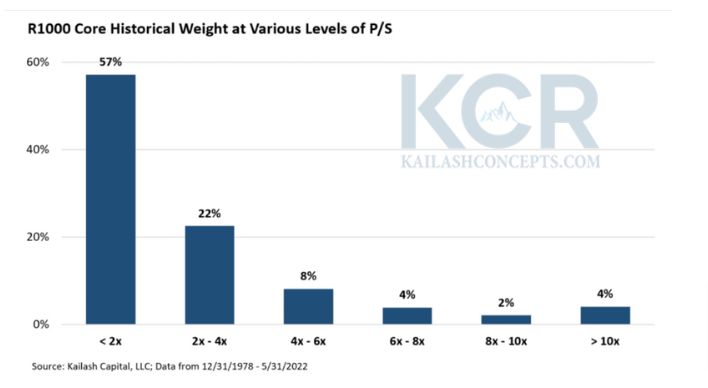

1/ Historically, investors in large cap core index funds had the bulk of their money invested in stocks with reasonable valuations with negligible exposure to stocks valued over 10x price to sales.

#stocks #investors #growthfunds

#stocks #investors #growthfunds

2/ As the below chart shows, that is no longer true today.

Should evoke caution for those using index fund investment strategies with large cap core exposure to make sure they are consistent with your investment objectives, risks, and other goals.

Should evoke caution for those using index fund investment strategies with large cap core exposure to make sure they are consistent with your investment objectives, risks, and other goals.

3/ Index fund investors’ exposure to stocks at excessive valuations with historically poor payoff structures is not without precedent – unfortunately, the precedent is not a good one.

4/ The asset management industry is full of superb active managers who have long histories of providing returns above market levels with low costs, low turnover, and excellent tax efficiency.

Read full blog:

kailashconcepts.com/large-cap-core…

Read full blog:

kailashconcepts.com/large-cap-core…

• • •

Missing some Tweet in this thread? You can try to

force a refresh