A thread🧵 on Why gross refining margins (GRM) are at multi year high & what it means for refining stocks

"Exxon made more money than God this year," said Biden

#RIL #HPCL #iocl #BPCL #MRPL #CHENNAIPETRO

"Exxon made more money than God this year," said Biden

#RIL #HPCL #iocl #BPCL #MRPL #CHENNAIPETRO

GRM is difference between value of crude based products & value of crude oil.

GRM trends

Q1FY23 GRM (in average basis)- $23

Q4FY22 GRM - $8.1

Q3FY22 GRM - $6.1

Q2FY22 GRM - $3.7

Q1FY22 GRM - $2

Q4FY21 GRM - $1.2

GRM trends

Q1FY23 GRM (in average basis)- $23

Q4FY22 GRM - $8.1

Q3FY22 GRM - $6.1

Q2FY22 GRM - $3.7

Q1FY22 GRM - $2

Q4FY21 GRM - $1.2

Why GRMs are multi year high?

- refiners shut several unprofitable facilities after crude turns negative in pandemic

- refining capacity down to 17.2 Mn bpd in Mar-22 bpd from 19 Mn bpd in April-20 while Downstream products demand remain robust, (1st time in 30 yrs).

- refiners shut several unprofitable facilities after crude turns negative in pandemic

- refining capacity down to 17.2 Mn bpd in Mar-22 bpd from 19 Mn bpd in April-20 while Downstream products demand remain robust, (1st time in 30 yrs).

Cont

- China & Russia are biggest refining nations, with sanction & war their refining capacity could not be used to meet World's fuel demand which rebounded to pre pandemic levels

- China Covid restrictions

- refiners who closed refineries in pandemic have no plans to re-open

- China & Russia are biggest refining nations, with sanction & war their refining capacity could not be used to meet World's fuel demand which rebounded to pre pandemic levels

- China Covid restrictions

- refiners who closed refineries in pandemic have no plans to re-open

What it means for Indian refiners

- They are making more money as they got discounted crude from Russia, adds $3 in GRM

- MRPL said every $1 inc in GRM add 700cr rev

- MS says $1 inc in GRM implies 4% EPS growth for Ril

- IOCL/BPCL/HPCL refining gains offset by marketing losses

- They are making more money as they got discounted crude from Russia, adds $3 in GRM

- MRPL said every $1 inc in GRM add 700cr rev

- MS says $1 inc in GRM implies 4% EPS growth for Ril

- IOCL/BPCL/HPCL refining gains offset by marketing losses

But since its commodity & rise is temporary and not sustainable.

Biden has been forcing refiners to do moe production

US recession may hurt fuel demands

Some refiners also expanding

With crude fallling, pressure mounts on refiners to reduce downstream products price

Biden has been forcing refiners to do moe production

US recession may hurt fuel demands

Some refiners also expanding

With crude fallling, pressure mounts on refiners to reduce downstream products price

Cont

Definitely Q1 will be excellent but because market is forward looking it will price down that its not sustainable. Hence small companies like MRPL & Chennai Petro which saw steep rise in share prices are falling with same speed. Be cautious ⚠️

Definitely Q1 will be excellent but because market is forward looking it will price down that its not sustainable. Hence small companies like MRPL & Chennai Petro which saw steep rise in share prices are falling with same speed. Be cautious ⚠️

Cont

Go with Reliance where share price has not seen any rise due to this event, whils Q1 remains strong just like Q4

Go with Reliance where share price has not seen any rise due to this event, whils Q1 remains strong just like Q4

Suggested Reads

Reuters

reuters.com/markets/commod…

Business Standard

business-standard.com/article/compan…

Reuters

reuters.com/markets/commod…

Business Standard

business-standard.com/article/compan…

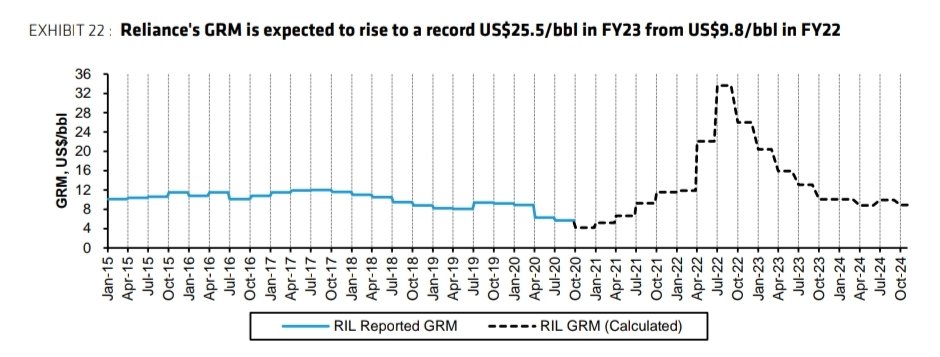

Reliance FY23 GRM is expected to be around $25/bbl from FY22 GRM of $10/bbl. These levels of GRM not seen in last 15 yrs.

See below #Reliance GRM in Charts

Src Bernstein

See below #Reliance GRM in Charts

Src Bernstein

Bernstein estimate O2C can achieve record EBITDA of INR845bn (+60% y-o-y) which is 25% higher than consensus estimates of INR676bn.

Reliance FY23 GRM is expected to be around $25/bbl from FY22 GRM of $10/bbl. These levels of GRM not seen in last 15 yrs.

See below #RelianceJio GRM Charts

Src Bernstein

See below #RelianceJio GRM Charts

Src Bernstein

Bernstein estimate Ril can achieve record EBITDA of INR845bn (+60% y-o-y) which is 25% higher than consensus estimates of INR676bn.

Setback for Refiners Govt impose taxes on windfall gains

https://twitter.com/ETNOWlive/status/1542723854321082368?t=onNGwKH5jIYnINL8cDMRrQ&s=19

Impact on Reliance

GRM could fall to $17 from $25 ($1 GRM= $400Mn Ebitda)

Tax Hike even for refinery in SEZ (50% of capacity)

EBITDA impact - 10%

Refining Biz valuation is 300 per share, so stock has fallen much than what it should be

Analyst Note on Tax Impact

GRM could fall to $17 from $25 ($1 GRM= $400Mn Ebitda)

Tax Hike even for refinery in SEZ (50% of capacity)

EBITDA impact - 10%

Refining Biz valuation is 300 per share, so stock has fallen much than what it should be

Analyst Note on Tax Impact

Impact on others

Export of Fuels as % of total production

IOCL BPCL HPCL - negligible

MRPL & Chennai Petro - 10%

RIL - 75%

Higher the export higher the tax impact

Impact on EPS of Oil Producers could be around 10-12%

Src @soumeet_sarkar @ETNOWlive

Export of Fuels as % of total production

IOCL BPCL HPCL - negligible

MRPL & Chennai Petro - 10%

RIL - 75%

Higher the export higher the tax impact

Impact on EPS of Oil Producers could be around 10-12%

Src @soumeet_sarkar @ETNOWlive

https://twitter.com/ETNOWlive/status/1542783472816623616?t=KUKGZKtpBBfi48uXct3ivg&s=19

Very Important : Today's Taxes & Duties are applicable on exports from SEZ & EOU too

https://twitter.com/CNBCTV18News/status/1542809153110167552?t=ZAhKwutKj8oU0m_clHi3fw&s=19

Whether NETRA : Early Warning & Signals predicted abourpt fall in crude refining margins.

Answer is Yes

See below June-22 edition @SahilKapoor @ankitapathak_ @dspmf

Answer is Yes

See below June-22 edition @SahilKapoor @ankitapathak_ @dspmf

Seems even if there would be no tax than also falling GRMs would have hurt them

https://twitter.com/soumeet_sarkar/status/1544869977773441024?t=f4s_o8S59fo4LhiNNdV33w&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh