As we know, @LiquityProtocol allows users to borrow $LUSD (with $ETH collateral) for a one time borrow fee (no accruing interest!)…

But how exactly is this borrow fee % derived?

How does it react to $LUSD peg fluctuations?

Let’s dive in 🧵👇

But how exactly is this borrow fee % derived?

How does it react to $LUSD peg fluctuations?

Let’s dive in 🧵👇

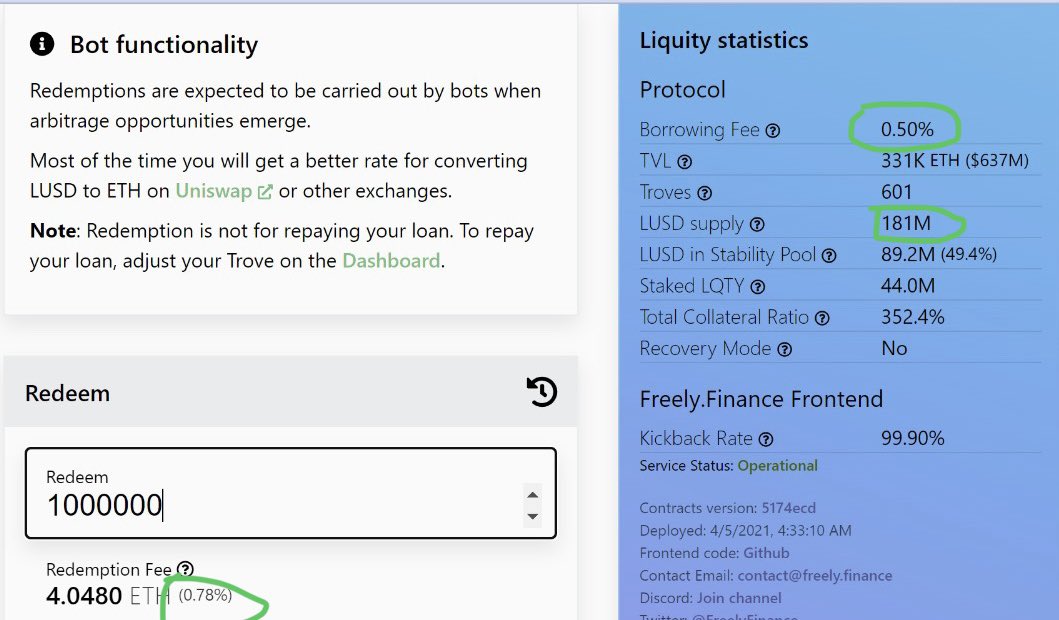

Currently, if I were to mint/redeem $LUSD, I would be charged a .5% borrow/redemption fee.

(Smallest fee possible, and will likely be .5% the majority of the time, especially during times of mkt volatility/depeg to the upside)

However, the fee CAN alter if LUSD slips below $1…

(Smallest fee possible, and will likely be .5% the majority of the time, especially during times of mkt volatility/depeg to the upside)

However, the fee CAN alter if LUSD slips below $1…

Here’s how it works:

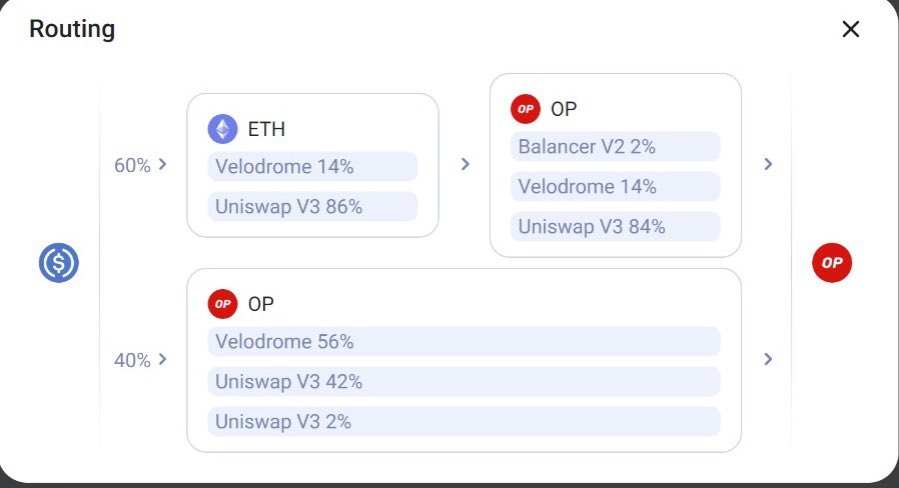

If LUSD <1, users will swap for LUSD in LPs -> arb by redeeming LUSD for 1$ worth of ETH collateral from the trove/s with the lowest C-ratio/s whilst paying their LUSD debt off -> LUSD price⬆️ + trove C-ratios⬆️ + borrow/redemption fee⬆️

(Example below👇)

If LUSD <1, users will swap for LUSD in LPs -> arb by redeeming LUSD for 1$ worth of ETH collateral from the trove/s with the lowest C-ratio/s whilst paying their LUSD debt off -> LUSD price⬆️ + trove C-ratios⬆️ + borrow/redemption fee⬆️

(Example below👇)

https://twitter.com/barryfried1/status/1538880704188227585

This system is effective for many diff reasons…

a. Troves with low C-ratios run the risk of being redeemed against (not ideal to lose $ETH collateral), thus incentivizing borrowers to top up their troves by swapping back into LUSD -> repaying debt (naturally $LUSD price ⬆️)

a. Troves with low C-ratios run the risk of being redeemed against (not ideal to lose $ETH collateral), thus incentivizing borrowers to top up their troves by swapping back into LUSD -> repaying debt (naturally $LUSD price ⬆️)

b. Base redemption fee of .5% disincentivizes redemptions above 99.5c, + fee scales the bigger the redemption

Redeeming is temp more expensive after redemptions to prevent low-collat borrowers from being redeemed against, yet not expensive enough in the event of a mass depeg

Redeeming is temp more expensive after redemptions to prevent low-collat borrowers from being redeemed against, yet not expensive enough in the event of a mass depeg

d. Opening troves will subsequently be more expensive (higher borrow fee), disincentivizing new $LUSD entering circulation during times of distress

So how exactly ARE borrow/redemption fees calculated? (After redemptions occur)

As we know, our redemption fee equation of (baseRate + 0.5%) * ETHdrawn is directly proportionate to the amnt of LUSD redeemed vs total supply

(which in turn proportionally increases the borrow fee)

As we know, our redemption fee equation of (baseRate + 0.5%) * ETHdrawn is directly proportionate to the amnt of LUSD redeemed vs total supply

(which in turn proportionally increases the borrow fee)

However, max borrow fee can scale up to 5%, while redemption fees can go as high as a min 50% for redeeming 100% of the supply, decaying exponentially (half life of 12hrs) back to the .5% floor based on time since last fee event.

Here’s our formula:

b(t) := b(t-1) + 𝛼 * m/n

b(t) = baserate at time t (aka what will the baserate be?)

b(t-1) = baserate at time before t

𝛼 = constant parameter, set to .5 to optimally control $LUSD price floor

m = amount of LUSD being redeemed

n = $LUSD current supply

b(t) := b(t-1) + 𝛼 * m/n

b(t) = baserate at time t (aka what will the baserate be?)

b(t-1) = baserate at time before t

𝛼 = constant parameter, set to .5 to optimally control $LUSD price floor

m = amount of LUSD being redeemed

n = $LUSD current supply

Time for an example!

Let’s say a user wants to swap for 10k depegged $LUSD ($.95) through an LP -> redeem (to burn the redeemed LUSD out of circ -> LUSD price ⬆️, in exchange for ETH collateral), given the current total LUSD supply is 1m LUSD + previous rate was .5% (floor)…

Let’s say a user wants to swap for 10k depegged $LUSD ($.95) through an LP -> redeem (to burn the redeemed LUSD out of circ -> LUSD price ⬆️, in exchange for ETH collateral), given the current total LUSD supply is 1m LUSD + previous rate was .5% (floor)…

How much will it cost him to do so? (Redemption fee)

How much will the borrow fee alter?

Our equation becomes:

New rate = previous rate + 𝛼 × (amount of LUSD being redeemed / current LUSD supply)

How much will the borrow fee alter?

Our equation becomes:

New rate = previous rate + 𝛼 × (amount of LUSD being redeemed / current LUSD supply)

New rate = .5% + .5 × (10k/1m)

.005 + .5 × .01

.005 + .005

New rate = .01 -> 1%

1% -> new redemption fee

.005 + .5 × .01

.005 + .005

New rate = .01 -> 1%

1% -> new redemption fee

Once the 10k $LUSD is redeemed for 9.9k worth of $ETH (10k * 1% redemption fee), borrow/redemption fee rates will rise to 1%.

$LUSD goes from 1m to a 990k total supply, effectively raising LUSD price to $.9595.

(.95*1m = 950k/990k (10k redeemed) -> .9595)

$LUSD goes from 1m to a 990k total supply, effectively raising LUSD price to $.9595.

(.95*1m = 950k/990k (10k redeemed) -> .9595)

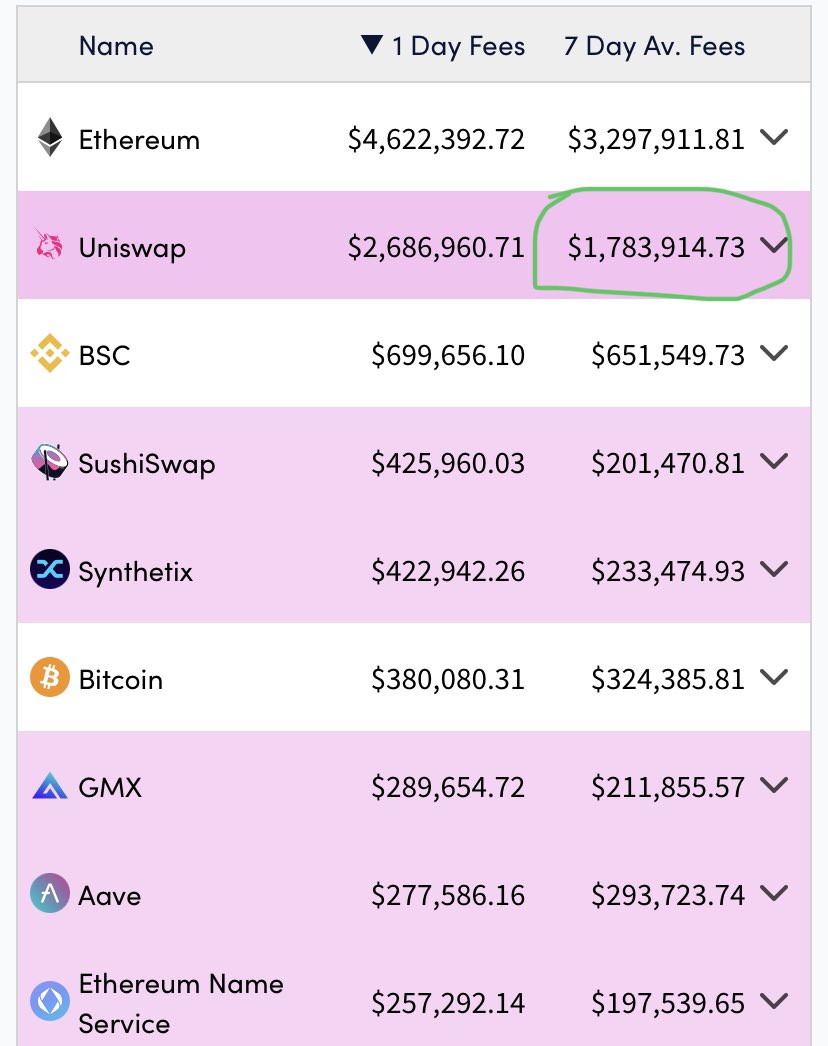

How abt a current example?

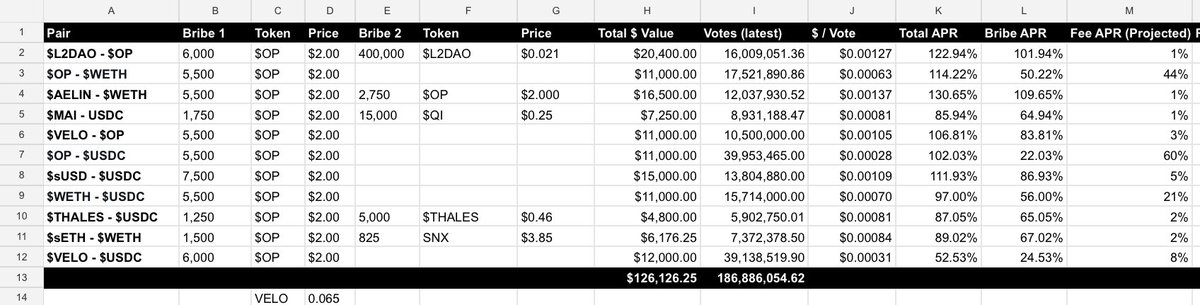

Currently, $LUSD has a total supply of 181m. (Obvs with a .5% borrow fee given $LUSD’s movement above peg these past few months due to mkt conditions)

If I wanted to redeem 1m $LUSD, how much will I be charged?

Currently, $LUSD has a total supply of 181m. (Obvs with a .5% borrow fee given $LUSD’s movement above peg these past few months due to mkt conditions)

If I wanted to redeem 1m $LUSD, how much will I be charged?

b(t)= .005 + .5 × (1m/181m)

.005 + .5 × .00552

.005 + .00276

.00776 -> .776% redemption fee! (thus borrow fee)

(And who gets these #RealYield borrow/redemption fees?

You guessed it — $LQTY stakers!)

.005 + .5 × .00552

.005 + .00276

.00776 -> .776% redemption fee! (thus borrow fee)

(And who gets these #RealYield borrow/redemption fees?

You guessed it — $LQTY stakers!)

(Note: this obviously wouldn’t happen now given LUSD is currently trading at $1.01)

If you’re interested in learning more about Liquity (extensive deep dive on the ins and outs of Liquity + how to navigate the UI), check out the linked threads below!

https://twitter.com/barryfried1/status/1556823282736939009?s=21&t=gwf0JySpYqUT1F5pvUQDFA

https://twitter.com/barryfried1/status/1538880663201492993

Thank you for reading.

Like and retweet!

Follow for daily DeFi threads

@BarryFried1

Comment below what I should cover next👇

Like and retweet!

Follow for daily DeFi threads

@BarryFried1

Comment below what I should cover next👇

https://twitter.com/BarryFried1/status/1557776489596293122

• • •

Missing some Tweet in this thread? You can try to

force a refresh