Problem: Underserved founders have limited access to capital

Solution: Create more investors 💰 with different approaches to venture investing

🧵👇

Solution: Create more investors 💰 with different approaches to venture investing

🧵👇

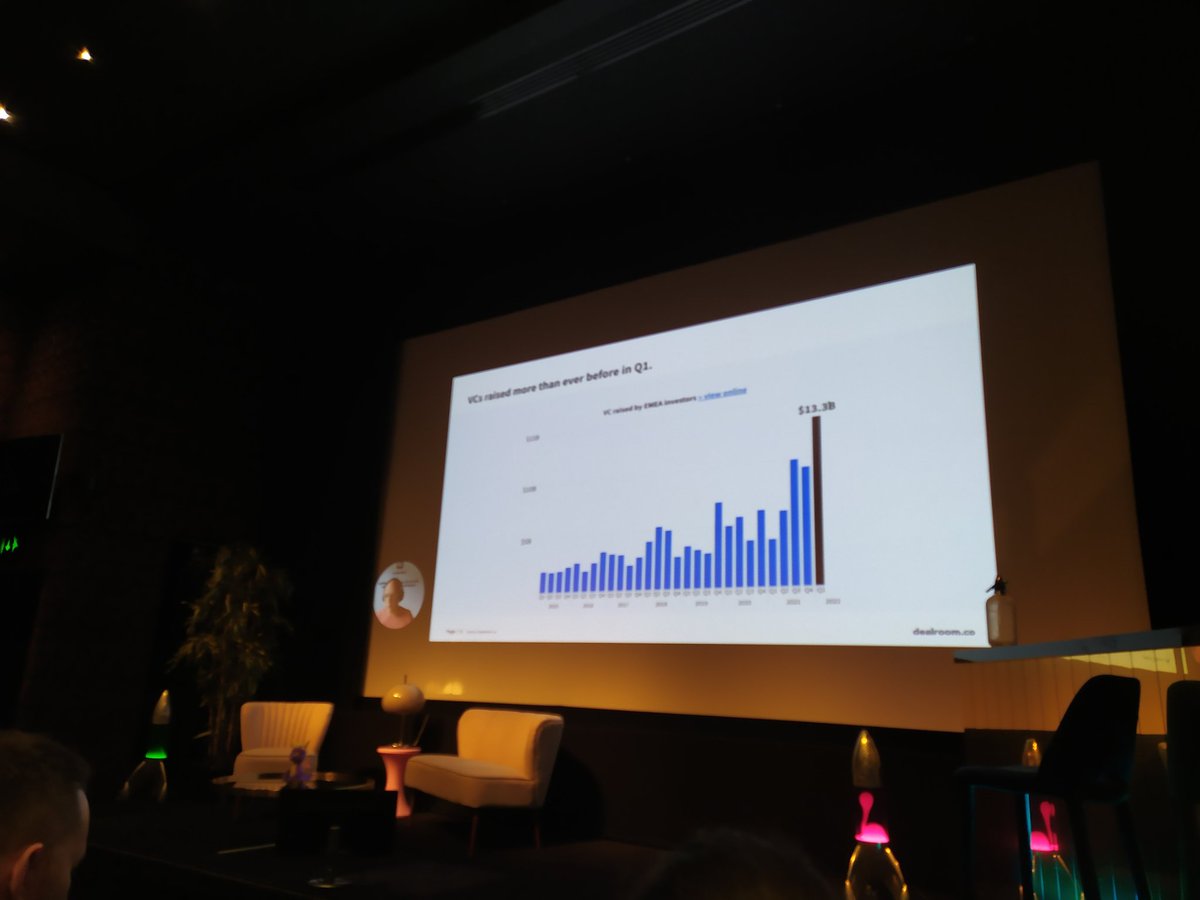

There are now more and more syndicates and platforms for angel investors and even micro-angels both in the US and Europe that can help you invest in emerging VC funds (normally small and top performing) with as little as 1k (sometimes less)

Give a ❤️ or comment along if you want to learn more. Gauging level of interest. I'm happy to DM you some of my favourites :)

#investing #investment #angelinvestor #venturecapital

#investing #investment #angelinvestor #venturecapital

• • •

Missing some Tweet in this thread? You can try to

force a refresh