Just made vid @RealVision #BTC price action explain from Oct/Nov’21 ATHs blow off top & plunge → now, from (overlooked) lens of listed derivs & futures backed ETFs’ heavy hand in mkts - $BITO

No sooner, ProShares announces $BITI INVERSE BTC ETF, debut today 🇺🇸mkt open

(thread)

No sooner, ProShares announces $BITI INVERSE BTC ETF, debut today 🇺🇸mkt open

(thread)

1/Need to stop measuring current BTC↓% perform START from Nov ATH $69k

The Oct → Nov sudden +50% “rally” = CME futs led w/ sharp & persistent asset mngrs’ open int↑ as futs backed ETFs come into existence, NOT real buying of spot BTC

Hence short lived rally → crash

The Oct → Nov sudden +50% “rally” = CME futs led w/ sharp & persistent asset mngrs’ open int↑ as futs backed ETFs come into existence, NOT real buying of spot BTC

Hence short lived rally → crash

2/ Therefore BTC Oct~Nov rally = “fake” as it was from process of/anticipation of new product rollout

If you ignore that ↑↓$20k in spot, BTC maintained % for % beta w/ NASDAQ (flat in 4Q21)

=BTC ~$40k 👈 where “% perform FROM” level should start, not from artificial $69k level

If you ignore that ↑↓$20k in spot, BTC maintained % for % beta w/ NASDAQ (flat in 4Q21)

=BTC ~$40k 👈 where “% perform FROM” level should start, not from artificial $69k level

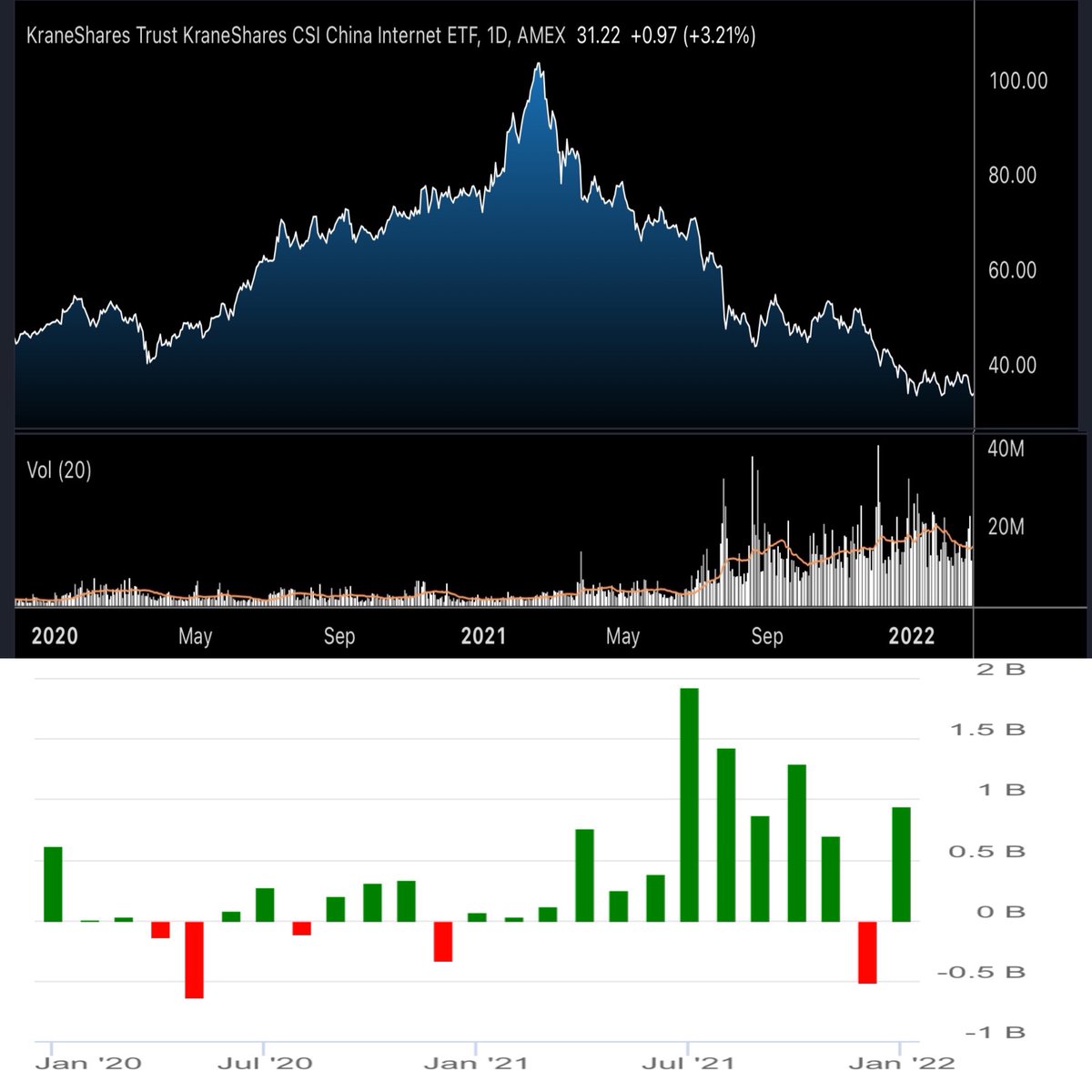

3/My new vid covers ETF share creation/redeem mechanic & how ETF “inflow” ≠ (always) long/buying, as ETF shares can be created to lend for purpose of shorting (see ‘21 $KWEB ↓70% w/ $7bn inflows👇)

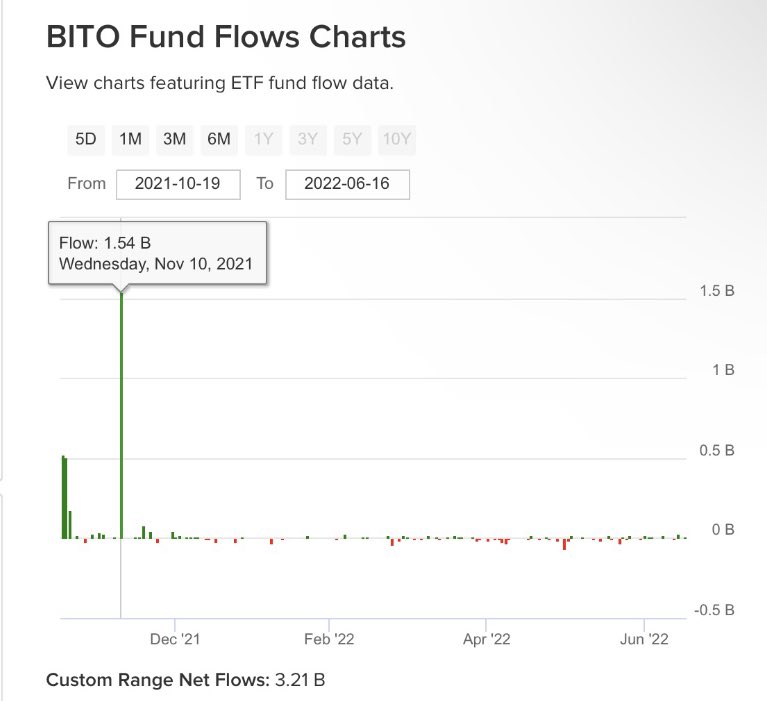

11/10: $BITO sudden +$1.5b inflow

↓

ATH day

✖️Shitty long?

or

✔️Solid short?

11/10: $BITO sudden +$1.5b inflow

↓

ATH day

✖️Shitty long?

or

✔️Solid short?

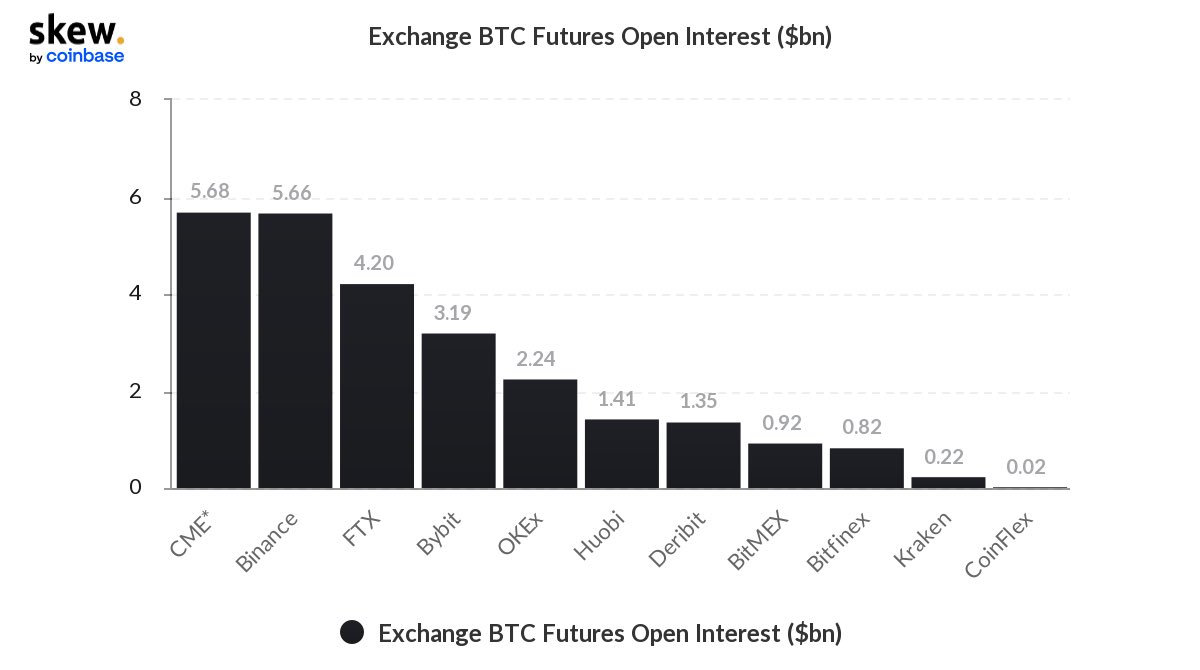

With $BITO $BTF & other CME BTC futures backed ETFs launch, CME overtook Binance as largest BTC futs exch by notional open int.

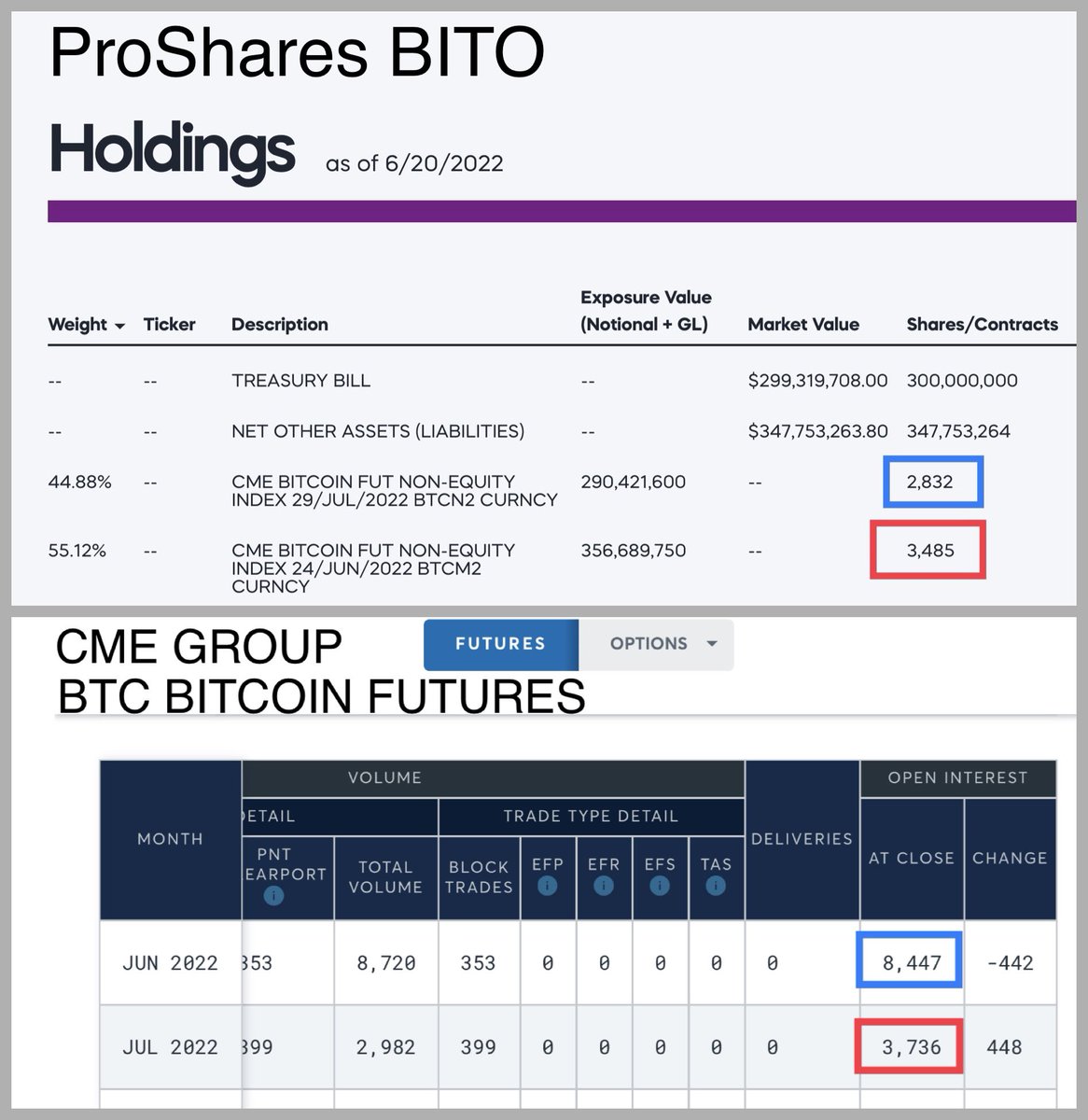

(As of Jun 20), $BITO holds nearly ½ of front month Jun BTC contracts & ¾ of Jul open int

& futures can/have/will move spot BTC

So BITO flows matter

(As of Jun 20), $BITO holds nearly ½ of front month Jun BTC contracts & ¾ of Jul open int

& futures can/have/will move spot BTC

So BITO flows matter

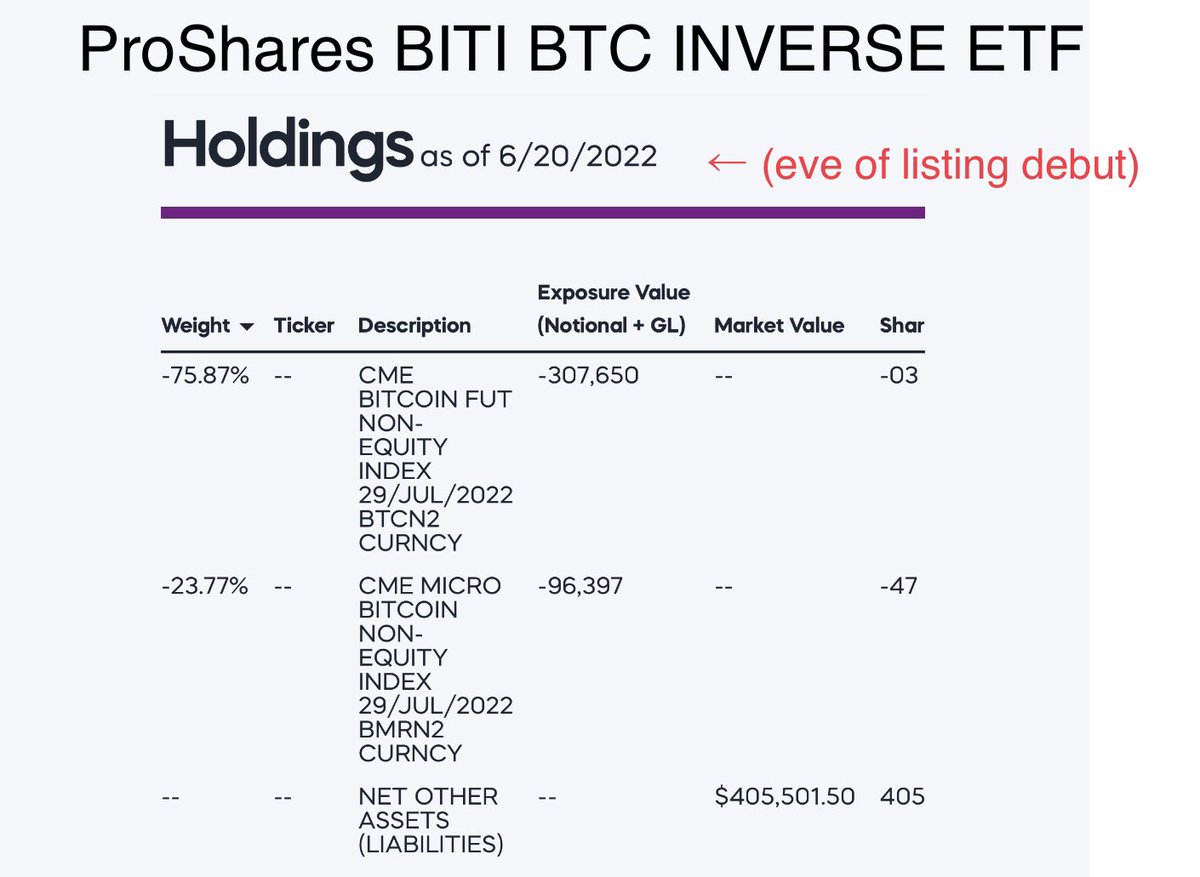

ProShares $BITI, the 1st 🇺🇸 listed short BTC (futs) ETF, announced yesterday for debut today

Very timely w/ my video explain (& yes obv coincidental - if I had predictive timing precision capabilities I wouldn’t spill out my nonsense thoughts on videos)

proshares.com/fund-highlight…

Very timely w/ my video explain (& yes obv coincidental - if I had predictive timing precision capabilities I wouldn’t spill out my nonsense thoughts on videos)

proshares.com/fund-highlight…

As with all futs (w/ curve in contango) backed ETFs + inverse & 2x/3x levered ETFs - if held long term, value drops near $0 (neither a “scam” nor purposeful design)

Short $BITI inverse BTC ETF may be attractive way for long BTC directional exposure as structural↓ works in favor

Short $BITI inverse BTC ETF may be attractive way for long BTC directional exposure as structural↓ works in favor

• • •

Missing some Tweet in this thread? You can try to

force a refresh