Behavioral #Finance, Portfolio Strategy & #Quantamental Tool Kits

KCR What’s In Your Portfolio?TM

Disclaimer: https://t.co/uKOhDw5bR0

How to get URL link on X (Twitter) App

2/7 Since there is no disclosure or reporting it’s tough to tell where the bodies are.

2/7 Since there is no disclosure or reporting it’s tough to tell where the bodies are.

https://twitter.com/Josh_Young_1/status/1587113585238573057

2/ Buying a new iPhone is nice. Keeping your home warm and eating food requires energy. That is non-negotiable. The world is structurally short of hydrocarbons due to the explosion of ESG investing and empirically failed government policies.

2/ Buying a new iPhone is nice. Keeping your home warm and eating food requires energy. That is non-negotiable. The world is structurally short of hydrocarbons due to the explosion of ESG investing and empirically failed government policies.

2/ Exactly 1 year ago today, we published this rant: Andrew Jassy Amazon's Next Bob Nardelli?

2/ Exactly 1 year ago today, we published this rant: Andrew Jassy Amazon's Next Bob Nardelli?

https://twitter.com/LynAldenContact/status/15824832570309795842/ Engineers have nearly doubled fuel economy despite exploding vehicle size, weight and horsepower due to consumer preference for bigger, safer faster cars

2/ #KCRDailyThread

2/ #KCRDailyThread

https://twitter.com/charliebilello/status/1582482052846620672

2/...and then the company said they were going end guidance for paid membership, choosing instead to focus on sales, operating income, operating margin, net income and EPS

2/...and then the company said they were going end guidance for paid membership, choosing instead to focus on sales, operating income, operating margin, net income and EPS

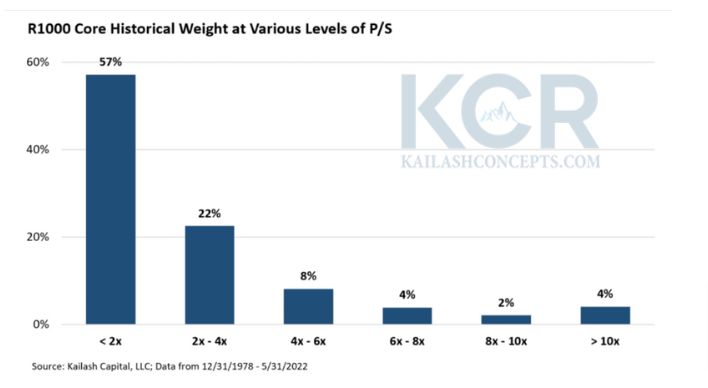

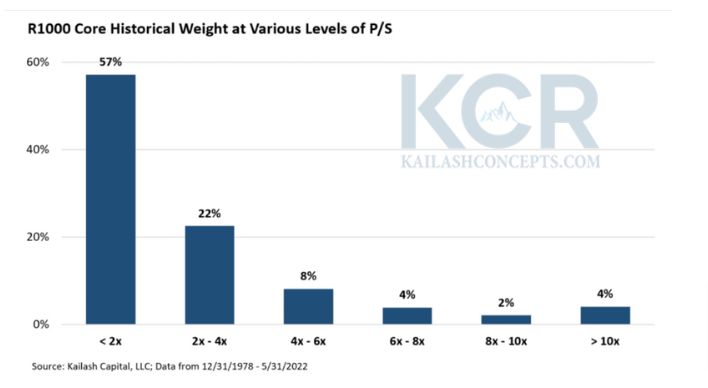

2/ As the below chart shows, that is no longer true today.

2/ As the below chart shows, that is no longer true today.