My take on #Relaxo Footwears (966/-) through data and charts.

Analysis from FY96 – FY22

Sales grew at ~16%

EBITDA ~18%

NP ~17.5% (~19% till FY21)

4-5% improvement in EBITDA / EBIT / Net Profit Margins on a rolling 10 yr ending FY22 over FY06

@dmuthuk @contrarianEPS

1/N

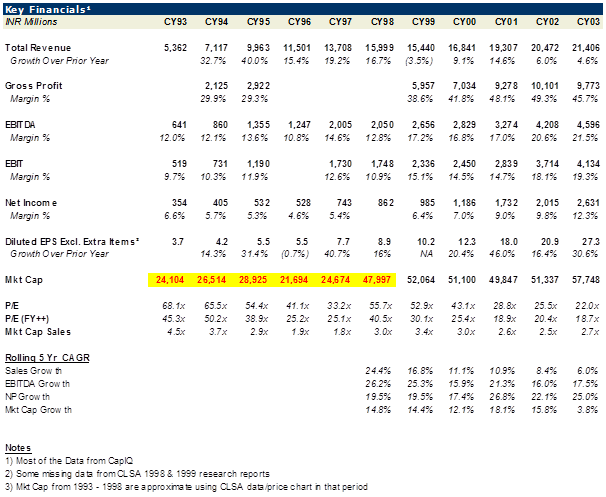

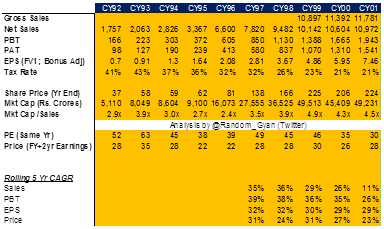

Analysis from FY96 – FY22

Sales grew at ~16%

EBITDA ~18%

NP ~17.5% (~19% till FY21)

4-5% improvement in EBITDA / EBIT / Net Profit Margins on a rolling 10 yr ending FY22 over FY06

@dmuthuk @contrarianEPS

1/N

2/N

Data from @screener_in

4-5% improvement in EBITDA flowing through led to doubling of Net Profits Margins from ~4% to ~8%. Future 4-5% improvements will only improve Net Profit Margins by 50%

Data from @screener_in

4-5% improvement in EBITDA flowing through led to doubling of Net Profits Margins from ~4% to ~8%. Future 4-5% improvements will only improve Net Profit Margins by 50%

3/N

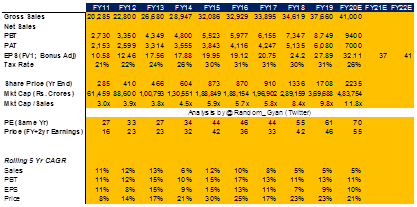

While co. performance is very impressive , the stock price has run up way ahead of fundamentals to reach absurdly expensive levels

Charts for P/S , EV/ EBITDA , PE

At ~10x Sales it is significantly more expensive than most tech co. in the US.

While co. performance is very impressive , the stock price has run up way ahead of fundamentals to reach absurdly expensive levels

Charts for P/S , EV/ EBITDA , PE

At ~10x Sales it is significantly more expensive than most tech co. in the US.

4/N

Looking at the 20 Yr log chart. That's 30% CAGR line!! for a co. growing at 15-18% p.a. I wouldn't be surprised if it falls another 50% to 425-450 levels in next 12-18 months. It would still be trading >30x PE

Looking at the 20 Yr log chart. That's 30% CAGR line!! for a co. growing at 15-18% p.a. I wouldn't be surprised if it falls another 50% to 425-450 levels in next 12-18 months. It would still be trading >30x PE

5/N

Crystal ball gazing upto FY40. Continue to assume improvement in EBITDA

Even for ultra long term investor the risk reward is unattractive. Its very likely that #Relaxo will struggle to give double digit returns this decade.

Don't hold any MF which holds this at this price!

Crystal ball gazing upto FY40. Continue to assume improvement in EBITDA

Even for ultra long term investor the risk reward is unattractive. Its very likely that #Relaxo will struggle to give double digit returns this decade.

Don't hold any MF which holds this at this price!

• • •

Missing some Tweet in this thread? You can try to

force a refresh