Crypto Bridges 🌉 solve one of the fundamental problems of blockchains:

#INTEROPERABILITY ✅

However, theft from cross-chain bridges totaled more than $1 BILLION in 2022

Here's a thread that will help you understand the RISKS

associated with cross-chain bridges:

🧵

#INTEROPERABILITY ✅

However, theft from cross-chain bridges totaled more than $1 BILLION in 2022

Here's a thread that will help you understand the RISKS

associated with cross-chain bridges:

🧵

First, bridges are used to transfer assets and data back & forth between multiple #blockchains

A specific blockchain asset is incompatible with other blockchains due to differing designs

So, bridges create WRAPPED assets that represent the asset from the original blockchain

A specific blockchain asset is incompatible with other blockchains due to differing designs

So, bridges create WRAPPED assets that represent the asset from the original blockchain

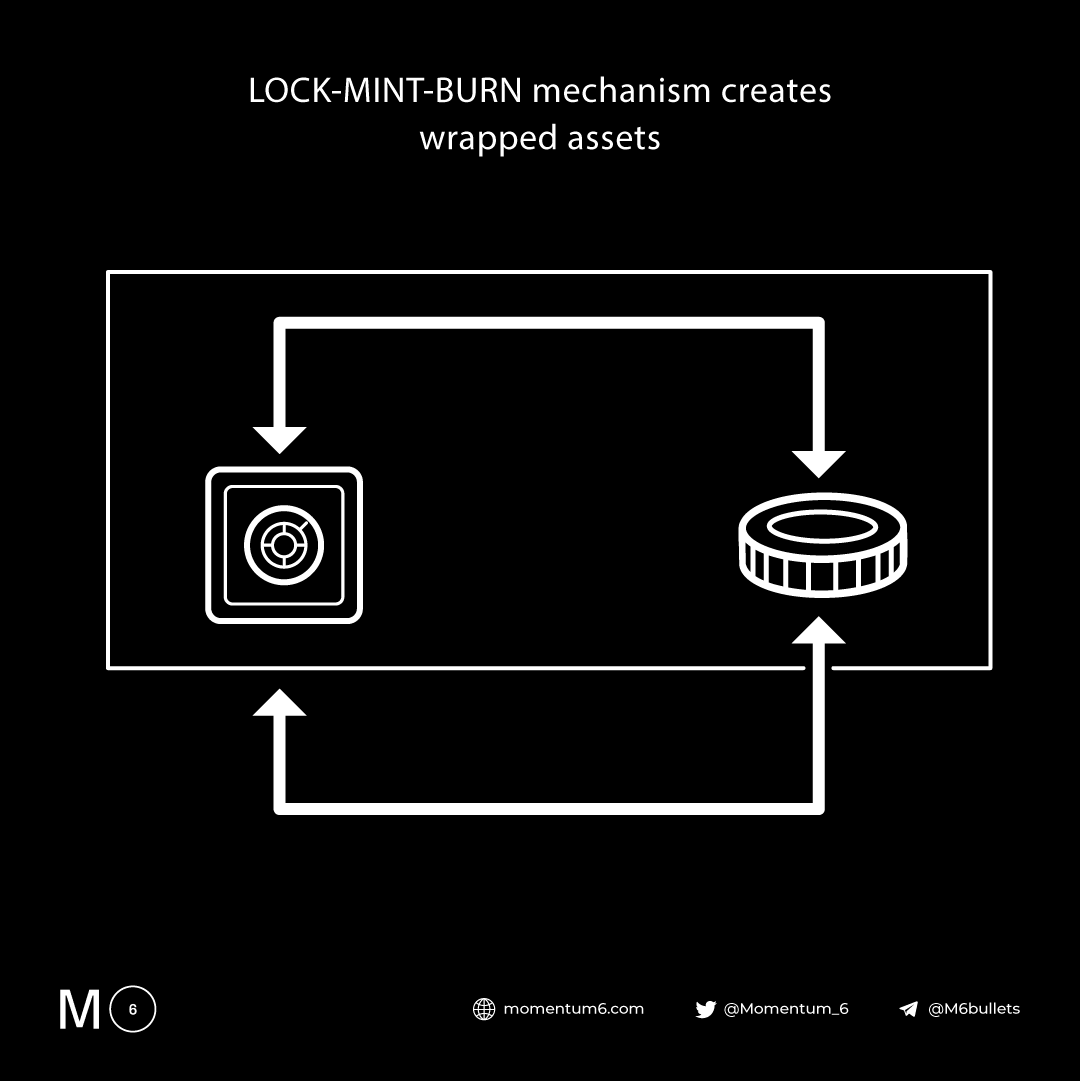

Bridges use a LOCK-MINT-BURN mechanism: 🔥

1. Users deposit their funds into a bridge smart contract

2. The contract locks the deposited assets & mints the equivalent amount of WRAPPED assets on the specified chain

3. The WRAPPED asset is pegged 1:1 to the original asset

1. Users deposit their funds into a bridge smart contract

2. The contract locks the deposited assets & mints the equivalent amount of WRAPPED assets on the specified chain

3. The WRAPPED asset is pegged 1:1 to the original asset

The user can once again deposit the WRAPPED asset into the bridge smart contract & unlock their original assets

This is how Bridges accomplish INTEROPERABILITY ✅

If the future is #multichain, cross-chain bridges will become a NECESSITY

This is how Bridges accomplish INTEROPERABILITY ✅

If the future is #multichain, cross-chain bridges will become a NECESSITY

But it is incredibly hard to build a SAFE cross-chain bridge

Here are some of the risks involved in cross-chain bridges:

1. CUSTODIAN RISK:

• Some bridges rely on one or a small set of validators who are responsible for communicating the state of blockchains

Here are some of the risks involved in cross-chain bridges:

1. CUSTODIAN RISK:

• Some bridges rely on one or a small set of validators who are responsible for communicating the state of blockchains

• Since they are the custodians, they control the LOCK-MINT-BURN mechanism

So a small set of individuals can steal all the deposited assets if they wish to

• Vitalik says "It's a lot easier to attack a bridging protocol's 19-node validator set than an L1's 30,000 nodes"

So a small set of individuals can steal all the deposited assets if they wish to

• Vitalik says "It's a lot easier to attack a bridging protocol's 19-node validator set than an L1's 30,000 nodes"

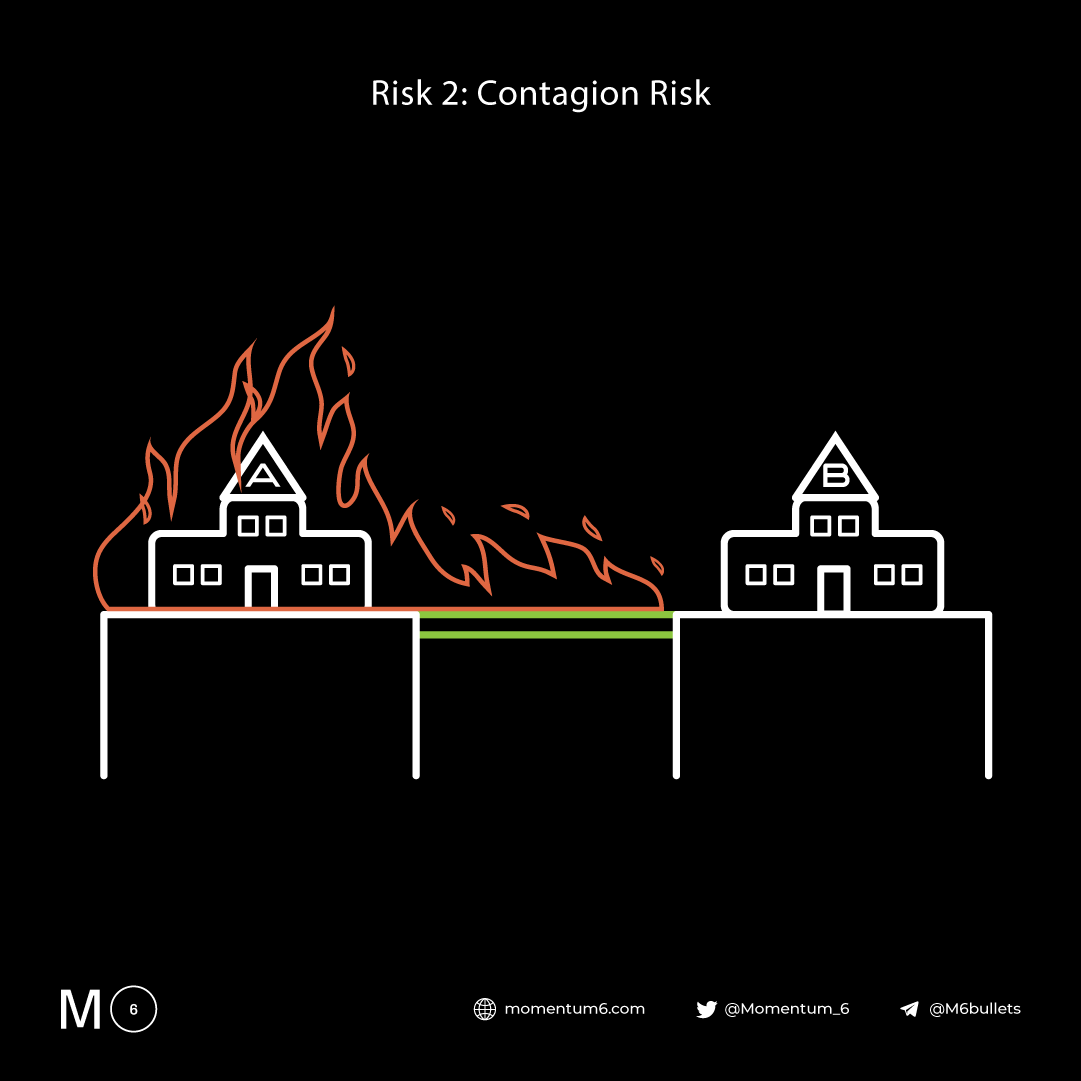

2. CONTAGION RISK:

• The locked assets on the bridge contract are vulnerable to the security risks of the other chain

• As a result, attacking one chain would also affect the bridged assets on the other chain

• So, bridges compound the risk between sovereign chains

• The locked assets on the bridge contract are vulnerable to the security risks of the other chain

• As a result, attacking one chain would also affect the bridged assets on the other chain

• So, bridges compound the risk between sovereign chains

3. POOR LIQUIDITY:

• A cross-chain bridge must have deep liquidity pools on both chains to offer low slippage

• But it is difficult to sustain deep liquidity pools for a long period of time

• In order to do so, the bridge has to be a MOAT which is also difficult

• A cross-chain bridge must have deep liquidity pools on both chains to offer low slippage

• But it is difficult to sustain deep liquidity pools for a long period of time

• In order to do so, the bridge has to be a MOAT which is also difficult

4. CENSORSHIP RISK:

• The native assets on a #blockchain are censorship-resistant which means no third party has control over your assets & the activities you wish to perform on the blockchain

• Since bridges rely on custodians they have control over the locked assets

• The native assets on a #blockchain are censorship-resistant which means no third party has control over your assets & the activities you wish to perform on the blockchain

• Since bridges rely on custodians they have control over the locked assets

• This signifies that one has to trust the custodian to burn/ mint tokens & ultimately you lose control over your native assets until you bring them back to the blockchain

• Additionally, the bridged assets are also at risk if the custodians lose their private keys

• Additionally, the bridged assets are also at risk if the custodians lose their private keys

Despite the risks involved, bridge protocols have a TVL of $10B & are ranked 3rd among all DeFi protocols

This shows that there is a market demand for a flawed product

So, understanding the risks involved can be helpful to look for protocols that try to reduce those risks

This shows that there is a market demand for a flawed product

So, understanding the risks involved can be helpful to look for protocols that try to reduce those risks

We hope you've found this thread on crypto cross-chain bridges 🌉 helpful.

Follow @Momentum_6 for more insightful threads and analysis on the fast paced crypto space

Please help share this thread by hitting Like/Retweet on the original tweet:

Follow @Momentum_6 for more insightful threads and analysis on the fast paced crypto space

Please help share this thread by hitting Like/Retweet on the original tweet:

https://twitter.com/Momentum_6/status/1549025981326798848

• • •

Missing some Tweet in this thread? You can try to

force a refresh