We are short $Sinch, a swedish telecommunications company. In our opinion, the company misstated its financial statements by billions, read the full report:

ningiresearch.com/2022/07/11/res…

ningiresearch.com/2022/07/11/res…

As a tech company #Sinch expensed ZERO R&D costs in 2021. All while #Twilio expensed 28% of revenue in the same time, #Sinch self proclaims being profitable for years while growing its business, read the full report: ningiresearch.com/2022/07/11/res…

At first glance, we found material misstatements of net profit and EBIT within #Sinch financial statements. Profit is misstated by SEK 34m and EBIT by SEK 22m, read the full report: ningiresearch.com/2022/07/11/res…

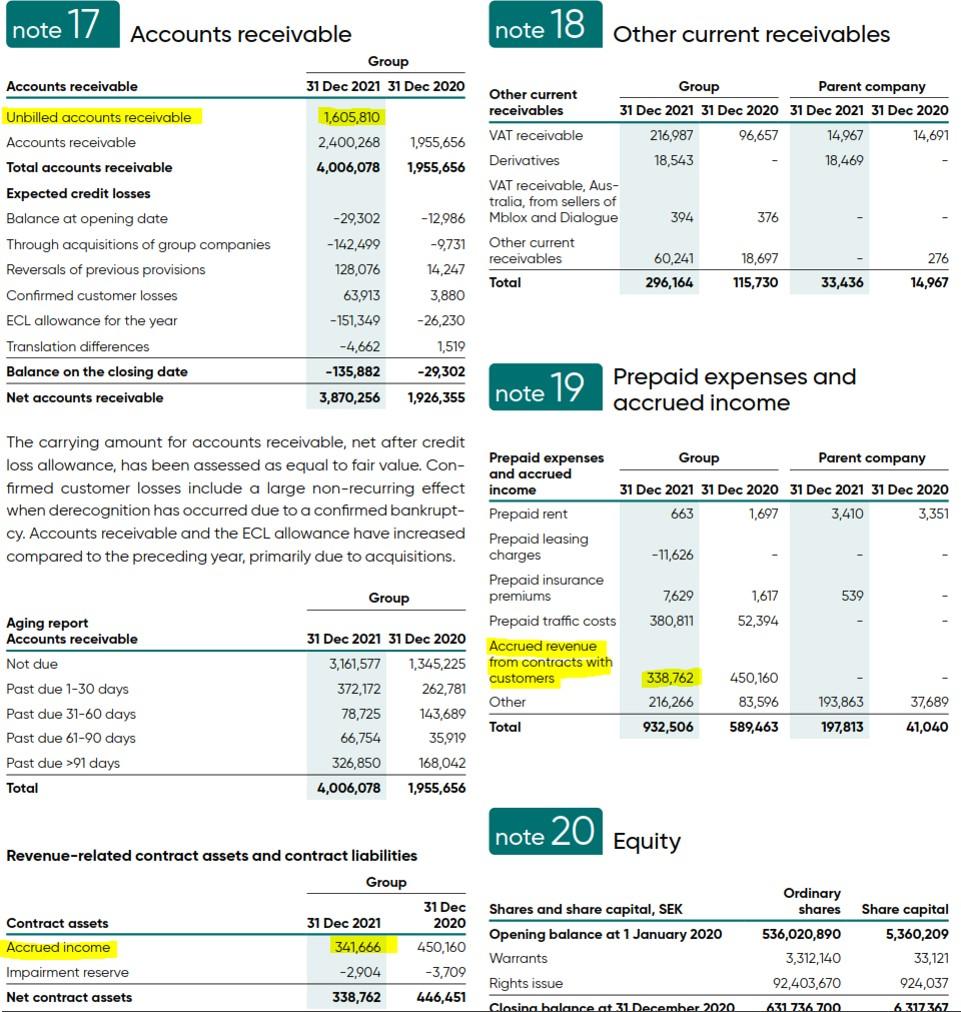

On page 106 of its 2021 report #Sinch used three different synonyms and reported three different figures for the same line item. Unbilled accounts receivable, accrued income and accrued revenue are all the same, so what’s true? Read the full report: ningiresearch.com/2022/07/11/res…

$SINCH.ST booked accrued revenue as accounts receivables to conceal the accrued revenue‘s significant growth in the last years. #Sinch also misstated several line items by #billions, read the full report: ningiresearch.com/2022/07/11/res…

Reconciliation of line items based on #Sinch financials was not possible. There is SEK 7m #missing where it should not be. In our opinion because Sinch booked accrued revenue as accounts receivable, read the full report: ningiresearch.com/2022/07/11/res…

Simple reconciliation of #Sinch balance sheet based on its financials wasn’t possible either. Because $SINCH concealed its growing accrued #revenue there is a significant #mismatch between accounts receivables and other current receivables, read report: ningiresearch.com/2022/07/11/res…

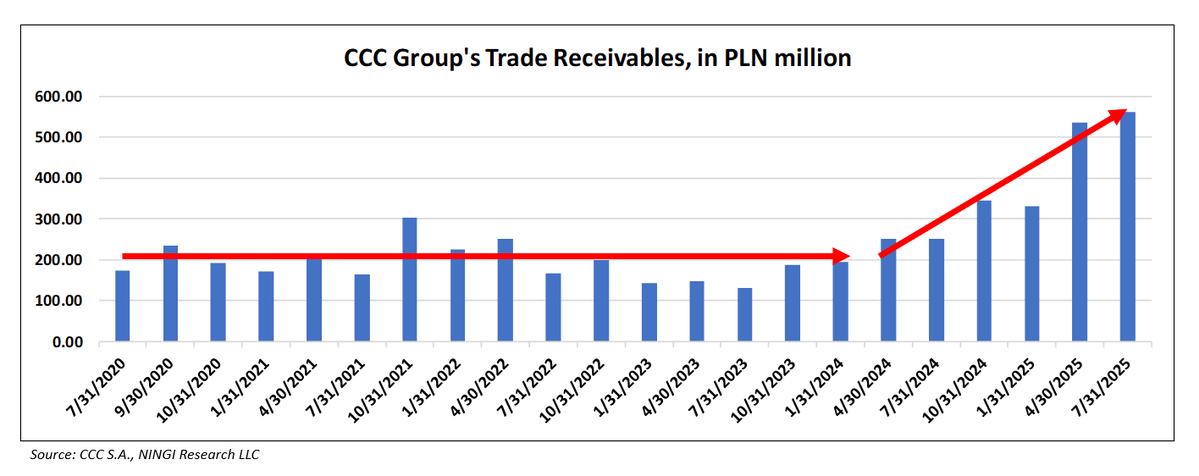

#Deloitte found material weaknesses at #Sinch Indian subsidiary because of possible #material misstatements in trade receivables due to the lack of #internal controls over its financial reporting, read the full report: ningiresearch.com/2022/07/11/res…

One of #Sinch Australian subsidiary was dissolved in 2016 and got a new obscure name. But it was consolidated since then every year any way and $SINCH.ST used it as an umbrella for other subsidiaries, read the full report: ningiresearch.com/2022/07/11/res…

Another #Sinch Australian subsidiary does not exist based on the information provided by the company. Without a valid ACN or ABN, a company cannot do any business in #Australia. ACN and ABN have to stated on every invoice, read the full report: ningiresearch.com/2022/07/11/res…

In our opinion, 70% of all receivables are from less credit-worthy customers or do not exist. $Sinch changed its approach for customer #credit risk management. An important paragraph was cut from 2020 on, read the full report: ningiresearch.com/2022/07/11/res…

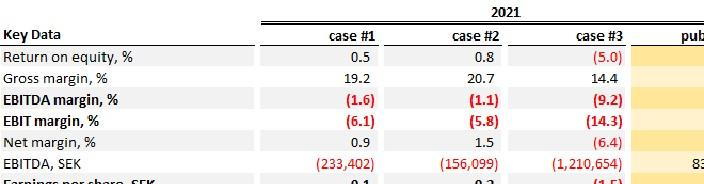

We think, that revenue, #EBITDA, EBIT and #EPS are significantly overstated. Revenue by 18% at worst, EBITDA and EBIT is negative in any case. A grim picture emerges for #Sinch, read the full report: ningiresearch.com/2022/07/11/res…

• • •

Missing some Tweet in this thread? You can try to

force a refresh