#CBDC wonks:

There are two main reasons why your monetary pipe dream of a panopticon won’t materialize anytime soon, if ever.

Short 🧵

There are two main reasons why your monetary pipe dream of a panopticon won’t materialize anytime soon, if ever.

Short 🧵

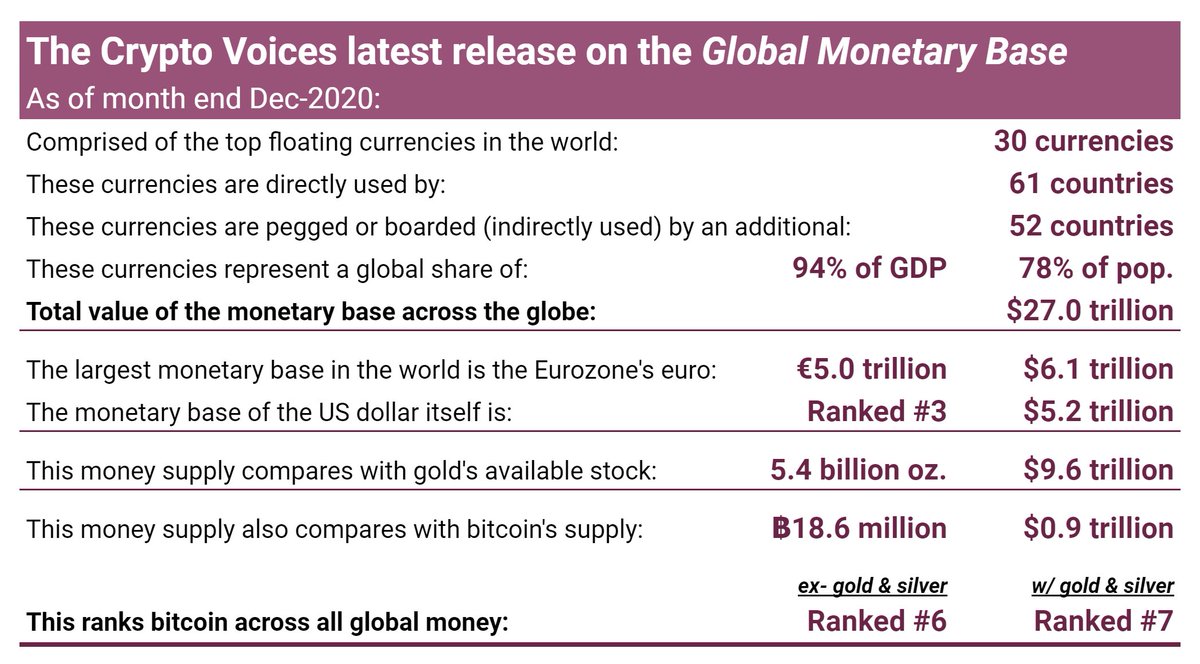

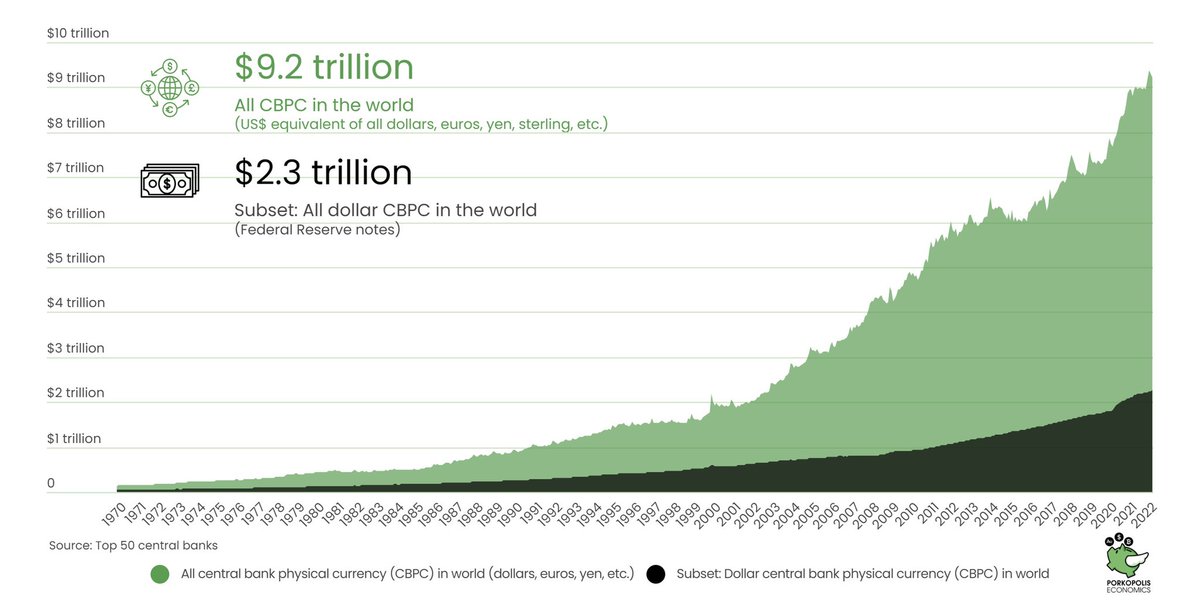

Firstly, the reigning “retail” tool of the central bank—physical banknotes—are more prevalent than you can imagine, vital to low income trade, and issuance grows much faster than global population.

CBDCs cannot compete with this trend: $9.2 trillion equivalent, and flying…

CBDCs cannot compete with this trend: $9.2 trillion equivalent, and flying…

There’s nowhere else to look to find the CBDC “addressable market.” This is that. Right here.

This is the global stock of all central bank physical currency (CBPC 😱) in the world.

CBDCs must complement—compete—with their own CBPC stock to be any kind “meaningful.”

This is the global stock of all central bank physical currency (CBPC 😱) in the world.

CBDCs must complement—compete—with their own CBPC stock to be any kind “meaningful.”

The CBPC stock has compounded at a globally weighted average of 10.4% per year since 1970.

Put another way, the stock of global physical cash _doubles_ every 7 years.

How easy do you think it will be to stop this trend?

Put another way, the stock of global physical cash _doubles_ every 7 years.

How easy do you think it will be to stop this trend?

Global population has compounded at 1.5% per year since 1970.

That’s a doubling every 47 years.

The global CBPC stock, on the other hand, doubles every 7 years.

How easy do you think it will be to stop this trend?

That’s a doubling every 47 years.

The global CBPC stock, on the other hand, doubles every 7 years.

How easy do you think it will be to stop this trend?

It’s already been tried. By a big player. In 2016, the Reserve Bank of India 🇮🇳 demonetised its 500 and 1000 rupee notes.

Stated reasons:

“Black money”

“Greater financial inclusion”

“Incentivize greater digitization”

Does it look like they kept the paper currency supply “down?”

Stated reasons:

“Black money”

“Greater financial inclusion”

“Incentivize greater digitization”

Does it look like they kept the paper currency supply “down?”

The rupee CBPC supply is now 3.3x higher than its nadir in December 2016, after demonetization.

It’s 1.8x higher than its peak in October 2016, before demonetization.

Overall since 2001, the rupee CBPC compounded at 14.1% per year.

That means it _doubled_ every 5.2 years.

It’s 1.8x higher than its peak in October 2016, before demonetization.

Overall since 2001, the rupee CBPC compounded at 14.1% per year.

That means it _doubled_ every 5.2 years.

India’s population compounded at 1.5% per year since 2001.

Its physical cash supply compounded at 14.1% per year since 2001.

How easy will it be to stop this trend?

Its physical cash supply compounded at 14.1% per year since 2001.

How easy will it be to stop this trend?

And to what end?

People actually died trying to change over cash in 2016. Political opponents claimed 100 ppl.

Employed persons were millions lower or stagnated at least until 2019.

To what end?

The rupee CBPC stock is _up_ 3.3x since Dec-2016.

People actually died trying to change over cash in 2016. Political opponents claimed 100 ppl.

Employed persons were millions lower or stagnated at least until 2019.

To what end?

The rupee CBPC stock is _up_ 3.3x since Dec-2016.

So that’s the first reason. Factually, CBPC > CBDC, and by far.

CBPC is flying. It’s printing up way more than you realize, way more than *you’re reproducing,* and by far.

The first reason CBDCs won’t work actually leads us to the second…

CBPC is flying. It’s printing up way more than you realize, way more than *you’re reproducing,* and by far.

The first reason CBDCs won’t work actually leads us to the second…

We’ve established that CBPCs > CBDCs, by far.

CBDCs are still mostly in theoretical, prototype mode, and even if they launch, they ain’t “stealing” market share from CBPCs.

So where could CBDCs “steal” market share?

CBDCs are still mostly in theoretical, prototype mode, and even if they launch, they ain’t “stealing” market share from CBPCs.

So where could CBDCs “steal” market share?

The banks.

And this won’t work, simply because:

CBDCs…

Make…

Banks…

Less…

Profitable.

#CMBLP

This is not a secret. It is already recognized in hundreds of papers. Here’s a latest one: federalreserve.gov/econres/feds/f…

And this won’t work, simply because:

CBDCs…

Make…

Banks…

Less…

Profitable.

#CMBLP

This is not a secret. It is already recognized in hundreds of papers. Here’s a latest one: federalreserve.gov/econres/feds/f…

Quote: “As rates on deposits increase because of competition with a retail CBDC, either banks’ profitability would decrease or, alternatively, to maintain profit margins, banks could raise lending rates.”

The 2nd part isn’t natural; it’s caused by the 1st, monopolized action.

The 2nd part isn’t natural; it’s caused by the 1st, monopolized action.

CBDC stock goes up ⬆️

CBPC stock unaffected ↔️

It *must* follow then, that retail deposits withdrawn from banks ⬇️

Banks have less funds to loan ⬇️

Banks earn less interest ⬇️

Every central bank knows this. Which is why they aren’t rushing in.

It’s… all… hype. 😱

CBPC stock unaffected ↔️

It *must* follow then, that retail deposits withdrawn from banks ⬇️

Banks have less funds to loan ⬇️

Banks earn less interest ⬇️

Every central bank knows this. Which is why they aren’t rushing in.

It’s… all… hype. 😱

Oh, and they’re:

—Not immutable;

—Not “blockchains;”

—Not private;

—Gonna be hacked on many levels;

—Socialist: further top-down monopolizations of a banking system that would work fine if the government got out of the way.

But, overall:

1) #CBPC > #CBDC

2) #CMBLP

—Not immutable;

—Not “blockchains;”

—Not private;

—Gonna be hacked on many levels;

—Socialist: further top-down monopolizations of a banking system that would work fine if the government got out of the way.

But, overall:

1) #CBPC > #CBDC

2) #CMBLP

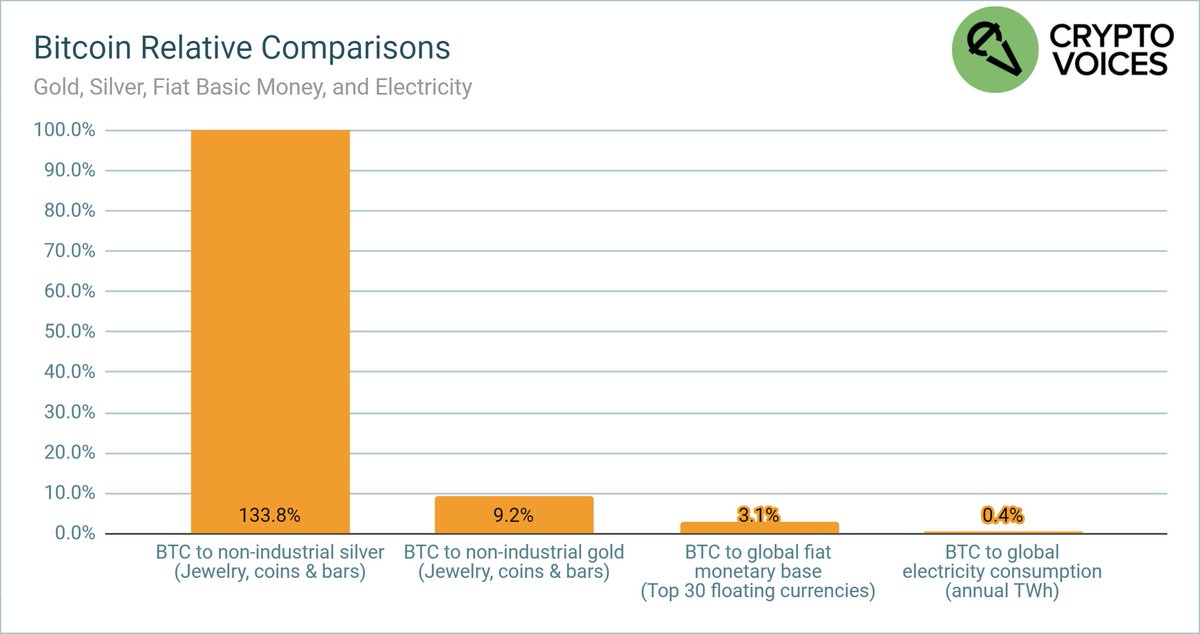

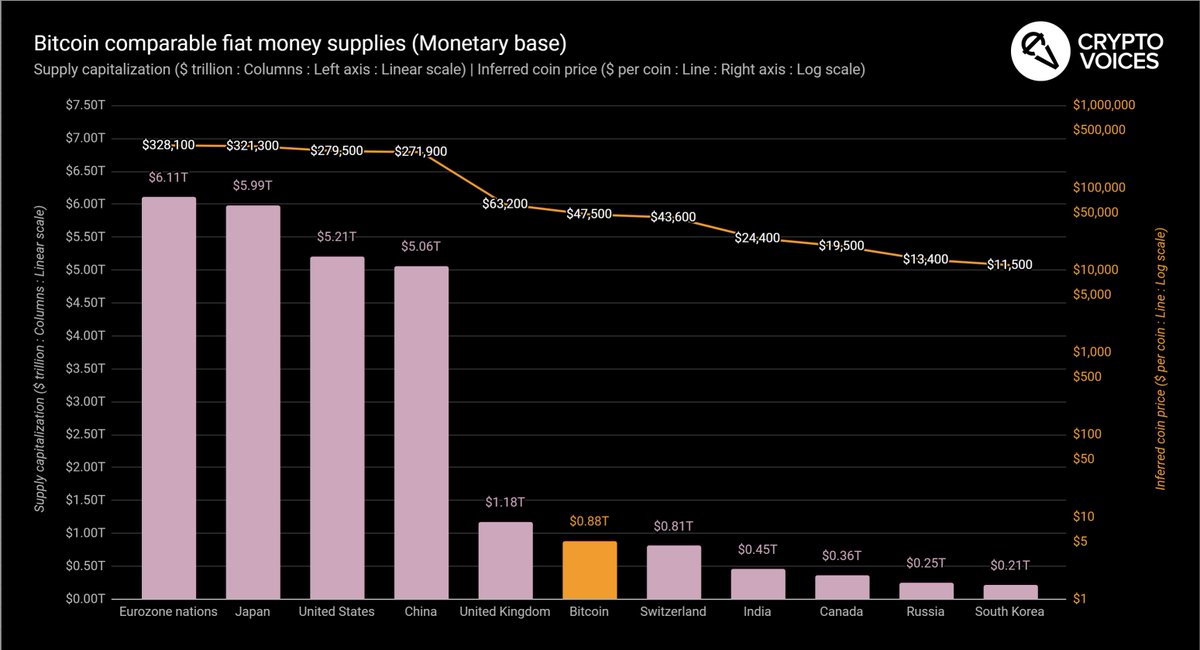

If you actually want a free, open, transparent, permissionless and immutable base money—that’s digital 😱—just buy #Bitcoin.

Otherwise, use 💵.

Otherwise, use 💵.

• • •

Missing some Tweet in this thread? You can try to

force a refresh