RECESSION INCOMING?

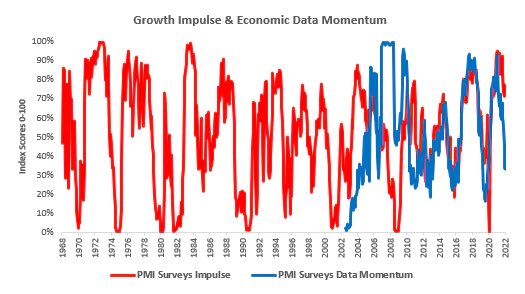

1/3 It is highly likely we are headed towards a recession. Arguably, we are already in one. Our economic data tracking places us at approximately 0.7% Real GDP growth versus a year ago. PCE data will confirm or deny whether we are currently in a recession:

1/3 It is highly likely we are headed towards a recession. Arguably, we are already in one. Our economic data tracking places us at approximately 0.7% Real GDP growth versus a year ago. PCE data will confirm or deny whether we are currently in a recession:

2/3 The US economy is prototypically consumer-dominated, with 69% of GDP coming from consumer spending alone. Currently the consumer remains well supported by nominal wages + employment, as shown below. However, as cyclical components of the economy slow, these are like to drag:

3/3 During late-cycle, with interest rates rising to keep up with inflation, household spending on items that require borrowing (autos & housing mainly) tends to weaken significantly as prospects for the economy begin to decline. We aggregate these components to forecast GDP:

@42macroDDale @michaellebowitz @Techs_Global @globalvaluefund @Credit_Junk @macro_daily @options_insight @PumpamentalsCAP @kylascan @MacroAlf @lukaskuemmerle

Overall, it remains highly likely that we’re headed for a recession, with markets already having discounted significant slowing of real economic growth. Let us help you navigate these turbulent times. #Read and #Subscribe:

prometheusresearch.substack.com/p/the-observat…

prometheusresearch.substack.com/p/the-observat…

• • •

Missing some Tweet in this thread? You can try to

force a refresh