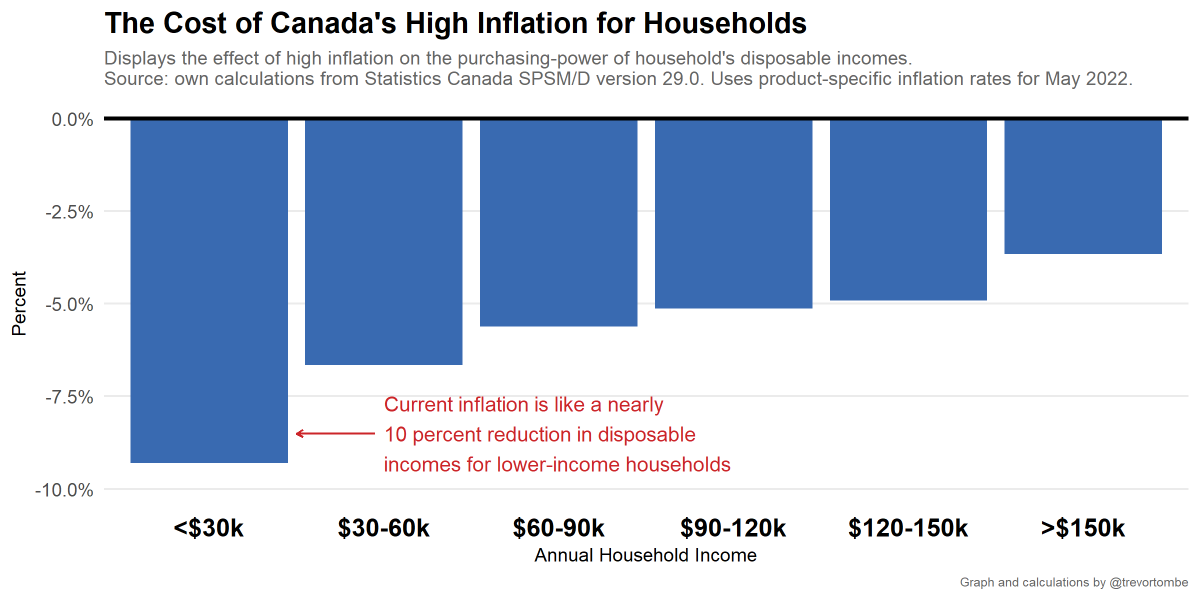

Today's high inflation is regressive. This point has been made by many, but I thought some numbers might help. 🧵 #cdnecon

I estimate the effect of price increases on household disposable incomes here 👇. The high rates for May (reported today) are like a nearly 10 percent reduction in the disposable incomes of the lowest income families. Let that sink in a moment.

This is not because lower-income households buy more items w/ big price increases. The reverse is true (owned accommodation, for example).

Here's a set of estimates of the inflation rate for different types of households based only on differences in products purchased.

Here's a set of estimates of the inflation rate for different types of households based only on differences in products purchased.

Instead, it's regressive today because the share of income saved (i.e., not buying stuff) rises with incomes. Accumulating debt (negative savings) to make ends meet also falls with income. So price increases will lower real disposable incomes more at the low end.

So when governments consider measures to support families struggling, it's especially important to target those measures appropriately.

How much income support might be required to offset the inflation hit?

How much income support might be required to offset the inflation hit?

I also estimate the dollar value of the inflation hit to households. On average, I estimate it's as though household disposable incomes have fallen nearly $400 per month! Across Canada, that's like a $6 billion total hit every month.

To insulate families earning less than 30k, they'd need a ~$200 per month transfer. Total fiscal cost: $500 million per month.

To insulate families earning less than 60k, total fiscal costs rise to $1.5B/month. And for families earning less than 90k, costs are ~$2.3B/month!

To insulate families earning less than 60k, total fiscal costs rise to $1.5B/month. And for families earning less than 90k, costs are ~$2.3B/month!

These large values make is clear it's difficult for government to fully insulate households. Partial measures are less costly, and so far what governments are doing. These estimates reveal the significant financial effect of the 7.7% inflation rate.

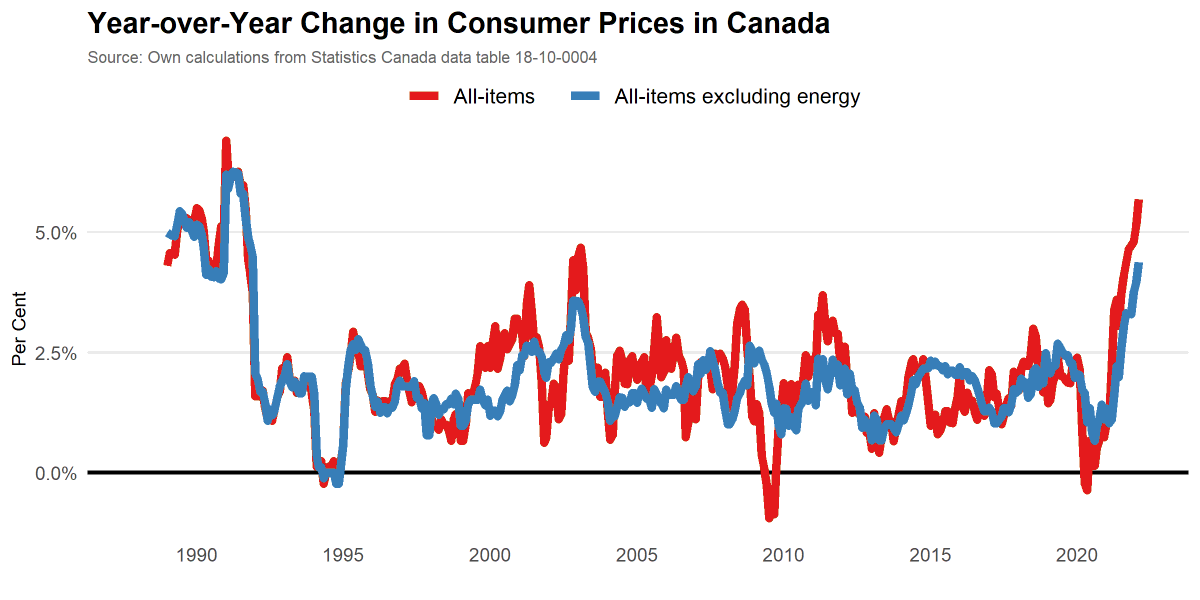

But we must not neglect that the largest driver (by far!! i can't stress this enough!!) is high energy prices. With rising oil and gas profits, the federal corporate income taxes are rising significantly.

Perhaps the feds can do a detailed accounting of the oil and gas windfall that may be in store, and redirect all of that to special targeted cash transfers. It might be a lot. I suspect (envelope math) somewhere between $500 million and $1 billion per month.

Income supports are perhaps the most direct way governments can help. Especially since much of what's behind inflation is beyond govt's (short-term) control.

Others (like @MikePMoffatt and @kevinmilligan) have some interesting ideas. But effects are small.

Others (like @MikePMoffatt and @kevinmilligan) have some interesting ideas. But effects are small.

Wonk aside: this isn't easy to estimate. But Statistics Canada not only does a great job with data collection and reporting, they also make this tax policy tool: statcan.gc.ca/en/microsimula… So I merge the CPI products with SPSD/M and simulate price changes like an excise tax.

The product categories aren't a perfect match, so I made several judgement calls. I think these results are very informative!

TL;DR: High inflation is bad, and today it's highly regressive. But there's no easy or cheap way forward for governments.

/fin

TL;DR: High inflation is bad, and today it's highly regressive. But there's no easy or cheap way forward for governments.

/fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh