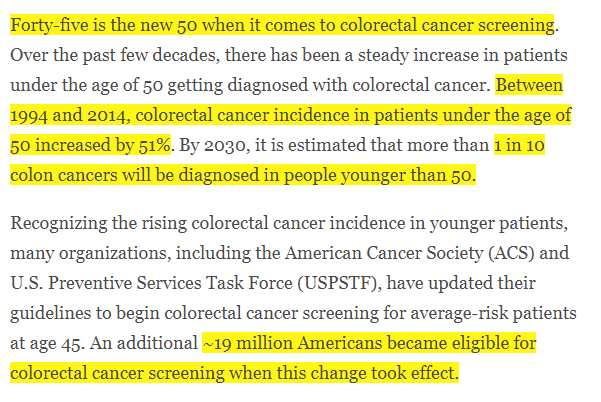

An article describing the "45 is the new 50" change in guidelines in the US for #ColorectalCancer #Screening. Slightly biased towards $EXAS Exact Sciences Cologuard. ache.org/blog/2022/upda…

$EXAS Exact Sciences is one of the companies I track, in many ways a pioneer in the #LiquidBiopsy #CancerScreening field although with a low-tech method compared to other players in this field such as $ILMN Illumina (via @GrailBio), and what other companies are planning ...

... in their near- to mid-term future such as: $GH Guardant Health, $BNR Burning Rock, $NTRA Natera, and other companies not yet trading such as Caris Life Sciences, @freenome , @LungLifeAI , @BluestarGenomix , #AdelaBio, and others.

The top 3 institutional investors for $EXAS as of Jun 29 2022 are @Vanguard_Group , T. Rowe Price and @ARKInvest . The later has recently increased their position by a bit more than $18M.

• • •

Missing some Tweet in this thread? You can try to

force a refresh