STRATEGY NO-01 🔥

A thread 🧵🧵

BANKNIFTY OPTION BUYING , STRATEGY, BASED ON PIVOT LEVELS 📈

LET'S START WITH BASICS,

What are PIVOT level..?

#trading #StockMarket #banknifty

A thread 🧵🧵

BANKNIFTY OPTION BUYING , STRATEGY, BASED ON PIVOT LEVELS 📈

LET'S START WITH BASICS,

What are PIVOT level..?

#trading #StockMarket #banknifty

Basically its price action based indicator, which is average of previous days HIGH, LOW , CLOSE AND OPEN of intraday swings

Once add the PIVOT LEVEL to your chart ,you will S1, S2, S3, S4 as key support levels on the side, R1, R2, R3 , R4 as key resistance levels for the day

Once add the PIVOT LEVEL to your chart ,you will S1, S2, S3, S4 as key support levels on the side, R1, R2, R3 , R4 as key resistance levels for the day

Support - Price may stock from continuous fall and bounce back upside

Resistance - price bounce back from continuous upmove and drop down to certain level

Continues ..!

Resistance - price bounce back from continuous upmove and drop down to certain level

Continues ..!

Ideal condition of pivot levels

If the price is trading above the pivot level ( any ) it means stock/index are try to move up ( bullish ) and vice versa..!

Conditions -

Time frame - 3min / 5min

Type of pivot - Standard ( zerodha & trading view )

If the price is trading above the pivot level ( any ) it means stock/index are try to move up ( bullish ) and vice versa..!

Conditions -

Time frame - 3min / 5min

Type of pivot - Standard ( zerodha & trading view )

Once the market Opens,here need to concentrate on pivot levels,where it is heading towards and which kind of candles are forming

Always wait for the market to come to pivot levels if the price is in between any 2 pivot levels don't enter( usually I say, don't trade in the air)

Always wait for the market to come to pivot levels if the price is in between any 2 pivot levels don't enter( usually I say, don't trade in the air)

Now the question is where to ENTER and what's the SL , AND TARGET

Here we get two kind of entries,

1. NON BREAKOUT OF PIVOT ( REVERSAL)

2. BREAKOUT OF PIVOT ( CONTINUATION )

Here we get two kind of entries,

1. NON BREAKOUT OF PIVOT ( REVERSAL)

2. BREAKOUT OF PIVOT ( CONTINUATION )

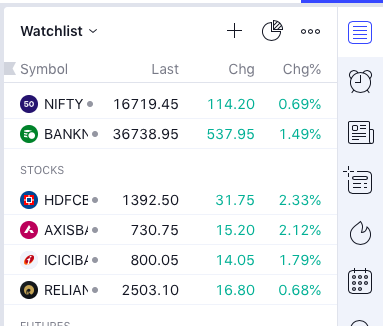

All with bank nifty, if you add all these major moves of banknifty HDFC AXIS AND ICICIBANK, if these stocks are giving you confirmation the accuracy will be good.

I always watch these stock movements along with banknifty .

I always watch these stock movements along with banknifty .

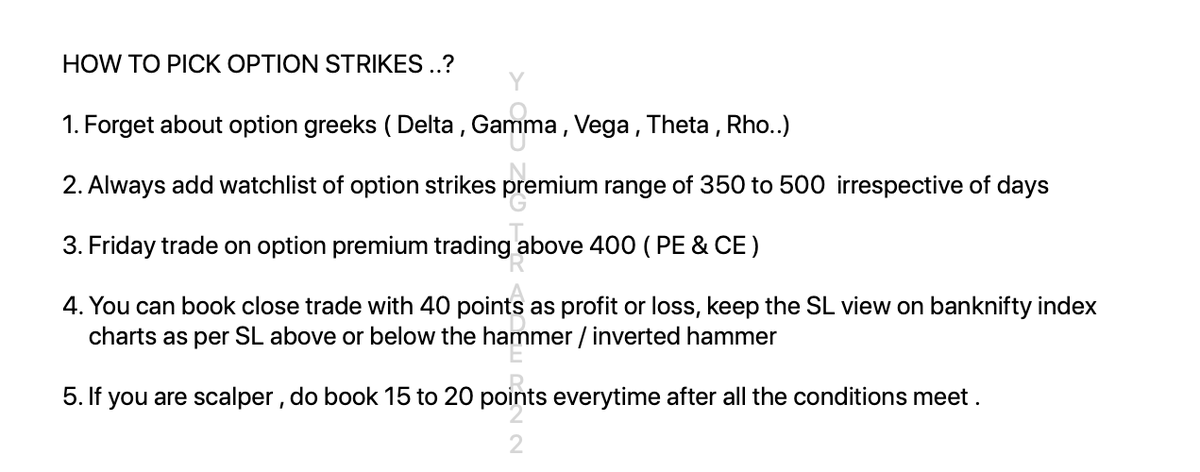

How to trade in options ..!

for 1:2 you will get 80 to 100 points if you are patience to catch the move ,

for 1:2 you will get 80 to 100 points if you are patience to catch the move ,

• • •

Missing some Tweet in this thread? You can try to

force a refresh