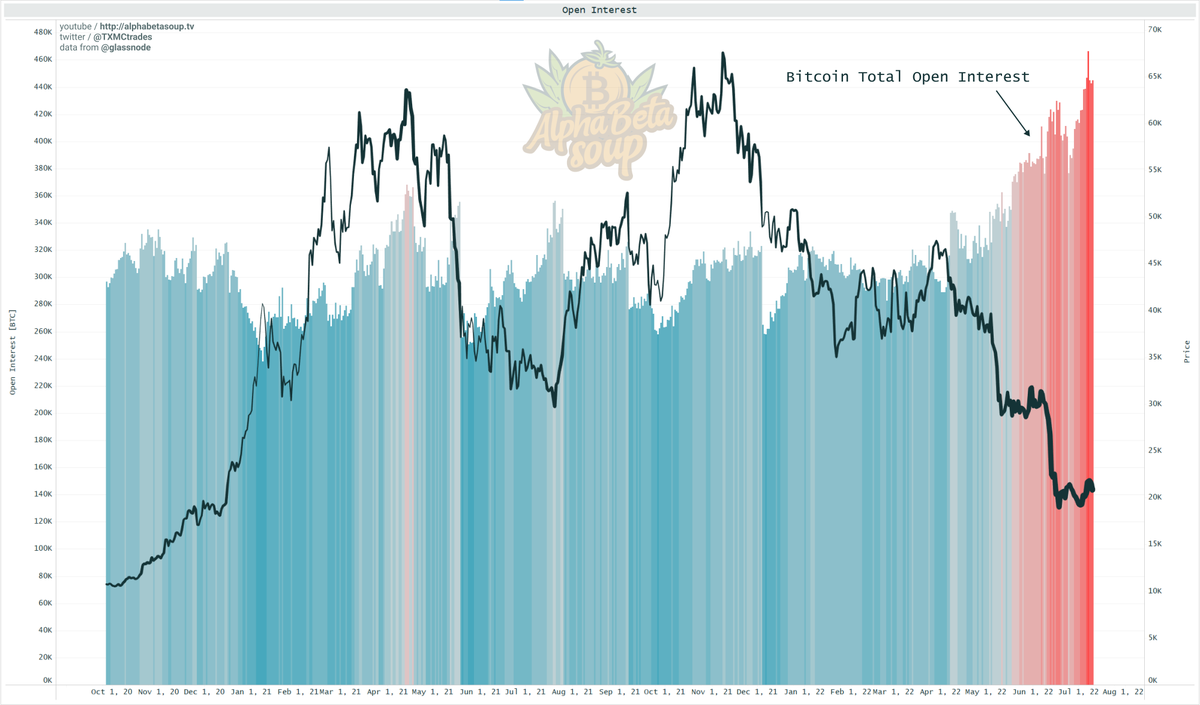

#BTC futures open interest has expanded mightily at the lows.

As an annoyingly curious guy by nature, I took a look.

My findings led me to OKX. Let me show off some charts.🧵

As an annoyingly curious guy by nature, I took a look.

My findings led me to OKX. Let me show off some charts.🧵

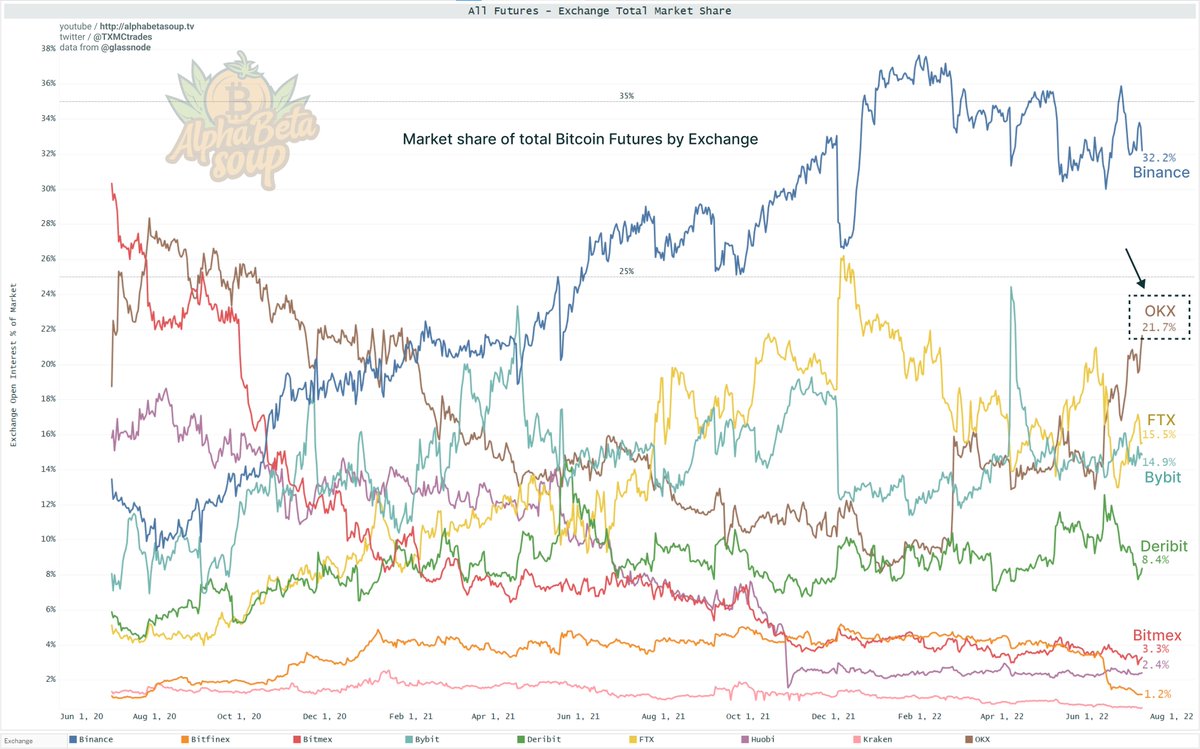

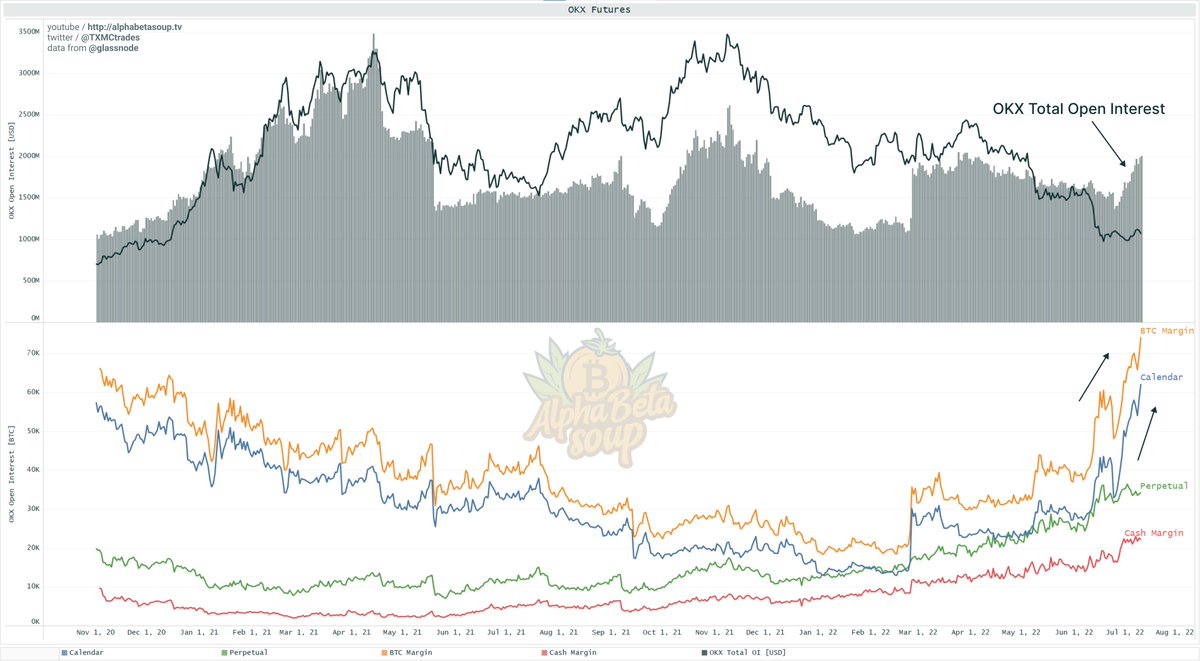

🟤OKX's star has been rising of late.

OKX's total market share of #BTC futures recently surpassed 🟡FTX for the #2 spot, trailing only the king dog 🔵Binance.

Their pie slice has grown from 12.9% to 21.7% since June 6th. Most other exchanges are roughly the same in that span.

OKX's total market share of #BTC futures recently surpassed 🟡FTX for the #2 spot, trailing only the king dog 🔵Binance.

Their pie slice has grown from 12.9% to 21.7% since June 6th. Most other exchanges are roughly the same in that span.

Futures comes in two varieties and two margin types:

🟢Perpetuals

🔵Calendars

🔴Cash margin

🟠BTC margin

As you can see, the expansion of Open Interest for OKX has been all BTC backed calendar futures, rivaling 2020 levels of dominance.

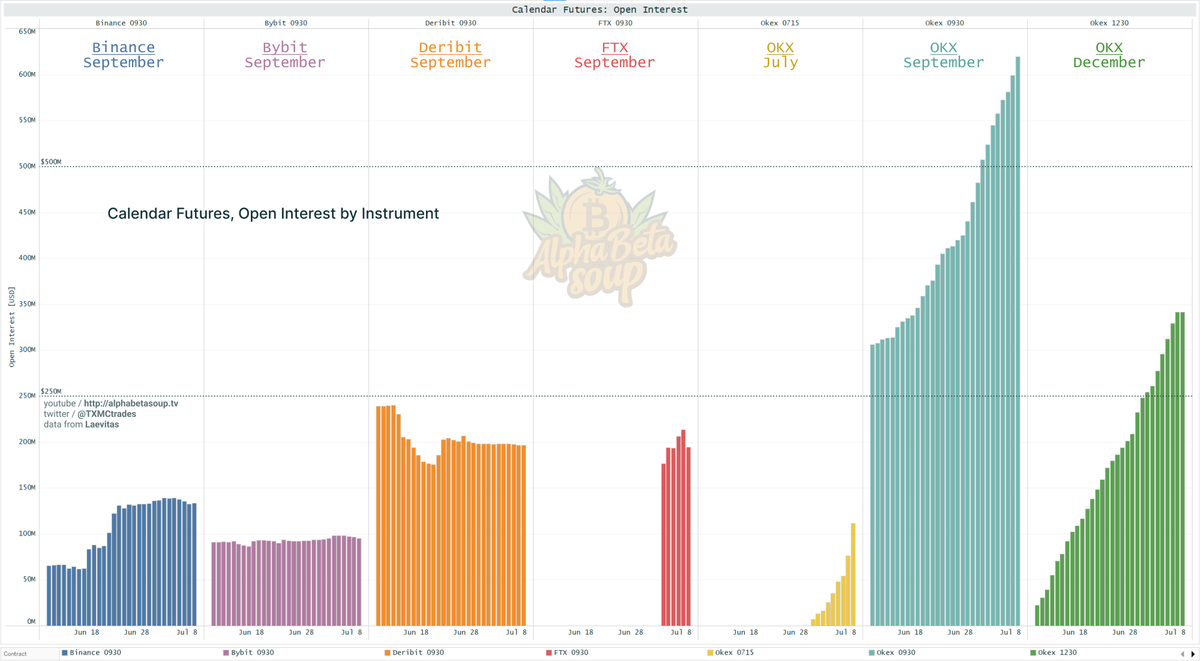

So which contracts are involved?

🟢Perpetuals

🔵Calendars

🔴Cash margin

🟠BTC margin

As you can see, the expansion of Open Interest for OKX has been all BTC backed calendar futures, rivaling 2020 levels of dominance.

So which contracts are involved?

The sky high majority of flows are going to the Sept contract on OKX, and a lesser degree December.

Nothing else in this corner of the market even comes close. But why?

Nothing else in this corner of the market even comes close. But why?

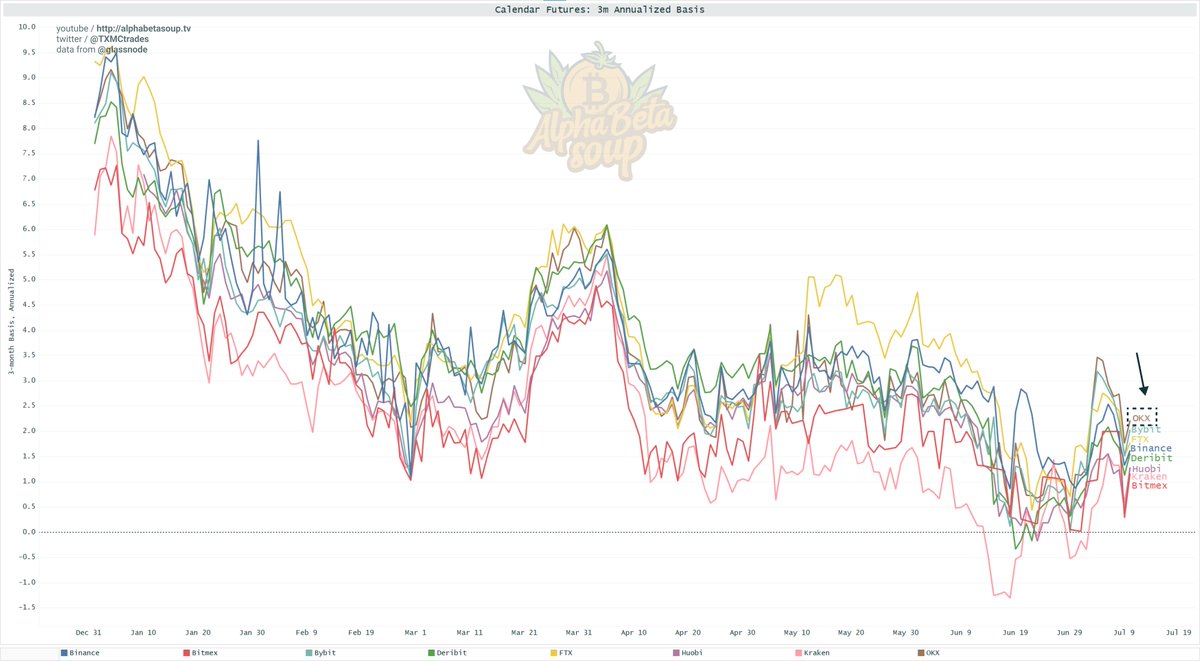

I can't say with certainty, but one thing to note- OKX has had the best annualized basis among calendar offerings since late June, currently at around 2.2%.

Everything is a yield game, and OKX is a decent choice in the current environment.

Everything is a yield game, and OKX is a decent choice in the current environment.

Perhaps this is part of a larger position across instruments- hard to know. One thing is for certain- other exchanges are not seeing the same flows.

I'd love to hear from traders in those markets: why the sudden return of OKX calendar dominance?

Anyways, have a good Monday✌️

I'd love to hear from traders in those markets: why the sudden return of OKX calendar dominance?

Anyways, have a good Monday✌️

• • •

Missing some Tweet in this thread? You can try to

force a refresh