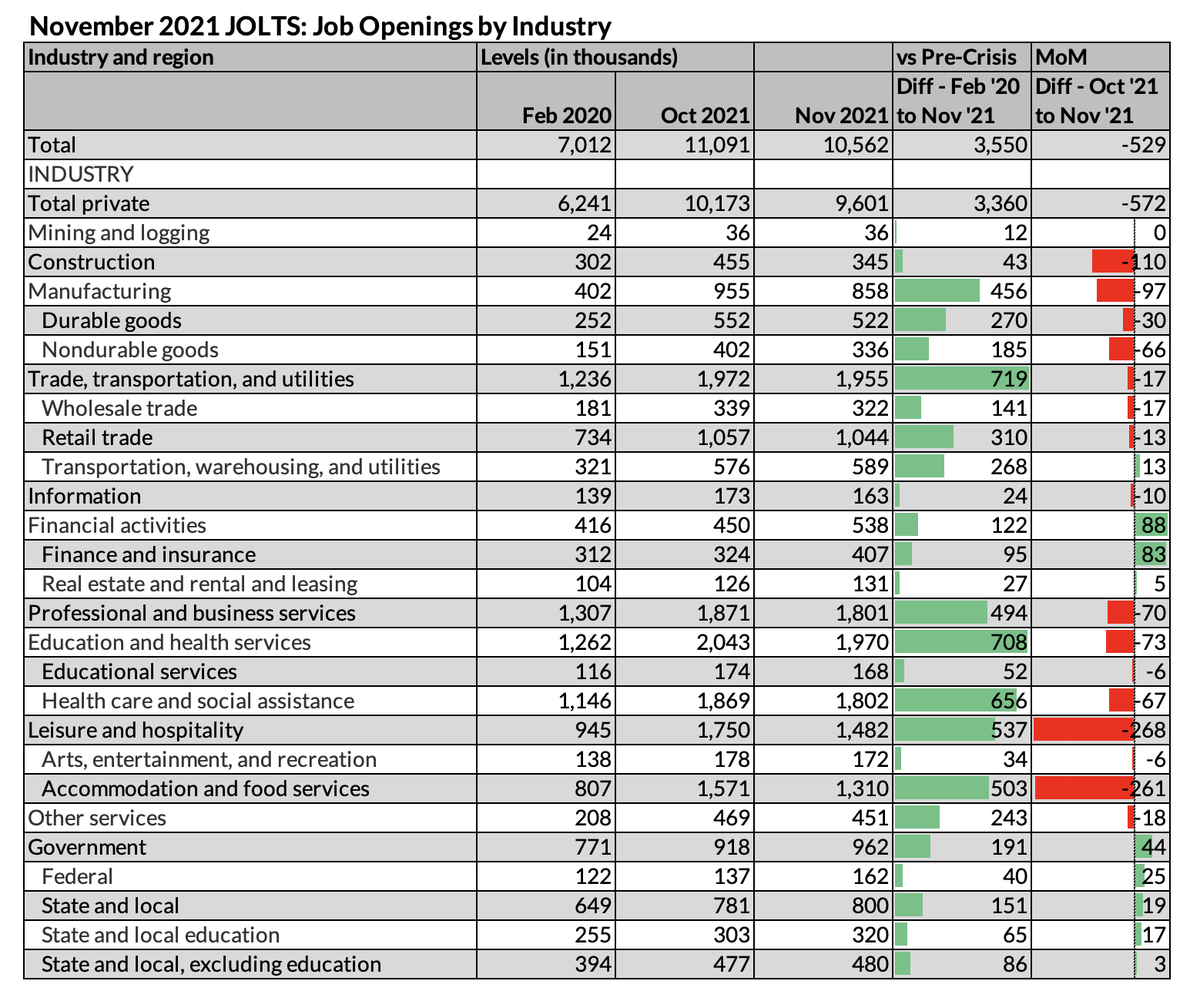

U.S. job openings dropped to 11.3 million in May, showing signs of cooling even though demand still remains well above pre-recession levels. Even if the job market is cooling from white hot to red hot, it's still hot.

#JOLTS 1/

#JOLTS 1/

The drop in job openings was primarily driven by professional & business services (-325,000) and #manufacturing (-208,000). Prof & biz services openings dropped 14% MoM as hiring freezes crimped demand & pushed it back to late-2021 levels.

#JOLTS 2/

#JOLTS 2/

Manufacturing job openings dropped by 208,000 or 20% MoM in May, though labor demand in manufacturing has been more volatile, so May is still roughly consistent with levels we've seen for much of 2021–2022.

#JOLTS 3/

#JOLTS 3/

The increase in #retail job openings (+104,000) in May is also not really consistent w/ stories of rotating demand from goods to services. Leisure & hospitality (+73,000) also saw an increase in job openings, suggesting consumer spending remains strong.

#JOLTS 4/

#JOLTS 4/

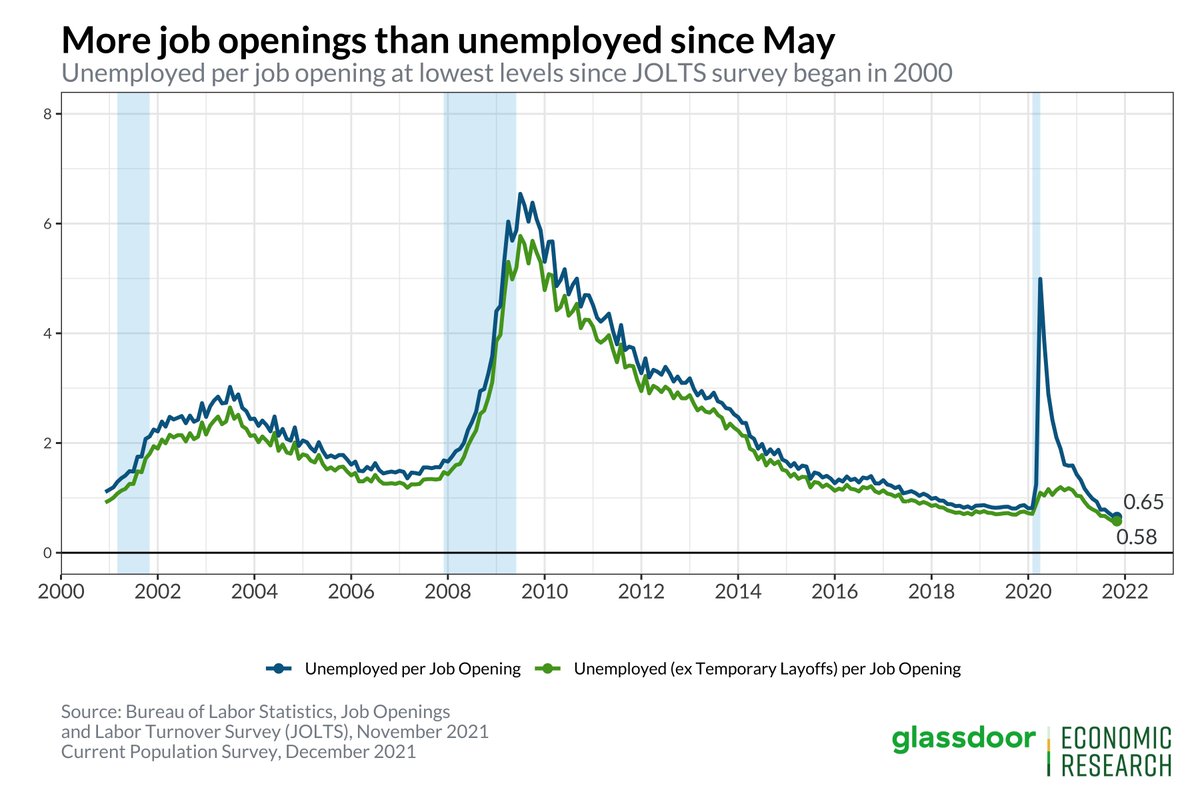

Chair Powell's oft-cited unemployed-vacancy ratio ticked up in May, rising to 0.529 from its low of 0.502 in March, as unemployment stayed level but openings began to cool.

Flipped, that's about ~1.9 job openings per unemployed worker down from ~2.0.

#JOLTS 5/

Flipped, that's about ~1.9 job openings per unemployed worker down from ~2.0.

#JOLTS 5/

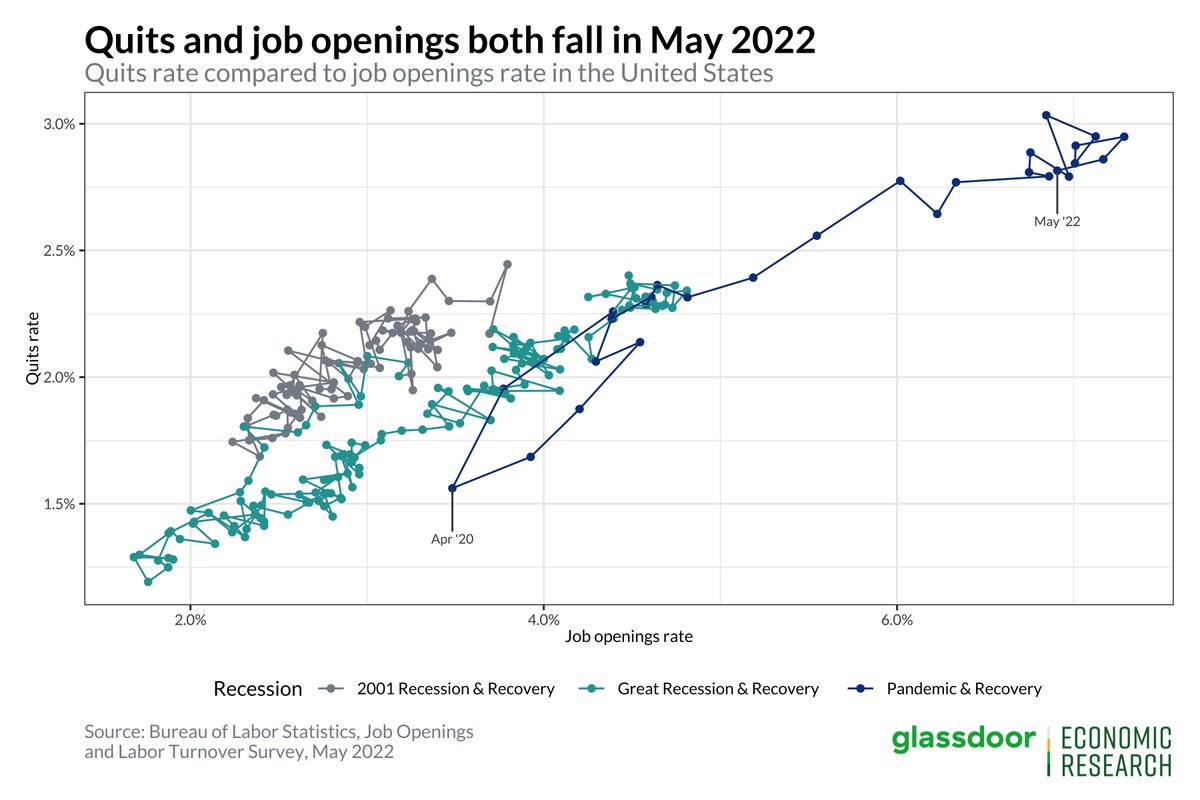

Quits cooled as well in May, falling to 4.27 million. Though like job openings, quits are still not far from record highs. Quits rose the most in leisure & hospitality (+54,000) and fell the most in financial activities (-55,000).

#JOLTS 6/

#JOLTS 6/

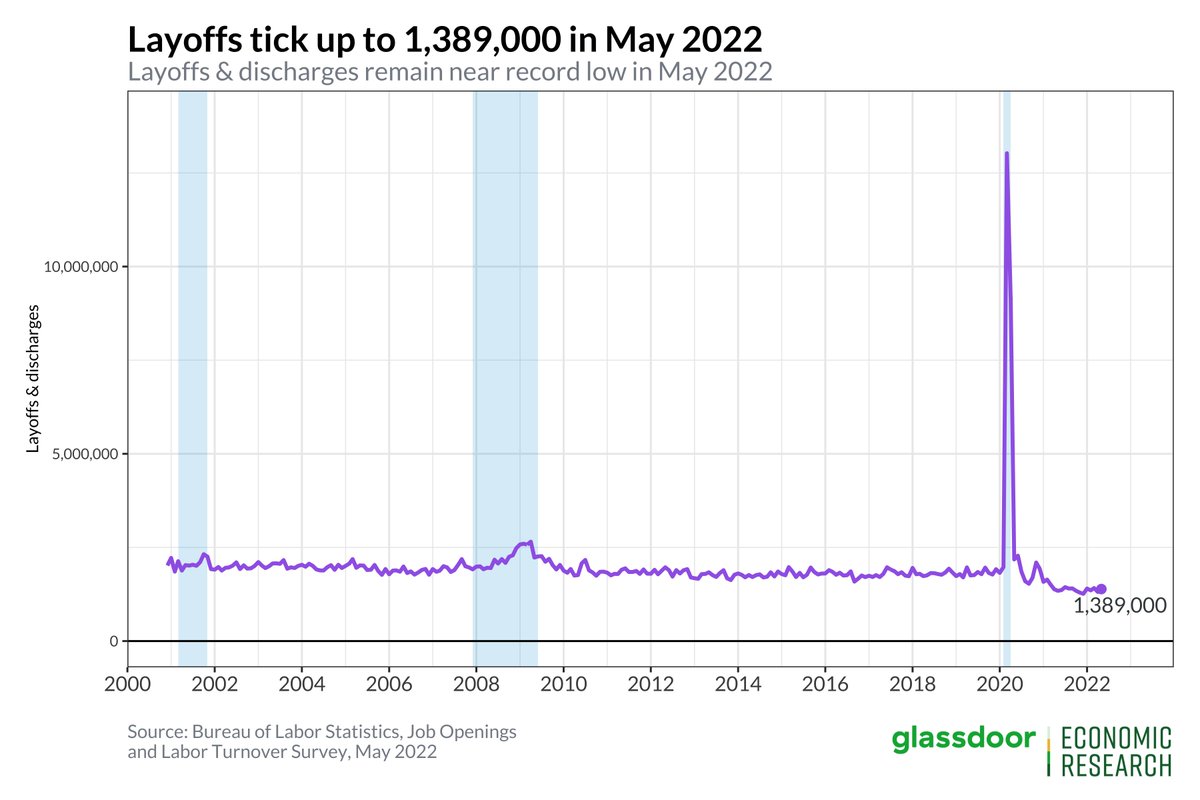

Layoffs & discharges ticked up in May, but remain near record lows. Layoffs didn't increase much in information (+1,000), financial activities (+10,000), professional & business services (+6,000)—all sectors where we've heard prominent stories of layoffs recently.

#JOLTS 7/

#JOLTS 7/

Quits & openings both fell in May, though they stayed firmly elevated. May is solidly in the cluster of dots in the top-right of the graph below, indicating the Great Resignation is still going on even as the labor market begins to cool.

#JOLTS 8/

#JOLTS 8/

All-in-all, the #JOLTS report indicates the labor market was still hot at the end of May. Recession fears did pick up in June, so it remains to be seen how labor demand holds up, but overall a positive sign for solid job gains in Fri's #jobsreport.

9/9

9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh