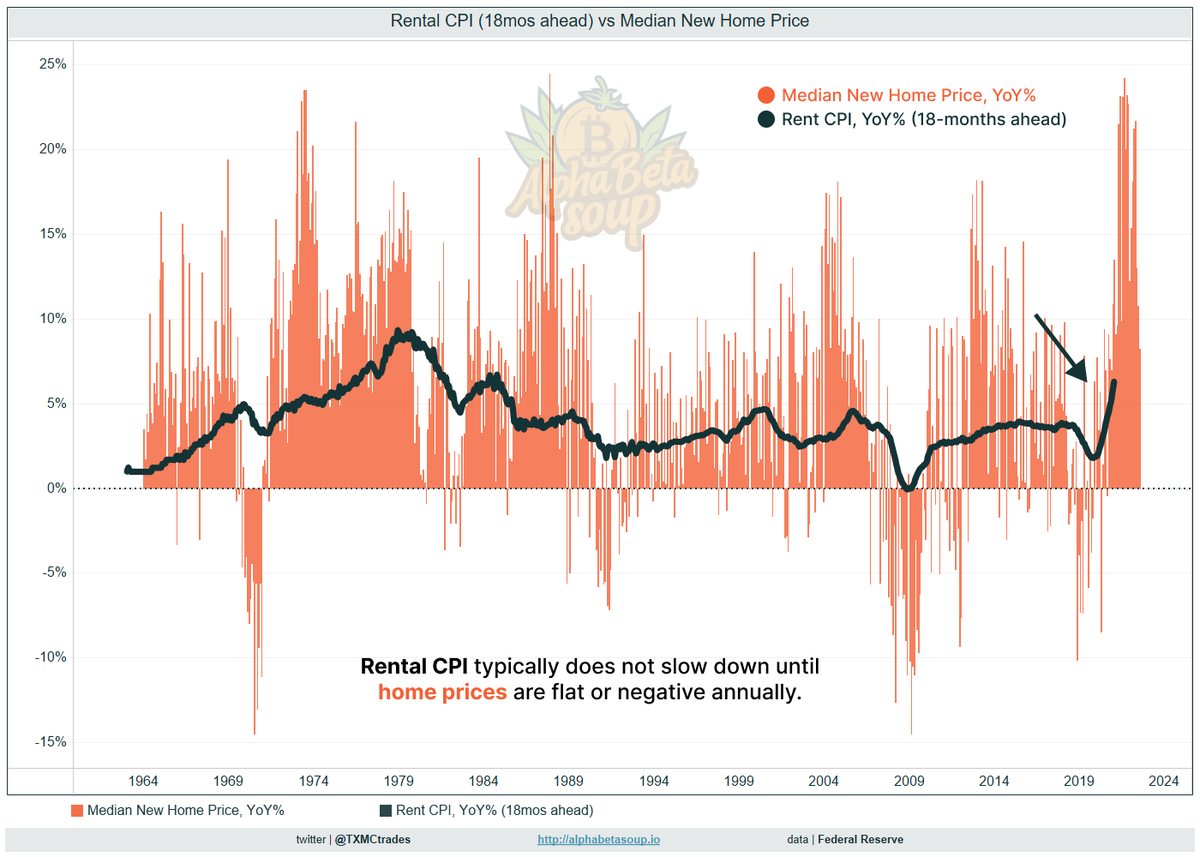

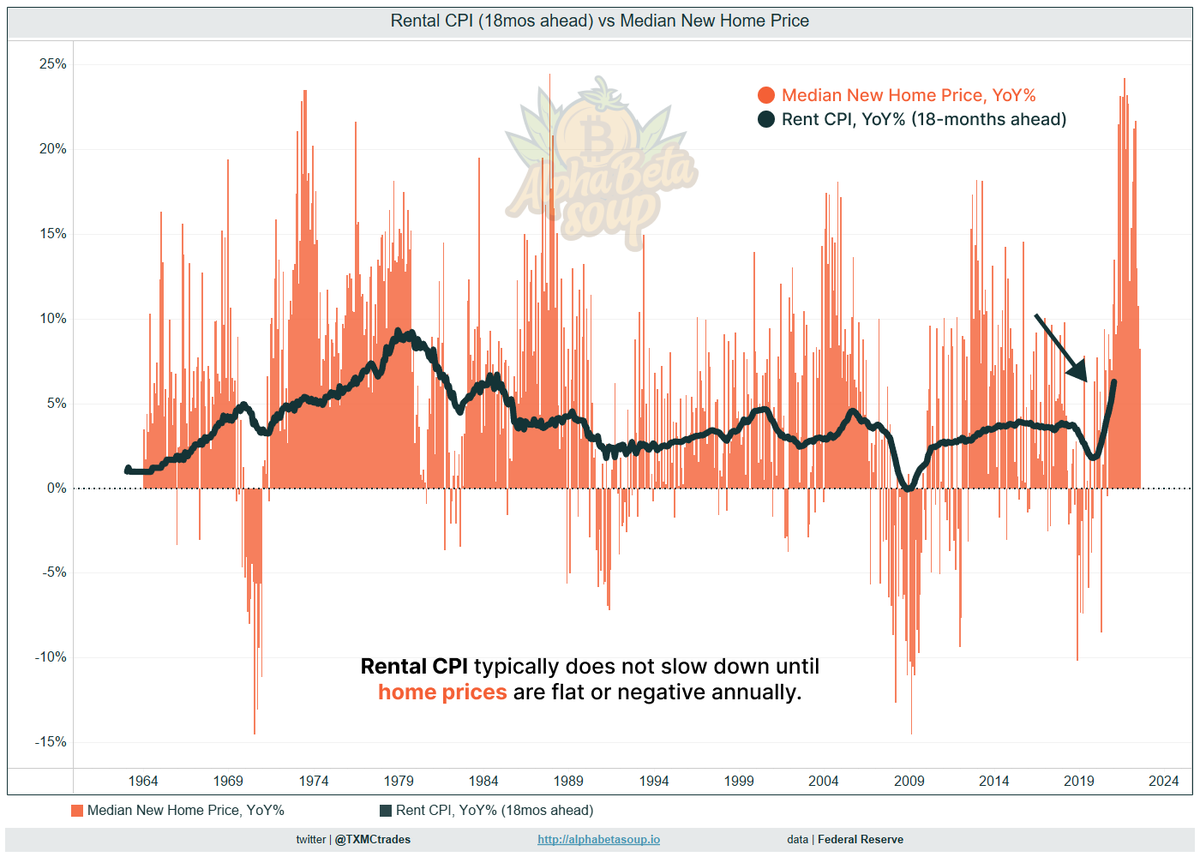

We begin with ⚫️rent CPI (18mos ahead) vs 🟠median new home prices annually.

We begin with ⚫️rent CPI (18mos ahead) vs 🟠median new home prices annually.

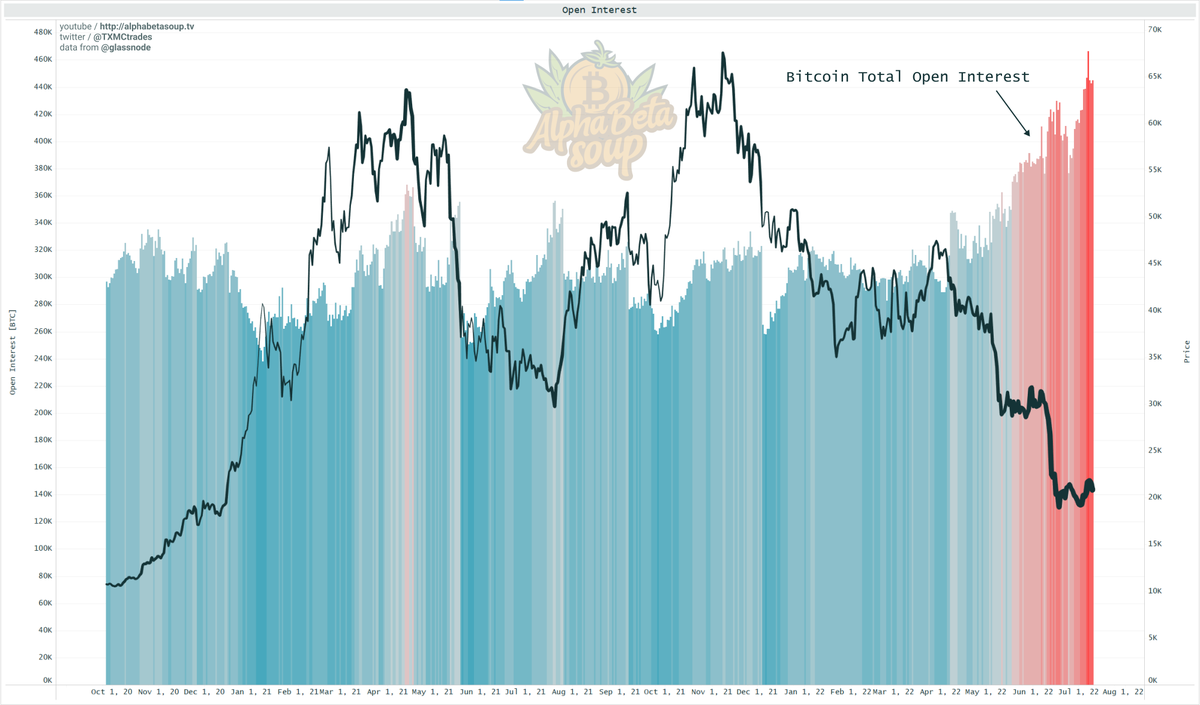

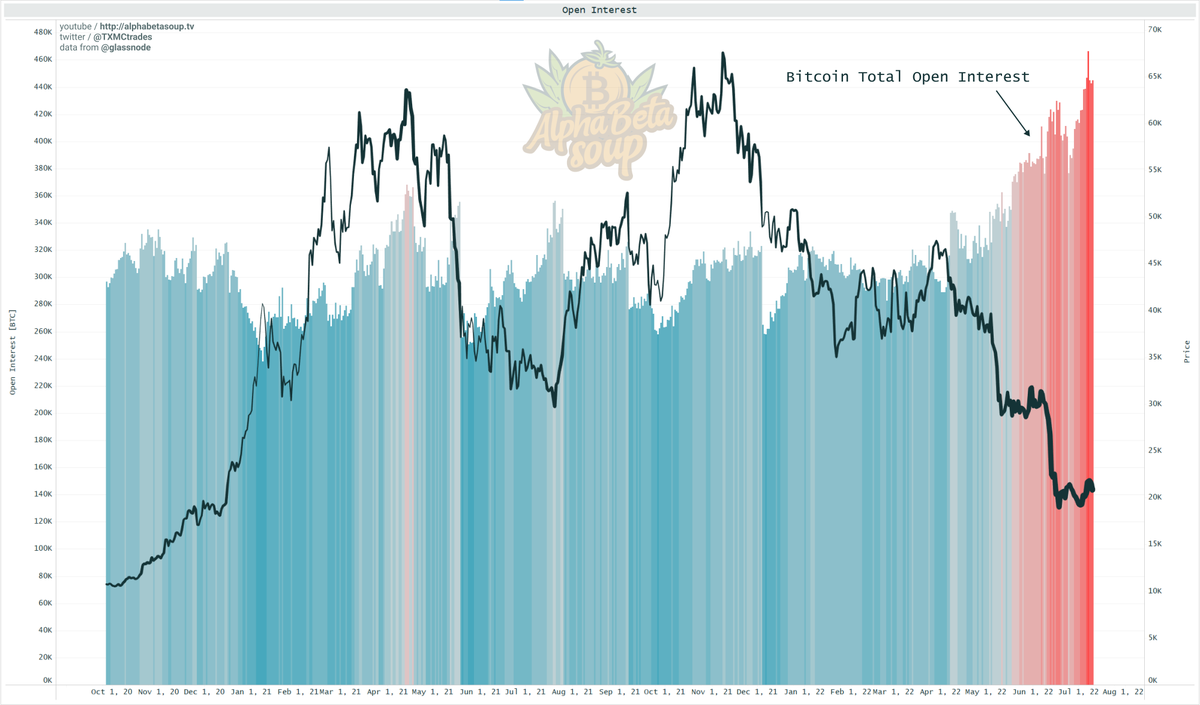

https://twitter.com/TXMCtrades/status/1526275582740373505The 2020-21 bull was authored by central bank policy, not by a tectonic shift of public interest in sound money.

https://twitter.com/TXMCtrades/status/1532356336243154949

https://twitter.com/TXMCtrades/status/1536456569101111296

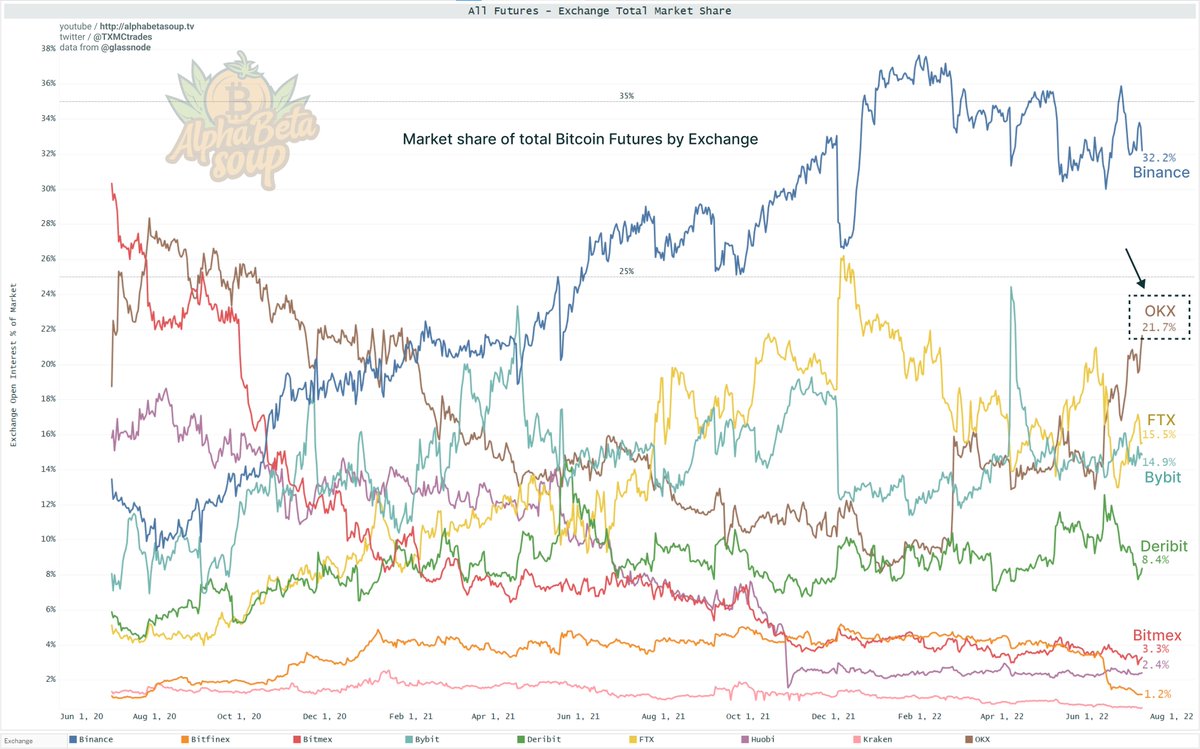

🟤OKX's star has been rising of late.

🟤OKX's star has been rising of late.

https://twitter.com/TXMCtrades/status/1525508741235453953Another flawed belief IMO is that easing (or pausing hikes) will automatically create risk appetite. That piles of cash are simply waiting, sidelined.