I was stopped out on my $BTC trade. I want to emphasize the importance of proper risk management and secure entries.

I hope my mistake can help you all in your trading journey. I will try to avoid recurrence of the same error.

Open thread.

I hope my mistake can help you all in your trading journey. I will try to avoid recurrence of the same error.

Open thread.

I always start my trades with a checklist of quality traits to determine whether it is worth to take them.

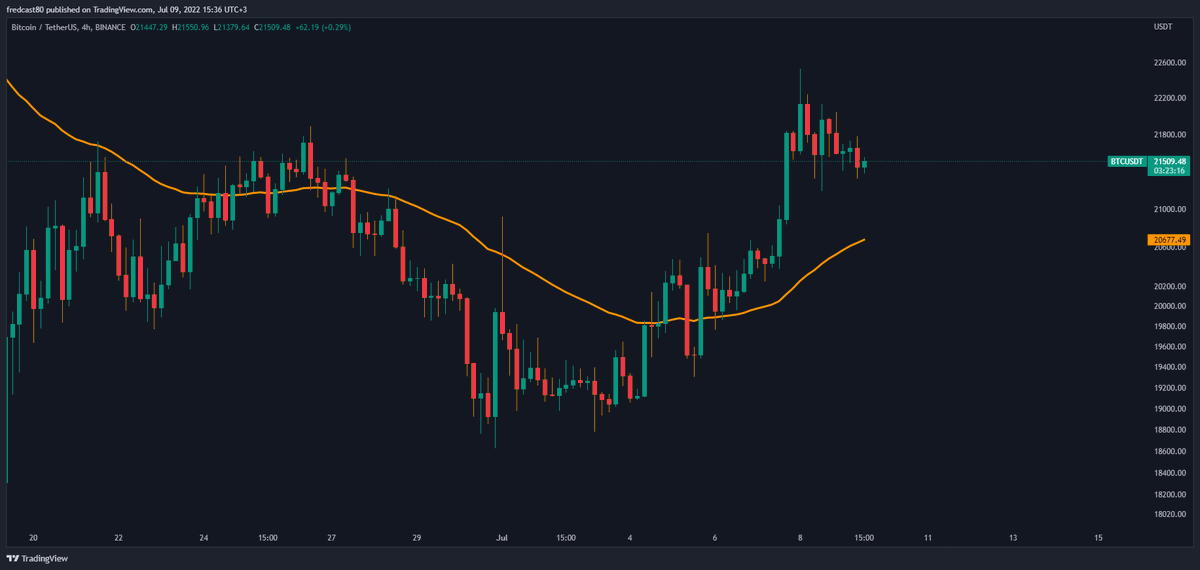

1. Time confluence: $BTC is above 50EMA in 4H and 1H, which indicates bullishness in Intraday✅

1. Time confluence: $BTC is above 50EMA in 4H and 1H, which indicates bullishness in Intraday✅

2. $BTC was just hitting a key level of support at the moment of identification of the trade (indicated in yellow). ✅

3. Trend direction: $BTC was making higher highs and higher lows which indicates Bullishness. ✅

4. Bullish Momentum: $BTC showed a bullish momentum candle which broke out a key level and old resistance became support. ✅

4. Bullish Momentum: $BTC showed a bullish momentum candle which broke out a key level and old resistance became support. ✅

5. Fib Level: $BTC was in a key Fib level, 50% retracement from the previous swing low the most recent swing high.

Going now to the timeframe of trading: 30min

6. A symmetrical triangle was found with the lower line being the most recent support.

7. A second trendline was found that should act as a stronger support.

6. A symmetrical triangle was found with the lower line being the most recent support.

7. A second trendline was found that should act as a stronger support.

8. Trade Setup: Breakout of the symmetrical triangle ✅

Everything is setup, I'm just waiting the breakout of the symmetrical triangle since I established that I'm going long as per all the described before.

Everything is setup, I'm just waiting the breakout of the symmetrical triangle since I established that I'm going long as per all the described before.

9. Entry: This was the hardest part for me since there are 3 ways to enter (depending on the risk tolerance).

- Enter at breakout, at the closing of the first candle (timeframe can be 15min)

- After the breakout, enter at the retest (it can be at Fib 50% i.e.) --> I took it.

- Enter at breakout, at the closing of the first candle (timeframe can be 15min)

- After the breakout, enter at the retest (it can be at Fib 50% i.e.) --> I took it.

- The safer entry: draw a line for the first impulse, retracement and then second impulse. Enter in the second impulse. Timeframe can be 15min or for riskier trades 5min.

After taking the trade, probably 10min later, a massive red candle wiped out most of the long traders SL (including mine).

Now the important lessons:

- The volume on weekends is low, thus the whales can manipulate easily, triggering SL and liquidating leverage traders.

- Always enter in the second impulse (even at expenses of less profits). Fake out chance is minimized.

#Crypto #btc #cryptotrading

- The volume on weekends is low, thus the whales can manipulate easily, triggering SL and liquidating leverage traders.

- Always enter in the second impulse (even at expenses of less profits). Fake out chance is minimized.

#Crypto #btc #cryptotrading

• • •

Missing some Tweet in this thread? You can try to

force a refresh