(1/15)

About:

Incorporated in 1989 by Mr LK Jain, Fiem Industries now is a leading manufacturers of Automotive Lighting & Signalling Equipment's and Rear View Mirrors

in India.

FIEM is among first companies in India introducing LED lights in two wheelers.

About:

Incorporated in 1989 by Mr LK Jain, Fiem Industries now is a leading manufacturers of Automotive Lighting & Signalling Equipment's and Rear View Mirrors

in India.

FIEM is among first companies in India introducing LED lights in two wheelers.

(2/15)

2-Wheeler Industry:

2 wheeler sales in India hit the lowest in 9 years in CY21. The average inventory which uses to hover around 25-30 days reached 50 days.

Though the Management of Fiem industries believe that the worst is behind them and the industry is set to grow.

2-Wheeler Industry:

2 wheeler sales in India hit the lowest in 9 years in CY21. The average inventory which uses to hover around 25-30 days reached 50 days.

Though the Management of Fiem industries believe that the worst is behind them and the industry is set to grow.

(3/15)

Segments:

The company deals in 2 segments-

• Automative Segment

• LED segment

Here are the products it deals in these two segments:

Segments:

The company deals in 2 segments-

• Automative Segment

• LED segment

Here are the products it deals in these two segments:

(4/15)

Presence:

The company has 9 manufacturing plants across India in the states of Haryana, Rajasthan, Gujarat, Tamil Nadu, Karnataka & Himachal Pradesh.

They also have 3 R&D centres in Italy, Japan and one in Haryana

Presence:

The company has 9 manufacturing plants across India in the states of Haryana, Rajasthan, Gujarat, Tamil Nadu, Karnataka & Himachal Pradesh.

They also have 3 R&D centres in Italy, Japan and one in Haryana

(5/15)

Strong clients:

The company has strong clientele with major names like Hero MotoCorp, TVS, Yamaha, Ola, Suzuki.

Other than these companies, it has a clientele base of more than 50 OEMs

It also has clients in USA, Thailand, Japan, Austria, Germany etc

Strong clients:

The company has strong clientele with major names like Hero MotoCorp, TVS, Yamaha, Ola, Suzuki.

Other than these companies, it has a clientele base of more than 50 OEMs

It also has clients in USA, Thailand, Japan, Austria, Germany etc

(6/15)

Wallet Share of 3 major Clients:

• HMSI: Headlamp 40%, tail lamps 76%, winker 85% & RVM 100%.

• TVS: 73% headlamp, tail lamps 69%, winker 82% & RVM 55%.

• Yamaha: Headlamps 91%, tail lamps 64%, winker 5% & RVM 32%.

Wallet Share of 3 major Clients:

• HMSI: Headlamp 40%, tail lamps 76%, winker 85% & RVM 100%.

• TVS: 73% headlamp, tail lamps 69%, winker 82% & RVM 55%.

• Yamaha: Headlamps 91%, tail lamps 64%, winker 5% & RVM 32%.

(7/15)

FY22 results:

The company achieved highest ever sales of ₹1,558 cr vs ₹1,207 cr in FY21, up by 29%.

EBITDA stood at ₹193.45 crores vs ₹130.6 crores during FY21, a jump of over 48%. PAT at ₹95.26 cr vs ₹47.12 cr YoY.

FY22 results:

The company achieved highest ever sales of ₹1,558 cr vs ₹1,207 cr in FY21, up by 29%.

EBITDA stood at ₹193.45 crores vs ₹130.6 crores during FY21, a jump of over 48%. PAT at ₹95.26 cr vs ₹47.12 cr YoY.

(8/15)

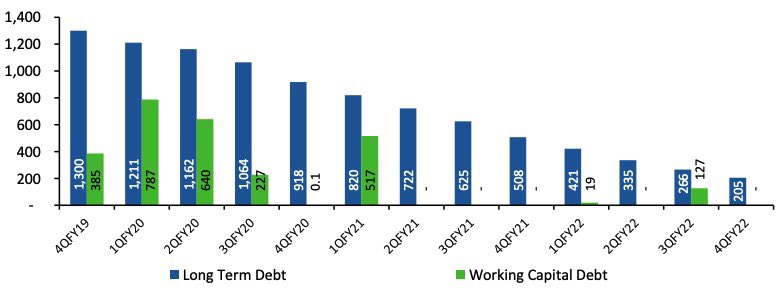

Debt profiling:

The company has a very strong debt profile. It only ₹20 crore in debt which it is planning to repay by the end of Q2FY23.

It’s interest coverage ratio which should be generally above 3, stands at 16.

It is planning to do a capex of ₹50cr this fiscal.

Debt profiling:

The company has a very strong debt profile. It only ₹20 crore in debt which it is planning to repay by the end of Q2FY23.

It’s interest coverage ratio which should be generally above 3, stands at 16.

It is planning to do a capex of ₹50cr this fiscal.

(9/15)

Focus on EV Segment:

• 2W EV is a big opportunity, which is growing in India. The company has ties with OLA and other

major EV OEMs in India.

• It is offering Diversified product portfolio with LED Lighting

solutions, Rear View Mirrors and Plastic Parts etc.

Focus on EV Segment:

• 2W EV is a big opportunity, which is growing in India. The company has ties with OLA and other

major EV OEMs in India.

• It is offering Diversified product portfolio with LED Lighting

solutions, Rear View Mirrors and Plastic Parts etc.

(10/15)

• Healthy order pipeline:

The company has ~80 new projects under its belt and is

working on 3 new models of Hero MotoCorp as well. EVs contributed

~₹40cr to Fiem’s total sales in FY22, and the company expects this to triple by the end of FY23.

• Healthy order pipeline:

The company has ~80 new projects under its belt and is

working on 3 new models of Hero MotoCorp as well. EVs contributed

~₹40cr to Fiem’s total sales in FY22, and the company expects this to triple by the end of FY23.

(11/15)

Management’s view:

• They expect the revenue to grow by ~15-20% with future margins to be in the range

of 12-12.5% aided by economies of scale

• It will be debt free by December this year & will not look to raise more debt

• Believes 2W’s worst is behind them.

Management’s view:

• They expect the revenue to grow by ~15-20% with future margins to be in the range

of 12-12.5% aided by economies of scale

• It will be debt free by December this year & will not look to raise more debt

• Believes 2W’s worst is behind them.

(12/15)

Shareholding Pattern:

• Promoters : 66.56%

• FIIs : 10.78%

• DIIs : 0.21%

• Others : 22.45%

Shareholding Pattern:

• Promoters : 66.56%

• FIIs : 10.78%

• DIIs : 0.21%

• Others : 22.45%

(13/15)

Numbers:

• Stock P/E : 15.6

• PEG Ratio : 0.84

• ROE : 15.5%

• ROCE : 20.6%

• Price to Sales : 0.91

• Interest coverage :16

• Debtor days : 41 up from 24 YoY

• Days Payable : 97 up from 83 YoY

• Market Cap : ₹1478crores

Numbers:

• Stock P/E : 15.6

• PEG Ratio : 0.84

• ROE : 15.5%

• ROCE : 20.6%

• Price to Sales : 0.91

• Interest coverage :16

• Debtor days : 41 up from 24 YoY

• Days Payable : 97 up from 83 YoY

• Market Cap : ₹1478crores

(14/15)

The companies focus on EV segment is a smart play as the 2 wheeler industry is going through a bleak phase in the country. It is mainly focusing on LED now and is expecting its share to go up to 60% by FY25

It is managing its margins well by keeping it at 12-12.5% range

The companies focus on EV segment is a smart play as the 2 wheeler industry is going through a bleak phase in the country. It is mainly focusing on LED now and is expecting its share to go up to 60% by FY25

It is managing its margins well by keeping it at 12-12.5% range

(15/15)

What’s your thought about FIEM industries and it’s future in the EV space?

@caniravkaria @kuttrapali26 @Anshi_________ @aparanjape

What’s your thought about FIEM industries and it’s future in the EV space?

@caniravkaria @kuttrapali26 @Anshi_________ @aparanjape

• • •

Missing some Tweet in this thread? You can try to

force a refresh