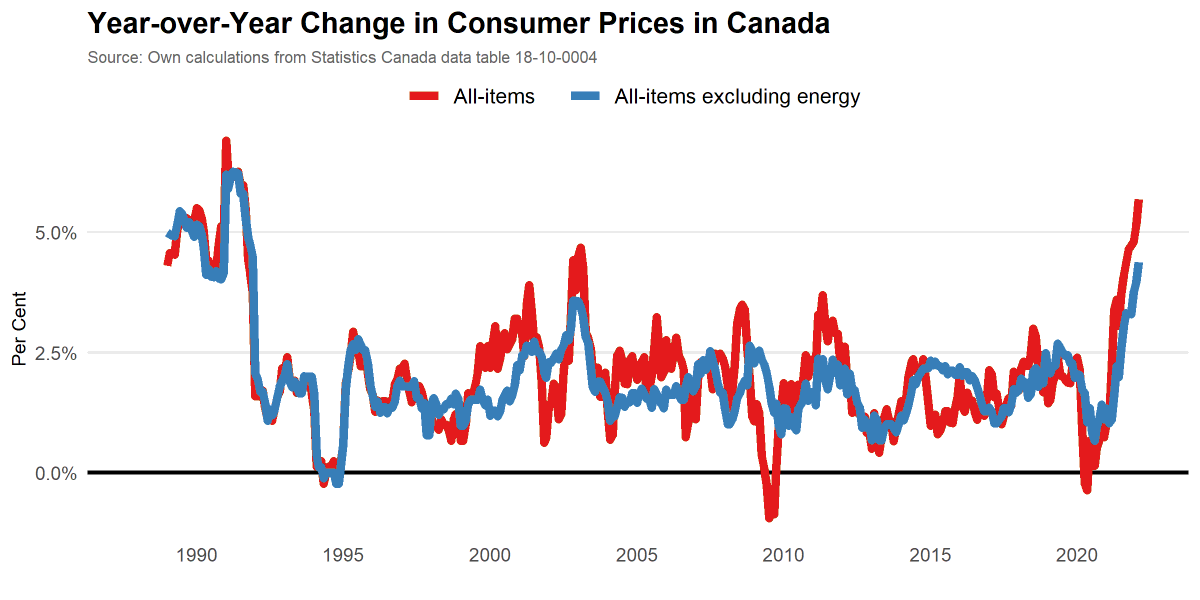

Inflation pressures are broad-based, to be absolutely clear, but this is worth noting: if shelter and energy prices remained flat since last year, I estimate headline inflation would have been 3.2% in May instead of 7.7%. #cdnecon

This is not to deny the financial pressures that price increases create. But it shows that the biggest pressures are narrowly concentrated. This may matter for policy makers trying to figure out where to direct efforts and to understand what is going on.

Also worth noting, this doesn't account for the spillover effects of rising energy prices on goods and services throughout the economy. This is hard to estimate, but my best attempt is that this may add another 1-1.5 points on top of energy's direct 2.5 point contribution in May.

I've long thought current high inflation is largely a shelter and energy price story. I still think so.

• • •

Missing some Tweet in this thread? You can try to

force a refresh