@SeiNetwork's Incentivised Testnet has moved on to Act 2 and the chance for non-validators to participate and earn $SEI rewards have come!

I've prepared a step-by-step guide to help you with it.

🧵(0/21)

#IBCGang #Cosmonauts #Cosmos #Crypto

I've prepared a step-by-step guide to help you with it.

🧵(0/21)

#IBCGang #Cosmonauts #Cosmos #Crypto

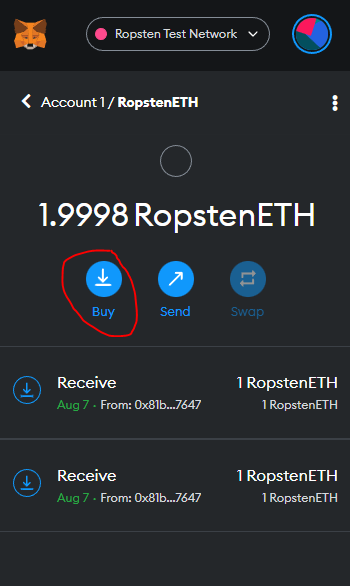

4. Next, go to your Metamask, Click on the toggle to change networks and then to the “show/hide test networks”

5. After that, the Ropsten Testnet will be visible. Select it. This is where your testnet tokens will be sent subsequently.

6. Next, we need to get some $RopstenETH to pay for the gas fees when bridging your testnet tokens over to the Sei testnet. Click on the RopstenETH section.

9. There will be a popup arriving on this website. Click on the "request 1 ether from faucet" button. It will prompt you to connect your MetaMask wallet and subsequently send you your RopstenETH.

10. Next, join Sei Network’s Discord over here: discord.gg/DvXnQ2M6. Go to the “atlantic-1-faucet” section.

11. Type in the following and send in the chat to receive your testnet tokens:

- The first one is to get 1 SEI and 1 aUSDC under your Sei address with:

!faucet sei1address

- The second one is to get 1 aUSDC under your Ethereum Ropsten address with:

!faucet ethereum 0xAddress

- The first one is to get 1 SEI and 1 aUSDC under your Sei address with:

!faucet sei1address

- The second one is to get 1 aUSDC under your Ethereum Ropsten address with:

!faucet ethereum 0xAddress

12. NOTE: You will have only one use per function and per address/discord user

Note that the EVM aUSDC tokens can take several minutes to arrive under your address, so no need to spam the faucet

Note that the EVM aUSDC tokens can take several minutes to arrive under your address, so no need to spam the faucet

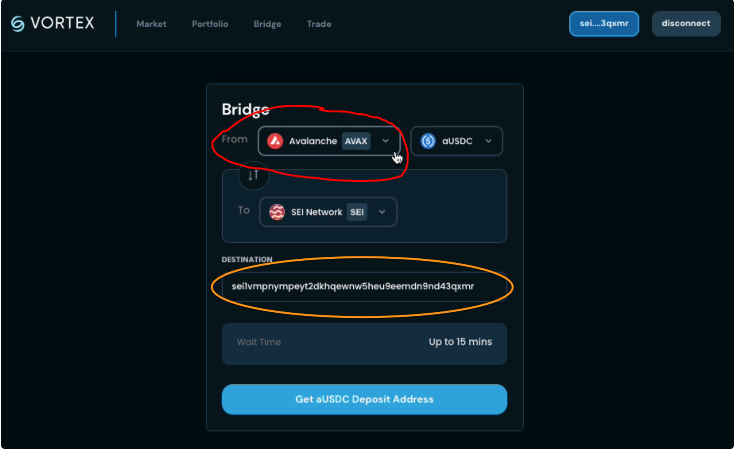

13. Go to trade.vortexprotocol.io/bridge. Paste your Sei address (e.g. sei....3qxmr) in the "Enter destination address" tab. Then, change the chain in the “From” section to Ethereum.

16. Tip: try sending a small amount of aUSDC (e.g. 0.2 aUSDC) over first to make sure that the bridge works as you can only get aUSDC once from the testnet faucet!

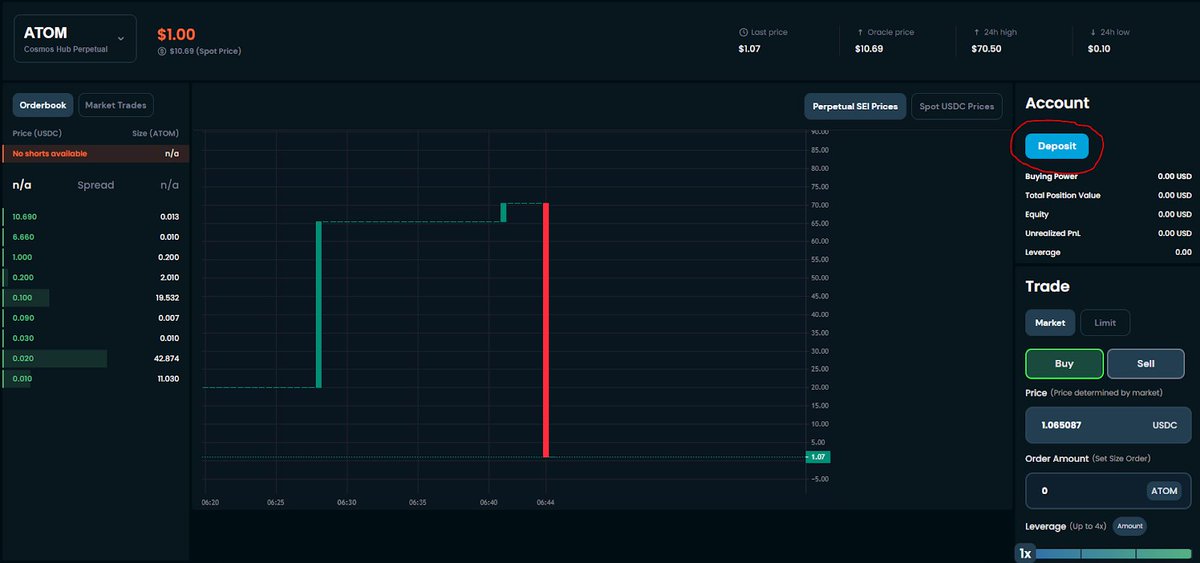

19. Now you are ready to start! Here’s a video on how you can place orders on Vortex Beta:

Just a reminder that the Sei Incentivised Testnet is happening now and for doing all of the above, you can be rewarded with $SEI!

Check out the missions here. Do note that the Incentivised Testnet is in Act 2.

3pgv.notion.site/All-Seinami-Te…

Check out the missions here. Do note that the Incentivised Testnet is in Act 2.

3pgv.notion.site/All-Seinami-Te…

Remember to submit all of the required information into this form after you’re done.

docs.google.com/forms/d/1qxpIL…

docs.google.com/forms/d/1qxpIL…

That's all folks! Enjoy the amazing UI that @VortexProtocol has to offer!

If this guide has helped you, do share it with everyone who's having difficulty getting testnet tokens for the Incentivised Testnet missions!

If this guide has helped you, do share it with everyone who's having difficulty getting testnet tokens for the Incentivised Testnet missions!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh