1/ Want to improve your investment strategy??⚡ There are 100's of indicators yet not 1 accurately predicts the future. Fundamentals are like a camera's sensor 📷 & technicals are the lens.👓 Together these elements help build a clearer picture! 🖼️ @ElrondNetwork #buidl #EGLD

2/ Analysis begins with defining timeframe: the timeframe dictates which data an analyst finds important. You can choose candles representing 1 second, 1 year & everything in-between. Larger (longer) candles capture more data & therefore represent a truer image of the average. 🧠

3/ Define your investing goals & objectives! Doing so will help U learn which timeframe suits you. Start simple & write them out. A goal = an achievable outcome that's generally broad & longer term while objectives = shorter term & define measurable actions to achieve the goal.

4/ Try using the S.M.A.R.T. format to help define these goals/objectives!

When I started investing I failed to have defined goals. 😖 I wanted to be in control of my success & I wanted it fast! I tried day-trading for a few months which ended up helping me establish my goals!

When I started investing I failed to have defined goals. 😖 I wanted to be in control of my success & I wanted it fast! I tried day-trading for a few months which ended up helping me establish my goals!

5/ From day-trading I discovered some objectives like spending less than 60-minutes looking at charts per day and making less than 10 trades per week. As I improved my trading according to these guidelines, objectives helped build my goals which helped define my timeline! 💯🤝

6/ Charts are sentiment: a view of or attitude toward a situation or event. Sentiment is just an opinion, so timing the market = timing emotional swings. At school I learned everyone has tight emotional ties to their money. This multiplies the unexpectedness of market swings! 🎭

7/ Because my objectives were defined to limit screen time and number of trades per week, when I add to the picture that element of trying to time market sentiment - emotional swings - it became clear that my long-term goal is simply to capture the average. 💯

8/ The long-term goal directs the short-term objectives!📢🎬 There will always be emotional swings high AND low, but by capturing the average you increase the probability that over time you will in fact capture below-average entries in your investment positions.

9/ #Retweet if this post helped build your investment goals, objectives or strategy! 🧠💪

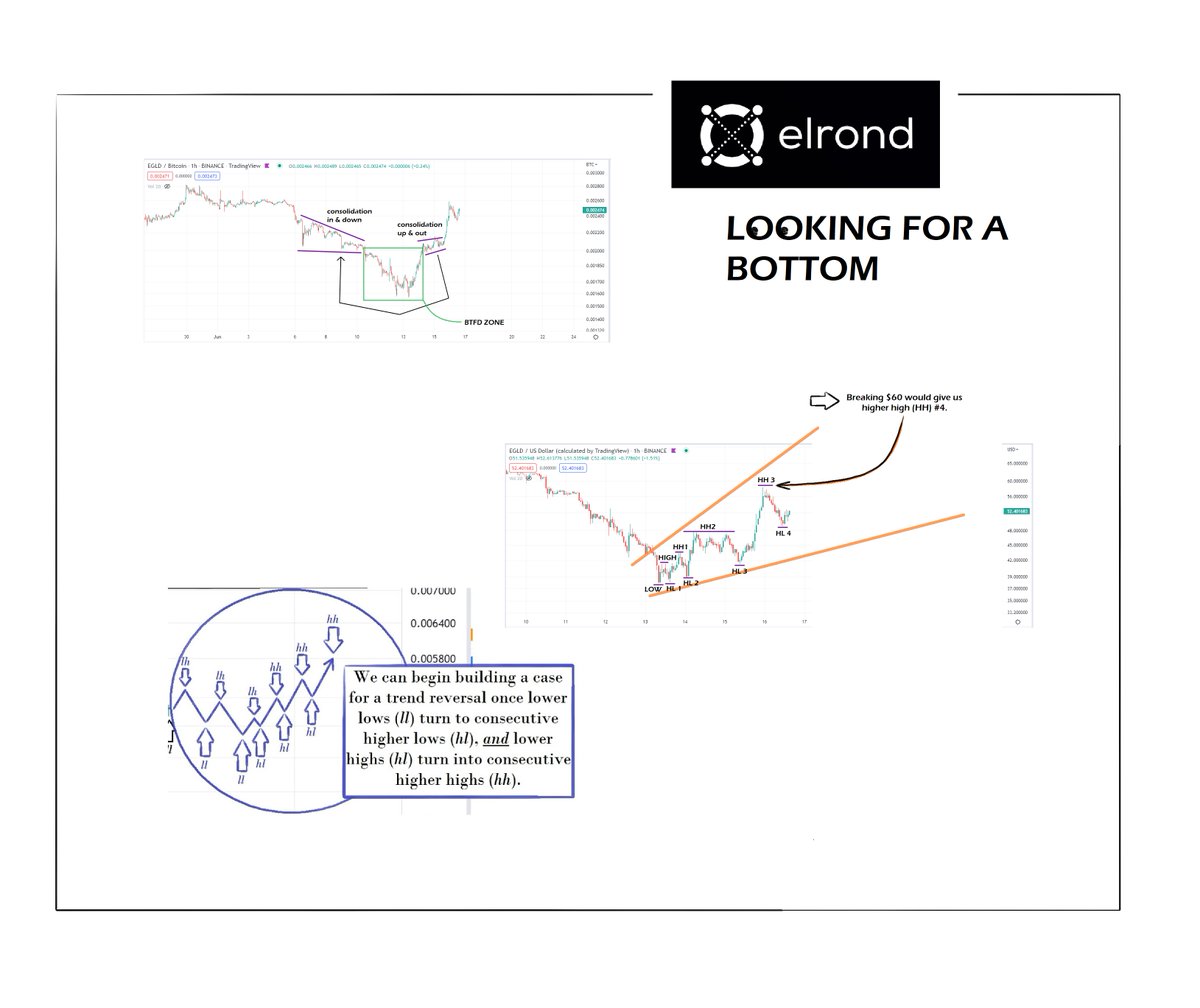

My timeline = long-term, "capture the average", so I place higher significance on larger timeframes like daily & weekly! Consider the big picture to increase probability of buying lows! 🙌

My timeline = long-term, "capture the average", so I place higher significance on larger timeframes like daily & weekly! Consider the big picture to increase probability of buying lows! 🙌

• • •

Missing some Tweet in this thread? You can try to

force a refresh