1/6

There is a new stablecoin farm in #DeFi town.

Up to 26% APY on $DAI by @oasisdotapp earn.

The vault opens 50x leveraged position on DAI to provide liquidity and generate trading fees on Uniswap V3 DAI/USDC LP pools.

How does it work 🧵

There is a new stablecoin farm in #DeFi town.

Up to 26% APY on $DAI by @oasisdotapp earn.

The vault opens 50x leveraged position on DAI to provide liquidity and generate trading fees on Uniswap V3 DAI/USDC LP pools.

How does it work 🧵

2/6

Flash loan is used to borrow 50x the amount of your DAI deposit.

DAI is swapped for USDC and deposited to Uniswap V3 to generate trading fees.

The Oasis Earn is built by integrating @gelatonetwork DAI/USDC wrapped version of Uniswap V3 LP that reinvests the earned fees.

Flash loan is used to borrow 50x the amount of your DAI deposit.

DAI is swapped for USDC and deposited to Uniswap V3 to generate trading fees.

The Oasis Earn is built by integrating @gelatonetwork DAI/USDC wrapped version of Uniswap V3 LP that reinvests the earned fees.

3/6

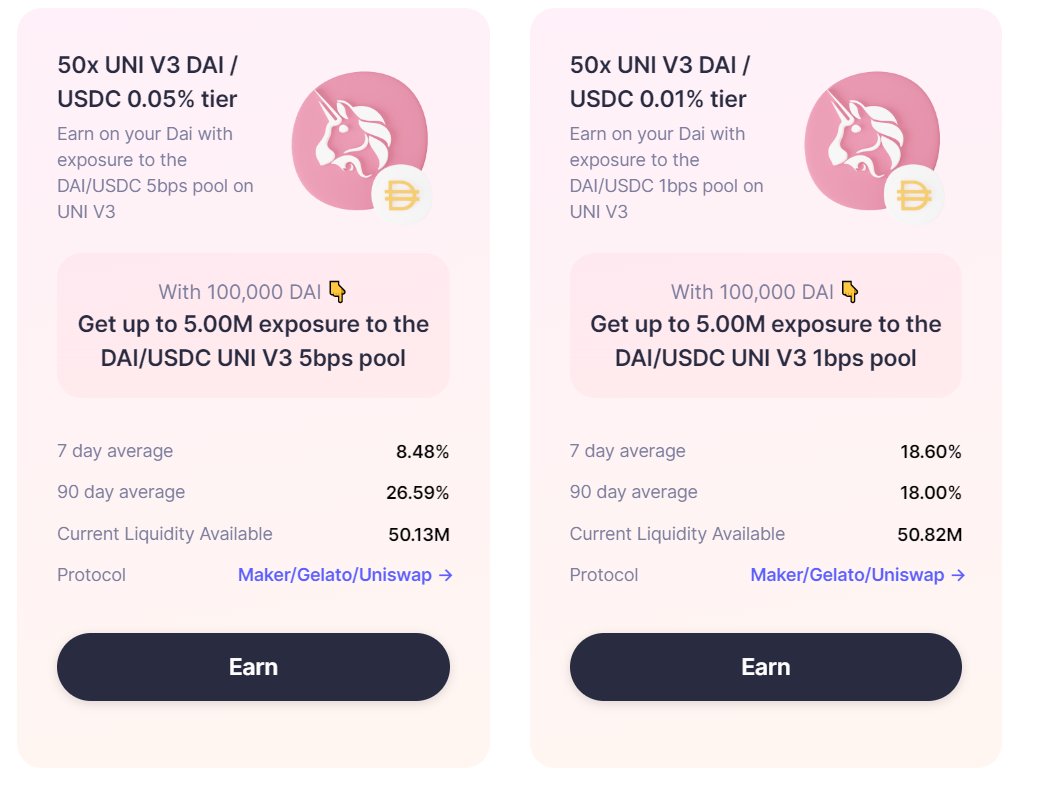

There are 2 Uni V3 pools to choose from.

1⃣ GUNIV3DAIUSDC-A that trades with a spread of 0.9994 - 1.0014 at a 0.05% fee.

2⃣ GUNIV3DAIUSDC2-A represents a Uniswap V3 position with a spread of 0.9998 - 1.0002 at a 0.01% fee

Which one is better? No clear winner for now.

There are 2 Uni V3 pools to choose from.

1⃣ GUNIV3DAIUSDC-A that trades with a spread of 0.9994 - 1.0014 at a 0.05% fee.

2⃣ GUNIV3DAIUSDC2-A represents a Uniswap V3 position with a spread of 0.9998 - 1.0002 at a 0.01% fee

Which one is better? No clear winner for now.

4/6

Borrowing Dai requires to pay a Stability fee which is 0.05%.

At 50x leverage, the Stability fee is 25% so the vault needs to generate more than 25% in trading fees to compensate for the borrowing costs.

Higher trading fees -> higher APY.

Borrowing Dai requires to pay a Stability fee which is 0.05%.

At 50x leverage, the Stability fee is 25% so the vault needs to generate more than 25% in trading fees to compensate for the borrowing costs.

Higher trading fees -> higher APY.

5/6

Leveraging up to 50x also means that there's a risk of liquidation.

If Dai price dumps by ~2%, the vault should be liquidated and LPs suffer a liquidation penalty.

To liquidate a undercollateralized position without risking the entire system min. deposit amount is 15k DAI.

Leveraging up to 50x also means that there's a risk of liquidation.

If Dai price dumps by ~2%, the vault should be liquidated and LPs suffer a liquidation penalty.

To liquidate a undercollateralized position without risking the entire system min. deposit amount is 15k DAI.

Correction: the stability fee is 0% for GUNIV3DAIUSDC-A that trades with a spread of 0.9994 - 1.0014 at a 0.05% fee.

• • •

Missing some Tweet in this thread? You can try to

force a refresh