Back by popular request - Pre-seed startup valuations!

Let’s look at over 4K pre-seed deal submissions @hustlefund has gotten over the past year+ and see what's happening in the world of US pre-seed venture capital 🧵

#Startups #VC #Entrepreneurship

1/9

Let’s look at over 4K pre-seed deal submissions @hustlefund has gotten over the past year+ and see what's happening in the world of US pre-seed venture capital 🧵

#Startups #VC #Entrepreneurship

1/9

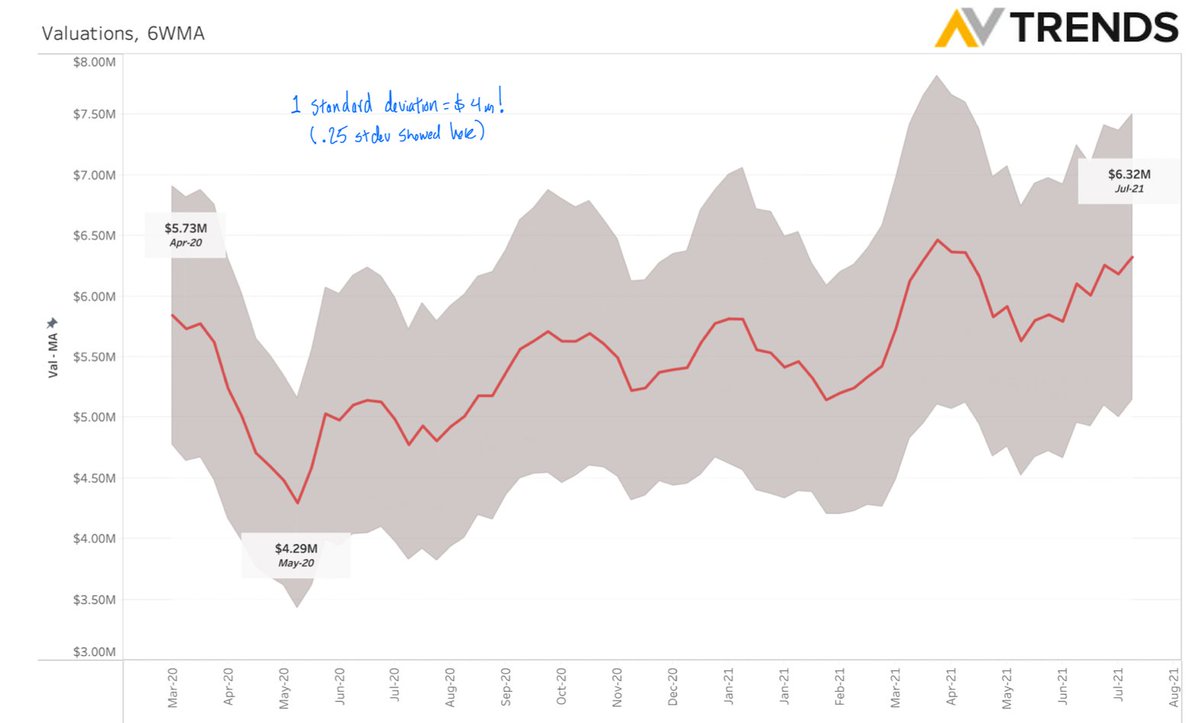

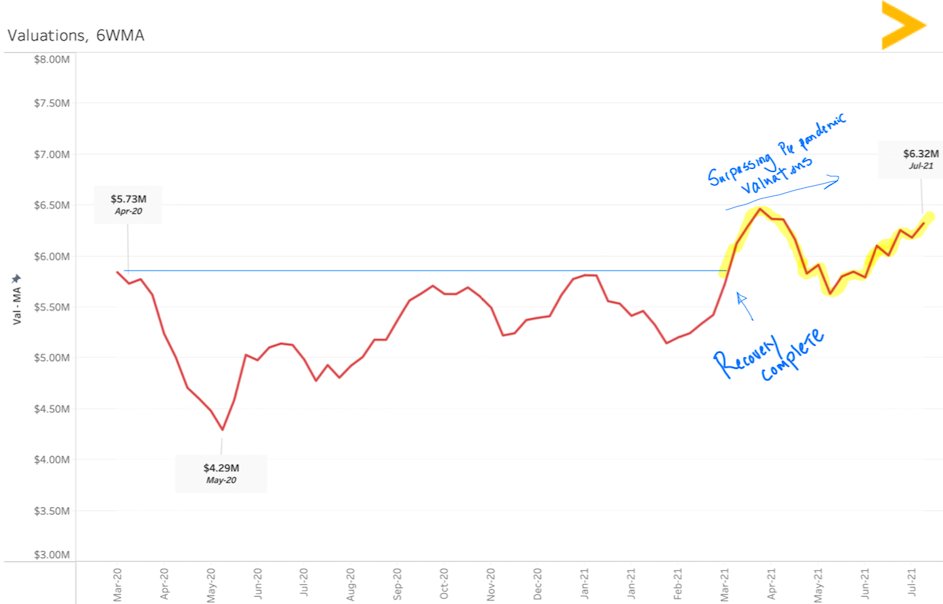

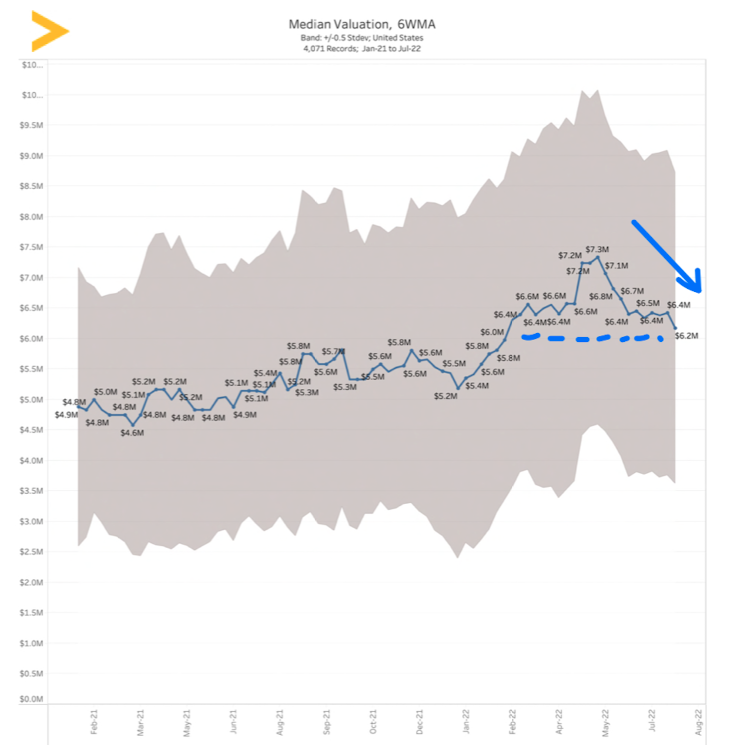

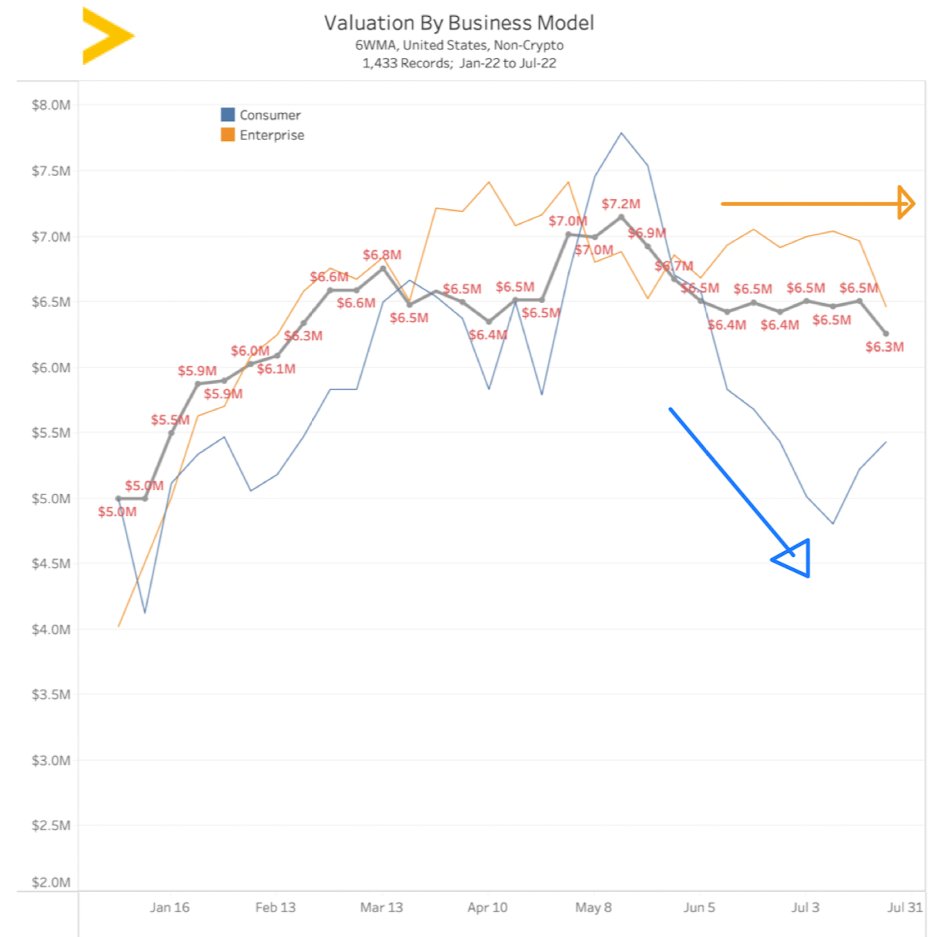

What we are seeing - valuations have trended lower in q2.

Valuations are back to EOY 2021 levels (~$6M USD) down from all-time highs of ~$7M USD in 1Q2022

2/9

Valuations are back to EOY 2021 levels (~$6M USD) down from all-time highs of ~$7M USD in 1Q2022

2/9

Things to note

- Data is based on submissions we received from US non-crypto startups

- Pre-seed startups are all very different & there is a lot of dispersion in valuations.

- Median trend <> the trend holds true for all pre-seed startups

3/9

- Data is based on submissions we received from US non-crypto startups

- Pre-seed startups are all very different & there is a lot of dispersion in valuations.

- Median trend <> the trend holds true for all pre-seed startups

3/9

There are a couple of drivers I am seeing (and many more I am probably missing)

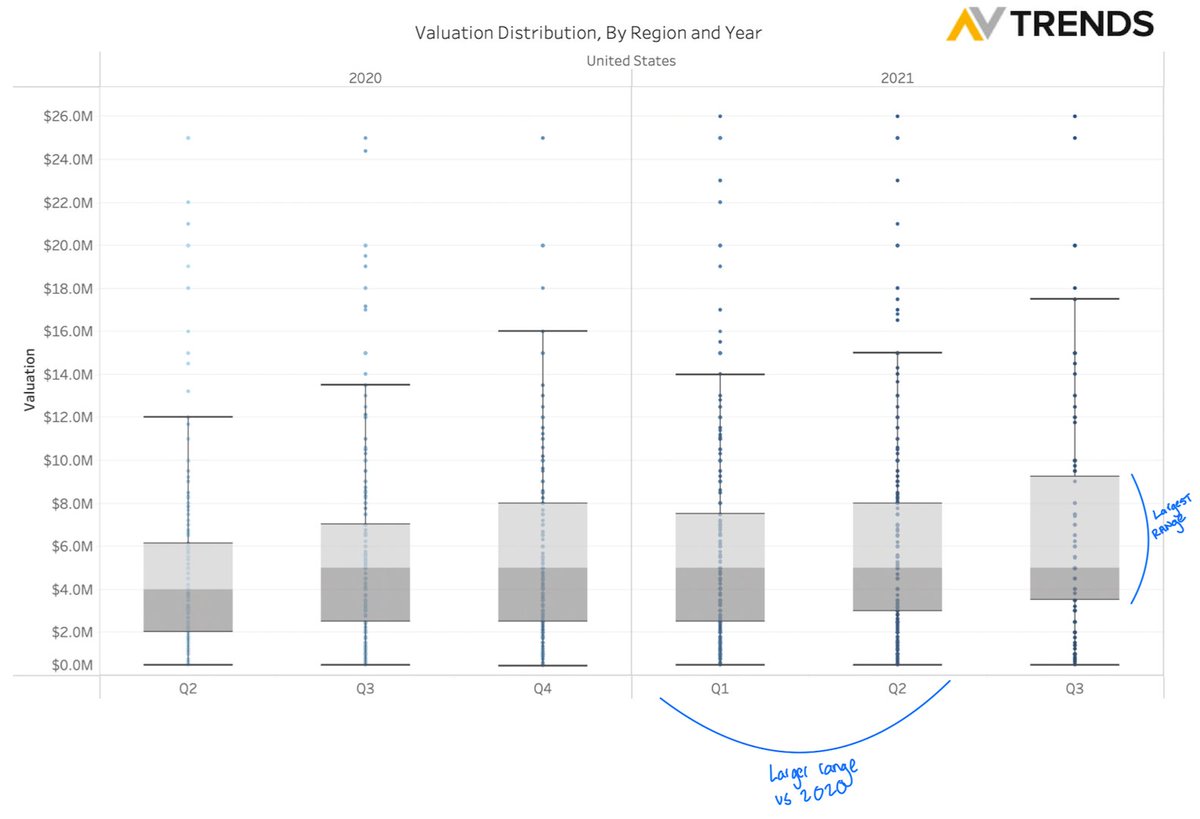

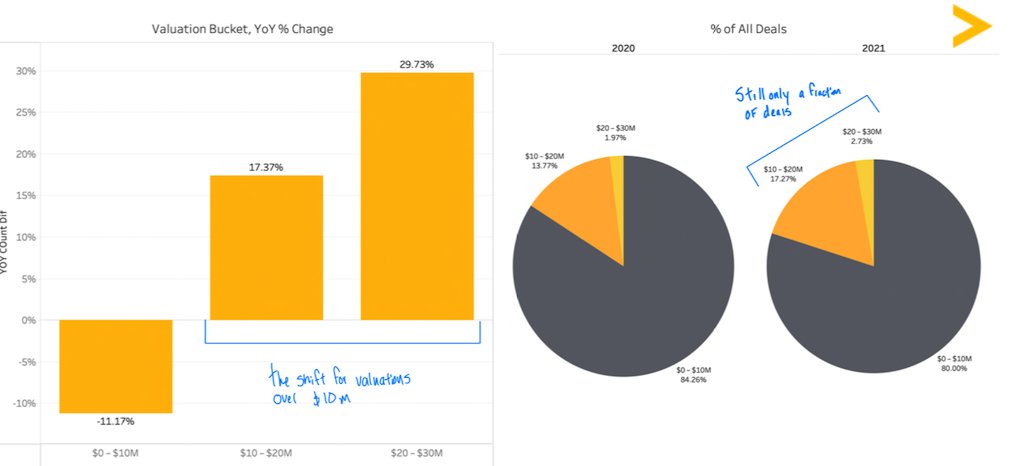

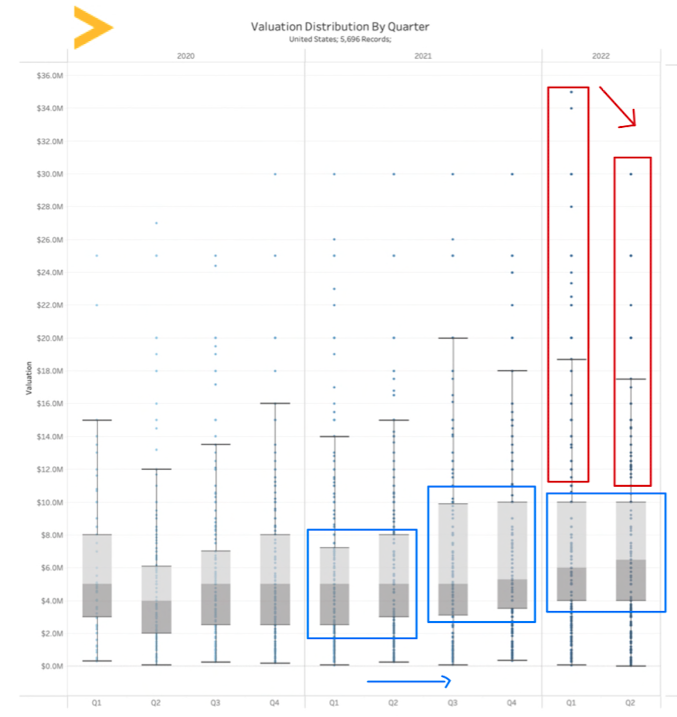

#1 - less high valuation startups & less dispersion in valuations.

While 2021 saw wider valuation ranges, 2022 saw ranges narrow, especially for higher valuations

4/9

#1 - less high valuation startups & less dispersion in valuations.

While 2021 saw wider valuation ranges, 2022 saw ranges narrow, especially for higher valuations

4/9

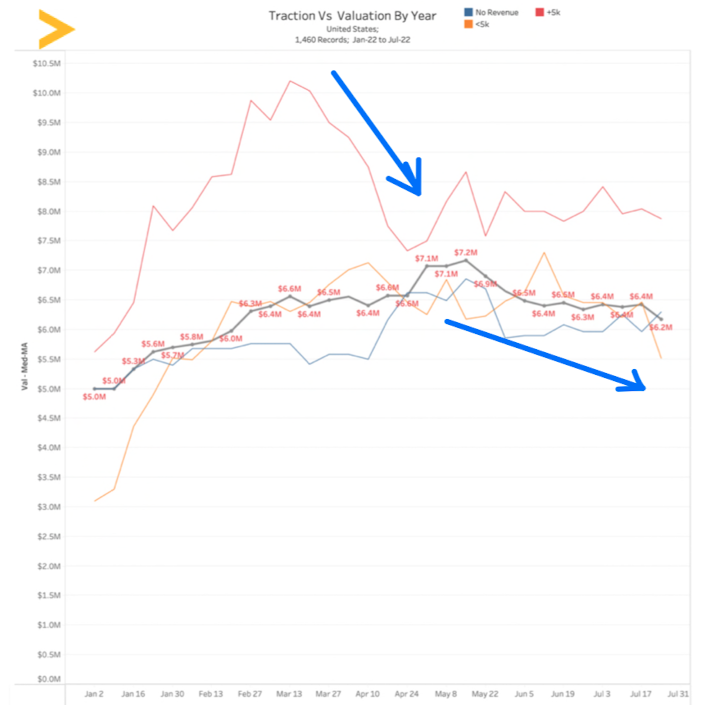

#2 - valuations for lower MRR startups decreased

While higher MRR valuations decreased in the first part of 2022, valuations for lower MRR startups came down in Q2.

5/9

While higher MRR valuations decreased in the first part of 2022, valuations for lower MRR startups came down in Q2.

5/9

#3 - valuations for consumer startups decreased

While consumer startups had very similar valuations to enterprise startups for much of 2021, their valuations decreased more in 2022 than valuations for enterprise startups

6/9

While consumer startups had very similar valuations to enterprise startups for much of 2021, their valuations decreased more in 2022 than valuations for enterprise startups

6/9

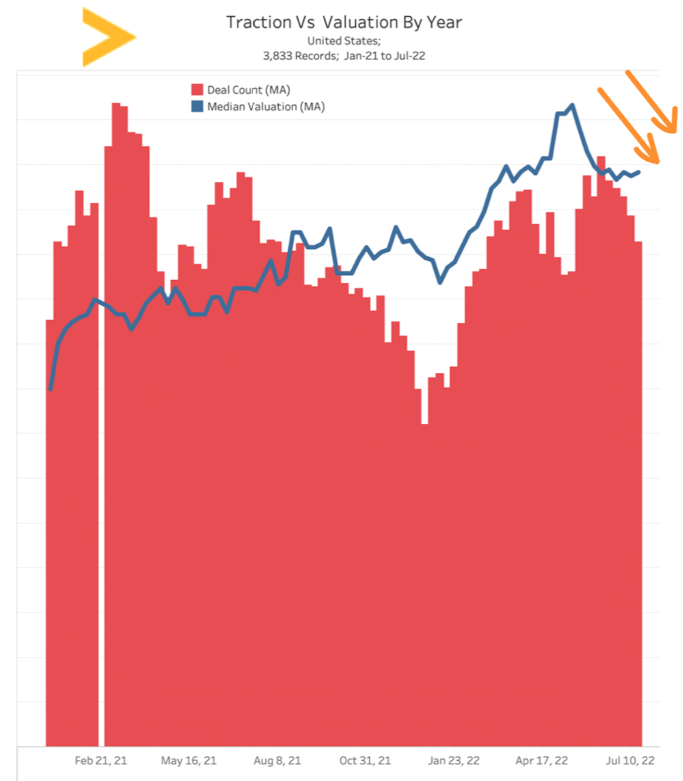

Also of note - In addition to valuations coming down, we have seen a slight decrease in the volume of deals we are seeing. This means instead of 6-700 deals a month, we are seeing closer to 500.

7/9

7/9

Hope this has been helpful.

As always questions, comments, and feedback are welcome.

Thanks for reading!

8/9

As always questions, comments, and feedback are welcome.

Thanks for reading!

8/9

CORRECTION - Instead of seeing 700+ deals, we are seeing closer to 600.

• • •

Missing some Tweet in this thread? You can try to

force a refresh