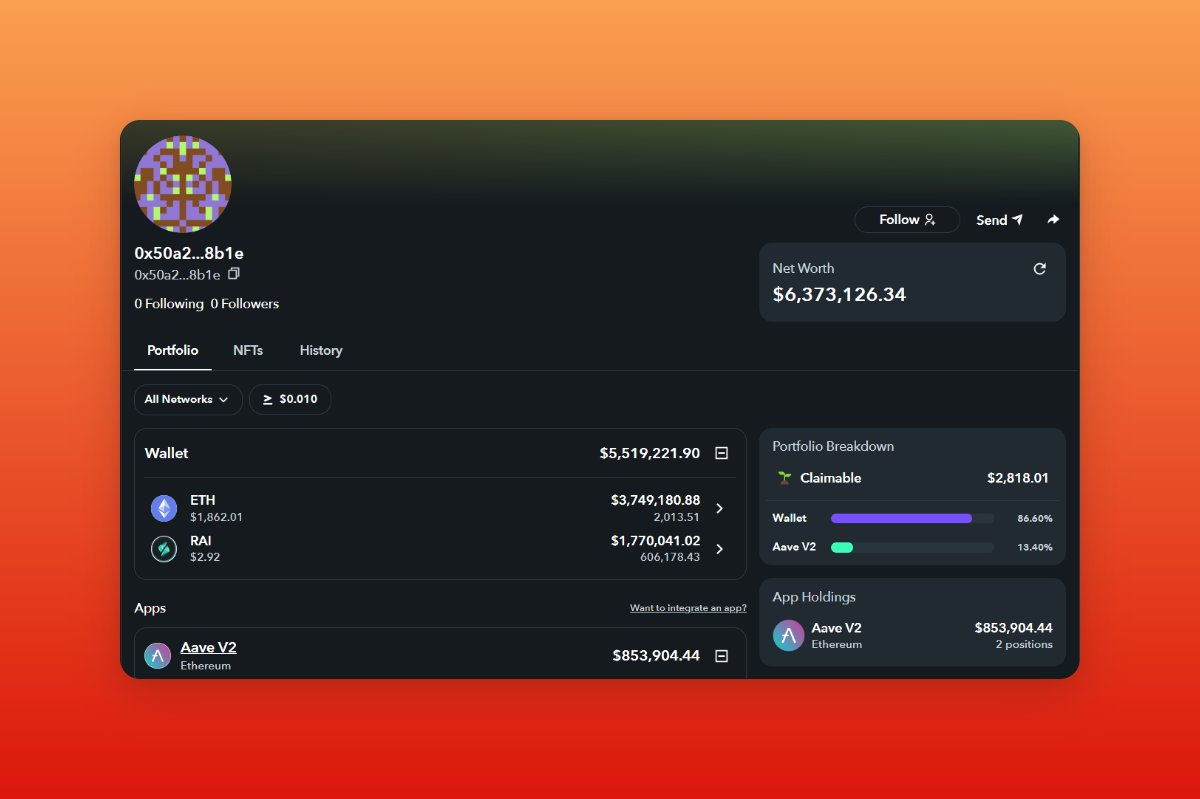

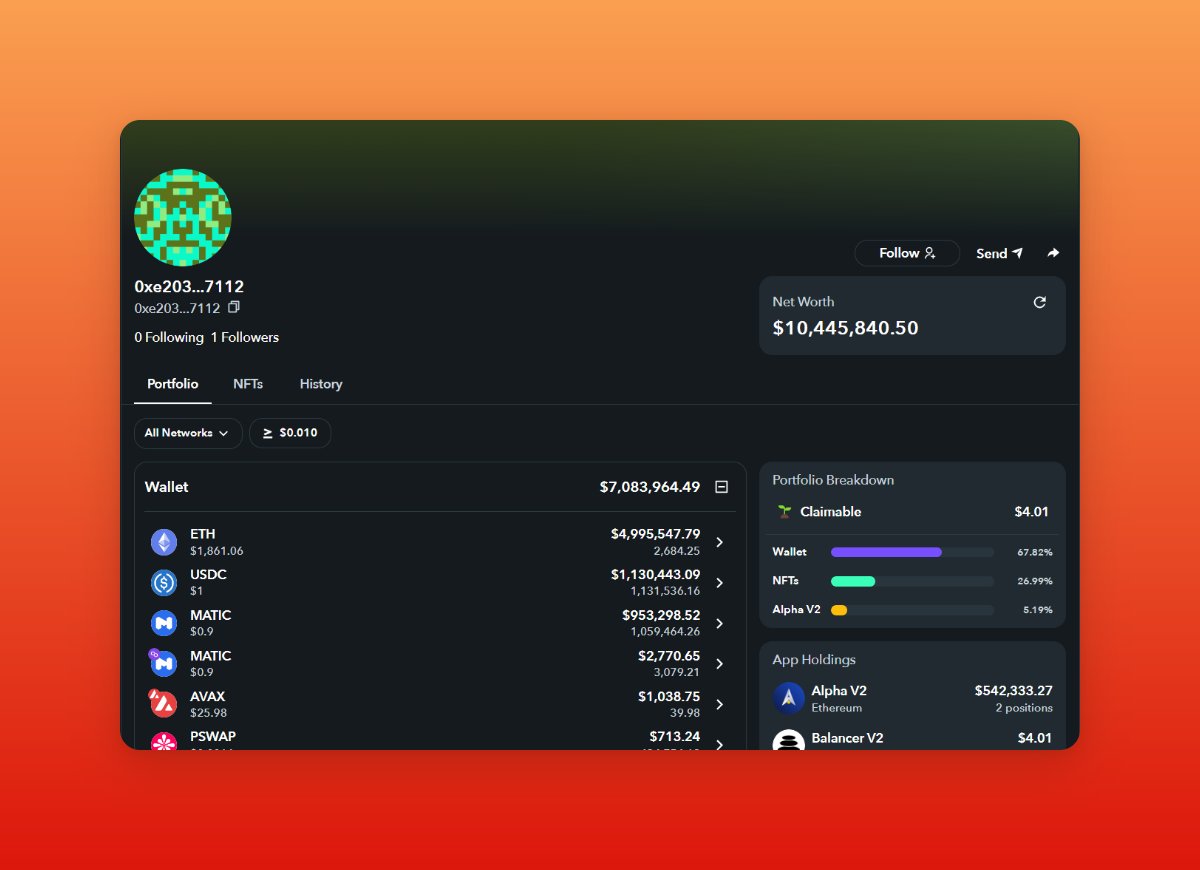

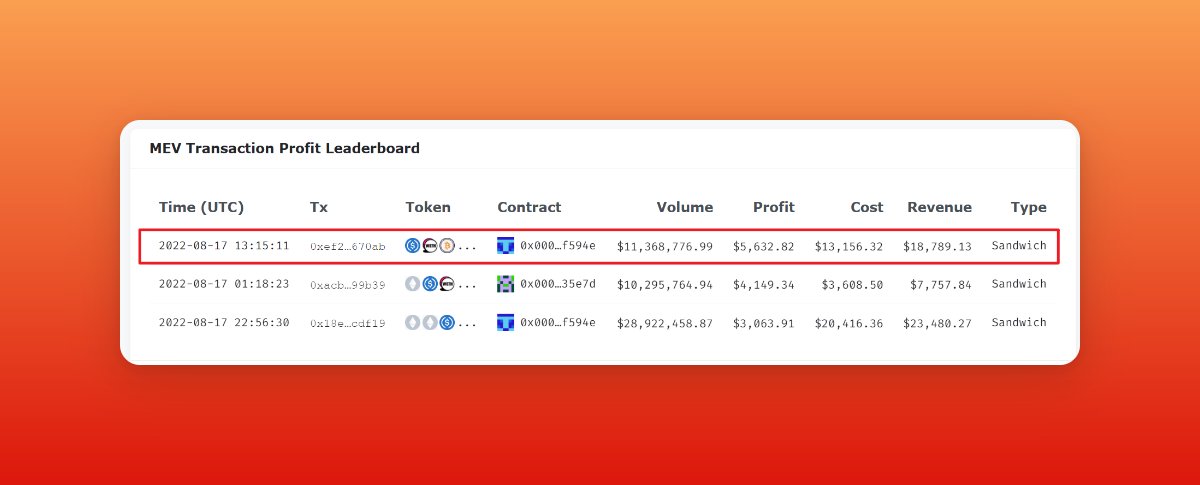

1/10 Yesterday must have been an awful day for rich token holders, as the top 3 victims of the day are all Token Millionaires.

2/10 The Token Millionaire with $10M in holdings has suffered heavy loss in the last 7 days. It was squeezed for $399,46 in 16 🥪s while losing $18,789 in yesterday's 🥪.

eigenphi.io/ethereum/sandw…

eigenphi.io/ethereum/sandw…

3/10 This 🥪 was also the top tx of the day, bringing the 😈 over $5,632 in profits.

eigenphi.io/ethereum/tx/0x…

eigenphi.io/ethereum/tx/0x…

4/10 The 😢 at the time was trying to swap 2,650 $WETH for $USDC but became the recipe of the 🥪.

How did the 😈 make the front-running? It just used 1,473 $WETH to buy $USDC, which raised the $WETH/$USDC price in a UniV3 LP (0x88e). Thus the 😢 had to pay more $WETH than usual.

How did the 😈 make the front-running? It just used 1,473 $WETH to buy $USDC, which raised the $WETH/$USDC price in a UniV3 LP (0x88e). Thus the 😢 had to pay more $WETH than usual.

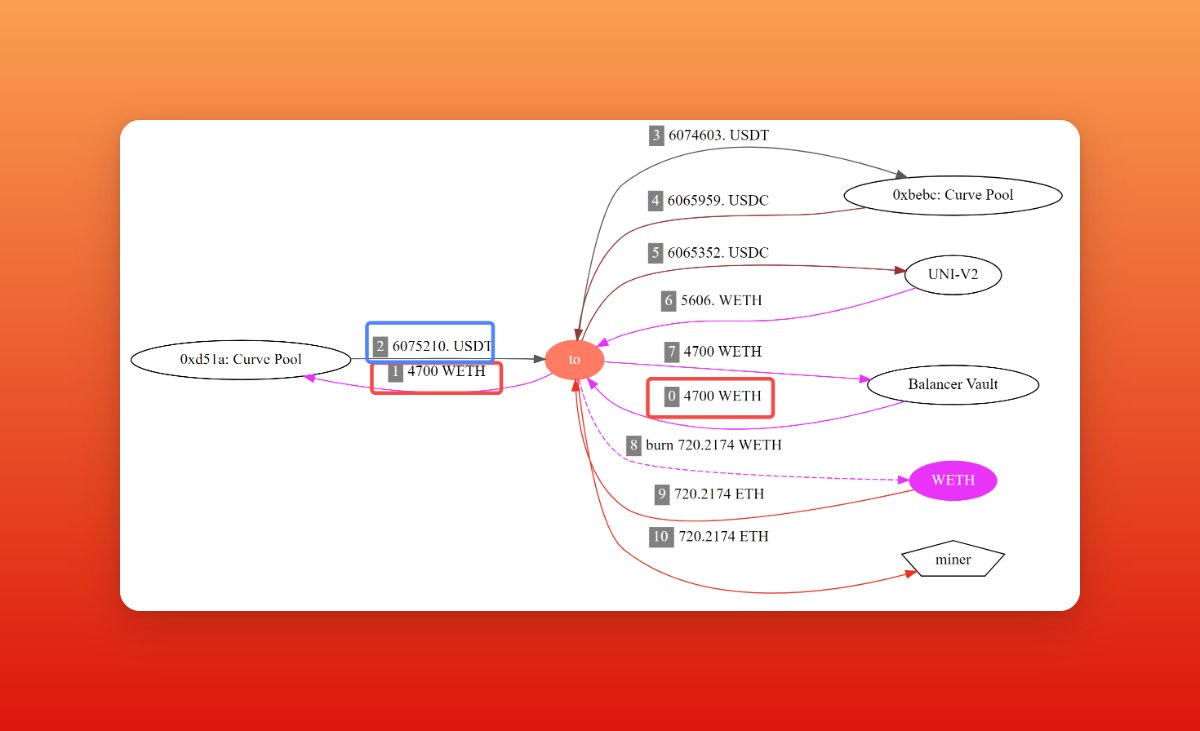

5/10 In another 🥪, whose victim has lost over $23,480, the #MEV employed over $12.8M to launch the attack with the help of an AAVE loan.

Finally, it only earned $3,063.9. The cost reached $20,416, most of which was paid to the miner 🔨.

eigenphi.io/ethereum/tx/0x…

Finally, it only earned $3,063.9. The cost reached $20,416, most of which was paid to the miner 🔨.

eigenphi.io/ethereum/tx/0x…

6/10 The top 2 profitable 🥪, whose trading volume hit $10M, have pushed $LUSD onto the hot token leaderboard.

eigenphi.io/ethereum/token…

eigenphi.io/ethereum/tx/0x…

eigenphi.io/ethereum/token…

eigenphi.io/ethereum/tx/0x…

7/10 As a result of those big 🥪s, the profit made by 🥪 chefs increased by nearly 40%, while the cost surged by 87%.

8/10 You can find more great 🥪 tx in #DeFi #Frontrunning #MEV #Ethereum 🥪 daily report.

eigenphi.io/ethereum/daily…

Also, you can submit some of the awesome tx you find in the report to #AwesomeTx Bounty, where 500 $USDT is waiting for you: github.com/eigenphi/Aweso…

eigenphi.io/ethereum/daily…

Also, you can submit some of the awesome tx you find in the report to #AwesomeTx Bounty, where 500 $USDT is waiting for you: github.com/eigenphi/Aweso…

9/10 For more #MEV data, you can visit our #DeFi #Arbitrage #MEV #Ethereum daily report from EigenPhi. EST period: 17/08~18/08 UTC+0.

eigenphi.io/ethereum/daily…

The data of #MEV performance on #BNBChain was also made for you: eigenphi.io/bsc/dailyRepor…. Source: @Eigenphi.

eigenphi.io/ethereum/daily…

The data of #MEV performance on #BNBChain was also made for you: eigenphi.io/bsc/dailyRepor…. Source: @Eigenphi.

10/10 I hope you've found this thread helpful.

Follow me @Eigenphi for more.

Like/Retweet the first tweet below if you can:

Follow me @Eigenphi for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/Eigenphi/status/1560295516809834496

• • •

Missing some Tweet in this thread? You can try to

force a refresh