My last #Terra $LUNA tweet.

We’re approaching a big announcement for former $STT holders but before we move on I want to summarize in one place my story and what I feel straight from my ♥️.

Keep your belts fastened and let’s go with a big, fat🧵 /1

We’re approaching a big announcement for former $STT holders but before we move on I want to summarize in one place my story and what I feel straight from my ♥️.

Keep your belts fastened and let’s go with a big, fat🧵 /1

My story with CT started at late 2020 when I started to tweet my deep analysis about crypto projects. I entered this industry without any connections with only 70 followers, encouraged to do so by my friends who made a very decent $ with my analyses.

/2

/2

I thought why not to publish them for free as I can help more people.

The success ratio of my predictions helped me to build amazing community of 10k followers within a very short period of time (If some of you still remember that time please let me know in the comment 🙏)

/3

The success ratio of my predictions helped me to build amazing community of 10k followers within a very short period of time (If some of you still remember that time please let me know in the comment 🙏)

/3

What surprised me the most, is the best financial results came exactly at the time I decided to share it on CT. This was a result of a big pressure coming from the community which gave me razor sharp motivation to get even deeper with my due diligence.

/4

/4

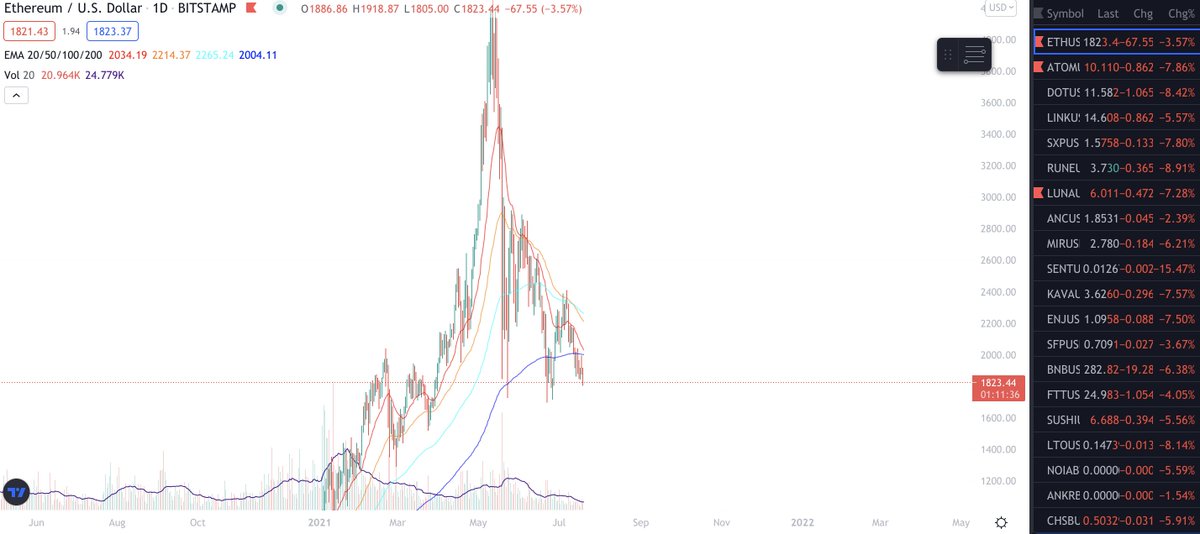

As you know one of my best picks was $LUNA. I bought it for 0.45$ in December 2020 and my life has changed forever. I was amazed by the vision of decentralized finance, innovative tokenomics and how smooth is the UI of the Terra chain.

/5

/5

Seeing rapid rise in devs activity I predicted building a launchpad could be a perfect play.

It was a tough challenge but long story short, this was the time I felt the strength of community. With your help I found the right people and this is how @StarTerra_io was founded.

/6

It was a tough challenge but long story short, this was the time I felt the strength of community. With your help I found the right people and this is how @StarTerra_io was founded.

/6

I decided to take a risk, left my fiat job and focus fully on building. Our amazing IT team led by @m_mkurdziel @tomkowalczyk helped us to stay ahead of competition and this how $STT became one of the first Terra blue chips from outside the TFL based projects.

/7

/7

The hype around the launch was far beyond our expectations and I’m not gonna lie, we weren’t 100% ready for that. We gathered above 100k people on our socials, Kucoin and Binance halted withdrawals of people willing to send their LUNA to buy $STT on the date of our listing.

/8

/8

This massive buying pressure, low initial supply, together with bots activity led to the supply shock that took $STT price from 0.12$ up to 30$ for a moment and stabilizing in 5-8$ range.

This made @StarTerra_io one of the most profitable listings in Q3 2022

/9

This made @StarTerra_io one of the most profitable listings in Q3 2022

/9

I need to admit I wasn’t personally prepared for such a big hype.

With increasing number of projects applying for IDO the number of work has doubled or tripled while I was struggling to delegate the tasks. I was literally working 16 hours a day.

/10

With increasing number of projects applying for IDO the number of work has doubled or tripled while I was struggling to delegate the tasks. I was literally working 16 hours a day.

/10

This all lead to couple of personal consequences. I was fighting with anxiety and depression, I’ve lost the fun arising from being in crypto and first and foremost I didn’t have time to do what put me here where I am in the first place, which is making analysis.

/11

/11

This brings me finally to the point of Terra collapse. $LUNA itself is not anything that affected me personally. I’ve been repeating couple of times I kept selling it on the way up which lead me to life-changing over 100x profit.

/12

/12

Something which hit me much harder is the $UST depeg. The fact I focused fully on running businesses made me stop focusing so much on the market. I paid a price for that as I converted my UST on the 0.50$ level loosing in result half of my previous $LUNA profits.

/13

/13

Summing this up, it was a priceless lesson for me and the fact it didn’t kill me makes me feel much stronger. I started to take care of my health, delegate tasks and work on the recovery behind the scenes. I am also really thankful my team to support it ♥️

/14

/14

This month we’ll finally share the fruits of this great effort.I hope after reading migration overview next week you’ll share our team excitement.

The next chapter of $STT journey is around the corner and you are all invited to be part of it 🫵.

GM!👊

#GameChanger

/15

The next chapter of $STT journey is around the corner and you are all invited to be part of it 🫵.

GM!👊

#GameChanger

/15

• • •

Missing some Tweet in this thread? You can try to

force a refresh