/1 @Platypusdefi Wars are coming on #Avalanche.

Two warriors will engage in the battle: @vector_fi and

@echidna_finance.

Who is going to be the Convex of Platypus?

Find out below🧵👇

Two warriors will engage in the battle: @vector_fi and

@echidna_finance.

Who is going to be the Convex of Platypus?

Find out below🧵👇

/2 Platypus is a single-side AMM stableswap designed to prioritize maximum capital efficiency and eliminate IL.

It is actually a competitor of Curve Finance.

This 🧵 will be focused on Platypus Wars. If you want to learn more about Platypus, check this 🧵 by @AvaxGems:

It is actually a competitor of Curve Finance.

This 🧵 will be focused on Platypus Wars. If you want to learn more about Platypus, check this 🧵 by @AvaxGems:

https://twitter.com/AvaxGems/status/1558179138116075520

/3 Platypus team recently announced that the vePTP holders will be able to control PTP emissions and will get a % of the protocol revenue.

So the vePTP holders will have 2 new revenue streams:

-bribes

-Platypus fees

So the vePTP holders will have 2 new revenue streams:

-bribes

-Platypus fees

/4 As Platypus is in the top 5 Avalanche protocols by TVL, other protocols will likely try to get a part of the $PTP emissions for their pools through bribing.

And the token holders of 2 protocols will control over 50% of the total vePTP👀

Here are the main PTP yield boosters:

And the token holders of 2 protocols will control over 50% of the total vePTP👀

Here are the main PTP yield boosters:

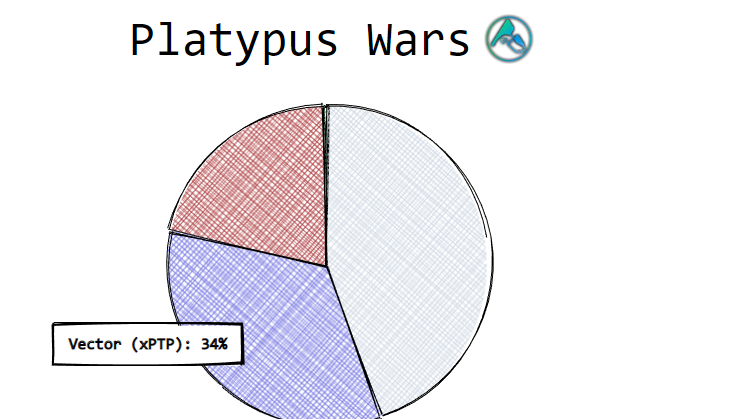

/4 Vector Finance($VTX)

Vector Finance is a yield booster for Platypus and Trader Joe.

It currently owns 55% of the total veJOE and 34% of the total vePTP.

$VTX(Vector token) market cap is $5,5M and has 18% of the total supply in circulation.

Vector Finance is a yield booster for Platypus and Trader Joe.

It currently owns 55% of the total veJOE and 34% of the total vePTP.

$VTX(Vector token) market cap is $5,5M and has 18% of the total supply in circulation.

/5 Vector Finance's most recent update is the introduction of Smart Converter.

Smart Converter helped in improving the conversion rate of Vector tokens derivatives(zJOE,xPTP).

Vector's PTP holdings continued to increase linearly in the last months.

Smart Converter helped in improving the conversion rate of Vector tokens derivatives(zJOE,xPTP).

Vector's PTP holdings continued to increase linearly in the last months.

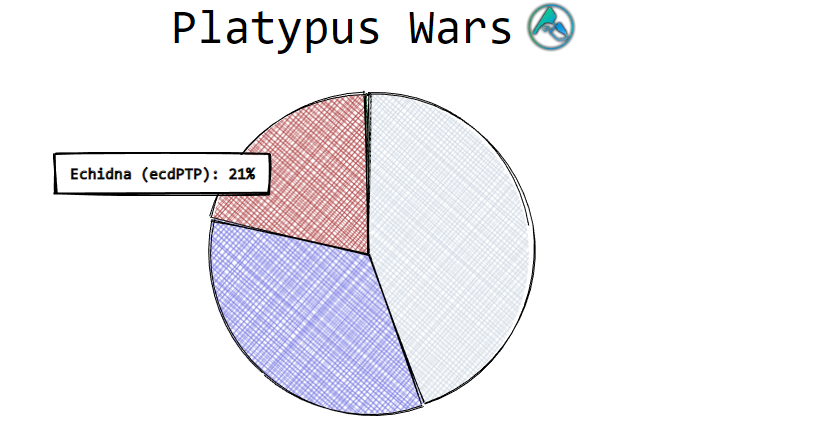

/5 Echidna Finance($ECD)

Echidna Finance is a yield booster for Platypus.

It owns 21% of the total vePTP.

Echidna's $PTP holdings stayed flat in the last months.

The team stated that they are waiting for PTP voting gauges before resuming the protocol development.

Echidna Finance is a yield booster for Platypus.

It owns 21% of the total vePTP.

Echidna's $PTP holdings stayed flat in the last months.

The team stated that they are waiting for PTP voting gauges before resuming the protocol development.

/6 From a long-term perspective, it might make more sense to buy $VTX because Vector PTP holdings continued to grow over time.

However, Echidna vePTP holdings represent 61% of Vector vePTP holdings, while $ECD has a market cap 13x lower than $VTX🤯

However, Echidna vePTP holdings represent 61% of Vector vePTP holdings, while $ECD has a market cap 13x lower than $VTX🤯

/7 Vector Finance is also a big veJOE holder, so this is one of the reasons for the difference between the market cap of these two tokens.

Platypus made $2M from fees in 2022. It isn't known how much of the protocol revenue will be shared with vePTP holders.

Platypus made $2M from fees in 2022. It isn't known how much of the protocol revenue will be shared with vePTP holders.

/8 Exciting times are coming for #Avalanche Ecosystem.

The $PTP voting gauge might be the catalyst that will bring Avalanche DeFi back to life.

That's it!

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

The $PTP voting gauge might be the catalyst that will bring Avalanche DeFi back to life.

That's it!

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

/9 Give them a follow for more Avalanche alpha:

@Subli_Defi

@rektdiomedes

@0xSindermann

@MrDuckbill

@CryptoSeq

@luigidemeo

@cl7_fk

@rogeravax

@MBApesNFT

@Subli_Defi

@rektdiomedes

@0xSindermann

@MrDuckbill

@CryptoSeq

@luigidemeo

@cl7_fk

@rogeravax

@MBApesNFT

• • •

Missing some Tweet in this thread? You can try to

force a refresh